Summary:

- Nvidia Corporation reports stellar earnings, exceeding Wall Street’s expectations and seeing a 15% increase in stock price.

- The company holds a strong position in the fast-growing AI market, but there are potential problems including competition, oversupply, and regulatory concerns.

- Despite its success, Nvidia Corporation’s stock may already be near a long-term top, and AI revenues are expected to slow down, impacting its valuation multiples.

- Ultimately, both bears and bulls could be right. Nvidia Corporation’s business may continue to excel, while the stock price actually declines.

Eugene Mymrin/Moment via Getty Images

Thesis Summary

Nvidia Corporation (NASDAQ:NVDA) just reported another stellar earnings. The company managed to exceed even the lofty expectations of Wall Street and was up 15% on the following day.

There’s certainly a lot to be bullish about when it comes to NVDA. The company still holds a moat in a very fast-growing and potentially life-altering market.

The comparisons with the dotcom era are once again propping up. I see both differences and similarities.

We find ourselves in front of what I consider to be AI overexcitement, with plenty of potential problems going forward.

These include:

-

Competition

-

Oversupply/Demand slowdown

-

Regulatory and ethical concerns.

The thesis of this article is that Nvidia could continue to do very well in the next decade or two, growing its revenues several fold and that the stock could be near a long-term top already.

Though this may seem contradictory, it has happened before.

A Quick Recap

In my last article on Nvidia, I discussed the potential problems from its China-associated revenues.

While these persist, the company seems to be managing to reduce its exposure to China and continue to sell its products by modifying them slightly.

I gave the stock a neutral rating based on some other concerns.

Following the latest earnings, I maintain my neutral rating. Arguably, the stock is not that overvalued compared to its peers. However, it’s just a matter of time before AI revenues slow down, and this will quickly take down Nvidia’s lofty valuation multiples.

Nvidia Earnings

Nvidia’s guidance last quarter made it clear to all investors what was going to happen at this earnings, but the company surpassed expectations.

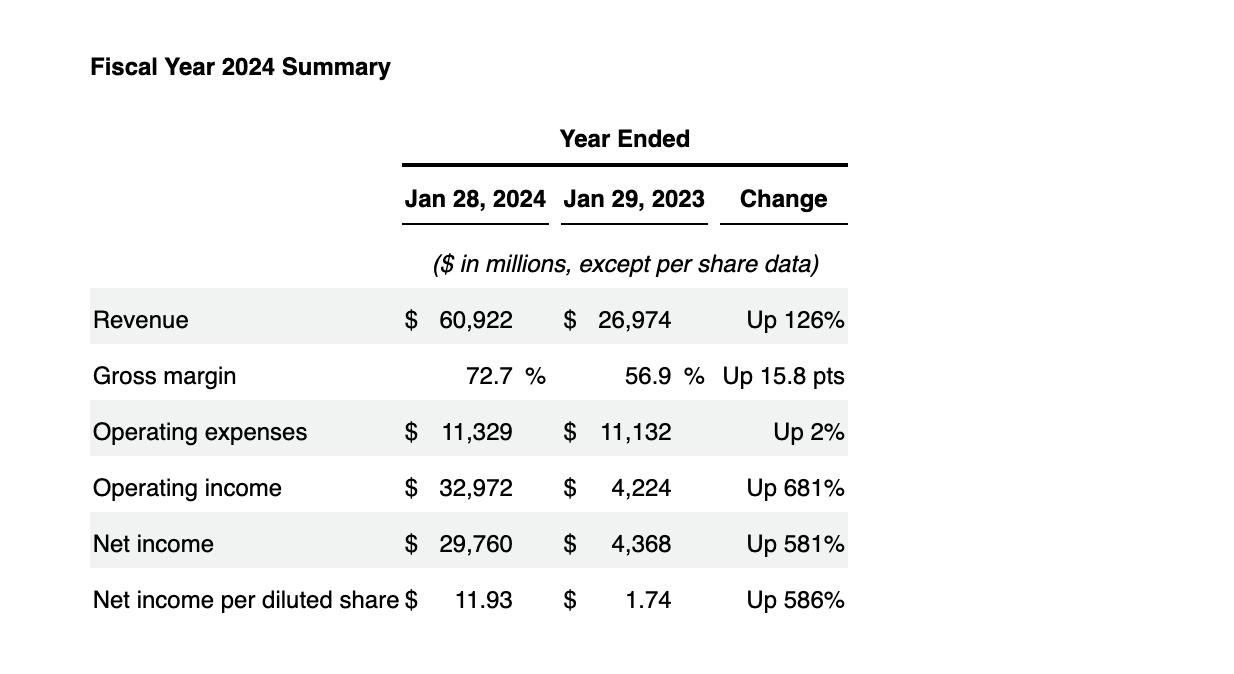

2024 Financial Summary (10K)

Revenues have grown to the tune of 126% YoY, and gross margins have expanded to 72.7%. This is nothing short of remarkable. The company has more than doubled its revenues, while operating income has remained mostly flat.

