Summary:

- Although not a computer science expert, I know enough to understand that AI doesn’t mean cognition, it really means “more” and “better”.

- Accordingly, companies tied to selling “more” and “better” will be the ones to truly profit from AI.

- Dell, at the threshold of a major and potentially prolonged AI-inspired hardware upgrade cycle, will be such company.

- The recently despised May 30th earnings release and guidance that upset many investors is the “little picture”.

- The “big picture” shows DELL to be a powerful growth opportunity based on a big hardware cycle just now getting off the ground.

Lina Moiseienko

Computers are stupid.

They never did, do not now, and will not ever “think.”

All they can ever do is recognize and react to the difference between electric current being “on” or “off.” In machine language, this is expressed as “1” or “0.”

This is so even with AI.

Don’t take my word for that. Here’s how ChatGPT 4o (the public poster child for AI) puts it:

While the conceptual and algorithmic foundations of AI involve complex mathematical and statistical methods, the implementation of these methods relies on the binary computation capabilities of traditional computer hardware. Thus, AI, in practice, is deeply rooted in the binary (ones and zeros) foundation of classical computing systems.

Everything about today’s computers is built to make these combinations of 1 and 0 comprehensible, useful, and desirable to regular humans.

Programmers typically use high-level languages like C++ or Python. These use syntax that is readily learned and used by humans who choose to study programming.

Below that is assembly language. This translates high-level language programming into 1s and 0s.

Numbers and letters each have specific binary (for mathematicians, that’s “base 2”) equivalents.

Numerically, we’re accustomed to base 10. That means we use ten digits, ranging from 0 through 9. Then, we start another sequence; 10, 11, etc.

Base 2 binary has only 0 and 1. So its sequence is 0, 1, 10, 11, 100, 101, 110, 111, 1000, etc.

In base 9, we could say 6. In base 2, that’s equivalent to 110.

Every letter has a numerical “ASCI” code. (You may have seen this if you’ve ever gone between text and numbers in Excel.) The ASCI code for “E” is 69. In binary, that’s 01000101.

There are also binary equivalents for numerical codes that represent colors and sounds.

This means intelligent computing, training on data, etc. are illusions.

Humans are doing all of the so-called computer thinking – and I really mean ALL of it.

Here’s ChatGPT 4o’s take on this (i.e., itself):

While AI is built upon sophisticated coding and algorithms, it lacks the conscious understanding and self-awareness that characterize human intelligence. AI systems are powerful tools capable of performing complex tasks and learning from data, but they do so through statistical methods and pattern recognition rather than true cognitive processing. The distinction between narrow AI and the theoretical concept of general AI highlights the current limitations and future aspirations within the field.

So now, we realize what AI really is. It means more processing. It means more speed. It means better output.

Ultimately, it’s the same sets of things we’ve always done with computers. The difference is that AI means much, much, much, much, much, much, much, more; and much, much, much, much, much, much, much better.

Think of it like the difference between a tiny black-and white circa-1940s television versus a contemporary giant internet-capable high-definition medium, perhaps even like watching a movie, say, on an Apple Vision Pro.

Images people etc. moving in visual settings with context-relevant sounds all come down to the same sets of things… human coded binary (1-0 or rather on-off). But one is exponentially better than the other.

- Now consider what it took to make an old-time Commodore 64 (if you can still find one) display “Hello World” on an old-time TV screen.

- Next consider what it’ll take to get ChatGPT 4o to compose a poem, compose music, to write a novel, to create realistic videos, to explain your medical symptoms, to doctors, to create a picture, or to drive a car.

The latter requires two sets of major advances.

It requires a spectacular amount of more coded instruction.

I get a headache even imagining how many programmed if-then-and-or type logic trees ChatGPT 4o would require. Consider too how many databases it would have to touch.

And then, try to imagine how much more such work it takes to “train” models on data and make computers imitate human output.

So secondly, we need unprecedentedly more speed… especially if we want answers instantaneously, instead of checking back in three weeks.

(And don’t expect the world to patient waiting for output. I remember the early pre-broadband internet. Response times I’d have considered great in the Eighties would today have me screaming and cursing.)

