Summary:

- Palantir Technologies Inc. stock was bought twice in 2023, leading to sizable gains, now holding a house position.

- AI growth is strong for Palantir, with recent partnerships and government contracts contributing to revenue growth.

- While the company’s performance is positive, the stock is inarguably expensive.

- Some potential red flags on cash flow deterioration relative to customer growth.

Pgiam/iStock via Getty Images

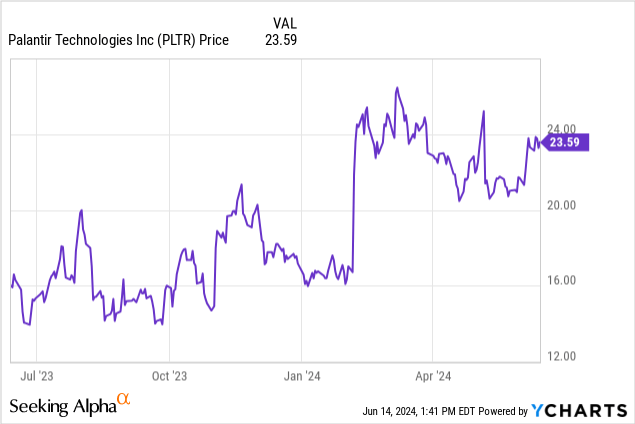

We have been in and out of Palantir Technologies Inc. (NYSE:PLTR) stock a number of times. In 2023, we rated this stock a buy twice, both times leading to sizable gains. We now hold what is known as a house position. However, for traders, back in November 2023 we put a near-term tactical sell on the stock in the $20-$21 range, with the goal of returning to the stock around $17.

If you look at the above chart, you will notice our tactical sell corresponds with the spike in the middle of the chart. The stock proceeded to fall nearly 25% from our tactical sell, and down to levels where we liked buying back into the stock. When this happened, we issued an update to the article with a pinned comment calling the stock attractive again. We follow the stock closely. Long-term, we do see this as a good buy and hold. But a lot of money can be made trading it, or at the very least embracing put selling and covered call selling to ramp up some income against your holdings.

This is the approach we like to take at our investing service. That said, since it has been several quarters since our call, we think holding at these levels is the best approach. Let us discuss recent events.

AI Ramps Growth

In the recent quarterly earnings, we saw performance which was ahead of consensus estimates on revenues, while earnings per share print was positive and in line. But we do acknowledge that while growth is still occurring, the pace of revenue growth is slowing versus past years. Still, the growth is strong and there is room for more governments and more businesses. The fact is that there appears to be a race for AI spending. In fact, a few weeks ago, a bipartisan group of US Senators called for over $30 billion in “emergency” AI funding.

Further, Palantir and Eaton (ETN) expanded their partnership in AI. And two weeks ago, Palantir won another defense contract. The company won a $480 million fixed-price contract from the U.S. Department of Defense for a prototype of its Maven artificial intelligence system. AI is changing the game, and Palantir is reaping the benefits.

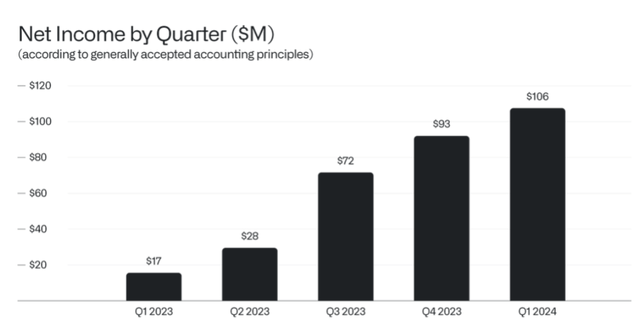

With that said, the pace of revenue growth remains strong, even if it is not growing like wildfire. Still, total revenue grew 20.8% year-over-year to $634.3 million, beating estimates by $16 million. Palantir’s profitability was in line at $0.08 per share. Being consistently profitable is a win, but make no mistake, shares are at a premium to the actual and projected future earnings. While Palantir can grow into this valuation, we may not see sizable upside from the mid-$20s for some time. Still, the trend in earnings is definitely positive:

