Summary:

- Airbnb faces near-term macroeconomic challenges, with inflation affecting discretionary spending and leisure travel across mid- to lower-income consumers.

- Management is focused on expanding in new regions and rereleasing Experiences feature.

- From a long-term perspective, Airbnb will be well positioned as the all-inclusive, go-to travel agent as the firm expands into AI capabilities.

ferrantraite/E+ via Getty Images

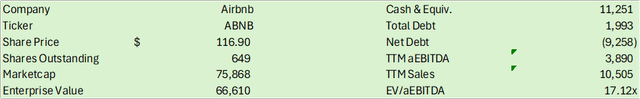

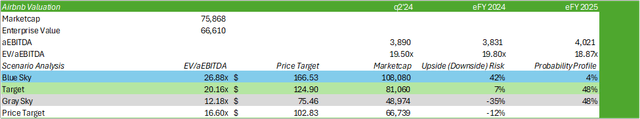

Airbnb (NASDAQ:ABNB) is faced with significant macroeconomic headwinds across a variety of consumer cohorts as inflationary pressures continue to challenge discretionary spending. Despite the relatively negative near-term outlook on the travel industry, management is being opportunistic in moving the company forward by expanding in different regions and rereleasing their Experiences feature. Despite the optimistic long-term outlook, I believe ABNB will face significant headwinds as consumers elect to bypass more and more vacations in order to preserve cash. Given this outlook, I recommend ABNB shares with a SELL rating with a price target of $102.83/share at 16.60x eFY25 EV/aEBITDA.

Airbnb Operations

Management made a very forward commitment to improving the quality of the hosting and guest experience across the platform and at active listings. The firm has been very successful in increasing their active listings to 8mm in q2’24 while removing 200,000 listings that were below Airbnb’s standards. I believe that improving the quality of listings will be beneficial to the firm in the long run, even if it means turning down potential business opportunities. Including this standard will improve guest confidence when traveling to new regions and will create a certain baseline expectation for the experience and safety for every stay. In addition to this, Airbnb rolled out their Guest Favorites feature which will allow guests to search through higher-rated properties suitable for their expected stay.

Management is also setting out on expanding Airbnb’s reach across Latin America, Europe, and Asia as many of these locations, specifically Japan, are becoming prime travel destinations that Airbnb can serve. I believe that the firm’s quality assurance protocol will bolster foreign visitors’ confidence in staying at an Airbnb location given this higher benchmark for approved listings. This will also play into management’s anticipation of bringing back Experiences as the firm expands outside of their core regions. Management’s vision of the rerelease of this feature will essentially take the place of a travel agent and merge both listings and regional activities for visitors as they travel to new regions.

Management noted on the q2’24 earnings call that lead times have reduced significantly towards historical levels as customers opt to book either same-day or a couple of weeks in advance. Management discerned that this doesn’t necessarily foreshadow a softer market during the peak holiday season; however, this could be suggestive of fewer people traveling or staying at short-term rentals during the holiday season. Airbnb is not alone in the matter. Reuters reported that Marriott International (MAR) is also facing a slowdown in leisure travel as lead times shorten. This sentiment is shared across other hotel and short-term rental agencies.

Disney (DIS) reported similar findings in which park attendance softened in q2’24 as a result of tighter budgets for lower-income consumers. Tripadvisor (TRIP) experienced a substantial decline in q2’24 revenue driven by a 10% decline in their Tripadvisor business and a 14% decline from branded hotels. Overall, the travel industry is showing signs of moderate decay as lower-earning consumers elect to forego travel plans for the year. Accordingly, higher-earning consumers continue with their travel plans with minimal impact to their budgets.