It’ll also mean bringing a meaningful portion of AI work down from the cloud. The new AI computers and phones we hear about will process a lot of the AI locally… on the devices.

This is an important change.

ChatGPT4o told me about seven advantages to device-based AI:

1. Privacy and security: Data remains on the device, reducing the risk of privacy breaches or data leaks associated with cloud storage and processing.

2. Faster Response Times: AI processes data locally, minimizing latency associated with sending data back and forth to cloud servers. This is crucial for applications requiring real-time responses, such as autonomous vehicles or medical devices.

3. Offline capability: Local AI can function without an internet connection, making it suitable for environments where connectivity is limited or unreliable.

4. Cost Efficiency: By reducing reliance on cloud services, organizations can potentially save on cloud computing costs, especially for applications that require continuous or high-volume processing.

5. Scalability: Local AI can be scaled by upgrading hardware or software locally, without relying on cloud infrastructure scalability, which may involve additional costs and complexities.

6. Regulatory Compliance: Certain industries or regions may have regulatory requirements that restrict the use of cloud services or mandate data localization. Local AI helps in complying with such regulations.

7. Edge Computing: Local AI supports edge computing paradigms where processing occurs closer to the data source or end-user device, enhancing efficiency and reducing network traffic.

So ultimately, AI isn’t really about thought, intelligence or cognition. It’s about more and better.

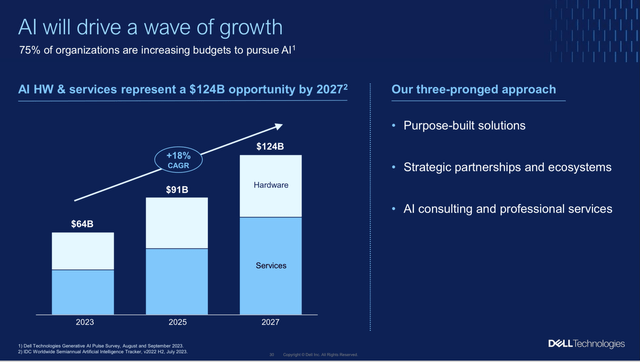

And this sets up a terrific growth opportunity for Dell Technologies, Inc. (NYSE:DELL).

However much we love playing with tools like ChatGPT now, and however much we admire what companies are doing today with AI, none of the hardware with which we work today will suffice for much longer.

For AI (much more processing, much more speed and much better output) to truly become part of our world, I believe we’ll have to replace much of, perhaps all, of today’s hardware.

And as with the first wave of personal computerization, it may not be reasonable to expect to get all we’ll need on day one.

We may need years, or decades worth of successive upgrades until we reach maturity.

This means we’re now poised at the start of a generational new hardware cycle.

Should we call this secular growth? Should we call this an instance of prolonged cyclical growth? More to the point… Who cares?

All we need to call it is a heck of a lot more new business and growth for Dell than is reflected in its circa-16 P/E.

That’s growth investing!

But before jumping in headfirst, we have to understand why DELL has such a modest P/E

There’s Baggage Here

We can’t naively assume low P/E is bullish.

We can debate whether the market is perfectly “efficient” (knowledgeable). But it’s not perfectly dumb.

We need to know why Dell’s P/E is low. And we need reasons to believe it won’t fall even lower.

There’s good news: We know the answers.

For starters, Dell has had a checkered history.

Most notably, Founder/CEO Michael Dell was part of a group that completed a buyout of the company in 2013. In late 2016, Dell made a huge acquisition of EMC. And in 2018, it again became a publicly traded company.

That’s just a tiny sample of all the many board battles, negotiations, discussions with outside investors, other transactions, product missteps, etc. involving this company.