Palantir Q1 2024 Shareholder Letter

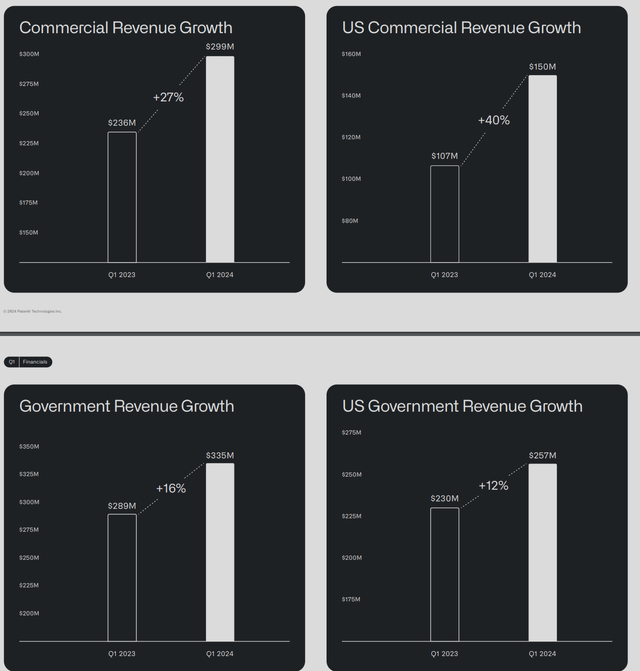

This is slow and steady growth, and quite positive. Now, that said, Palantir has two reporting segments in both the Government and Commercial segments. Commercial revenue is benefitting from AI, and it grew 27% year-over-year and 5% quarter-over-quarter to $299 million. US Commercial growth is back, and strong. US commercial revenue grew 40% year-over-year and 14% quarter-over-quarter to $150 million, very strong, while the US commercial customer count grew 69% year-over-year, as well as 19% quarter-over-quarter to 262 customers.

This is a testament to the expanded sales team at the company. This reacceleration stems from demand for Palantir’s AI offerings, which is why when the stock was sub $10 we called it the real AI winner.

While the Commercial revenue is strong, Government results have been mixed for several quarters. However, it started perking up a bit with international conflicts. And we saw positive news recently as noted above with partnerships and government contracts. In Q1, Government revenue grew 16% year-over-year and 3% quarter-over-quarter to $335 million. Of course, the US Government is the largest customer in this segment. US government revenue grew 12% year-over-year and 8% quarter-over-quarter to $257 million, or 77% of all Government revenue.

The question is whether the pace of growth can be maintained, or even expanded. Of course, percentage change increases are harder when comps are made to larger revenue numbers. Something to keep in mind when considering the pace of growth.

Palantir Q1 2024 Business Update

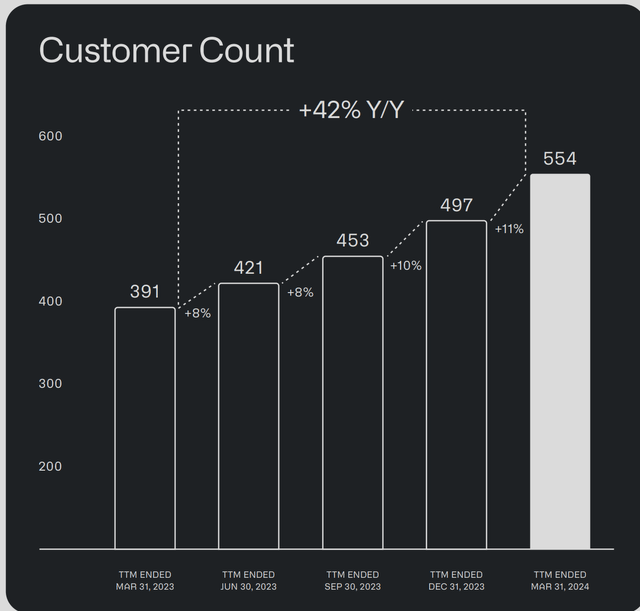

Previously, we had noted that the customer growth by count had slowed. There had been an average regular growth of about 30 customers a quarter, but saw a recent bump thanks to the expansion of the sales team.

