Summary:

- Google recently announced incredible new AI capabilities, including its personalized agent-like service named “Project Astra”, which opens up new and promising monetization opportunities.

- Meta is also moving in the agentic direction as its AI model evolves, with incredible deployment opportunities through its popular communication apps like WhatsApp and Instagram/ Facebook Messenger.

- While Meta stock is trading at a cheaper valuation multiple, Google is still the better investment.

Justin Sullivan/Getty Images News

The two advertising giants, Alphabet (NASDAQ:GOOG)(NEOE:GOOG:CA) and Meta (META)(META:CA), are in a tight race to build versatile AI models and effectively deploy them across their platforms, in order to keep users engaged and the ad dollars flowing. Meta has been trumpeting the capabilities of its latest Llama 3 model, while Google recently introduced the powerful Gemini 1.5 Pro model. Both tech behemoths boast massive user bases that allow for wide-scale distribution of their models. Although only one is worth buying, and that is Alphabet stock.

In the previous article about Google, we covered how Google Cloud is becoming more profitable. In a simplified manner, I delved into specific technical concepts like “compute-optimal scaling” that has enabled Alphabet to train and deploy its models more cost-efficiently, conducive to widening profit margins for its cloud segment. Now aside from Google Cloud, these strategies also enable the tech giant to serve generative AI-powered searches more cost-efficiently. In this article, we will be covering how well-positioned Google is in monetizing the broader rollout of Gemini across its suite of consumer apps, in comparison to chief rival Meta’s rollout of new generative AI features across its social media apps.

Google moving ahead of Meta in terms of monetization

At the recent Google I/O event, Google revealed the roll out of AI Overviews in Google Search to all U.S. users, and that the company would roll it out to other countries more broadly over the coming months, to about 1 billion users by the end of the year. It will be powered by a custom Gemini model that is specifically tailored for Google Search.

On the Q1 2024 Google earnings call, CEO Sundar Pichai had shared that:

We have already served billions of queries with our generative AI features. It’s enabling people to access new information, to ask questions in new ways, and to ask more complex questions. Most notably, based on our testing, we are encouraged that we are seeing an increase in Search usage among people who use the new AI overviews as well as increased user satisfaction with the results.

The fact that test users of AI overviews are using it more frequently is a very encouraging sign, affirming that Google’s user interface experience is positive, and that the Gemini model is able to deliver useful responses.

Moreover, Google would not be rolling out AI Overviews broadly if it wasn’t confident that it can adequately monetize the new search format. On the other hand, Meta is warning of revenue displacement risk as it rolls out its own generative AI features like the Meta AI assistant chatbot, as CEO Mark Zuckerberg highlighted on the Q1 2024 Meta Platforms earnings call:

And I think we’ve seen that with reels and with stories and with the shift to mobile and all these things where basically we build out the inventory first for a period of time and then we monetize it. And during that time when it’s scaling, sometimes it’s not just the case that we’re not making money from that thing. It can often actually be the case that it displaces other revenue from other things.

Hence, at least over the near-term, Google appears to be better positioned than Meta in terms of yielding a return on investment for shareholders from all that AI-focused infrastructure spending.

Google’s AI Overviews and Gemini App

Now it might be confusing to keep track of the different Gemini-powered services that Google is offering. On the one hand there is AI Overviews, which is essentially the evolution of the traditional Search engine, and will continue to be monetized through advertisements. And then on the other hand there is also the Gemini app, a conversational chatbot in response to OpenAI’s ChatGPT.

And this is where Google’s plans for monetization may become confusing for investors, because while the Search giant has been moving forward with showing ads in AI Overviews, the Gemini app remains free. So this raises the question, what if users simply ask Gemini for the answer or suggestions they are looking for instead of Google Search? The company would simply be losing out on ad revenue in such instances.