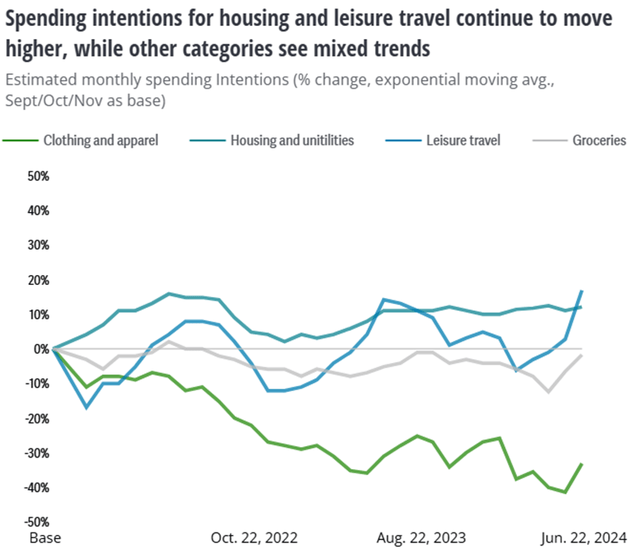

According to Deloitte, leisure travel improved in the month of July from the previous year and remains above their base year of 2021, suggesting that consumers continued to travel despite the shorter lead times.

Deloitte

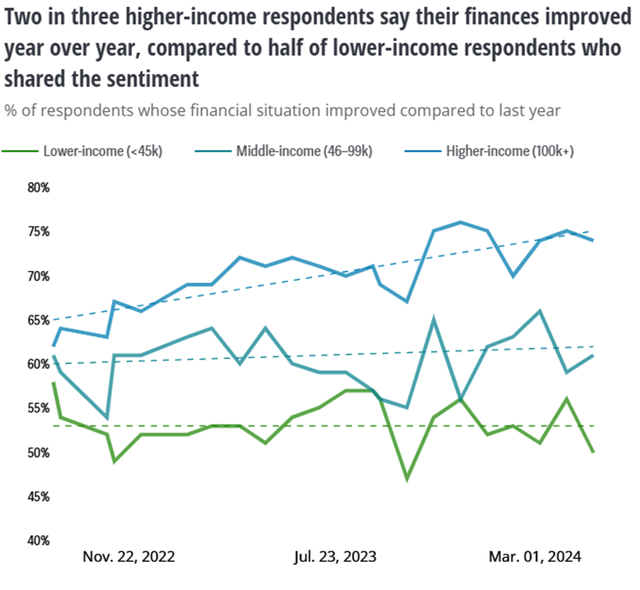

This very well could be a positive sign for Airbnb as consumers appear to be prioritizing travel over other discretionary spending items such as clothing and apparel. Though optimistic, this appears to primarily apply to higher-income earners as low- and middle-income earners appear to be less confident with their financial situation.

Deloitte

This factor may be playing into Airbnb’s skepticism for the duration of eFY24 as the economic outlook dims. According to Bankrate, only 53% of Americans planned to travel during the summer of 2024 with the remainder skipping their travel plans entirely. 65% of those surveyed by the data aggregator suggested that affordability is the primary challenge faced when deciding whether to travel this year.

Tying all of this back to Airbnb, I forecast the firm to continue growing at the top-line as consumers elect to tighten their travel budgets and keep trips domestic, if at all, which will likely benefit the firm as it pertains to their core markets. Longer term, Airbnb may realize stronger growth in future periods as the firm entrenches their business into regions with capacity constraints during highly visible events, such as the Olympics or, as management suggested, a Taylor Swift concert. Given that Airbnb caters strongly to large groups traveling together for durations of 3+ days, I believe that the firm can carve out a corner of the market during large, heavily visited events.

Airbnb Financials

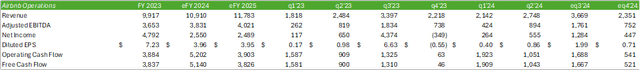

Corporate Reports

Given the challenging macroeconomic environment ahead, I believe Airbnb can realize 10% top-line growth for eFY24 and 8% growth in eFY25. Revenue growth will be pressured by less discretionary spending and may be offset by higher-income consumers seeking to both travel and leverage Airbnb’s relaunch of their Experiences feature. Airbnb also recently launched their Icons feature as a subgroup to Experiences, which allows for guests to experience different picturesque themes. This may allow for the firm to drive some growth for those seeking a staycation or a social media backdrop for photos while on vacation.