Palantir Q4 2024 Business Update

So we saw a 42% increase year-year in total customer count. But as you can see, there was an average 30 customers added for the preceding 4 quarters, then a 57 customer count boost in Q1. This is very bullish in our opinion.

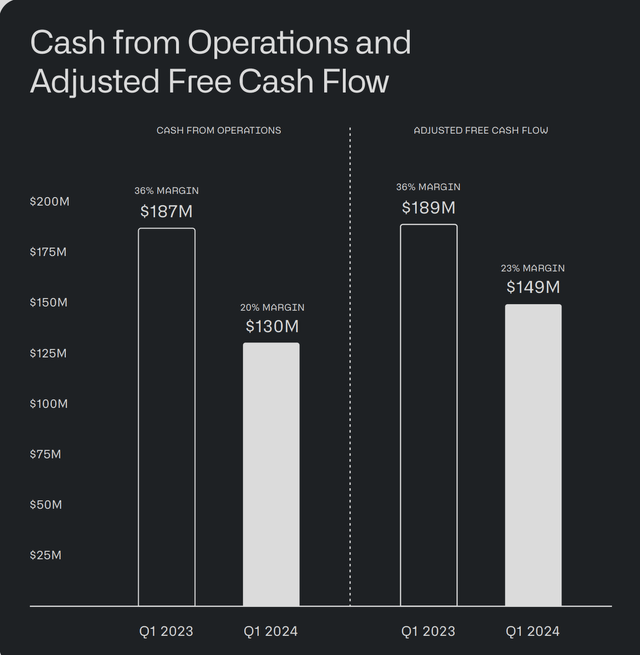

Cash flow declined from last year

Palantir remains cash flow positive, but we note a decline from a year ago despite the big boost in customers and revenues.

Palantir Q1 2024 Business Update

Adjusted free cash flow was $149 million for the quarter, and the 14th-straight quarter for which this was positive. The other major positive is that the company has $3.9 billion in cash and equivalents and no debt. This is also positive. Cash from operations was $130 million, representing a 20% margin which is down from 36% a year ago, while the adjusted free cash flow margin was 23% also down from 36%. This is a line item we will continue to monitor closely.

The growth is there, but the stock is inarguably expensive

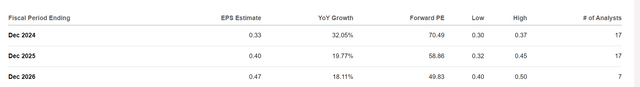

When we consider the valuation, it has actually improved relative to several years ago. Still, even with the improvement, thanks to the growth, Palantir stock is expensive. Given that the market will now be looking for ongoing EPS growth, not just sales and customer growth, the valuation looks really stretched at $24 per share. And the analyst expectations for EPS growth is not all that impressive.

Seeking Alpha PLTR Earnings Estimates

Sure, the 32% growth this year is impressive, but the next two years growth expectations are muted. Palantir will need to overdeliver and really up future guidance to show strong growth here. So here at $24 we are at 18 times sales looking forward. That is fine for a company with rampant growth, but anticipated revenue growth of some 20% is tough to justify such a valuation. The EV/EBITDA on a FWD basis 53X with a price to cash flow over 63X.

These valuations are difficult to come by without wildfire-like growth. We like the company, own Palantir Technologies Inc. stock, and while the growth is respectable, shares are inarguably expensive.

Take home

The performance of Palantir Technologies Inc. is mighty fine, but the stock is expensive. The results in Q1 led the company to upping its guidance. The increase in customer count and higher revenues did not translate to growth in cash flows, which gives us some pause, though one quarter doth not make a trend.

We will need to see Palantir continue to win more contracts, convert more customers, and deliver EPS beats and raises for the stock to really rally past the mid-$20s in our opinion. Long-term we like the stock, in the near-term traders should embrace the volatility and/or consider selling option premium.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for our highest conviction ideas?

Start WINNING TODAY! Advance your savings and retirement timeline by embracing a blended trading and investing approach at our one-stop shop.

We activated our Flag Day deal ahead of other services, so you can lock in our best price in 5 years. Join Seeking Alpha’s premier service while spots remain at the 2018 founding rate! It’s available to the first 3 subscribers ONLY.

Enjoy a money back guarantee if you aren’t satisfied (you will be). Start WINNING today. Get in the game!