Summary:

- Market selloff due to economic data presents investment opportunity.

- Airbnb’s strong growth potential is supported by under-penetration in the lodging market.

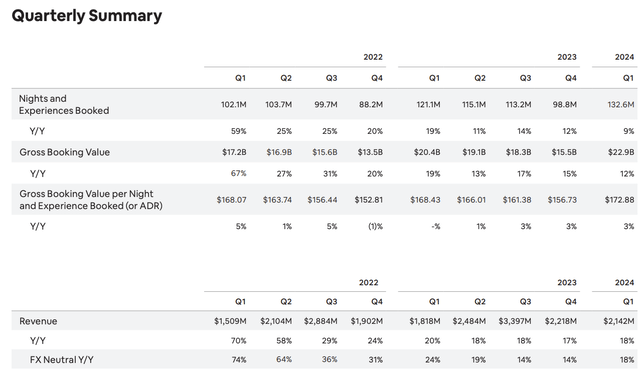

- Airbnb demonstrates strong bargaining power, maintaining a 3% annual growth in booking value per night despite economic pressures.

- Airbnb’s international expansion strategy could potentially double its booking value if it reaches penetration levels comparable to the Americas.

Klaus Vedfelt/DigitalVision via Getty Images

Investment Thesis

The market experienced a selloff by the latest PMI data and the unimpressive US unemployment numbers. Wall Street is getting nervous, with growing concerns that American wallets are snapping shut and the economy might be losing steam. In the wake of the market tumble, we’ve seen a predictable flight to safety – cash is pouring into classic defensive plays like healthcare stocks and utilities.

We see potential opportunities for investors in the recent selloff. Businesses with superior products and low market penetration rates are likely to continue expanding. Among these businesses is Airbnb (NASDAQ:ABNB). After examining its fundamentals, we believe the company will likely maintain its growth trajectory over the next few years. We recommend investors consider including it in their portfolios.

Recent Stock Performance

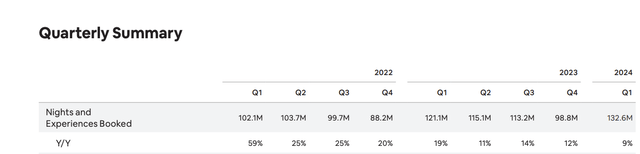

The stock price of Airbnb has fluctuated. It still hasn’t returned to its peak during 2021–2022. This can be attributed to the company’s declining growth starting in 2022. There has been a slowdown in the growth of both the total value of bookings and the number of nights reserved. (See below chart and exhibit)

Stock performance (Seeking Alpha) Operating metrics (ABNB)

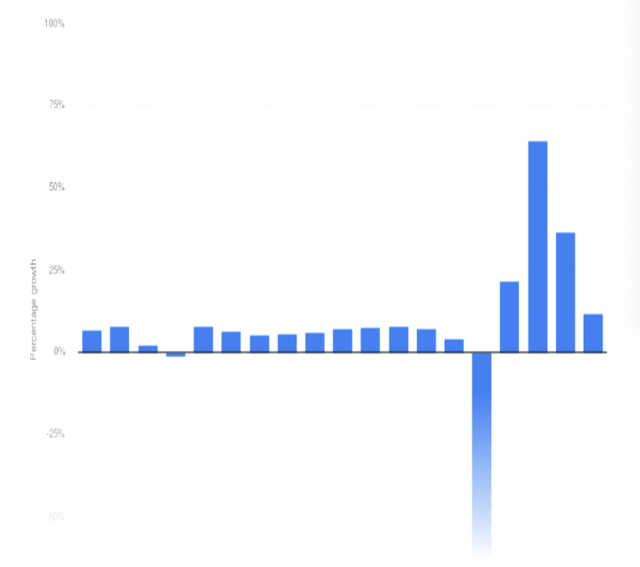

We attribute the 2023 slowdown to a normalization of demand following unusually high post-pandemic levels, noting that the current growth rate is still higher than pre-pandemic levels. (see below chart)

Annual growth in global air traffic passenger demand from 2006 to 2023, with a forecast for 2024 (Statista)

Competitive Advantage & Low Penetration

Global tourism industry growth may be impacted by geopolitical concerns and a potential economic slowdown. However, we think that companies with a competitive advantage and low penetration should continue to shine.