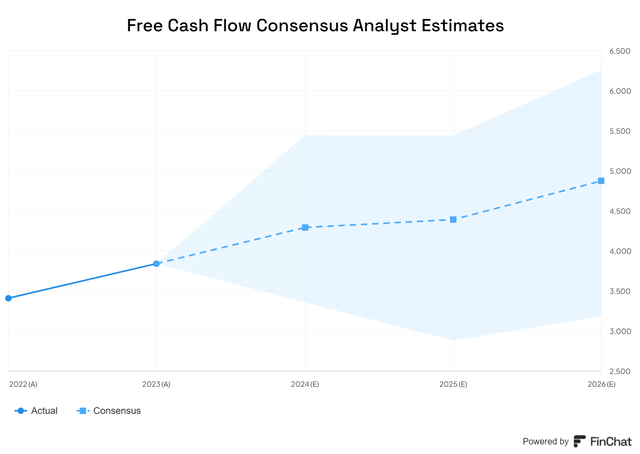

Taking into consideration management’s expansion plans into other underserved regions, I anticipate modest margin compression and a slightly elevated capital investment outlay for eFY25, resulting in a modest decline in free cash flow generation for the fiscal year. Consensus estimates show similar forecasts as the firm will be navigating a challenging market paired with increased spending for application improvement.

FinChat

Despite the near-term headwinds, I do believe that the investments will pay off as the firm’s geographical expansion plays out. Tourism in Japan has been rapidly increasing due to the weak Yen, allowing for the dollar to be stretched further for luxuries that some consumers may be priced out of domestically.

Airbnb Risks

Bull Case

Despite the macroeconomic headwinds, higher-earning consumers continue to travel to destinations with little slowdown in sight. Lower-earning consumers are electing to either bypass their travel plans or travel domestically at a lower cost. Airbnb also plans to launch an assortment of features to make higher-quality listings easier to find while curating entire trips. Management is also seeking more affordable experiences to cater to the lower-income, cost-conscious Gen Z cohort in order to drive more business to their product portfolio.

Bear Case For Airbnb

47% of consumers are bypassing summer travel plans in order to save money with 65% citing affordability. Further economic deterioration and inflationary pressures may reduce the average consumers’ discretionary spending, forcing them to either bypass trips or consider taking on debt in order to travel. Economic headwinds could persist into the coming years and lead to potential declines in revenue and margin compression for Airbnb.

Valuation & Shareholder Value

Corporate Reports

ABNB shares have been pressured throughout CY24, experiencing a -14% YTD decline. If macroeconomic headwinds persist, ABNB shares may continue to reflect these challenges and continue to slide. Despite investor sentiment, management is taking the proper steps to position the firm for a strong recovery by expanding their Experiences feature with Icons and other curated events.

In addition to this, Airbnb is proactively rewarding shareholders by buying back stock. The firm repurchased $749mm shares in q2’24 alone and has $5.25b remaining under the current share repurchase program.

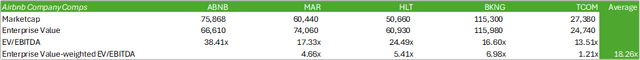

On an unadjusted basis, ABNB shares trade at a premium to other travel-related enterprises, with an average EV/EBITDA of 18.26x.

Seeking Alpha

Despite the slowing growth, I do believe ABNB’s premium can be justified given the firm’s long-term growth trajectory as it expands into other regions and expands their Experiences offerings. Despite these factors, I do believe ABNB will be faced with significant macroeconomic headwinds that may impact the share price in the near term. Given my forecast, I rate ABNB shares with a SELL recommendation with a price target of $102.83/share at 16.60x eFY25 EV/aEBITDA.

Corporate Reports

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.