In fact, survey-based research from Morgan Stanley found that “36% of Google’s Gemini users are using the chatbot to shop for products”, which represents missed opportunities for Google to show ads.

Of course, Google has been encouraging users to use the new generative AI-powered Search for such commercial use cases in its demonstrations of AI Overviews, as this is where the tech giant aims to show timely ads, at least for the time being.

Whereas the demonstrations of the Gemini app seem to more focused on helping users complete personal tasks, demonstrating how it can integrate with other Google Workspace apps like Gmail, Google Docs/Sheets and Google Drive. The monetization strategy here is to make users accustomed to asking Gemini to complete personal tasks for them such as drafting an email or managing travel itineraries, and eventually encouraging them to upgrade towards using Gemini Advanced, powered by its latest Gemini 1.5 Pro model. Gemini Advanced is currently only accessible via a ‘Google One AI Premium’ plan, bundled with other Google services (mainly file storage space) for $19.99/month.

Furthermore, Google also introduced “Project Astra” at the I/O event, which is the personal AI agent that one can conversate with verbally, showing incredible capabilities in terms of spatial understanding, video processing and memory. Following the demonstration, Google DeepMind CEO Demis Hassabis shared that “some of these agent capabilities will come to Google products like the Gemini app later this year”. Now it remains to be seen which (if any) agentic capabilities will be available for free through the Gemini app, and which features require users to upgrade to a paid subscription, and how aggressively Google will be able to charge for this service to generate revenue and profit growth for investors.

Meta AI assistant and the “personal agents” evolution

Now with regards to Meta, the company has also introduced its own chatbot called ‘Meta AI assistant’, and Zuckerberg had discussed on the last earnings call that they also plan to evolve this chatbot feature into an AI-powered agent that can help users complete more complicated, multi-step tasks, and suggested different monetization possibilities:

We’re not working on search ads or anything like that. I think this will end up being a pretty different business. I do think that there will be an ability to have ads and paid content in Meta AI interactions over time as well as people being able to pay for whether it’s bigger models or more compute or some of the premium features and things like that, but that’s all very early in flushing out.

…

I think that the next phase for a lot of these things are handling more complex tasks and becoming more like agents rather than just chat bots… what an agent is going to do is you give it an intent or a goal, then it goes off and probably actually performs many queries on its own in the background in order to help accomplish your goal

It is unclear how Meta will monetize such “personal agents”, though a subscription-based model is most likely, given that it is the approach that rivals like Google and OpenAI are adopting.

So to make things clear, the social media giant’s current chatbot, “Meta AI assistant”, which is available through apps like WhatsApp and Messenger, is likely to be monetized through ads/ paid content, competing against Google’s AI overviews for ad dollars. And then Meta’s anticipated “personal agent”, which would be powered by more complex AI models, could likely be monetized through a subscription fee, and would compete against Alphabet’s Google One subscription service.

Google’s AI Overviews versus Meta AI assistant

Now in terms of Meta AI assistant competing against Google’s AI Overviews for user engagement and ad dollars going forward, Google’s advantage lies in the fact that it simply offers a much broader suite of consumer applications that can be leveraged to provide users with more contextually valuable responses.

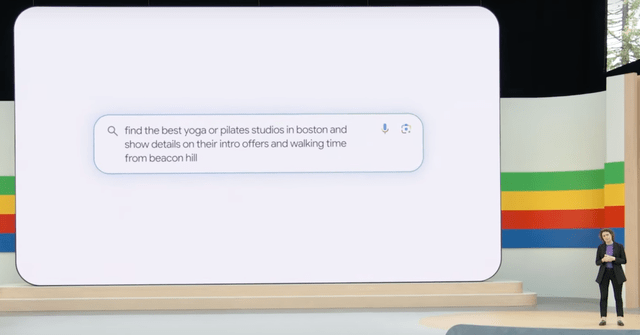

For example, as per the example Google shared during its I/O event recently, a person searching for yoga classes nearby could enter a multi-part question at once to incorporate all the different factors they consider when making their decision.

