Summary:

- Palantir beat Q2’24 estimates and reported its highest GAAP profit in the company’s history.

- Strong momentum in AIP is driving massive earnings and free cash flow gains.

- Palantir raised its FY 2024 revenue outlook a second time this year and now expects 23% Y/Y growth.

- Growing AIP uptake and higher free cash flow margins indicate potential for future growth and multiplier expansion.

da-kuk

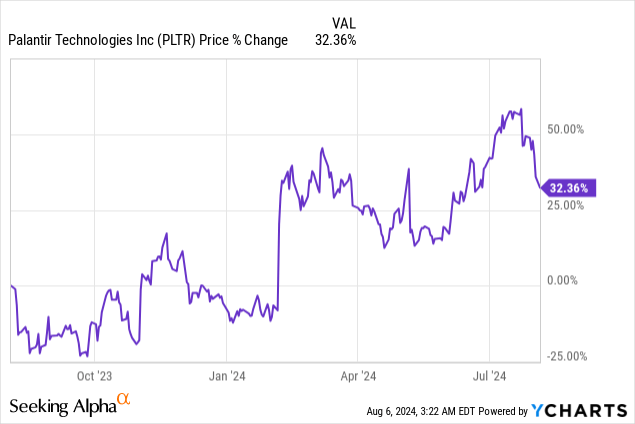

Palantir (NYSE:PLTR) submitted a much better than expected earnings scorecard for the second fiscal quarter on Monday that showed solid top-line momentum and a significant amount of net customer additions, driven by AIP adoption. The software analytics company also raised its outlook for FY 2024 revenues, the second time this year, and posted its highest GAAP profit ever in Palantir’s history. The U.S. commercial segment once again saw strong traction and the company’s free cash flow is growing rapidly. While shares are not a bargain, I believe that Palantir has enormous growth potential as it scales its AI offerings.

Previous rating

I rated shares of Palantir a strong buy in May — Strike While The Iron Is Hot — as the company revealed considerable traction with its AI platform, called ‘Artificial Intelligence Palantir.’ The momentum in AIP continued in the second fiscal quarter and Palantir added a large amount of new clients to its business, especially in commercial. I believe the profit and free cash flow surge, driven by growing AIP adoption, is a game-changing moment for the analytics company and I confirm my strong buy rating following Q2 results.

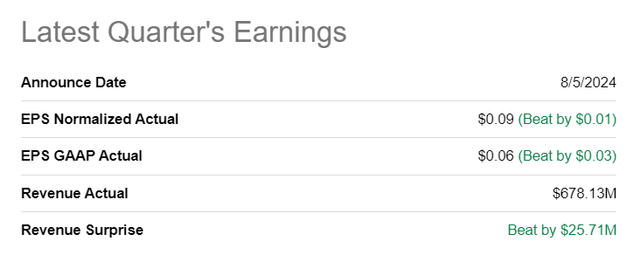

Palantir beat estimates for Q2’24

Palantir reported its seventh consecutive quarter of GAAP profitability and managed to surpass consensus estimates for the second-quarter. The software platform reported $0.09 per-share in adjusted GAAP profits, which beat the average Wall Street prediction by $0.01 per-share. Revenues came in at $678.3M and were $26M better than the consensus estimate.

AI momentum driving customer acquisition gains and profit/FCF upsurge

Palantir’s revenues soared 27% year-over-year in the second-quarter on strong momentum with Palantir AIP. Customers can use AIP, which is integrated into the company’s other software packages, as a way to harness the power of artificial intelligence-supported predictive analytics. Compared to the first-quarter, Palantir saw a 6 PP revenue acceleration Q/Q, mainly because of growing adoption of the company’s AI platform.

