Summary:

- Even though Airbnb, Inc.’s third quarter of 2022 was tainted by macroeconomic headwinds, it was still a record-breaking quarter.

- Total sales reached a record high of $2.9 billion, a 29% increase year-over-year.

- Since its inception in 2008, Airbnb has grown rapidly and gained market share.

- Because it provides lodging at lower prices than its competitor Booking.com, Airbnb is in a strong position to weather any economic storm.

- This is an excellent time to buy because the Airbnb, Inc. stock price is currently undervalued.

courtneyk

Introduction

Airbnb, Inc. (NASDAQ:ABNB) operates a website that arranges or offers lodging, primarily homestays or tourism experiences. The company does not own any real estate or lodging; instead, it acts as a broker, earning a commission on each booking. The company was established in 2008 and is headquartered in San Francisco, California. It has grown to become one of the world’s largest online lodging marketplaces.

Airbnb has recovered well from the Covid-19 crisis, and its free cash flow is now at an all-time high (TTM free cash flow margin of 40%!). The company offers less-expensive lodging compared to Booking Holdings Inc. (BKNG), which is advantageous in times of potential recession. People still want to go on vacation, but they prefer a less expensive option such as Airbnb. People, on the other hand, are particularly interested in earning extra money through hosting.

While sales, free cash flow, and earnings have increased significantly, the stock price has lagged. This is an excellent time to buy because the stock price is currently undervalued. There are still risks in the business, such as government regulatory risk, but I believe these risks are manageable.

Airbnb’s Unique Position In An Expanding TAM

When compared to other sectors, the hospitality industry is expanding rapidly but is also highly vulnerable. After being shut down during the corona crisis, business is picking up again. Total addressable market (“TAM”) is one metric that can shed light on Airbnb’s expansion.

Total addressable market refers to the total revenue potential in the hospitality industry, which includes lodging, food and beverage, and tourism. The hospitality TAM can be used to evaluate a company’s growth potential and potential revenue in the hospitality industry.

A recent study estimated that by 2021, the worldwide hospitality industry would be worth $3,953 billion in revenue. By 2028, the market is projected to be worth more than $6,716.3 billion, representing a compound annual growth rate (CAGR) of over 10.24 percent.

The increasing TAM is due, in large part, to the following major players in the hospitality industry:

- Online marketplace to book lodging or experiences:

- Airbnb – a global online marketplace for arranging or offering lodging and experiences, it has grown to become one of the largest online marketplaces for lodging in the world.

- Booking Holdings Inc. (BNKG) – an American company that owns and operates several travel fare aggregator and travel fare metasearch engines including Booking.com, Kayak, Agoda, and others.

- Expedia (EXPE) – an American competitor of Booking which operates Expedia, Hotels.com, Vrbo, Orbitz, Travelocity, CheapTickets, and others.

- Hotel chains:

- Marriott International (MAR) – one of the largest hotel chains in the world with over 7,000 properties in 131 countries.

- Hilton Worldwide (HLT) – another large hotel chain with over 6,000 properties in 117 countries.

- InterContinental Hotels Group (IHG) – a global hotel company with over 5,000 properties in nearly 100 countries.

- Wyndham Hotels & Resorts (WH) – a hotel company with over 9,000 properties in 80 countries.

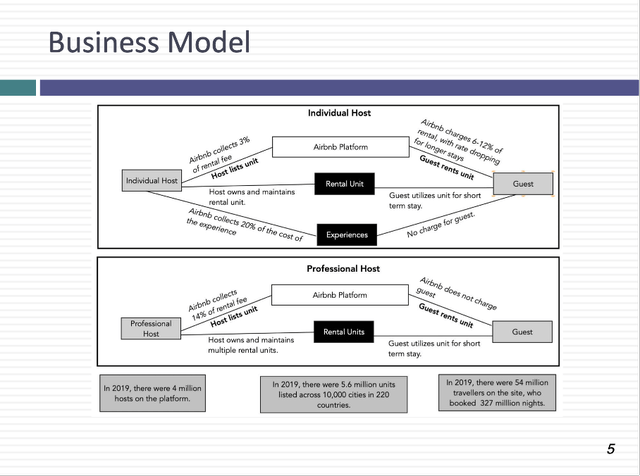

Since its inception in 2008, Airbnb has grown rapidly and gained market share in the hospitality industry. The company has upended the traditional hotel industry by providing a diverse range of lodging options, such as apartments, houses, and even castles, at often lower prices than traditional hotels. The business model of Airbnb is described in a presentation given by NYU Stern below. Airbnb’s revenue as a percentage of gross bookings is around 12%.

Airbnb’s business model (NYU Stern)

Airbnb’s unique business model, which allows individuals to rent out their homes or apartments to travelers, has aided the company’s rapid growth and market share gains. Furthermore, the company’s emphasis on providing unique and local experiences through its “Experiences” feature aided in driving growth and attracting new customers.