AI Overviews question example (Google I/O 2024)

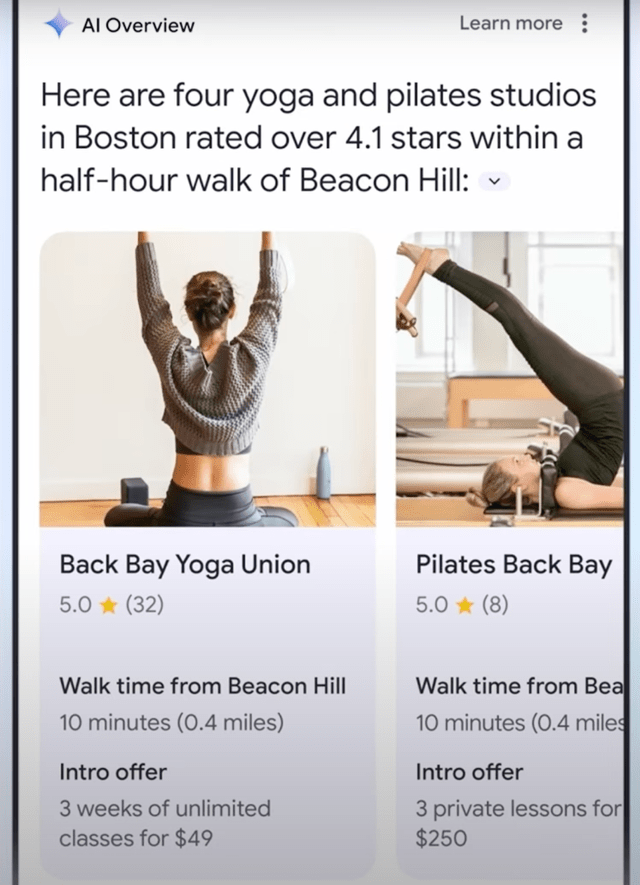

Google savvily showcased how data from Google maps is automatically incorporated into the Overviews to allow users to consider the choices holistically all at once.

AI Overviews response example, incorporating data from Google Maps and business reviews (Google I/O 2024)

Google even boasted how it can incorporate the extensive information it holds on all the businesses indexed on Google search, such as business ratings, reviews and opening hours.

AI Overviews leveraging data from businesses indexed on Google search (Google I/O 2024)

Hence, such advantages that Google holds over Meta could potentially encourage people to use AI Overviews instead of Meta AI assistant, better positioning Google to generate ad dollars for shareholders.

And the advantages for Google does not stop there. At the I/O event, Google also showcased an example of when users need to search for solutions relating to physical objects/ devices. AI overviews could not only find relevant content from articles listed on Google, but also from its massive library of YouTube videos. There is even the opportunity for Google to pinpoint the exact part of the video that is relevant to the user.

Owning the largest video-sharing platform in the world is likely to be a big advantage for Google in this AI revolution.

To stay competitive, Meta is also encouraging greater video-sharing on its social media platforms like Instagram and Facebook, with executives on the last earnings call claiming that majority of the time spent on its apps were on videos.

CEO Mark Zuckerberg:

On Instagram, reels and video continue to drive engagement with reels alone now making up 50% of the time that’s spent within the app.

CFO Susan Li:

Video also continues to grow across our platform and it now represents more than 60% of time on both Facebook and Instagram. Reels remains the primary driver of that growth and we’re progressing on our work to bring together reels longer form video and live video into one experience on Facebook.

However, Google’s YouTube simply has a much larger collection and wider range of videos to leverage for a variety of different use cases. A 2023 research paper from a team at the University of Massachusetts Amherst estimated that there are over 10 billion videos on YouTube.