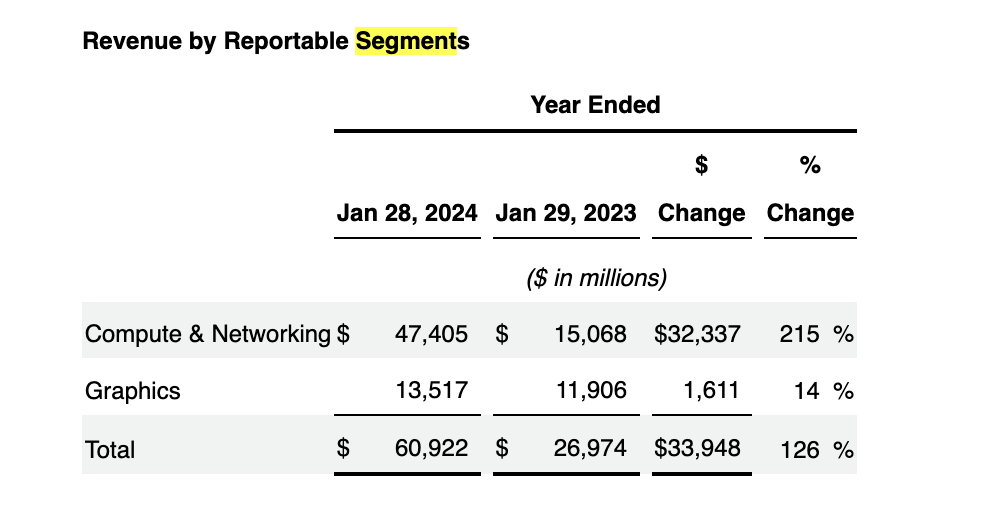

Revenue Segments (10K)

The bulk of this has come from an increase in Compute & Networking, which increased by 215%.

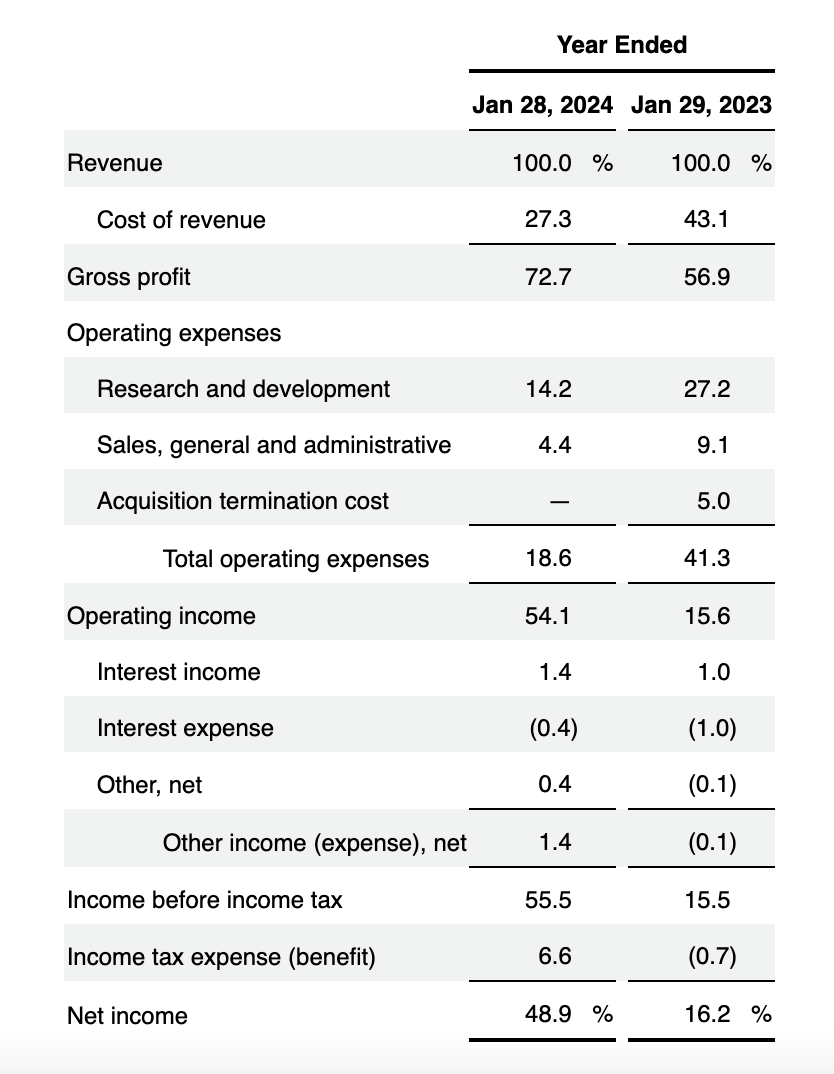

Net Income (10K)

And as we can see, the 72.7% gross margin translates into a very handsome 54.1% operating margin and a 48.9% net income margin.