Third Quarter Earnings Were Strong

The pandemic of COVID-19 has had a significant impact on the travel and hospitality industries, including Airbnb. As borders were closed and travel restrictions were imposed in the early stages of the pandemic, demand for travel and lodging dropped dramatically. As a result, Airbnb’s revenue dropped significantly, as did the number of listings on its platform. As the pandemic progressed, Airbnb began to focus on domestic travel, as well as longer-term stays and the “Experiences” feature, which had been growing in popularity prior to the pandemic.

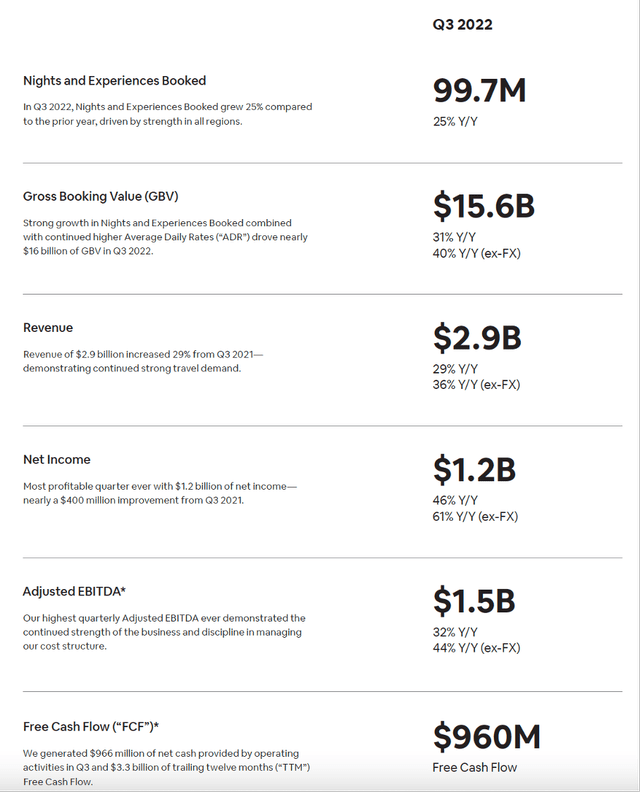

Despite macroeconomic headwinds, the third quarter of 2022 was another record quarter. Airbnb booked nearly 100 million nights and experiences (a 25% increase year-over-year). The gross booking value was $15.6 billion, a 31% increase year-on-year. Revenue increased 29% year-on-year to an all-time high of $2.9 billion.

Net income was $1.2 billion, a 46% increase over the previous year. The net income margin is extremely high at 42%. Airbnb generated $960 million in free cash flow on an adjusted EBITDA of $1.5 billion. The quarter’s free cash flow margin is also exceptionally high, at 33%.

Third quarter results (ABNB 3Q22 results)

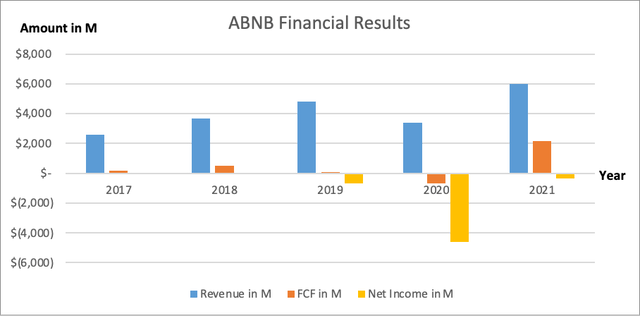

Looking at the big picture, the company’s revenue increased rapidly from 2017 to 2019 (at a CAGR of 36%). During the 2020 Corona crisis, free cash flow (“FCF”) was slightly negative at $667 million. In 2021, the company’s revenue reached an all-time high.

Airbnb generated $3.2 billion in free cash flow over the last year compared to $8 billion in revenue (TTM free cash flow margin of 40%). Its large free cash flows can be used to further grow the company or to return value to shareholders.

Airbnb financial results (SEC and author’s own graphical representation)

Airbnb has demonstrated resilient growth over the last five years and has successfully navigated the company through adverse weather conditions, despite macroeconomic uncertainty. In their third-quarter earnings transcript, Airbnb CEO Brian Chesky stated the following:

And even with the macroeconomic uncertainties, we believe that we are well positioned for the road ahead. Now why is this? Well, new use cases such as long-term stays and non-urban travel are here to stay. And this is because millions of people now have the flexibility that they didn’t have before the pandemic. At the same time, we have seen recovery in urban and cross-border travel, two of our strongest segments before the pandemic. And just like during the Great Recession in 2008, when everything started, people today are especially interested in earning extra income through hosting.