Meta CFO Susan Li’s remark that Reels (up to 90-second short-form videos) is the primary driver of the video-consumption growth on its platforms suggests that most videos on its social media apps are oriented towards entertainment, whereas YouTube also boasts a wide range of long-form videos such as news, product reviews, guides, educational and ‘how to’ instructional content. Google simply has a much deeper reservoir of knowledge to tap into to answer users’ questions. Thereby better positioning the company to generate ad revenue for shareholders.

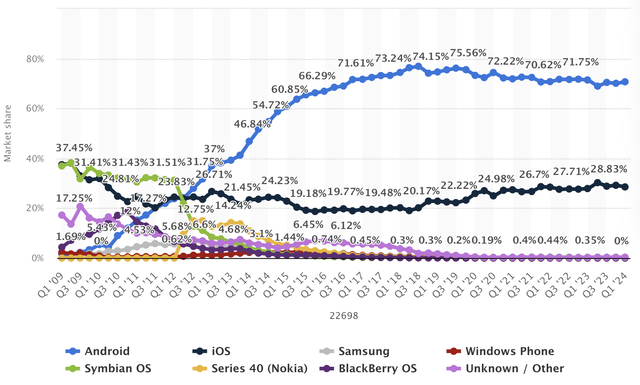

Although perhaps Google’s biggest advantage against Meta is the fact that it owns the most popular mobile operating system on the planet, with Android boasting over 70% market share in Q1 2024.

Mobile Operating System market share (Statista)

The way Google is leveraging this advantage is by making its AI-powered features directly accessible across the entire operating system. Dave Burke, Vice President of Engineering for the Android Platform, mentioned at I/O event that (emphasis added):

A couple months ago we launched Gemini on Android. Like Circle to Search, Gemini works at the system level. So instead of going to a separate app, I can bring Gemini right to what I’m doing. Now, we’re making Gemini context aware, so it can anticipate what you’re trying to do and provide more helpful suggestions in the moment.

This will make it much harder for Meta Platforms to encourage people to use the Meta AI assistant for everyday tasks, as it would only be accessible through its own apps like Instagram, Facebook or WhatsApp. Whereas Google’s Gemini is accessible to Android users at the overarching mobile operating system level from any app on the phone.

Furthermore, Google’s demonstrations of how Gemini will be deployed within Android showcased how Gemini will be accessible through both text and voice commands, thereby replacing the traditional Google Assistant.

So while one would have to open one of Meta’s social media apps to access its AI assistant, Google’s Gemini is much more easily accessible through voice command at the system level on their phones.

So Google clearly has the upper edge here in terms of which assistant people would opt for to start their searches, given the faster and easier accessibility of Gemini across the massive base of Android users. It not only gives the Search giant an edge over Meta, but also rival services like OpenAI’s ChatGPT and Perplexity.

However, this could change with regulation, whereby Alphabet could be required to offer choice screens to consumers for them to choose which voice assistant they want to set as their default on their device. Although there is a case to be made that consumers could still opt for the Gemini voice assistant if it more seamlessly and effectively integrates with Google’s suite of popular apps like Gmail, Google Maps, Google Photos and YouTube that consumers may use frequently.

The “personal agent” war

So now let’s move onto the subscription-based “personal agent” war between the two tech giants. As mentioned earlier, Google already charges $19.99/month for Google Advanced, and the rollout of more agentic capabilities (as showcased with Project Astra) could potentially enable the Search giant to charge even higher prices. And Meta’s Mark Zuckerberg has also hinted at charging consumers for larger, more complex AI models that it will roll out going forward.

Now in order to determine which of the two tech giants is better positioned to monetize their AI models through subscription fees, we must consider what kind of activities people currently use each platform for, and what the future capabilities are likely to be.

Meta’s apps like WhatsApp and Messenger are popular means of communicating with friends & family, and Facebook and Instagram are popular sources of entertainment (with the rise of Reels videos). But more valuably, its suite of social media apps are increasingly being used to discover and shop for products and engage in various commercial activities.