(1) the company was able to maintain strong bargaining power against its users.

Despite the aggressive measures implemented by central banks to curb demand, Airbnb has maintained a 3% annual growth rate in the value of bookings each night.

Operating metrics (ABNB)

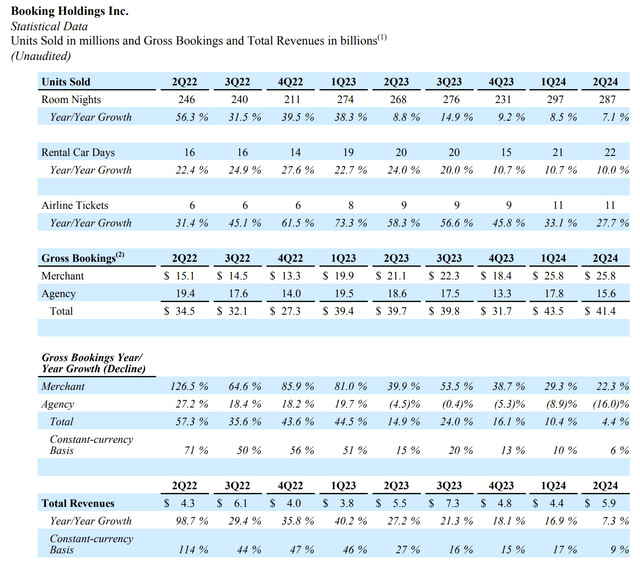

Airbnb saw increases in bookings (12%), nights booked (9%), and revenues (18%) in Q12024 (see above exhibit). The biggest company in the hospitality industry, Booking Holdings (BKNG), saw a similar slowdown at the same time. Its growth in booking value and revenue is currently, however, much weaker than Airbnb. (see the below exhibit)

Operating metrics (BKNG)

To compare Booking and Airbnb on a like-for-like basis, we made some assumptions. Assuming all Booking’s reservations are for hotels, our calculation suggests that Booking’s average book value per night of $145 is lower than Airbnb’s current average of $172.

Airbnb’s ability to command a premium price is evident in customer preferences. A survey asked people why they use Airbnb. Most people said two main things:

- It’s easy to use and pay on Airbnb. 95% of users liked this.

- Airbnb is more convenient than hotels. 86% of users thought this.

This reflects that Airbnb can create value by adding more selections and a sense of security for its customers.

Additionally, Airbnb is excellent at providing its clients with a price-value proposition that is appealing. The global average price for a one-bedroom listing on Airbnb in March was $114, which is far less than the $148 average for hotels, according to the company’s data. These numbers may provide Airbnb an advantage over rivals like Booking since they demonstrate the company’s ability to satisfy both affluent and cost-conscious clients.

Even though Booking presently has around twice as many nights reserved than Airbnb, Airbnb seems to be in a better position to bargain with its suppliers. This is clear from the fact that Airbnb’s suppliers are individual owners and corporations, but Booking’s suppliers are only companies. Thus, Airbnb is more powerful than Booking in supplier negotiations.

2. Airbnb is currently under-penetrated in the alternative lodging market.

Right now, Airbnb’s penetration rate in the lodging sector is relatively low. With $1.8 trillion allocated to short-term stays, $210 billion to long-term stays, and $1.4 trillion to experiences, Airbnb has estimated that its potential market is worth $3.4 trillion. Based on 2023 booking data, Airbnb has a 2.1% penetration rate as of right now. This offers the business enormous upside potential. Furthermore, compared to the overall hotel market, the growth rate of the alternative lodging sector was higher. The management of Booking expressed optimism about alternative lodging in Q2 2024 as well, noting that the percentage of nights booked had climbed to 36%, up 200 basis points from Q2 2023, and that alternative night growth was 12% greater than overall growth. These data suggest that alternative lodging may have not plateaued.

