Summary:

- Overall, there’s a lot to like about Airbnb and a lot to dislike. Insider sales and SBC are a massive dilution for shareholders.

- The risk-reward ratio for Airbnb is not right at the current valuation.

- The return is too dependent on keeping the high valuation in the future; if not, the shareholder is threatened with return-free years.

Panuwat Dangsungnoen

Introduction

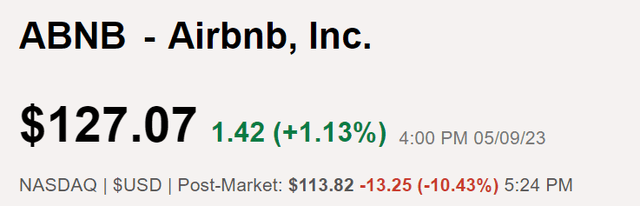

Airbnb (NASDAQ:ABNB) just announced its Q1 numbers, and the stock is down 10% so far in after-hours trading (Editor’s note: shares are down 12% in early May 10 trading). This article is about short-term headwinds and why they might lead to a further falling stock price. But also, why the stock is a long-term buy.

Seeking Alpha

The stock recently traded in the $80s range, and there was an excellent buying opportunity. In the meantime, the shares have become somewhat expensive again, and even after this 10% slump, one can certainly not talk about getting cheap. However, it rarely gets cheap: the stock has only traded below $90 for a few days in the last 12 months.

Seeking Alpha

Q1 results

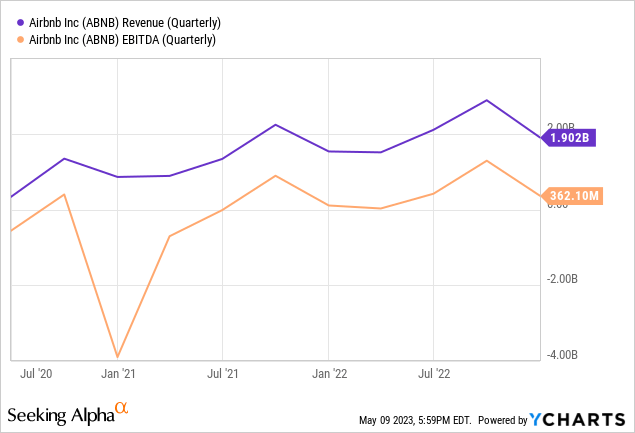

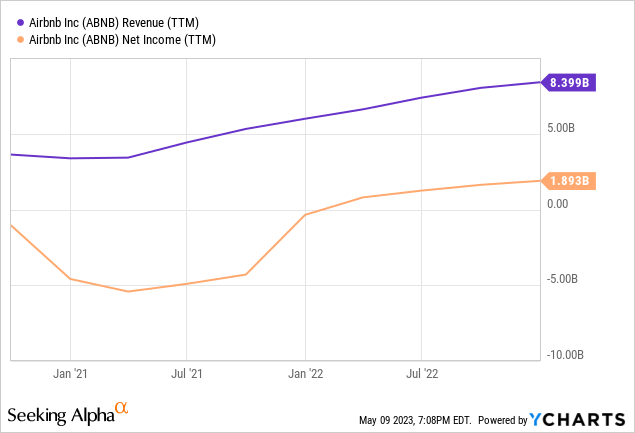

This chart shows that Airbnb’s revenue is increasing steadily, with both the highs and the lows getting higher.

Q1 revenue was $1.82B, slightly less than Q4 2022 but 20% more year-over-year. EBITDA of $262M is also less than the previous quarter but 14% more year-over-year.

The stock drop was mainly because the outlook is disappointing. It seems like there will be more pressure on margins, which suggests that the landlords lower their prices, which usually happens when less demand is expected.

Sees Q2 revenue of $2.35B to $2.45B vs. consensus of $2.42B.

ABNB expects Y/Y growth in nights and experiences booked in Q2 to be lower than its revenue growth during the quarter.

ABNB anticipates a slightly lower ADR in Q2 2023 than Q2 2022.

In Q2 2023, company expects adj. EBITDA to be similar to adj. EBITDA in Q2 2022 on a nominal basis, but lower on a margin basis.

So, the stock is falling because the market thinks the current inflation and economic situation will lead people to save more on travel. This reasoning is coherent and could happen in the same way. But in the long term, there are numerous tailwinds. I want to mention three of them before getting more into the negative aspects of the stock at this moment.