Google, on the other hand, offers a much wider suite of consumer applications. Google Search is already widely used for commercial searches, not just physical products, but also all kinds of services like dentists, barbers, gyms, etc. And the deep integrations with other useful apps like Google Maps and YouTube further augments the commercial search experience. Google is clearly ahead of Meta from this perspective.

Furthermore, YouTube remains the most popular destination for video-consumption, beyond just entertainment. And the Google Play store is also a widely used marketplace for finding/ buying new apps.

And then of course we have the Google Workspace apps like Gmail, Google Drive for file storage, as well as productivity apps like Google Docs/ Sheets.

The point is, Google offers a much wider suite of services than Meta through which it can deploy agentic capabilities and bundle together to offer a more appealing subscription service.

When Mark Zuckerberg was discussing the potential consumer applications of its anticipated “agents” on the last earnings call, he said:

what an agent is going to do is you give it an intent or a goal, then it goes off and probably actually performs many queries on its own in the background in order to help accomplish your goal, whether that goal is researching something online or eventually finding the right thing that you’re looking to buy. There’s a lot of complexity and sort of different things that I think people don’t even realize that they will be able to ask computers to do for them.

Now activities like “researching something online or … finding the right thing that you’re looking to buy” are both things that Google’s agents will also enable people to do, so no real differentiator there.

Whereas when Google discussed the potential applicability of Gemini’s agentic capabilities at Google I/O, it focused much more on helping users complete personal tasks that they would usually do with apps from Google Workspace.

Google gave a clever example of a sole trader/ businessperson wanting to analyze the profitability across their products, with Gemini fetching the relevant data from the user’s relevant Google Sheets. This is simply not possible for Meta to offer, as it doesn’t offer competitive productivity apps to integrate with its agent.

Furthermore, one key advantage Google has over Meta is that Google’s services are more widely used in the corporate world than Meta’s apps. Hence as employees become increasingly accustomed to using Google’s Gemini-powered services at work, they could potentially become inclined to also using Gemini for personal use-cases.

Moreover, the use of Google services in work environments also means that employers will likely offer training demos to help employees make the most effective use out of these new services, such as certain tricks for how to phrase commands to get the best responses or highest quality task completions from Gemini. Hence as working professionals become increasingly accustomed to using Gemini to complete certain tasks for them, they may potentially be more likely to also use Gemini for personal tasks.

Overall, I believe Google is better positioned to generate subscription-based revenue for investors than Meta, given the Search giant’s wider array of popular apps that can be bundled together for a more compelling subscription offering. Google certainly has greater opportunities, although which apps and services will actually be bundled together remains to be seen.

Risks to the bull case for Google

AI Overviews may not be the preferred tool for commercial experiences: As mentioned earlier, AI Overviews is where Google wants users to search for products and services they need, as this is where the Search giant aims to show ads. Although users may prefer to engage in commercial activities through conversational chatbots and agents to which they can ask numerous follow-up questions to better compare and contrast products before making purchasing decisions. Hence users could end up preferring the Meta AI assistant over Google’s AI Overviews. This creates the risk of Google potentially losing out on ad revenue to Meta.

Though on the flip side, Google also offers the Gemini conversational service, and a notable portion of users are already using it for shopping activities, as mentioned earlier. And if Google continues to keep the freemium tier of Gemini ad-free while Meta tries to monetize through advertising, users could potentially prefer the Gemini app for such commercial services where they could receive impartial suggestions. Even though Google would not be making any money off of this use case, instead just making it harder for Meta to monetize its own chat service through ads. Though Google could indeed strive to monetize the increased use of Gemini by encouraging users to upgrade towards Gemini Advanced to facilitate richer commercial experiences.

Google’s roll out too slow: While the Search giant showed off incredible new AI capabilities at its I/O event, the executives shared that agentic features like “Project Astra” would only become available later this year.

