Airbnb: I Am Still Not Convinced

Summary:

- Airbnb investors suffered a hammering in early May due to over-optimism.

- I had cautioned investors in February that a massive slowdown could be approaching. Perhaps, these investors probably thought management was “sandbagging.”

- Reality is often harsher than it seems, but when reality hits, it’s better to accept that ABNB is still priced at a steep premium.

- Growth investors looking for higher upside have likely left for the AI hype train, leaving Airbnb “diamond hands” to support the stock.

courtneyk

Airbnb, Inc. (NASDAQ:ABNB) stock has struggled for momentum since its initial attempt to bottom out following last month’s short report floundered after the market assessed its weak forward guidance in early May.

As such, ABNB investors will need to decide whether more dip buyers could return as they picked up the pieces last month following the short report.

I noted that ABNB’s selling pressure has abated over the past three weeks. However, there aren’t clear signs of dip buying momentum, even as it consolidated.

Therefore, market operators are likely biding their time as they analyzed a more positive second half for the short-term vacation rental market leader.

Keen investors should recall that the market was right to punish over-optimistic ABNB investors in early May as they chased its upward momentum. I cautioned investors in February to avoid chasing its previous February momentum surge, as investors need to reflect a “potentially substantial slowdown in adjusted EBITDA growth in 2023.”

That’s right. Airbnb had already warned investors since its FQ4’22 earnings call to expect growth normalization. Hence, should investors be surprised that Airbnb will likely experience a slowdown from Q2? I don’t think so, and investors who ignored it, considering that the company was “sandbagging,” aren’t facing reality.

Does it make sense? Consider that arch-rival and OTA leader Booking Holdings (BKNG) saw its stock hit all-time highs in mid-May before a bull trap or false upside breakout saw a steep pullback over the past two weeks.

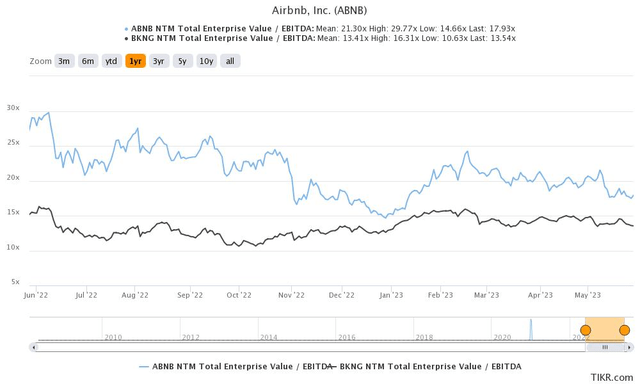

That’s right. “Legacy” player BKNG continues to defy gravity, while ABNB remains more than 50% below its early 2021 highs. I think the answer is pretty straightforward. ABNB wasn’t able to justify its high-growth valuation. As a result, even though BKNG re-tested its new highs recently, it’s still valued markedly lower than ABNB.

ABNB Vs. BKNG forward EBITDA multiples (TIKR)

As seen above, the valuation gap between ABNB and BKNG has closed significantly from last year. Hence, I believe ABNB investors have been given an invaluable lesson in valuation, including high-conviction (“diamond hands”) investors about Airbnb’s ability to gain more share.

Morningstar highlighted that Airbnb is the leader in the short-term vacation rental market. However, Booking remains ahead in terms of overall OTA market share. Despite that, none of the leading players have gained a significant lead, suggesting that the market remains fragmented.

As such, Airbnb’s free cash flow or FCF profitability should allow the company to leverage incremental product and marketing investments to drive growth further. Moreover, management reminded investors that “90% of [its] traffic is direct or unpaid,” allowing the company to benefit from significant marketing spend efficiencies.

Moreover, the company also focuses on increasing its cross-border reach, which outperformed the domestic market in Q1. Despite that, I believe investors also need to reflect higher execution risks on its cross-border initiatives, as regulations could remain less friendly and different from domestic regulations.

Notwithstanding, I believe it likely boils down to whether dip buyers are still willing to support the stock at the current levels and not allow sellers to force another selloff to break the current support zone.

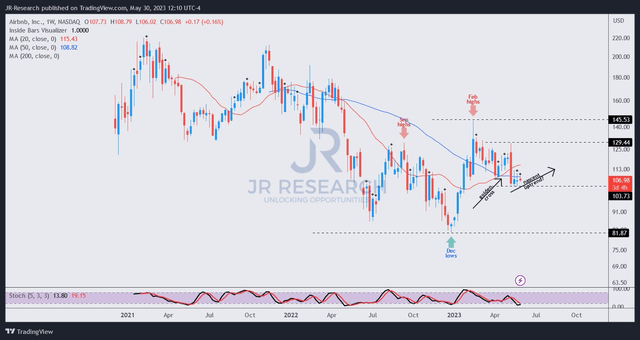

ABNB price chart (weekly) (TradingView)

I gleaned that ABNB buyers are holding out at the current levels but have not managed to muster sufficient buying momentum to return it to a sustained uptrend.

However, there are glimpses of optimism, as a golden cross is noted, indicating that the downtrend has reversed. However, buyers still need to return confidently to help lift ABNB’s price action above the 50-week moving average or MA (blue line) before momentum buyers can be encouraged to come on board.

Seeking Alpha Quant rated ABNB’s valuation with a “D-” grade, suggesting it likely isn’t attractive to value investors. In contrast, the broad group of growth investors seem enamored with AI tech stocks recently and have probably shifted their attention toward those bets.

That likely leaves the high-conviction investors who see the current dips as buyable to support the stock. I assessed that ABNB’s momentum is at a critical juncture with no clear signals to buy.

Coupled with its fairly-balanced valuation, I remain neutral on ABNB at the current levels. However, if more bad news comes into play, forcing a steeper selloff, it should help improve the risk/reward upside, and I might consider reviewing my rating.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!