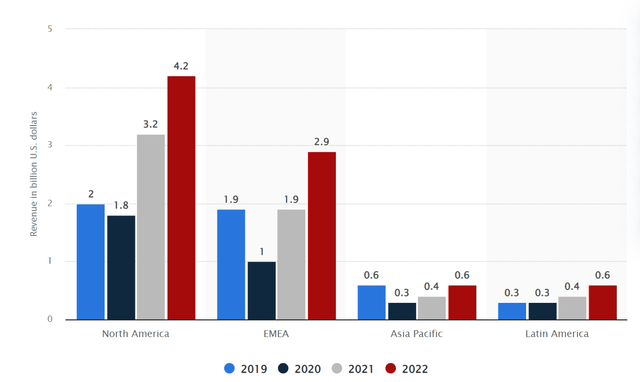

1. There is tremendous potential in emerging markets

In this chart, you can see what Airbnb’s regional revenue distribution looks like. 50% is roughly North America, and the rest is the rest of the world. EMEA includes Europe, the Middle East, and Africa. So most of that $2.9 billion is coming from Europe. Developing countries in Latin America, Africa, and Asia still account for a relatively small share of the revenue.

statista

This is mainly because Airbnb is much less known in many countries than in Western countries. For example, I live in Thailand and sometimes book through Airbnb. The locals, even the property owners, however, do not use Airbnb to a large extent. But a few years ago, no one knew Airbnb; that has definitely changed. Recently, a Thai told me he saw a report on Thai television the other day about how foreigners in Thailand rent long-term and then sublet via Airbnb by the day or month. This is prohibited because they do not have a work permit, but in any case, Airbnb becomes better known through such channels, and locals realize that this is an attractive way to get tenants. Because so far, I get the best deals when I drive around, ask at several accommodations, and call twenty phone numbers. If there were more on Airbnb, it would be beneficial for me but also for the landlords.

This story is not representative of Western countries and cities in Asia, but it still shows that Airbnb in many countries is still far from its full potential. I belong to the small but growing group of remote working people who rent long-term. At the same time, rental prices tend to rise in developing countries, which also benefits Airbnb.

But I have another short experience story. Two months ago, I was in Vietnam, in Hanoi, and was surprised that there was not much on Airbnb. I am sure there is a mismatch here: more tourists would book through Airbnb if there were more to choose from. Eventually, the Vietnamese people will realize this, and more will be offered.

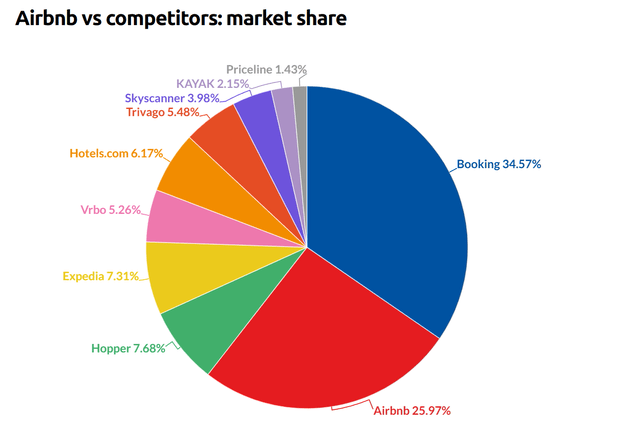

2. Airbnb has excellent opportunities to gain further market share

According to businessofapps.com, this is the market distribution of online bookings for 2021.

businessofapps.com

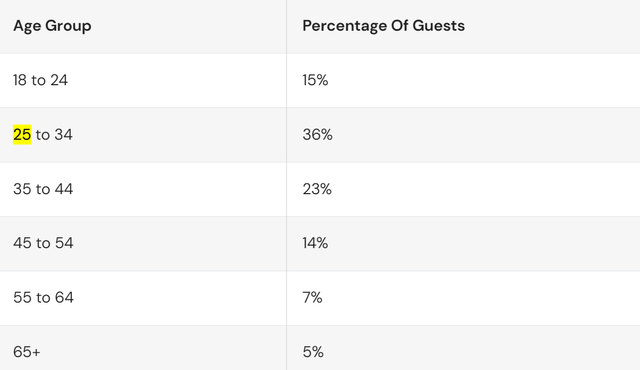

This, combined with the fact that Airbnb users tend to be young, suggests that younger people find the concept and user-experience of Airbnb more attractive than classic hotel booking.

searchlogistics.com

That users are satisfied can be seen, among other things, in the excellent ratings in the Apple and Google App Store.