Rewinding back to the Google I/O event from 2023, at the time they had shared how popular third-party apps like Walmart and Uber Eats would be integrating with Bard (now Gemini), enabling users to engage in various commercial activities. They had mentioned that such integrations would roll out over the next couple of months. One year later, these integrations have still not manifested.

Brands integrating with Bard/ Gemini (Google I/O 2023)

So that begs the questions, will Google’s new agentic capabilities actually roll out later this year? I’m not saying that it will not roll out, but Google certainly needs to move faster given the number of competitors striving to take market share away from the tech giant.

The good news is that chief rival Meta has also not yet been able to introduce such complex agentic capabilities. Although rising rival OpenAI is certainly moving ahead fast with the introduction of ChatGPT 4o, and the rumored partnership with Apple would open up a massive distribution channel for the Microsoft-backed start-up. Thereby creating formidable competition against Google. Hence, the pressure is on for Alphabet to move faster with the rollout of personal AI agents.

Financial performance and Valuation

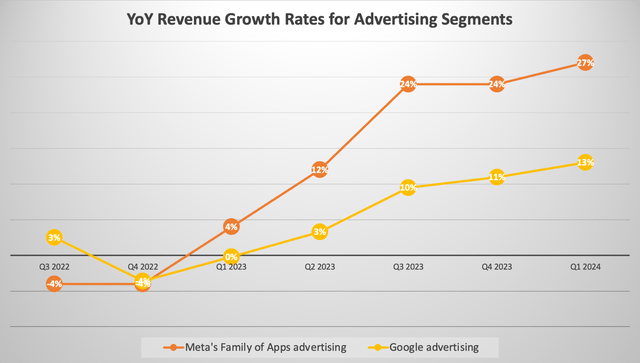

Google saw advertising revenue accelerate in Q1 2024, boosted by YouTube in particular growing by almost 21% last quarter.

Nexus, Data compiled from company filings

Now while Meta’s Family of Apps advertising revenue has been growing at a much faster rate than Google, it is important to remember that the Search giant’s advertising segment grows off of a much larger revenue base than Meta’s. For context, Google Advertising generated over $61.6 billion in Q1 2024, while Meta’s Family of Apps ad revenue was $35.6 billion over the same period.

Though the real test will come henceforth as to whether Google can sustain ad revenue growth as it rolls out AI Overviews more broadly across the world.

On the Q1 2024 earnings call, Chief Business Officer Philipp Schindler had shared that:

We’re continuing to experiment with new ad formats, including search and shopping ads alongside search results in SGE. And we shared in March how folks are finding ads either above or below the SGE results helpful.

These insights are certainly more encouraging than Meta’s Zuckerberg warning of revenue displacement risk as the social media giant encourages users to try out its new generative AI-powered features.

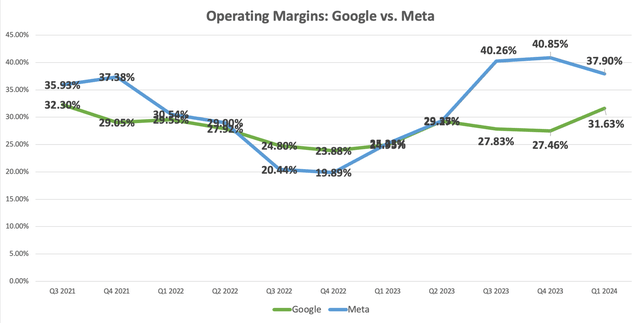

Now from a profitability perspective, Meta has been more profitable than Google over the past few quarters. The social media giant’s ‘Year of Efficiency’, involving notable cost-cutting measures, has helped boost its operating margin.

Nexus, Data compiled from company filings

That being said, Google saw a noteworthy spike in operating margin last quarter, as it strives to better control costs. Similar to how Meta had its Year of Efficiency last year, the market is expecting Google to tighten its belt this year, which should be conducive to profit margin expansion.