Here’s the guidance for the coming quarter:

-

$24 billion in revenues plus or minus 2%

-

Non-GAAP Operating margins 77%

-

Mid-70s margins for the remainder of the year.

This quarter, revenues came in at $22.1 billion, up 22% sequentially, and now the company expects roughly 10% growth for the next quarter.

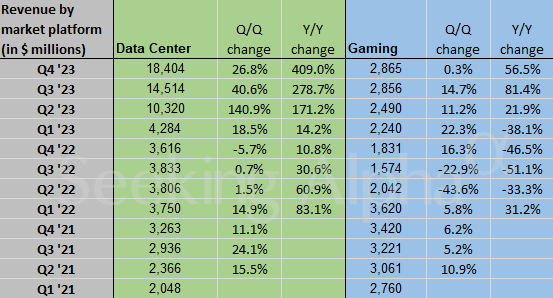

Quarterly Revenue by segment (Seeking Alpha)

So, despite an absolute monster year, growth will be slowing down going forward.

Nonetheless, demand for Nvidia’s GPUs will continue to grow at a healthy clip.

For anyone who still doesn’t fully understand why Nvidia’s GPUs have become so sought after, I think this quote by Jensen from the last earnings call highlights it quite well:

These recommender systems used to be all based on CPU approaches. But the recent migration to deep learning and now generative AI has really put these recommender systems now directly into the path of GPU acceleration. It needs GPU acceleration for the embeddings. It needs GPU acceleration for the nearest neighbor search. It needs GPU acceleration for the re-ranking and it needs GPU acceleration to generate the augmented information for you.

So GPUs are in every single step of a recommender system now. And as you know, recommender system is the single largest software engine on the planet.”

Source: Earnings Call.

Is Nvidia that expensive?

Following the latest earnings, some have actually argued that, despite significant stock appreciation, the stock is cheaper than before.