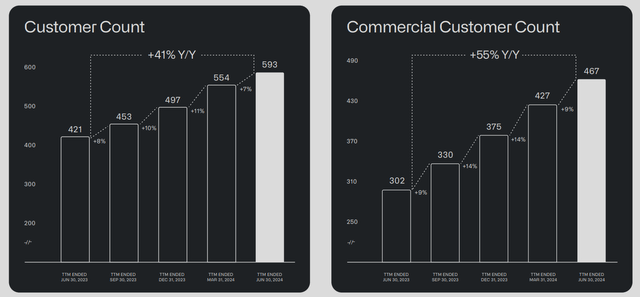

A larger number of customers are also flocking to Palantir’s platform, which implies improving prospects for organic revenue potential in the quarters ahead. Palantir continued to see considerable customer acquisition momentum across its segments, but especially in Commercial in Q2’24. In the second fiscal quarter, the software company added 40 customers in its commercial business. Year-over-year, Palantir’s customer count surged by 55% with AIP being a magnet for customer acquisition.

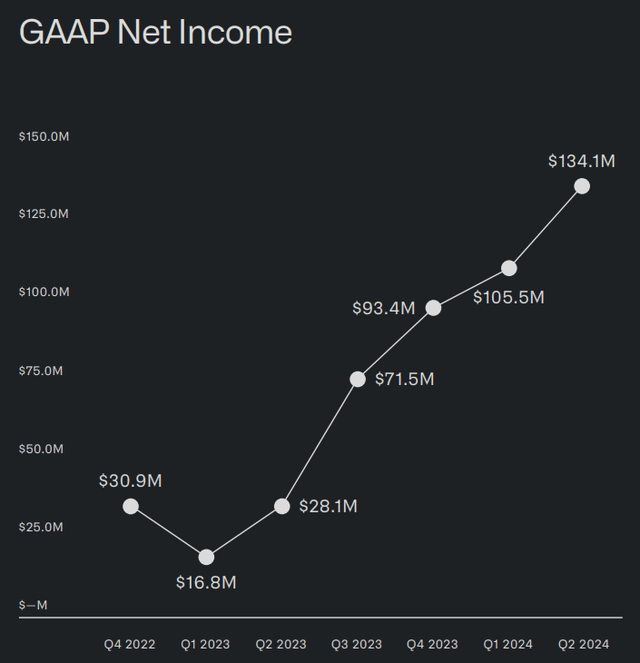

Importantly, Palantir has been able to translate this AIP-driven momentum in actual earnings and free cash flow growth in the second-quarter.

Palantir generated its highest profit in the firm’s history in Q2’24 on growing uptake of the company’s AI platform. The analytics company reported $134.1M in net profits in the last quarter, showing a year-over-year growth rate of 377%. This growth came mainly from the U.S. commercial segment, which grew about twice as fast (+55% Y/Y) as Palantir’s consolidated top line (+27% Y/Y).

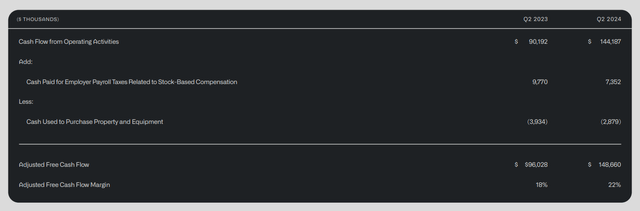

The key figure that will be the most important one for the software company going forward is free cash flow. Palantir is obviously continuing to acquire a good amount of new customers, especially in the commercial business, which translates into attractive free cash flow growth potential. In Q2’24 Palantir earned a solid $148.7M in FCF on revenues of $678.1M. Palantir’s free cash flow grew 55% year-over-year, and the software company achieved a free cash flow margin of 22%, showing a 4 PP margin expansion compared to the year-earlier period. Palantir’s free cash flow grew twice as fast as its revenues, indicating that the company has reached a critical AI inflection point with regard to profitability.