We think that Airbnb is better positioned than Booking in these alternative lodging opportunities because it better addresses the pain points for customers. Contrary to hotels, alternative lodging is hosted by individuals, and thus the quality of the product differs. Therefore, establishing trust and maintaining quality control is essential for success. To build trust, Airbnb requires users to create accounts, and the platform records review history from both hosts and customers. This creates the creditworthiness basis for its review system. While Booking primarily focuses on price comparison and relies on its suppliers (hotels) for quality control, its customers are not required to create an account to book. Hence, its review system is not as robust as Airbnb’s. As a result, Airbnb establishes stronger trust between suppliers and customers than Booking.

On the supplier side, a study suggested that a 1% increase in Airbnb listings leads to a 0.018% increase in rents and a 0.026% increase in house prices. Therefore, despite many cities now imposing restrictions on Airbnb listings, its listings continued to grow. According to Airbnb, it grew suppliers by 18% in 2023 and 17% in Q1 2024, even after eliminating certain unqualified hosts. As long as Airbnb can attract more valuable customers and generate additional income for hosts, suppliers will come. Airbnb reported 7.7 million listings worldwide by the end of 2023, and hosts earned more than $57 billion in 2023. There are 144 million residences in the US if we limit our analysis to only the US market. Therefore, Airbnb has a lot of space to grow in terms of its supplier base potential globally.

Valuation

Base Case

TAM

The company currently has a 2.1% market share (based on 2023 booking value calculation) in its TAM of $3.4 trillion.

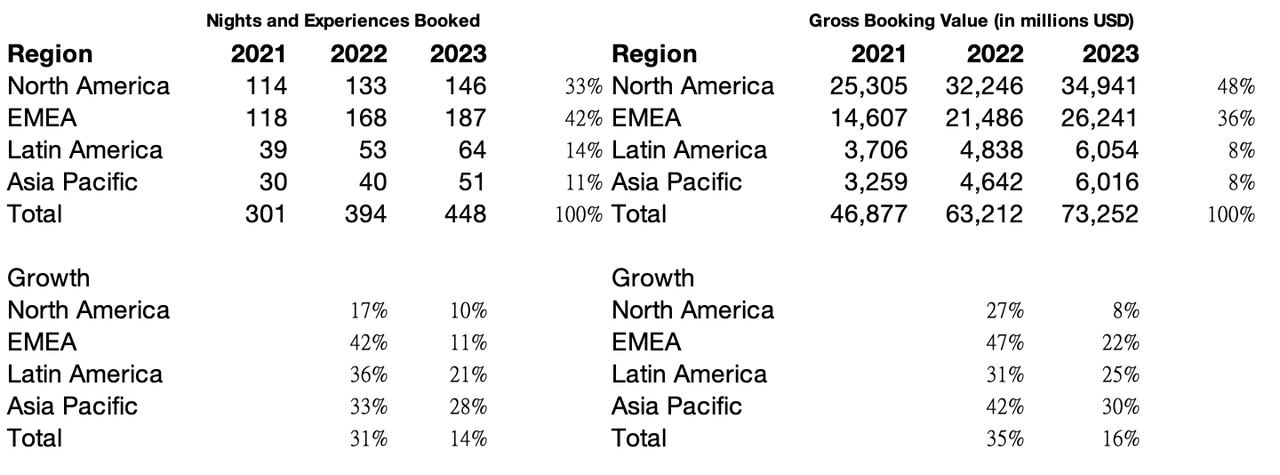

The management stated that they believe non-core regions provide additional opportunities. Airbnb saw a 14% (see below exhibit) increase in nights booked in 2023, while bookings in Latin America and Asia increased at far faster rates—21% and 28%, respectively. The growth rate of bookings was somewhat higher than that of nights.