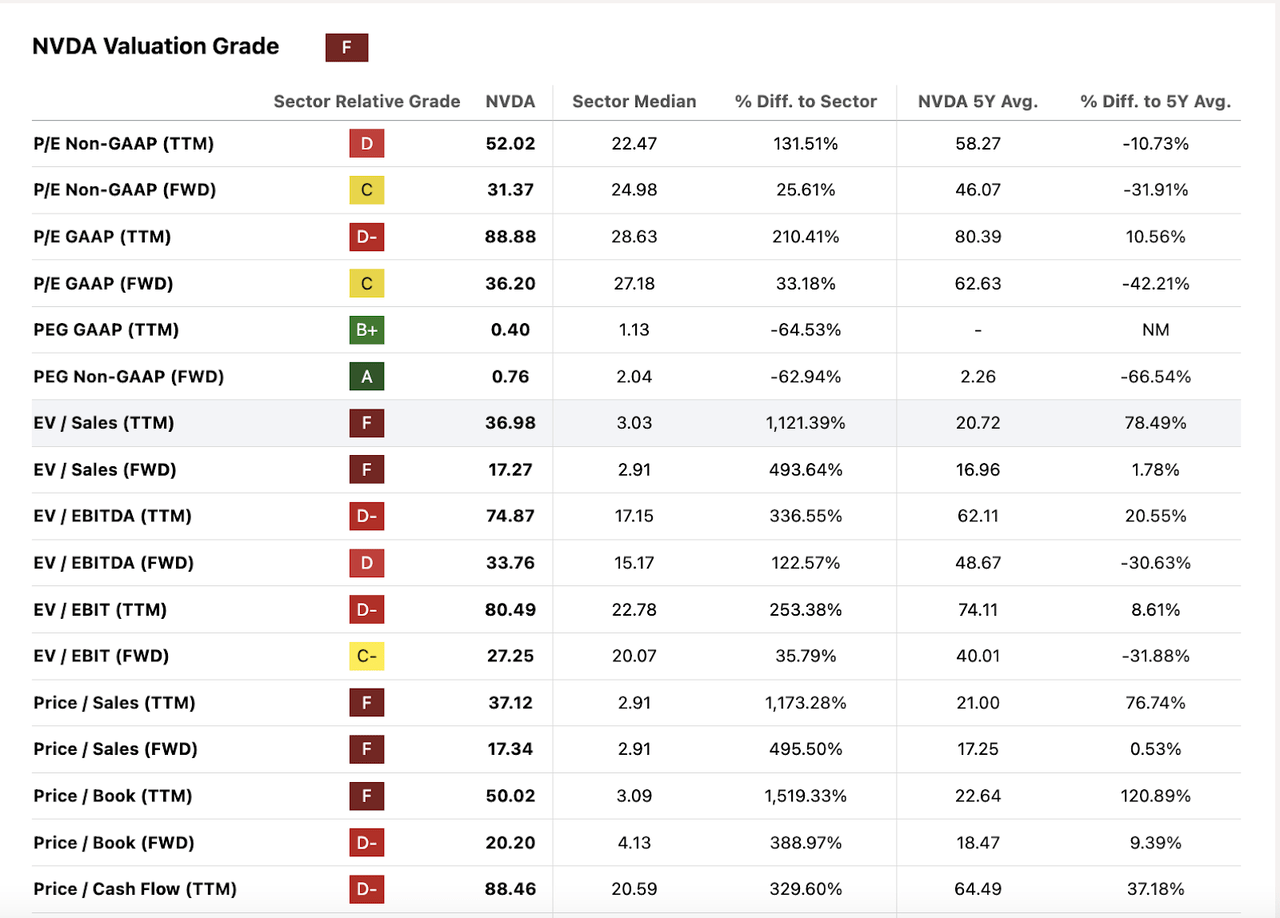

NVDA valuation multiples (Seeking Alpha)

NVDA’s forward P/E currently sits at 31, which is actually not that far from say, Apple’s (AAPL) 28, and actually lower than Microsoft’s (MSFT) 34.

Furthermore, the stock is actually pretty well priced if we look at PEG and forward PEG, both of which are well below one.

However, the stock is very expensive, even compared to its lofty magnificent peers if we look, for example, at the EV/EBITDA of 74, or the Price/Book of over 50.

For reference, Apple has an EV/EBITDA of under 21 and a Price/Book of 38.

So, there’s an argument here to be made that Nvidia is only as expensive, at least in some metrics, as its peers. And, arguably, it is well worth a premium, given that the company has doubled its revenues.

Could both bears and bulls be right?

The AI revolution is now widely accepted as something present and inevitable. Undoubtedly, Nvidia is at the forefront of this space.

Some investors like to compare this to the dot.com crash, but we need to add some nuance. A lot of stocks crashed in 1999. Some never recovered, and others became the largest e-commerce platform in the world.

On the one hand, we had companies like Pets.com. In 1999 Pets.com made $619,000 in revenue and spent $11.8 million on advertising. This was a company with no earnings, trading at an insane valuation.