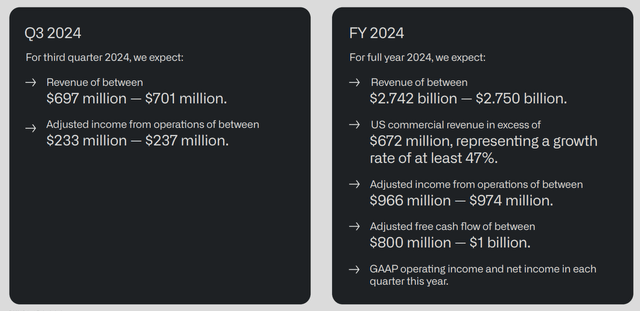

Palantir raises its full-year guidance

With the company adding a good amount of new customers and enterprise clients being willing to spend on AI capabilities, Palantir had the confidence to raise its revenue outlook a second time this year. Palantir now expects to generate $2.742-2.750B in revenue in FY 2024, increasing its guidance by $63M at the mid-point. The new guidance implies a 23% year-over-year growth rate, as opposed to 21% Y/Y that was guided for in the last quarter.

Palantir’s valuation and catalysts

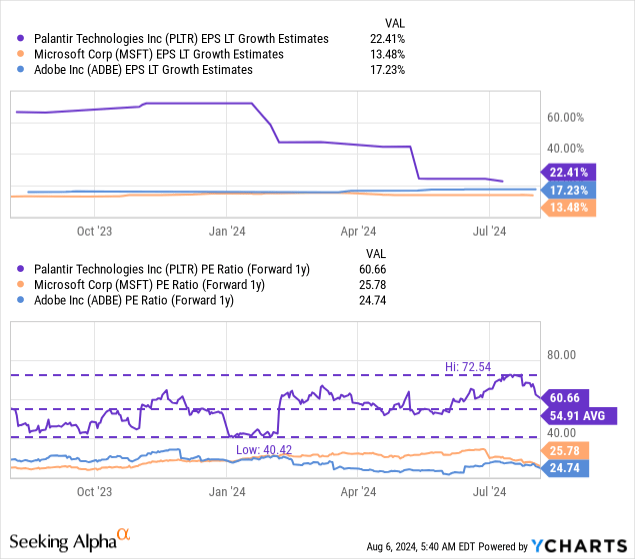

Palantir is set to be profitable on a full-year earnings basis this year, which is why the software company can now be valued based off of a price-to-earnings ratio. Currently, Palantir is trading at a P/E ratio of 61X, which is admittedly not a cheap valuation factor. However, Palantir is just now seeing its earnings and free cash flows soar which is set to result in a much lower P/E ratio going forward. Analysts currently project 22%+ long term EPS growth, which means Palantir is growing its earnings potentially much faster than super-profitable software companies like Microsoft (MSFT) and Adobe (ADBE), both of which are also investing in boosting their software offers with AI capabilities. Microsoft and Adobe currently trade at forward (FY 2025) P/E ratios of 26X and 25X, but both companies have longer operating histories and have therefore larger customer bases, especially in enterprise.

Palantir’s customer base is expanding rapidly, however, especially in commercial, which should help the company lever the strength of its AI platform going forward. The second consecutive guidance raise also indicates that the company expects a revenue acceleration to happen, which further supports the value proposition here. Palantir has a historical P/E average of 55X and if we apply this multiplier to the FY 2027 consensus estimate of $0.57 per-share, Palantir could have a fair value of $31.40 per-share. This is a dynamic number and my fair value estimate may rise or fall depending on Palantir’s customer acquisition/retention, free cash flow margins and momentum in commercial.

Palantir’s risks

Although Palantir has the business momentum to justify a high P/E ratio, the software company is trading at a high multiplier, in part because the company achieved GAAP profitability only last year. Investors therefore face considerable downside risks should the software company report weakening customer monetization, lower rates of customer acquisition, especially in commercial, and deteriorating free cash flow margins. What would potentially change my mind about Palantir is if a recession were to result in a serious curtailing of AI investment budgets in the enterprise market.

Closing thoughts

Palantir is a fast-growing software company that benefits from companies’ desire to tap into the potential of AI applications to support business intelligence insights. The company has clearly hit critical scale now and benefits from accelerating AI adoption. This AI inflection point is driving significant net customer acquisition momentum, especially in commercial, and the company is seeing its profits and free cash flows surge as a result. In Q2’24, Palantir’s free cash flow grew twice as fast as its consolidated revenues, and the company achieved FCF margin gains as well. While shares of Palantir are not cheap, I believe that the software platform has considerable free cash flow growth and earnings potential in the next several years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.