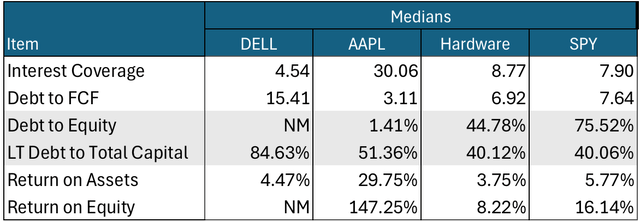

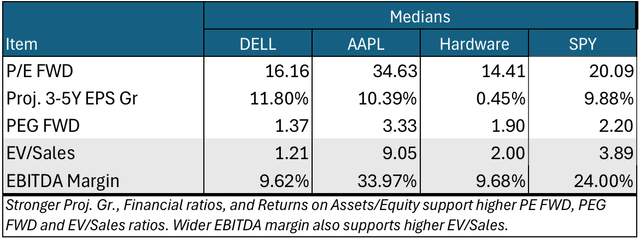

The machinations leave today’s Dell with a set of fundamentals that pale in comparison to those of Apple (AAPL), another big hardware supplier.

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

(I prefer medians since these aren’t impacted by wild distortions often caused by unusual data items, even in big companies that can dominate weighted averages.)

On July 8, 2024, I explained why I’m no fan of Apple’s corporate suite. But I do have to tip my hat in one respect…

So far, consultants, investment bankers, lawyers and accountants seem to have had a much less impact on Apple. Dell, on the other hand, seems to have been a home away from home for many such outsiders.

By now scorning such corporate maneuvers, I suppose I’m doing penance. (My early professional years were in law and managing a junk-bond mutual fund.) Better late than never.

But even if we get past Dell’s prior addiction to heavy corporate stuff, there’s more to address.

Consider the product line for which Dell is best known…personal computers (including laptops) and related things IT pros use to connect them (to one another and the cloud).

For much of my early career, this was a sizzling hot business. Demand and growth were huge as much of the world went converted from no computers to having them.

And the early devices were pretty primitive (from today’s vantage point). So, for a long time, there was lots of money to being made selling new and improved devices to existing users.

Dell wasn’t the only supplier. But the pie was big enough and growing briskly enough to feed lots of mouths.

Ultimately, though, Father Time outran the Technology Hardware, Storage and Peripherals Industry.

New hardware offerings lately have been incrementally better than their predecessors. But they haven’t been radically better.

So, buyers have become much slower to upgrade.

Recently raised interest rates and economic uncertainty and rising inventories further dimmed demand for what Dell sells.

This was reflected in the investment community’s disdain for Dell’s May 30, 2024 earnings-guidance release. The stock’s responded with a 1-day 18% drop.

That’s enough negativity. At least it’s in the past.

As investors, especially when considering a growth investment, we need to look forward…

The Bull Case for DELL Is About AI – About Selling “More” and “Better”

Dell is introducing AI into key products.

This is not a futuristic dream. It’s real today. And it’s very early in what will be a long growth cycle.

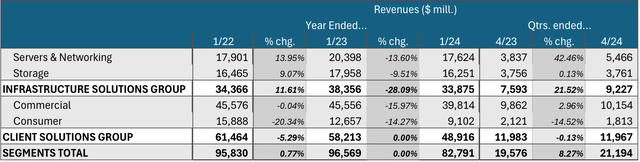

Dell organizes itself around two segments.

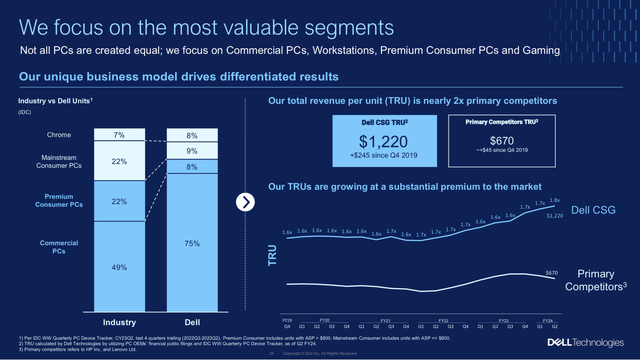

Many of us deal with the company through its Client Solutions Group (CSG). It sells desktop pcs, notebooks, and workstations. It also sells familiar peripherals like docking stations, keyboards, mice, and webcams.

This calls to mind low-margin commodity-like products devoid of any sort of economic moat.

I don’t care about the absence of a moat.

Moat is a horrible metaphor… 100 percent of all moat-protected Medieval seats of power failed to survive, due to sieges, catapults, etc. (And had any lasted into the 1900s, aerial bombardment would have killed them off.)

