Summary:

- Airbnb continues to experience growth and strong cash flows, but its valuation looks stretched.

- While Airbnb’s core business can still provide significant growth, the company appears set to increase focus on its expansion into adjacent verticals.

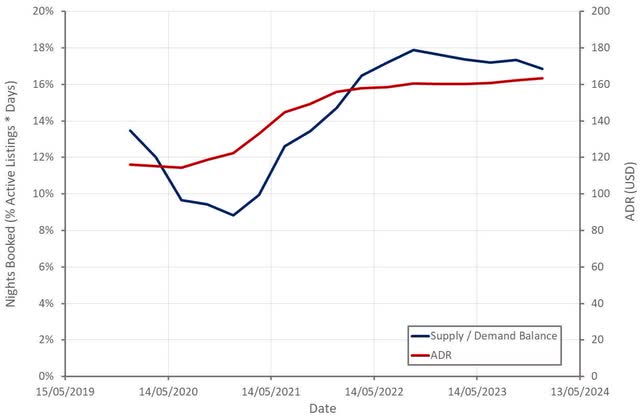

- Airbnb’s near-term share price performance is likely to be dictated by ADRs and the company’s ability to generate solid demand with minimal marketing.

Milko/E+ via Getty Images

Airbnb (NASDAQ:ABNB) continues to register solid growth and strong margins, although the demand environment continues to normalize. 2024 should provide more of the same, meaning double-digit growth, extremely strong cash flows and large share repurchases. Airbnb’s valuation is beginning to look stretched, though, particularly if the company is unable to maintain its current level of profitability. There is reason to be cautious in this regard, as data suggests the balance of supply and demand could begin to cause pricing pressure later this year, and into next year. My opinion remains largely unchanged from when I last wrote about the stock. Airbnb is a strong company with a solid future, but there are near-term risks.

Core Platform

Airbnb’s core platform can potentially still provide plenty of growth, with the company continuing to lower barriers to adoption, attract new supply and expand internationally.

There remains a large gap between consumer awareness and willingness to regularly use Airbnb and this is something that the company hopes to correct by reducing barriers to adoption. Airbnb is trying to drive users to the app, which should reduce customer acquisition costs, increase retention and improve conversion. Airbnb app downloads have been strong and 55% of gross nights booked were through the app in the fourth quarter.

Airbnb is also focused on limiting ADR expansion to help support demand. The company has a number of initiatives in this area:

- Two-thirds of Hosts now offer weekly or monthly discounts.

- Airbnb’s Similar Listings feature lets hosts compare their listing to others in the area, which should help support price discovery. 1.4 million Hosts have used Similar Listings since it was launched.

- Airbnb also introduced Total Price Display in early 2023, which aims to create better transparency into total cost. Since this feature was introduced, nearly 300,000 listings have removed or lowered their cleaning fees. Close to 40% of Airbnb’s active listings now charge no cleaning fee.

The average nightly price of a one-bedroom listing on Airbnb in December was down 2% YoY compared to a 7% increase for hotels.

Airbnb is also trying to make hosting mainstream, although it appears to have fewer active initiatives in this area. Regardless, supply is increasing at a rapid pace, which could eventually cause its own problems. The Airbnb-Friendly Apartments program is one supply initiative that Airbnb has. This program helps long-term renters find apartments that they can host on Airbnb part-time. There are now over 400 buildings and 125,000 units on the platform across 17 US states.

In terms of international expansion, Airbnb has been focused on Germany Brazil and Korea in recent quarters. Going forward this focus will expand to include Switzerland, Belgium and the Netherlands.

Platform Expansion

Now that the core business is in a position of strength, Airbnb plans on dedicating more resources to expanding into adjacent verticals. After this was discussed on the fourth quarter earnings call, some investors took this to mean that Airbnb’s ambitions had grown substantially. The company’s CFO recently stated that this was a misinterpretation though. Airbnb only plans on pursuing adjacent verticals where it can compete and win.

Specifically mentioned opportunities include:

- Cohosting

- Experiences

- Travel planning

- Provision of services in the listing

Airbnb also believes that generative AI could help it to provide an experience that is more personalized than anything previously possible. This would be like a personal concierge for travel and assist Airbnb’s cross vertical ambitions. Airbnb acquired GamePlanner.AI in November 2023 to help accelerate its AI roadmap. Taken together, this seems to suggest that Airbnb wants to make its platform a hub for planning and managing vacations, rather than just booking accommodation.

Sponsored listings are another potential option, although Airbnb has been reluctant to do this so far because it would likely lead to growth of larger property managers, undermining one of Airbnb’s value propositions.

While expansion of the business is a positive, investors should probably be aware that an increased focus on this could be due to a weaker outlook for the core business. If Airbnb is serious about expanding into adjacent verticals, it will likely require significant investments, which could be a near-term drag on margins.