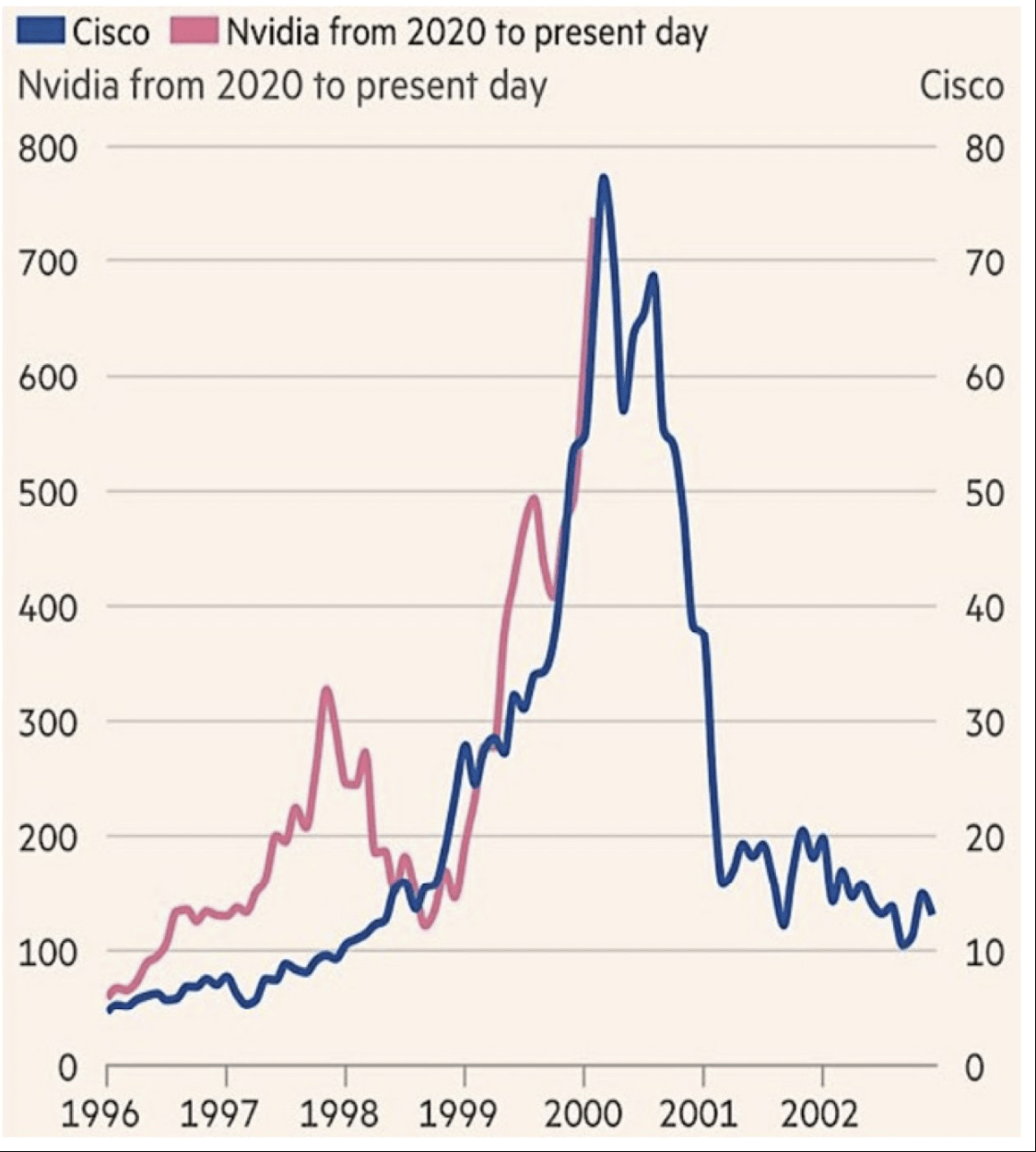

However, Nvidia does possess many similarities to arguably the largest winner of the 1990s Internet hype: Cisco Systems (CSCO)

Cisco reached $80 on March 27, 2000, becoming the world’s largest company and trading at a 220 P/E. But why wouldn’t it be?

It was the time of the new age of the Internet, and Cisco’s switches and routers were the literal bridge to this new world. Does that narrative sound familiar?

However, as we can see, the stock lost over 80% of its value and has never reclaimed those highs, trading today close to $50.

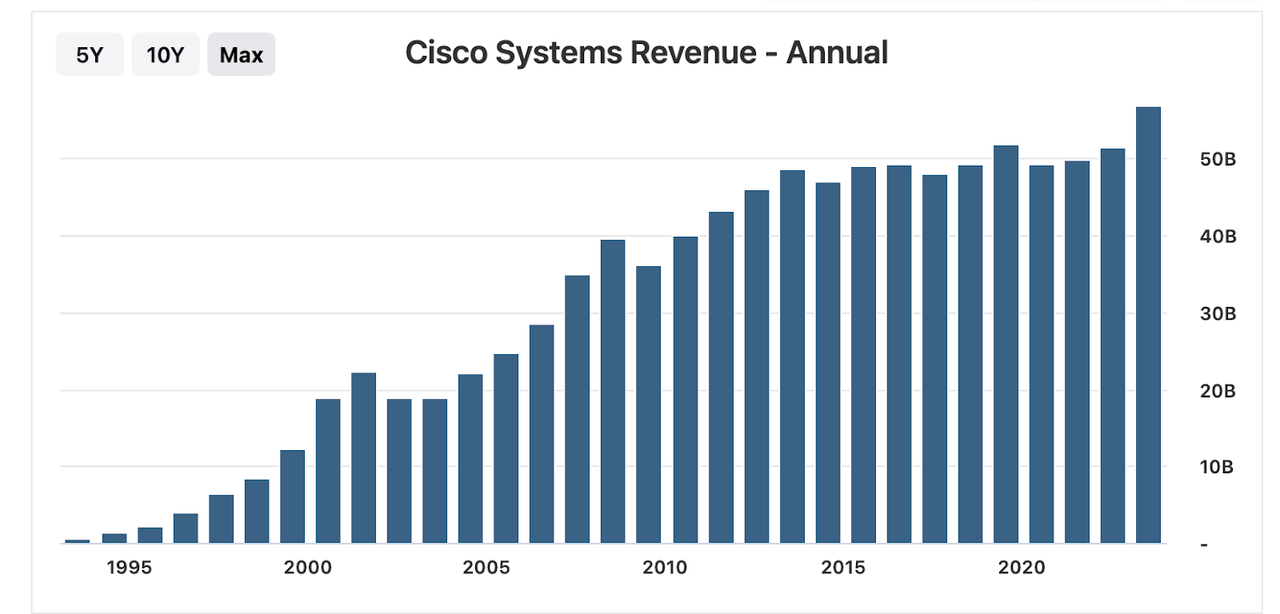

What’s interesting, though, is that CSCO’s business never actually suffered that much, even after the crash.