Businesses must compete or die. And given that, CSG has what I really want to see, on sub-markets worth fighting for.

So, if John Doe chooses to go on CheapJunkyPCs.com and buy a cut-rate product, that’s fine. Dell won’t battle hard for that customer.

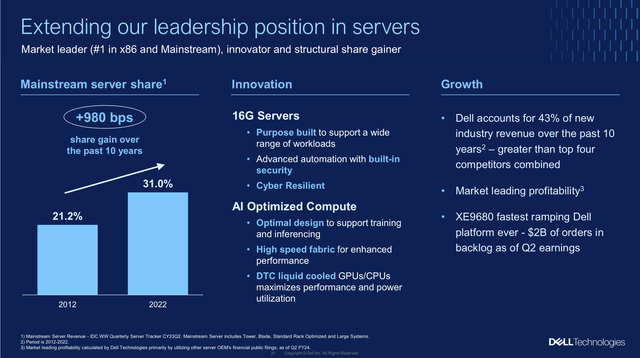

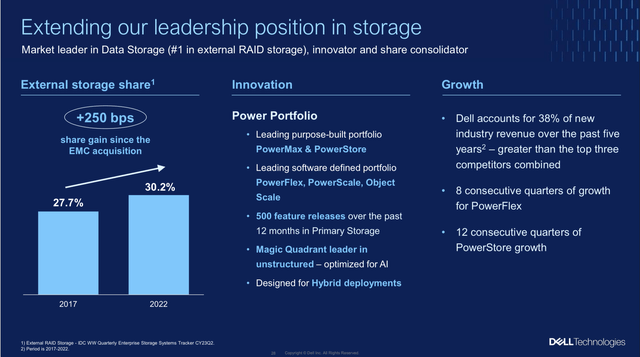

IT professionals are likely to also work with Dell’s Infrastructure Solutions Group (ISG). Here, Dell sells things like high-performance servers, storage (the big stuff, not the sort of gizmos ordinary folks buy), and virtualization software.

The latter creates the experience of working on a pc, for example. But there is no real pc. It’s in the cloud. If your company is already doing AI, it’s likely using the sort of servers, etc. ISG sells.

Here are Dell’s market shares in key ISG product categories.

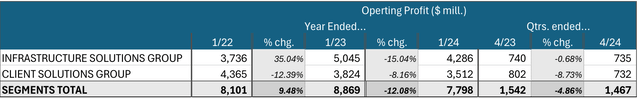

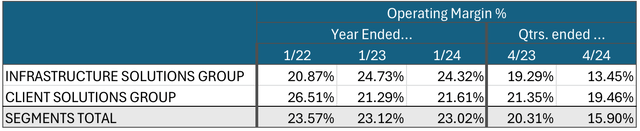

Here’s how the segments contributed to Revenues and operating Profits:

Author Compilation and Calculations based on data from latest 10-K and 10-Q Author Compilation and Calculations based on data from latest 10-K and 10-Q Author Compilation and Calculations based on data from latest 10-K and 10-Q

Recently, I pointed out imbalances in Alphabet (GOOGL) and Apple (AAPL). They’re overwhelmingly dominated by one thing…. (advertising and iPhone, respectively).

We see above that Dell is more reasonably balanced across ISG and CSG.

Both groups have been weak lately. The economy and the so-far uninspiring cycle hit both. The Consumer portion of CSG seems to have been really taking it on the chin.

But again, I don’t care about the past. From our vantage point in the bad part of a cycle, the future naturally looks better.

Here’s Dell’s view of an AI-driven future.

