Summary:

- Airbnb’s growth prospects are strong, with a focus on profits and a healthy balance sheet.

- Q3 earnings showed record results, with nights and experiences booked up 14% YoY and revenue growing 18% YoY.

- Airbnb’s international growth potential and plans to expand its platform make it an attractive investment opportunity.

Carl Court

Introduction

I can’t help it. Every time I am about to consider selling or trimming my stake in Airbnb (NASDAQ:ABNB), I go over my investment case and still see a very promising and improving company whose growth prospects are even more visible now than a few years ago. This is why in this article I will explain why I am not selling and am actually holding tighter onto my shares.

Airbnb has grown remarkably, and it has been able to turn an interesting side hustle idea into a whole new way of traveling. Moreover, it has been able to turn this idea into a profitable business that has been able to overcome even a challenge as problematic as the pandemic. Now, not only strong tailwinds are helping the travel industry, but also, thanks to its management, the company is led with financial discipline. It is a company where the focus on growth, focus on profits, and focus on a healthy balance sheet walk hand in hand.

In particular, Airbnb’s balance sheet, as I tried to show in my last article on the company, carries a hidden asset in the form of unearned fees. As of September 30, 2023, it had $11.0 billion of cash, cash equivalents, short-term investments, and restricted cash. In addition, it also had $6.0 billion of funds held on behalf of guests. Pay attention, this is a true float: money at no interest rate the company can use in the time between rent collection (when a guest books a stay) and payment (after a guest has ended the stay). If the company invests this money during that period of time, the interest or the returns it earns stay with the company.

However, some investors are concerned the company’s best days may already be behind since Airbnb spoke, in its last earnings call, about “a little bit of softness in demand”. When a company with Airbnb’s growth rate and the multiples coming from it talks about softness, then everyone gets concerned about the possible end of a good story.

Now, on SA, I have shared several articles on the company explaining why I am long the stock. In particular, I am bullish overall on travel and tourism with pent-up demand still existing in 2023, when consumer confidence fell to its lows. Airbnb is unique in its offering because it is, first and foremost, a community of hosts and guests. This makes it so effective that it almost doesn’t need to spend on marketing because word of mouth is more effective to become more known. Furthermore, the more this community grows, the more it creates a true moat because it prevents other platforms from entering disruptively the market. Finally, Airbnb, while it offers more than 6 million different listings, is completely asset-light, enabling it to have a very simple and healthy balance sheet with very little D&A.

For some investors, up until 2021, Airbnb was interesting but was ruled out because it was losing money. Soon after its 2021 IPO, Airbnb started turning this issue around and became profitable starting Q2 2022. As Seeking Alpha’s profitability page shows, its margins are now jaw-dropping: 83% gross profit margin and 57% net income margin. Return on common equity is around 75%, return on total capital around 15%, and return on total assets is at 26%. Finally, its net income per employee is extremely high: $802k per employee.

Q3 Earnings

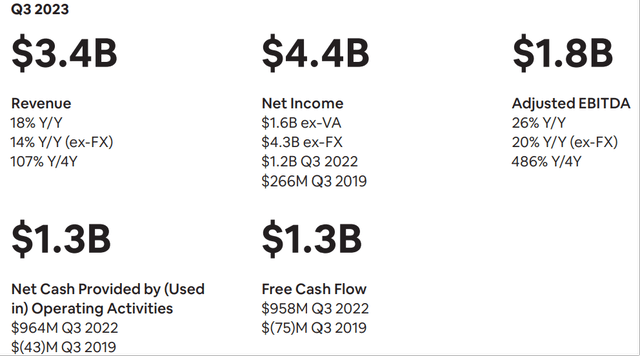

Q3 is usually strong for travel and tourism in general, and Airbnb reported record results:

ABNB Q3 2023 Shareholder letter

- Nights and Experiences booked exceeded 113 million, +14% YoY.

- Gross Booking Value was up 17% YoY to $18.3 billion.

- Revenue of $3.4 billion grew 18% YoY.

- Net income was $4.4 billion. Wait a moment, you might say, how can a company’s net income be greater than its revenue? In this case, Airbnb had a one-time income tax benefit. Excluding this benefit, Airbnb’s net income would have been $1.6 billion.

- Free cash flow grew 37% YoY to $1.3 billion.

Since Airbnb depends on active listings and new supply, it was particularly important to see it report a 19% YoY growth in active listings. This means Airbnb added almost 1 million new listings this year.

In terms of travel trends, it was particularly important to hear how cross-border nights booked are growing thanks to international travel still in recovery mode. Moreover, Airbnb has been able to understand how long-term stays are growing and has incentivized its hosts to give better prices. Currently, Airbnb’s revenue stream has long-term stays accounting for 18% of gross nights booked.