Operating metrics (From ABNB and edited by author)

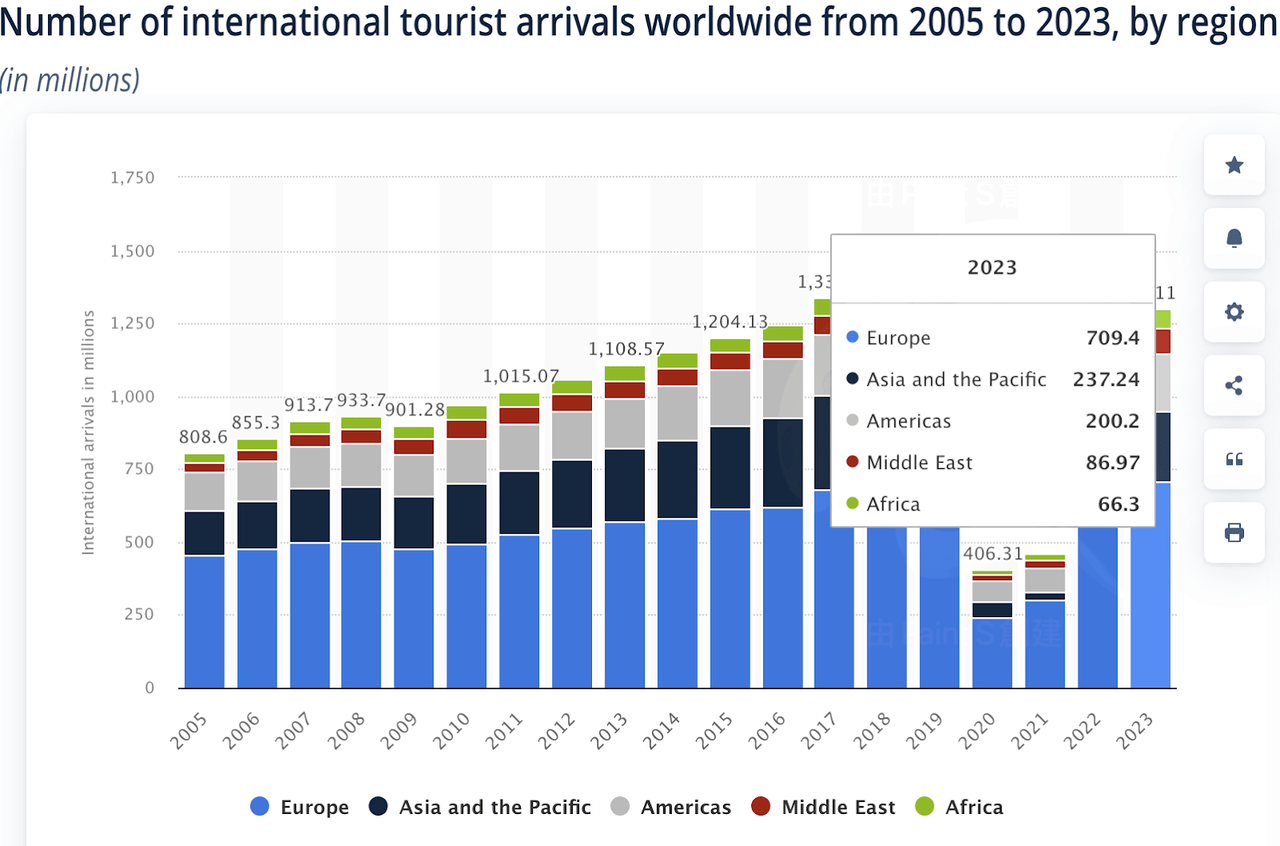

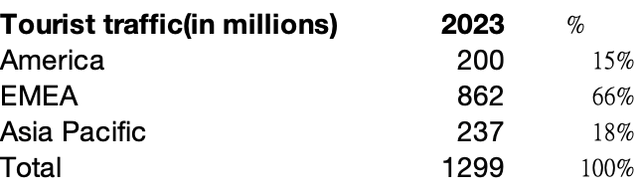

According to Statista (see below chart), 66% of all foreign travel occurs in EMEA, and 18% occurs in Asia. The majority of Airbnb’s current booking nights are in America (47%) followed by EMEA (42%) and Asia (11%), calculated by the states above.