CSCO revenues (stock analysis)

CSCO’s revenues went from $12.18 billion in 1999 to over $22 billion in 2021. After that, the company experienced one year of falling revenues, followed by a flat year, and then another five consecutive years of healthy growth.

In fact, the company’s revenues have grown from $19 billion in early 2000 to over $50 billion today.

To anyone looking at this chart, you’d call CSCO a success story, but that’s not how investors who bought at the peak feel like.

There’s definitely an argument to be made that Nvidia is on a similar path.

CSCO/NVDA comparison (X)

But what did it take to take down CSCO? Once the largest company in the world?

Obviously, a broader market downturn contributed, but all that really had to happen was for growth to slow down.

My point here is that Nvidia could absolutely continue to deliver good results over the next two decades, and simultaneously, the stock could already be close to a long-term top.

The AI Headwinds

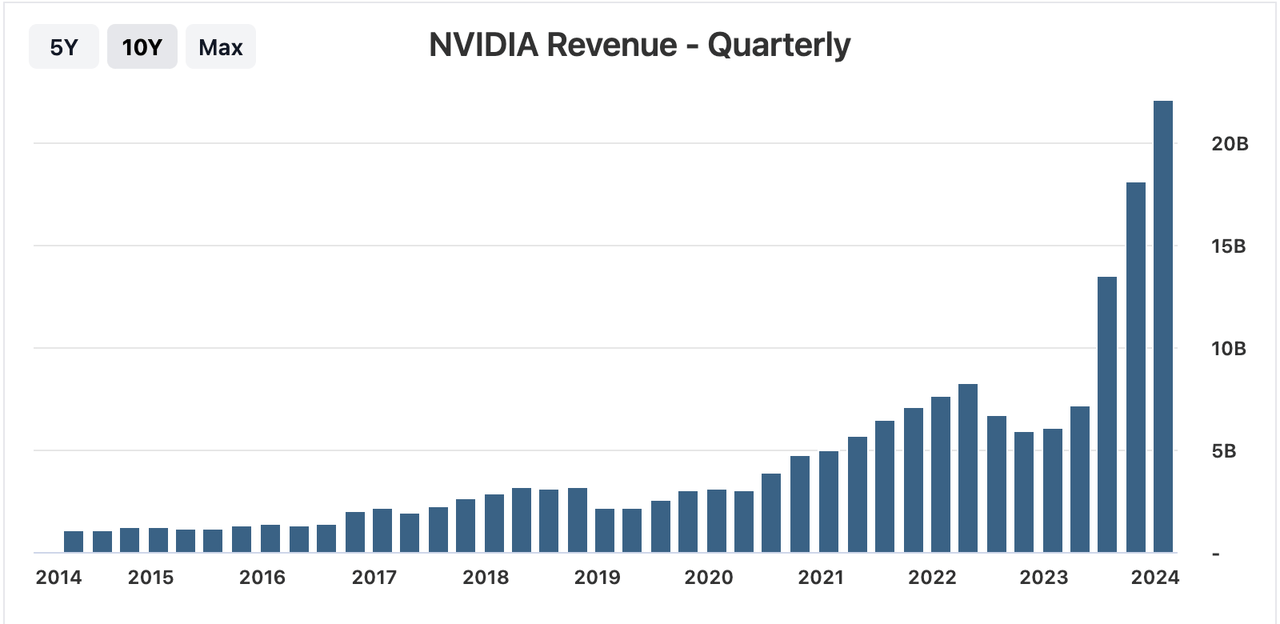

Arguably, in order for Nvidia to go the way of CSCO, all we need is to see a sufficient slowdown in growth. Well, based on the current trend and guidance that is already happening.

NVDA revenues (stock analysis)

QoQ, revenues are already slowing down, with the next quarter projected to bring only 10% sequential growth. Moving forward, comparables are going to get very hard.

But let’s get deeper into the fundamentals here. Like with the internet, it’s just a matter of time before things normalize.

Competition

There is currently a huge demand for a product it seems, only Nvidia can manufacture. This is making the company billions while also taking billions away from its clients.

The list of Nvidia’s competitors (and clients) includes all of the largest names with the deepest pockets.

-

Tesla (TSLA) is developing the Dojo supercomputer, which runs on its in-house produced D1 chips.