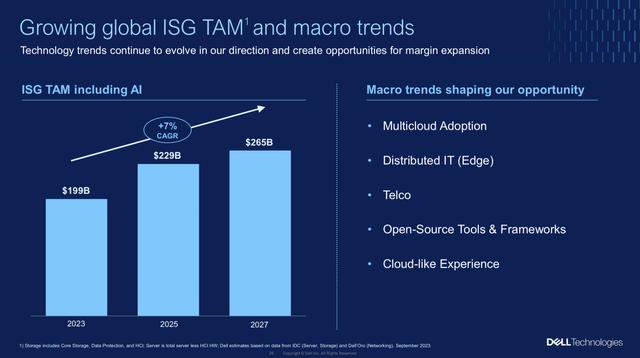

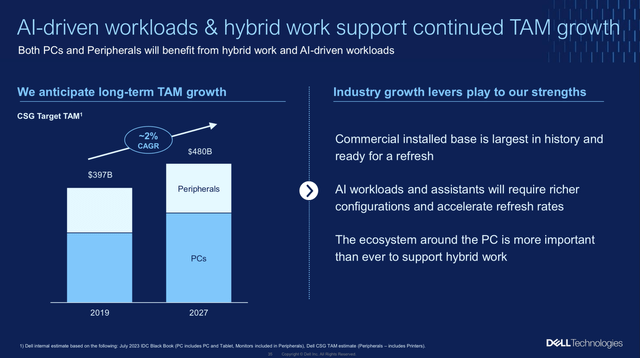

The next two images show Dell’s expectations regarding AI’s influence on segment TAM (Total Addressable Market).

Here it is for ISG.

And here’s it’s CSG. View.

Notice what the last two images do not claim.

We’re not being overpowered by dazzling projections of stupendous near-term growth.

That’s fine. Tech generally and AI particularly have hyped more boldly than anything I’ve seen in many years.

I’d be bothered by DELL’s down-to-earth projections if the stock’s P/E were, say, 75. But it’s not.

DELL can afford to present a more measured view. Remember, its stock sells for only 16.16 times the consensus next-year earnings estimate.

We can take a longer-term view. And we need not stretch “longer” into the very distant future.

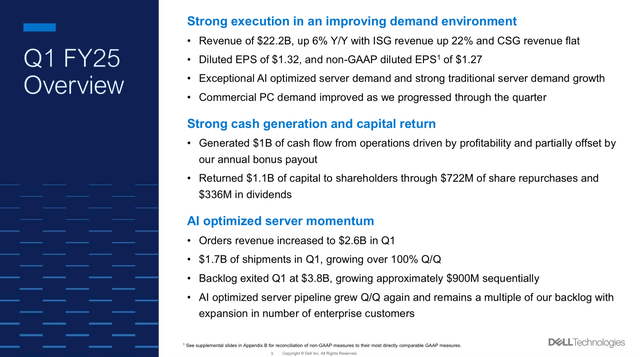

As noted, investors hated the most recent quarter. But that doesn’t change the objective reality that Dell’s long-term future has already started to take shape.

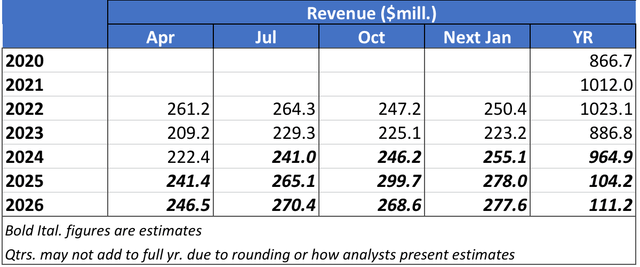

Look at the following tables.

Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations

The foregoing suggests Dell is in the process of passing through an inflection point between falling and rising results.

Risk

The CrowdStrike (CRWD) update bug that recently took down so many Microsoft-based computers world-wide could become an issue.

Microsoft (MSFT) wasn’t directly at fault. And Dell had no role at all in the outage.

Dell sells hardware that runs on Microsoft operating systems. So, if MSFT loses market share, it would hurt Dell.

That could happen if users take increasing umbrage at MSFT’s reputed security weaknesses and excess reliance on an outside vendor (i.e., CRWD) to handle this.

Microsoft is too well established to lose its big gorilla status.

But I have to acknowledge the possibility it may lose some ground. That would impact other firms, like Dell, that operate within MSFT’s orbit.

A really big unknown here is exactly how long it will take for the big bucks to start showing up in Dell’s earnings. Maybe we’ll start seeing a significant amount before this year ends. Maybe we’ll need a slower ramp up.

Serious growth investors focus mainly on the much brighter future, the destination.