Extremely Favorable Stock Valuation

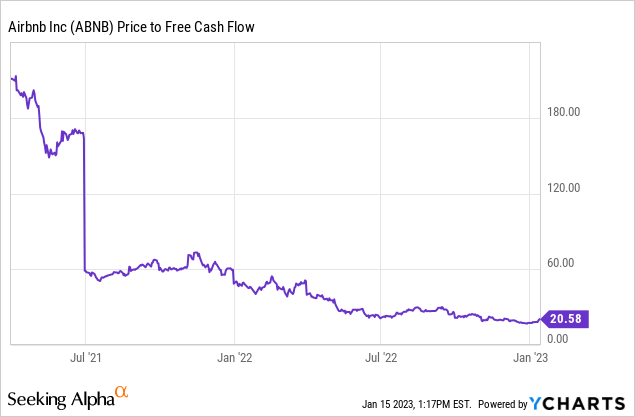

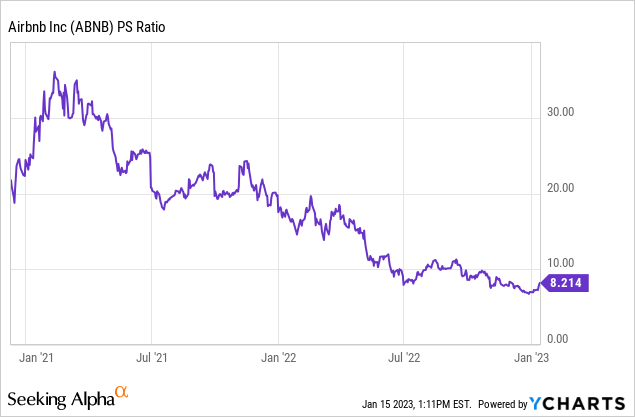

Airbnb’s stock valuation has historically been charted by its price to sales ratio, as the company did not generate much free cash flow. The company is now free cash flow rich, with a trailing twelve-month free cash flow margin of 40%.

The company’s price to free cash flow ratio is only 20.6, which is considered low in comparison to its strong growth numbers.

Another insight comes from its price to sales ratio. While its sales have increased significantly, its stock price has not. Now, the price to sales ratio is only 8.2, which is very appealing.

Risks To Mention

The hospitality industry is vulnerable to a number of threats that can jeopardize its operations and financial performance. Airbnb generates revenue by charging fees, so the company has low overhead and is not vulnerable to changing consumer preferences.

Major risks directly associated with Airbnb include unpredictable events such as pandemics, which can drastically alter the travel and hospitality industries. Furthermore, the hospitality industry is vulnerable to economic downturns because they can lead to a decrease in consumer spending.

We do not see any risks from competitors. Booking and Expedia do not pose a significant threat because both offer more luxury lodgings, while Airbnb offers lodging at a wide range of prices that are more affordable.

I see significant threats in government regulations such as zoning laws, taxes, and health and safety regulations.

Many cities and municipalities have laws that make it illegal for people to rent out their homes or apartments for a short period of time. Because of these regulations, Airbnb has faced legal challenges and fines in some cities.

Another area of regulation is taxation. Many jurisdictions require Airbnb to collect and remit taxes on behalf of its hosts. This includes lodging taxes, sales taxes, and occupancy taxes. In some cases, Airbnb has faced legal challenges regarding its tax collection and remittance practices.

Additionally, there are regulations related to health and safety, particularly after COVID-19 pandemics, where Airbnb is required to adhere to certain safety protocols, such as sanitization and cleaning standards, to ensure that the properties on its platform are safe for guests.

Conclusion

Airbnb, Inc. offers a platform for booking and listing lodgings (primarily homestays) and experiences (primarily during travel). As a result of its rapid expansion, it is now one of the world’s most important hospitality markets. Because it provides lodging at lower prices than its competitor Booking.com, Airbnb is in a strong position to weather any economic storm. Many people wish to travel, but they are looking for more affordable options like Airbnb.

Even though the third quarter of 2022 was tainted by macroeconomic headwinds, it was still a record-breaking period. Nearly one hundred million Airbnb nights and experiences were reserved. Total sales reached a record high of $2.9 billion, a 29% increase year-over-year.

Plus, the company’s net income shot up by 46% year-over-year, to $1.2 billion. Having a net profit margin of 42% is very impressive. The business made $960 million in free cash flow on adjusted EBITDA of $1.5 billion. With a margin of 33% on free cash flow, this company is also doing exceptionally well.

With a projected CAGR of over 10.24%, the global hospitality industry is projected to be worth over $6716.30 billion in 2028.

Using multiple valuation methods, including price to free cash flow and price to sales, Airbnb, Inc. is a low-priced stock. The stock price has lagged behind the significant increases in revenue, free cash flow, and earnings. This is an excellent time to buy because the stock price is currently undervalued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ABNB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.