Financial Analysis

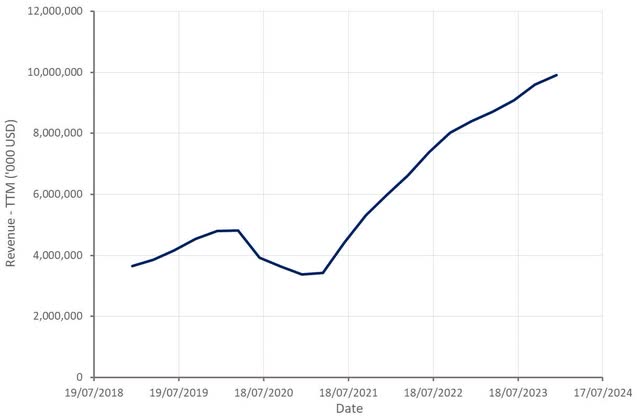

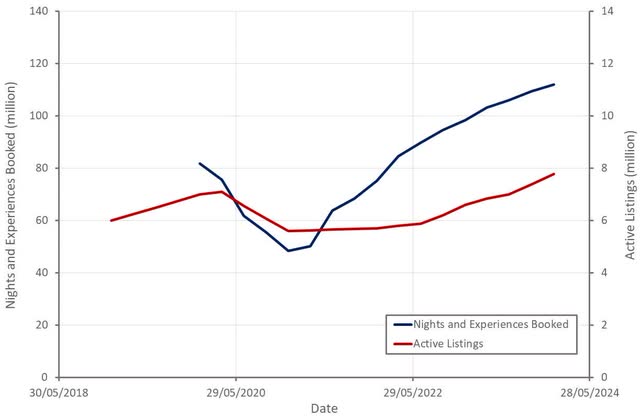

Airbnb’s revenue growth was 14% YoY in constant currency in the fourth quarter. Nights and Experiences Booked increased 12% YoY and gross booking value was up 15%.

In terms of geographies, North America has slowed, while Latin America remains an area of strength. For example, Chile, Peru and Ecuador are all up about 2x since pre-COVID. APAC remains a laggard in terms of recovering from COVID.

Airbnb expects 2.03-2.07 billion USD revenue in the first quarter of 2024, representing a 12-14% YoY growth rate. First quarter growth will benefit from the timing of Easter at the expense of the second quarter though.

Figure 1: Airbnb Revenue (source: Created by author using data from Airbnb)

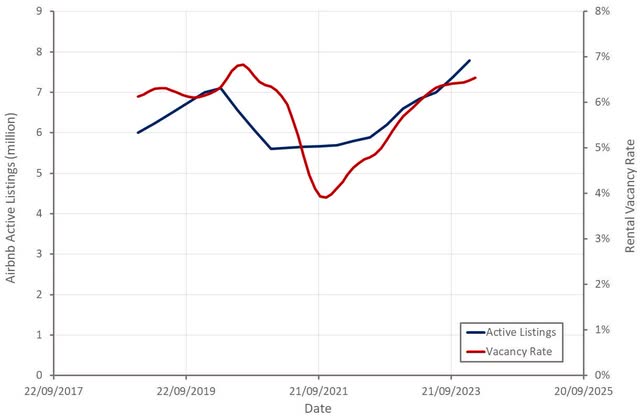

Airbnb now has over 5 million hosts and 7.7 million active listings globally, with the number of listings up 18% YoY.

It is possible that the rapidly growing supply of new housing in the US will impact supply in Airbnb’s most important market. The rental vacancy rate continues to edge upwards, despite the strong labor market, suggesting that the housing market isn’t as tight as widely believed. Elevated vacancy rates may cause some investors to turn to the short-term rental market for relief.

Figure 2: Rental Vacancy Rate and Airbnb Active Listings (source: Created by author using data from Airbnb and The Federal Reserve)

Listings are still catching up to demand after the pandemic, but if supply growth remains strong, ADRs could soon come under pressure. Demand growth appears to be tapering off and would also likely be negatively impacted in the event of an economic slowdown.

Figure 3: Airbnb Nights and Experiences Booked (source: Created by author using data from Airbnb) Figure 4: Airbnb ADR (source Created by author using data from Airbnb)

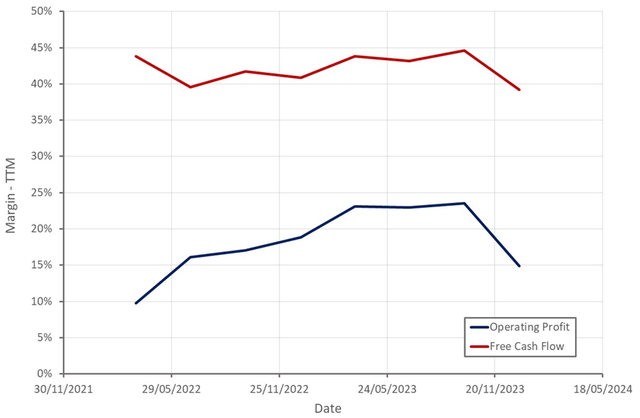

Airbnb recorded a net loss in the fourth quarter due to a non-recurring tax withholding expenses and lodging tax reserves. Excluding this, Airbnb’s profitability and free cash flows remain fairly solid.

Airbnb generated 3.8 billion USD free cash flow in 2023 and repurchased 2.25 billion USD of shares. Airbnb’s profitability is far less impressive than its cash flows though, and the difference is largely the result of stock-based compensation, which amounted to over 150,000 USD per employee in 2023. As a result, Airbnb’s outstanding share count has been declining at a far lower rate than the company’s share repurchases might suggest.

Airbnb’s profitability is highly dependent on ADRs and its ability to generate demand with limited marketing spend. If supply growth continues to outpace demand, ADRs will eventually suffer, and Airbnb may be forced to increase marketing spend in response. For this reason, I believe that near-term profits are at risk, although this will likely take time to play out.

Figure 5: Airbnb Operating Profit Margin (source: Created by author using data from Airbnb)

Conclusion

Despite considerable expansion in recent months, Airbnb’s revenue multiple remains well below 2021 levels, although it is still high in absolute terms given the company’s growth rate. Airbnb’s ability to support this type of valuation going forward will be dependent on the company’s ability to maintain its profit margins.

While conditions are likely to remain solid in 2024, Airbnb’s margins are already starting to come under pressure. The real test likely won’t come until later in the year or next year when supply begins to overwhelm demand. Lower ADRs would likely significantly reduce Airbnb’s profitability, although the company could increase its take rate in response. This situation could be exacerbated if Airbnb throws significant resources at its expansion efforts.

Figure 6: Airbnb EV/S Multiple (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.