International tourist number (Statista) Tourist traffic (From Statista and edited by author)

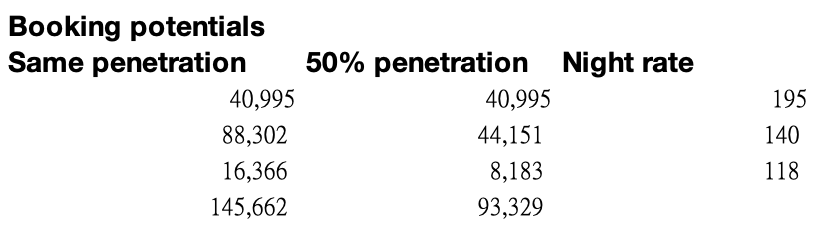

As a result, Airbnb is probably still under-penetrated in these areas. Thus, Airbnb’s potential booking value can double if it can maintain its growth in this area and reach a level of penetration comparable to that of the Americas. The potential booking value is 27% greater if we assume a 50% penetration rate similar to that of America (see exhibit below).

Booking potentials estimation (Author)

Thus, we think that Airbnb’s international expansion strategy is a good one. Therefore, we predict that in ten years, Airbnb will have a 10% market share. This translates into a 17.8% CAGR for the next 10 years, and we assume a terminal growth rate of 3% thereafter.

Margin

The company currently has a take rate of 13%, which is far below Booking’s 26%. However, the company mentioned it has not been focused on take rate optimization due to its focus on supplier and market share growth. They are now ready to explore this opportunity. Based on the fact that the company should have stronger bargaining power towards its individual suppliers, there should be room for more take rate increases in the future.

Hence, we assume it can increase its take rate to 15% (from 13%) and free cash flow margin to increase to 40% (from 38%).

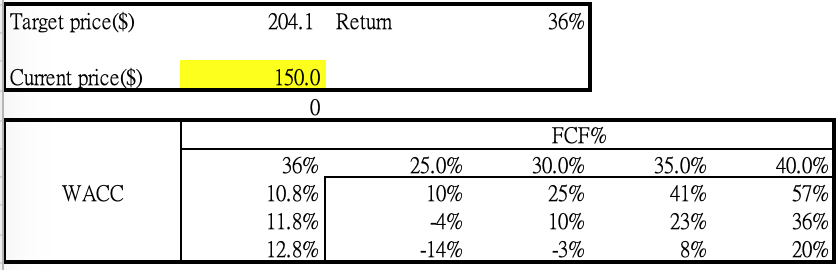

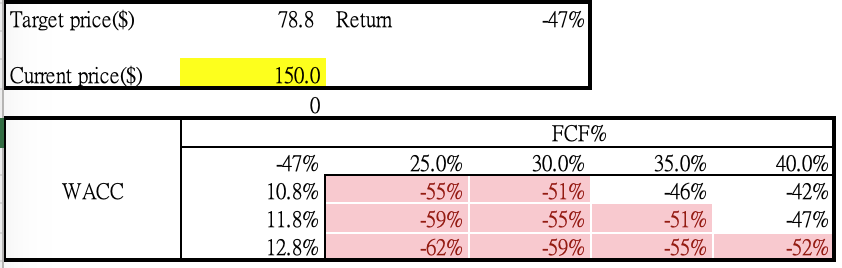

Along with a WACC of 11.8%, our calculation arrives at an equity value of $130 billion or $204 per share, implying a 36% upside. Based on the sensitivity test below, we believe that there is enough room for a margin of safety under different free cash flow margins and WACC assumptions.

Sensitivity analysis (LEL)