Thanks to its 2023 Summer release, Airbnb has been able to lower prices while improving search features that make it easier for guests to find the right place to stay.

But, most importantly, sometimes Airbnb’s international growth is overlooked. Not many are aware that Airbnb’s penetration in the U.S. is not even comparable to that in many other countries. Just recently, Airbnb has focused on Germany, Brazil, and Korea and saw these countries double the size as they were prior to the pandemic, as the company’s Co-Founder and CEO Brian Chesky explained during the last earnings call. In the next 24 months, Airbnb announced “a major acceleration” to penetrate around a dozen new markets where the opportunity is massive, but Airbnb’s penetration is low. Just to get an idea of what we are talking about, these countries also see Italy and Spain, two of the most visited countries in the world. This means Airbnb still has to go for the big ones.

Another point to consider when thinking about Airbnb’s future growth is its extensible platform. So far, Airbnb has not spent time in developing services for its hosts and guests on its platform. But Brian Chesky announced during the last earnings call that:

we are now getting ready to re-expand Airbnb beyond its core. It was always our attention to do much more than just short-term housing for travelers. We’re always intended to do more of that. So we’re working on making Airbnb more of an extensible platform. And I think, ultimately, there are actually quite literally dozens of services, guests and hosts that we could build on top of the Airbnb system. I think a lot of it comes down to making the platform extensible so we can offer these services. I think at the end of the day, we’re really thinking about are a couple of big ideas. First, I think that we are thinking about generative AI as an opportunity to reimagine much of our product category and product catalog. So if you think about how you can sell a lot of different types of products and new offerings, generative AI could be really, really powerful. It can match you in a way you’ve never seen before.

So imagine Airbnb being almost like the ultimate travel agent as an app. We think this can unlock opportunities that we’ve never seen.

What I Don’t Like About Airbnb

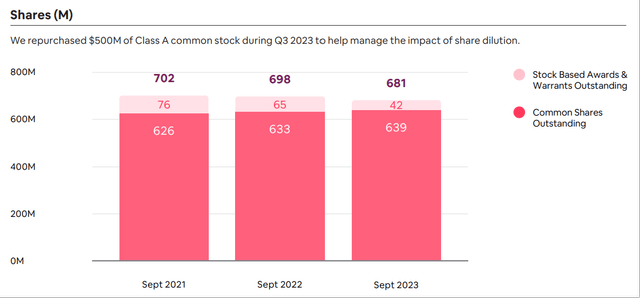

Like many tech companies with a very strong growth path, Airbnb pays many employees not only in cash but also in stock. This creates shareholder dilution, which obviously I don’t like. As we can see below, Airbnb’s share count has decreased only a tiny bit since 2021.

ABNB Q3 2023 Shareholder Letter

The company also discloses that it expects SBC for FY2023

to be approximately 20% higher than in full-year 2022. We anticipate a similar year-over-year growth rate for SBC expense in 2024. The increase in SBC expense exceeds the pace of headcount growth anticipated over the same time period due to the accounting for our restricted stock unit (“RSU”) awards, which has changed over time. Beyond 2024, after the last of the double-trigger RSUs (which we stopped issuing after our IPO in December 2020) have vested or expired, we anticipate that SBC expense will grow largely in-line with headcount growth.

To offset the impact of SBC, Airbnb announced a share repurchase authorization of up to $2.5 billion of its stock. In the past quarter, the company repurchased $500 million of stock, leading to a total of $1 billion spent under this program. As we can see, shares have not increased, but at what cost, I say! As shareholders, we have already spent $1 billion just to keep Airbnb’s share count almost flat. This is $1 billion less in FCF, which could be used for shareholders’ remuneration, too.

Valuation and Conclusion

Considering a 15% CAGR for Airbnb’s revenue, we could forecast the company to break $20 billion in revenue by 2028, when the company may hold at least $18.5 billion of funds on behalf of customers. Just from this money held on behalf of its customers, Airbnb could earn at least a 3% interest, which leads to $600 million in interest income. Considering that by 2028 the company’s net income could be around $6 billion, almost 10% could come from interest income. If Airbnb’s share count will stay flat from here to 2028 then we have an estimated 2028 EPS of $8.74, close to the one Seeking Alpha reports. However, if the share count is reduced, then our 2028 EPS could be around $11-12. The fwd PE would then come down from 14.5 to 11.6, making the stock a bit cheaper than it actually appears to be. We are not before a compelling steal, but if Airbnb’s growth trajectory is the one Brian Chesky is outlining, then we are still in buy territory.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.