But for what it’s worth, many investors, even many who think they’re growth investors, care mainly about the path.

Case in point – the beating DELL stock took after the last conference call. As guidance continues to jockey with reality, such an episode could be repeated.

Meanwhile, Dell is more debt-heavy than other large-cap big-name AI plays.

Despite that, Dell is cash flow positive. It’s paying a dividend. And it buys back stock.

But stronger balance sheets are more comforting. You ever know what will happen in the future.

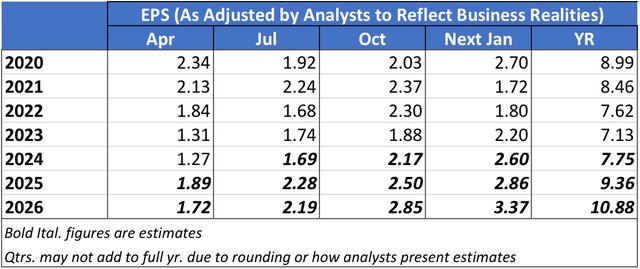

Valuation

DELL shares are attractively valued.

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

Based on EV/Sales, this stock is bargain priced. The ratio, for DELL, is well below medians for SPY and the Industry. Dell’s EV/Sales ratio is far below that of AAPL.

DELL’s EBITDA Margin, relevant in determining how high or low an EV/Sales ratio should be, is not great. But comparatively speaking, it’s not nearly low enough to justify the stock’s meager EV/Sales ratio.

DELL’s P/E FWD is about on par with the median for the lackluster industry. But the company’s Proj. 3-5Y EPS Gr is on par with that of AAPL and a bit above the SPY median. So DELL is bargain priced compared to these benchmarks.

The Industry P/E FWD is a tad lower. But analysts have much lower long-term EPS growth for many companies in that group.

The valuation we see for DELL is a hard-to-resist rarity in the AI world.

What to do About DELL Stock

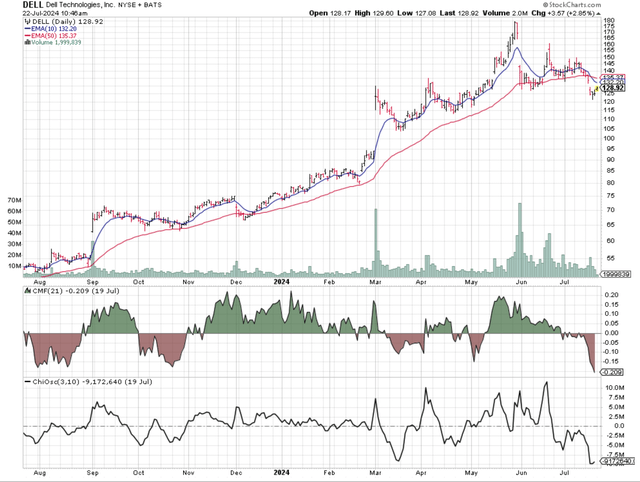

While DELL’s valuation looks good, its price chart is middling.

The price recently crossed below the 10-day exponential moving average (EMA). And the 10-day EMA recently dropped below the lackluster 50-day EMA.

There’s no encouragement from the Chaikin Money Flow (CMF) or the Chaikin Oscillator (CO). Both measure which party to trades is more motivated. CMF does it for institutional investors. CO does it for the market in general.

Both indicators are negative. That tells us sellers are more motivated. That’s a headwind against shares as they try to advance.

If I were a pure technical analyst, I’d say to wait on DELL. But I’m not. I use charts to add context to the present, not predict the future.

I get Mr. Market’s lack of immediate enthusiasm. Many are still licking wounds incurred in the wake of DELL’s last earnings release and disappointing near-term guidance.

But I don’t base my investment case on that. Instead, it’s motivated by the long product upcycle at which DELL now stands on the threshold.

Shareholders may not benefit next week or next month. But growth investors ought not bypass an opportunity to plant a stake at today’s valuation.

As I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than the market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market, and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market, but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market, but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market, and I’m bearish about the direction of the market.

Based on this scale, I’m rating DELL as a “Buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DELL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.