-

Apple has developed its M3 series.

-

Google (GOOGL) just released its Cloud TPU v5p, its in-house AI accelerator.

-

Advanced Micro Devices (AMD) is soon releasing GPUs that could be comparable to the Nvidia RTX 4080

-

Intel (INTC), which is building out its foundry infrastructure, is now teaming up with Microsoft in order to develop their own custom computing chips.

What’s important to point out here is that none of these competitors even has to out-GPU Nvidia. Nvidia may remain the most advanced GPU maker for decades to come.

But, at the very least, these companies will, in time, be able to make similar and, the key here, much more affordable alternatives. Nvidia’s current margins and growth rates just don’t seem sustainable under this scenario.

It’s funny how today, everyone sees Nvidia as unchallengeable in the GPU space, and so few actually saw this coming two years ago. The same could apply moving forward.

Oversupply/Demand slowdown

With all of this new competition and productive capacity, it’s only a matter of time before this happens.

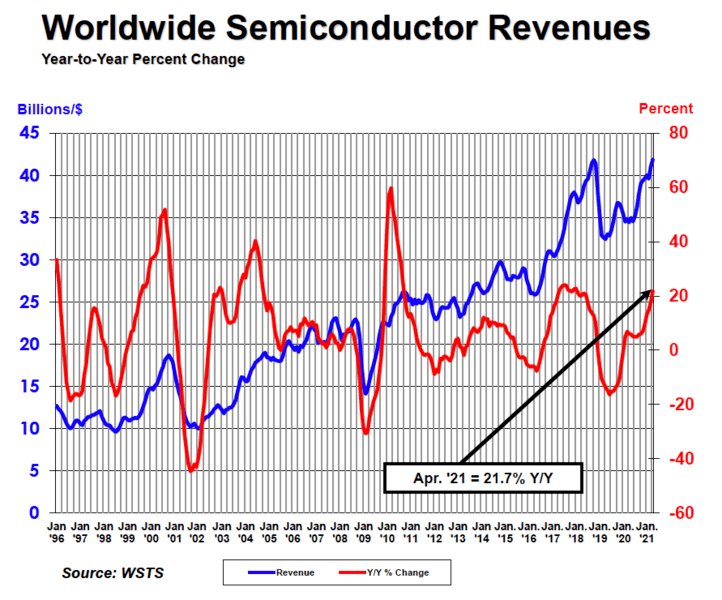

Evolution of semiconductor sales (WSTS)

Semiconductors have for a very long time been known to be a cyclical business. At times, there’s a large need for these, prompting overinvestment. This new productive capacity all ends up coming online at the same time, and that eventually leads to an oversupply.

The cyclicality is best appreciated when we look at the change in YoY revenues (red). However, it is true that over the long term, we have seen higher revenues for semiconductors.

And yes, it is also true that AI has supercharged this cycle, but has it completely erased it?

On the other hand, I believe higher supply in the coming years will also be met by softening demand.

AI mania has reached fever pitch, and I believe there is a lot of demand being driven by “speculation.”