On the last earnings call, CEO Sundar Pichai mentioned that:

We also remain focused on long-term efforts to durably re-engineer our cost base. You can see the impact of this work reflected in our operating [margin]. We continue to manage our headcount growth and align teams with our highest priority areas.

The company is truly re-engineering their cost base in a durable manner for the long-term. In the previous article, we covered how Google is weaving ‘cost-efficiency’ into the fabric of its AI innovation, using techniques like “compute-optimal scaling”, to drive sustainable profitability for shareholders.

Furthermore, on the Q1 2024 earnings call, CEO Sundar Pichai proclaimed that:

a number of technical breakthroughs are enhancing machine speed and efficiency, including the new family of Gemini models and a new generation of TPUs. For example, since introducing SGE about a year ago, machine costs associated with SGE responses have decreased 80% from when first introduced in labs driven by hardware, engineering, and technical breakthroughs.

Hence, Google has been proving its ability to drive long-term cost-efficiencies and should be able to continue driving operating margin expansion for shareholders going forward.

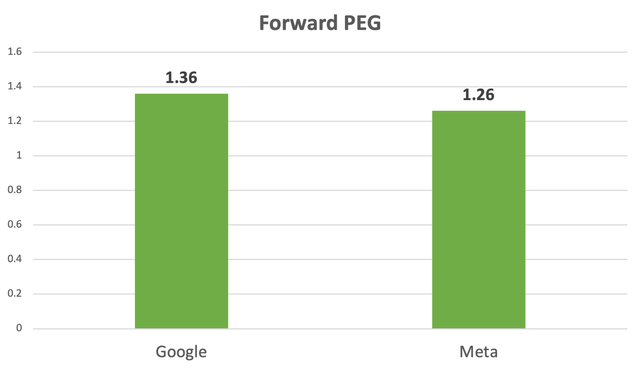

Now in terms of valuation, Google and Meta trade at similar Forward PE multiples of between 23x to 24x.

Although a better valuation multiple to consider would be the Forward PEG ratio, which adjusts the Forward PE multiple for the expected future EPS growth rate over the next 3-5 years.

A Forward PEG of 1 would imply that a stock is trading at fair value relative to future growth expectations.

Nexus, Data compiled from Seeking Alpha

Now based on this valuation measure, Meta stock is slightly cheaper than Google. However, both GOOG and META are trading significantly below their 5-year average PEG ratios of 1.49 and 1.51, respectively.

Although looking beyond the numbers, we must consider why the market would assign a higher valuation multiple to Google over Meta.

Firstly, as discussed, Google seems to be in a better position than Meta when it comes to monetizing generative AI. Because while the social media giant is warning of potential revenue displacement as it rolls out new features, Google is already striving to monetize AI Overviews through ads. Moreover, I believe the Search giant is also better positioned than Meta when it comes to offering attractive, bundled subscription offerings thanks to its wider suite of consumer apps, conducive to lucrative subscription revenue for shareholders, as I laid out the case earlier.

But reasons for the market to assign a higher valuation multiple to GOOG over META does not stop there. Alphabet also boasts the third-largest Cloud Provider Service in the world, Google Cloud. The cloud industry is one of the earliest beneficiaries of the AI revolution as enterprises around the world seek to transform their business processes, as well as their products and services, fit for the new era of generative AI. All of which requires immense cloud computing power, and Google Cloud is one of the key beneficiaries of this shift. Hence, Google is witnessing strong and immediate revenue growth from its cloud unit as well, further supporting the bull case for the stock.

Meanwhile, Meta’s other massive bet, the Metaverse, has yet to turn a profit for shareholders.

Therefore, I believe a Forward PEG of 1.36 is an attractive multiple to pay for Google stock given the growth opportunities ahead, and hence maintain a ‘buy’ rating on the stock, while Meta stock remains a ‘hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.