Bull Case

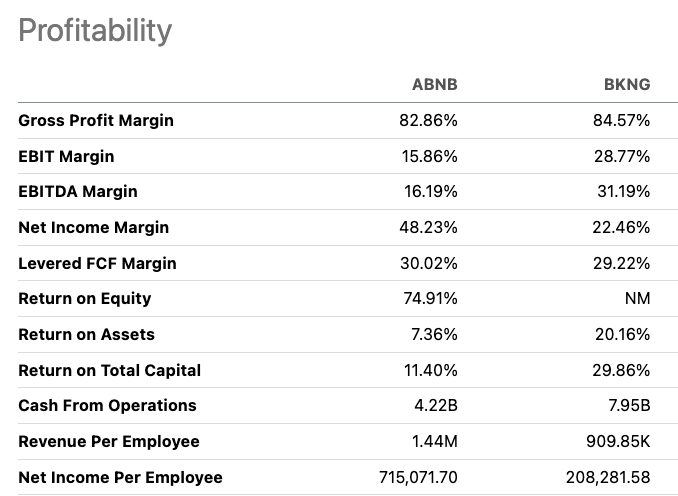

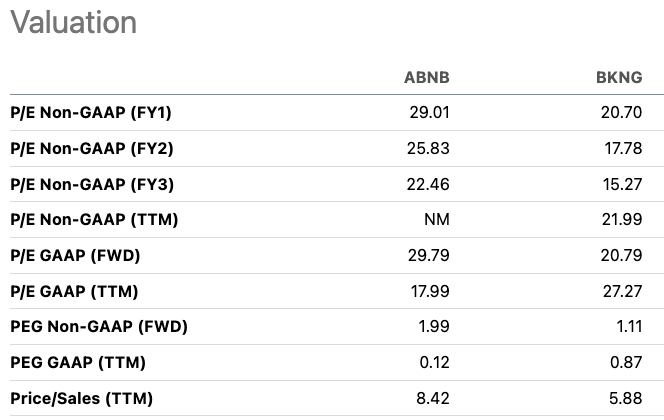

Profitability (Seeking Alpha)

Compared to Booking, Airbnb currently has a lower EBIT margin and gross profit margin. Additionally, it has lower earnings and revenues. Even when accounting for its present growth pace, the stock is trading at a premium valuation multiple of Booking. It might be inferred from this that the market values Airbnb highly, given its potential for expansion.

Valuation (Seeking Alpha)

There is evidence to back up this assertion. Its organization efficiency is already superior to Booking, as seen by indicators like revenue per employee and net income per employee that are significantly greater than Booking. Therefore, we believe that Airbnb is continuing to spend money on marketing and product development in order to increase its user base and, in turn, temporarily limit its ability to expand its margin.

Thus, in our bull case, we anticipate that Airbnb will be able to double its booking values, as we showed in the previous section given that Airbnb has a strong hold on the non-core sector. Given Airbnb’s greater negotiating strength over Booking, we predict that Airbnb will be able to get a take rate that is similar to Booking in this scenario. Assuming that Airbnb’s stock trades at the same price-to-sales ratio as Booking, we arrive at a valuation of 232 billion, which represents a 172% increase from its current level.

Risk

Bear Case

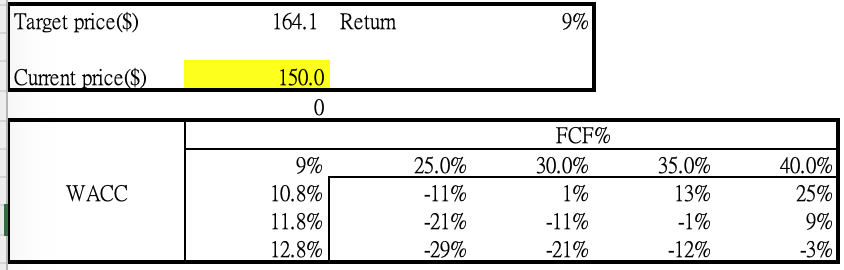

The company’s booking and nights booked growth have continued to slow down in the past several quarters. In Q1 2024, the company mentioned that it expected to see a re-acceleration in growth in Q3 2024 given that international market expansion has started to pick up. Our valuation is based on a 17.8% CAGR for the next 10 years, and thus the company should prove to the market that its growth rate trend should not further slow down from the current 18% level. For example, if the CAGR of the next 10 years slows down to 14.5% (long-term market share of 7.5%), then our model shows only a 9% upside from the current level.

Sensitivity analysis (LEL)

Furthermore, if the global accommodation sector experiences severe stagnation due to rising geopolitical risks, resulting in the company only maintaining a flat 3% growth, our model suggests a 47% downside risk.

Sensitivity analysis (LEL)

Conclusion

Despite seeing no signs of geopolitical risk slowdown, which may pose growth risks to the travel industry in the near term, we believe that Airbnb is best positioned in the under-penetrated alternative lodging industry with the right products to compete. We think this market can be much larger than the traditional lodging industry, and thus the upside potential should still outweigh economic slowdown risks amid these uncertain times. This is one of the safe investing strategies for investors to ignore short-term market noise.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.