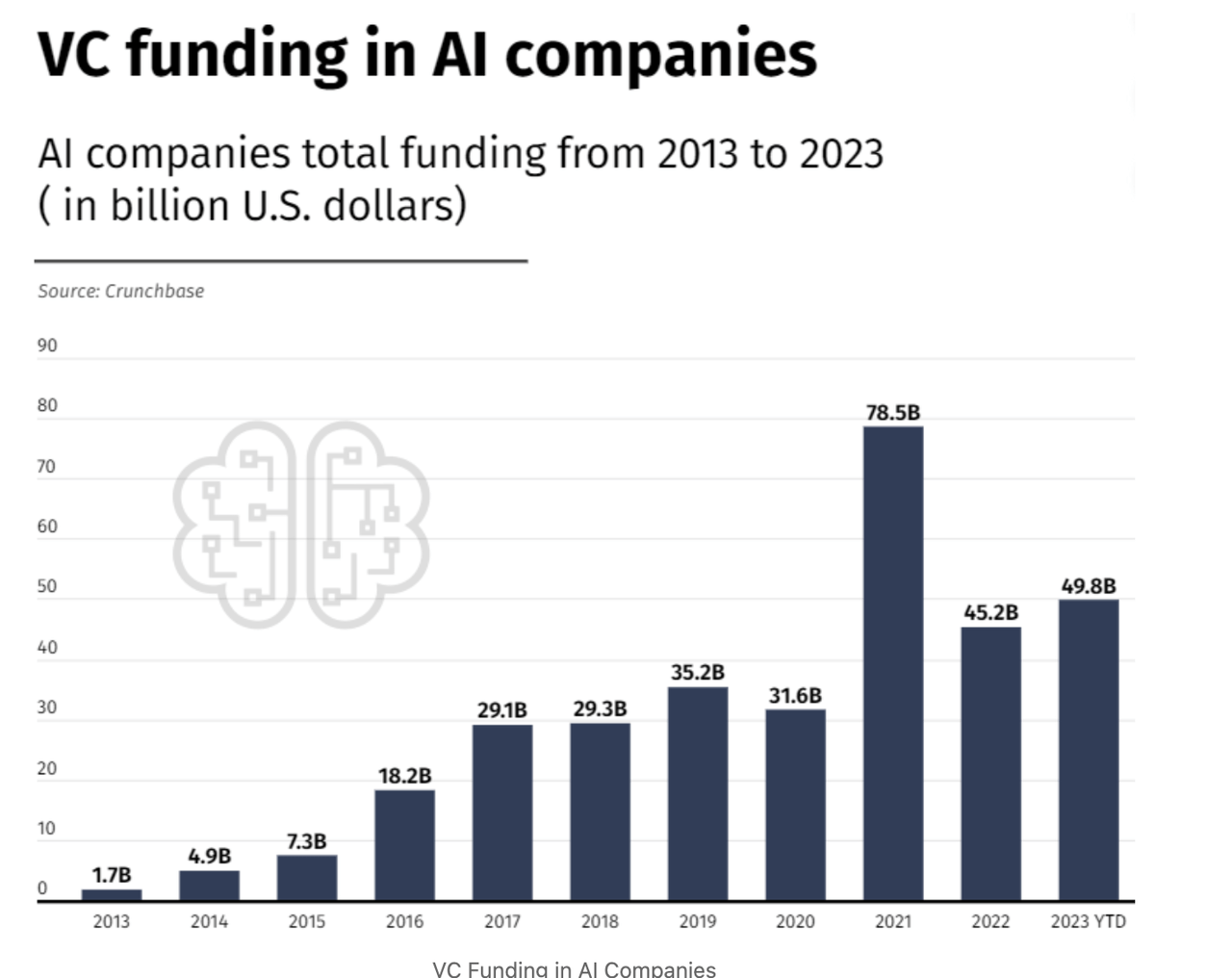

VC funding AI companies (Crunchbase)

VC funding reached $50 billion in 2023 and will likely make new highs in 2024.

Not that there’s anything wrong with that. This is all part of a free-market process of creative destruction. Today we are creating, and tomorrow we will be destroying.

There’s a flurry of AI start-ups popping up, offering free AI this, and free AI that. There’s no room for all of them, and, for that matter, there’s no room for free either.

Eventually, these companies will begin to charge, and as we shift from freemium to subscription models, the market will naturally consolidate and thin out.

No doubt, companies like Google, Microsoft and Adobe will try hard to integrate AI into their suite of applications. And what will happen to the thousands of super niche products out there today? They will slowly be phased out or acquired.

Today’s overexcitement in AI, seems no different to me than the hype we saw five years ago with EVs or the huge run-up in blockchain projects 2021.

All of these are great technologies, but eventually, the initial hype dies down. EVs will continue to increase adoption, but not at the rate many expected. This is already taking a toll on companies like Tesla. Maybe an even better comparison to Nvidia than CSCO.

Regulatory and Ethical Concerns

The world is blinded by the benefits and is overlooking what could be very significant costs associated with the development and deployment of AI technology.

For starters, a big part of the appeal of LLM is they can take all of the information from the internet and distil it. But can they? Does ChatGPT have the rights to all the content on the internet?

The New York Times certainly doesn’t think so, as they recently sued OpenAI for copyright infringement.

Furthermore, AI will pose an ever-increasing security threat. It will become a target of hacks and attacks, and a lot of money will have to be invested in securing these systems.

Not to mention the potential threat AI poses to humanity. AI technology could one day be equal to the nuclear bomb in its destructive capabilities. Are governments around the world required to intervene here? Should there be a limit on who can manage AI applications and for what purpose?

These are all legal and regulatory issues that will no doubt slow down the progress of AI advancements.

Takeaway

Nvidia Corporation stock has no doubt reached bubble-like levels of valuation. But, under the right circumstances, this can be justified. That would require for this kind of exponential growth would continue, and that is not something I see as likely

The company, though perhaps modest in its forecast, is already guiding to a slowdown in revenues, and there are numerous headwinds to Nvidia and the broader AI market.

More likely, I see Nvidia going the way of CSCO. It will remain a great company, and probably even increase its revenues several fold in the next two decades.

But does that mean its stock will keep rising? All I know is that’s not what happened to CSCO when its revenues kept growing but slowed down.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!