Ecosia search engine

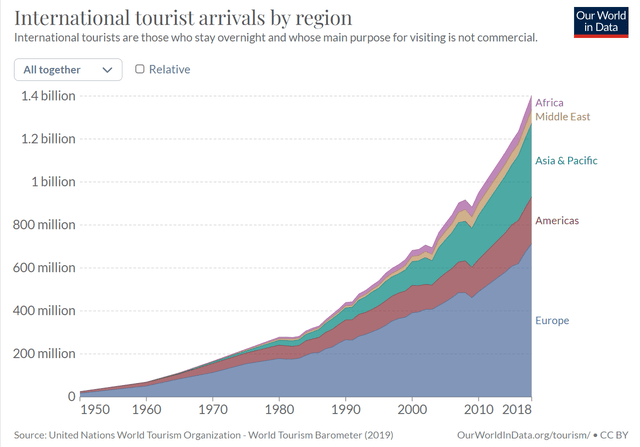

But it is also the case that if the company’s market share remains the same in percentage terms, there will still be more users in absolute terms. Tourism is a mass phenomenon that has not yet reached its end. In the past, wealthy tourists came from Western countries, but with growing prosperity in emerging markets, we are getting to a point where more and more people can travel. India is an excellent example of this: it is economically emerging, has a young population, and is the most populous country.

ourworldindata.org

3. The company is now profitable – this means share buybacks

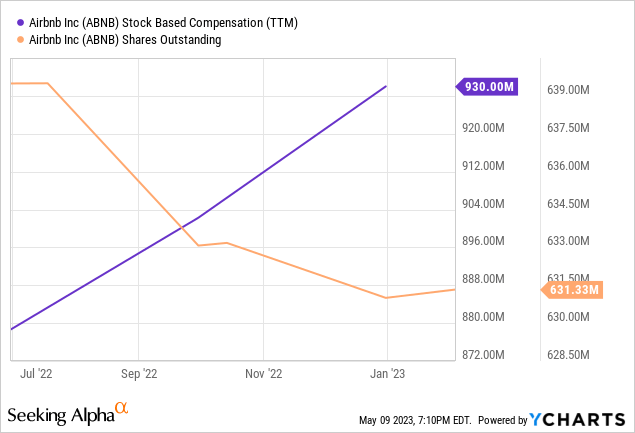

The first share buybacks began last year, and so far, about 8 million shares have been repurchased, corresponding to about $800 million of the market cap. This will now be expanded.

Board approved a new share repurchase authorization of up to $2.5B of class A common stock.

$2.5B represents about 3% of the market capitalization and will give the stock a noticeable boost. Above all, the company would probably buy back more shares when the price falls lower.

Risks and short-term headwinds

North America and Europe remain the most important markets for Airbnb, but inflation and rising prices for essentials are tough for their broad middle class. Saving on travel is one of the most obvious things to do. Airbnb is hit twice by this effect. Firstly, there are fewer nights per person per year, and secondly, this increases the pressure on landlords to lower their prices as the supply/demand ratio changes.

Share dilution and insider selling

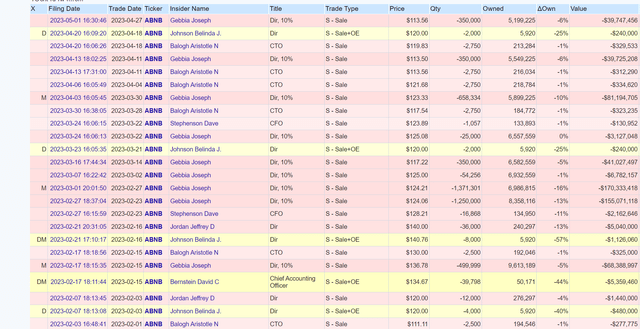

I always pay attention to share dilution and whether there is insider selling. In addition, it’s important to look at stock-based compensation. SBC and insider selling are both very high.

Insider sales are massive, this is the list since the beginning of February, and in total, this is about $621M. In just three months and even before that, there was already a lot.

openinsider.com

Is that a cause for concern? Absolutely. It’s a massive dilution for shareholders and nullifies the share buyback effect. The whole thing reminds me of Palantir (PLTR), where enormous insider selling was an issue for a long time while the company itself was just on the verge of profitability.

In the case of Airbnb, you can profit from rising share prices, but don’t get a share of the profits. There are no dividends, and insider sales offset the share buybacks. Therefore, there is a big difference between the legally required GAAP and non-GAAP earnings. In fact, the company says that last quarter was the first GAAP profitable Q1 quarter ever.

Conclusion

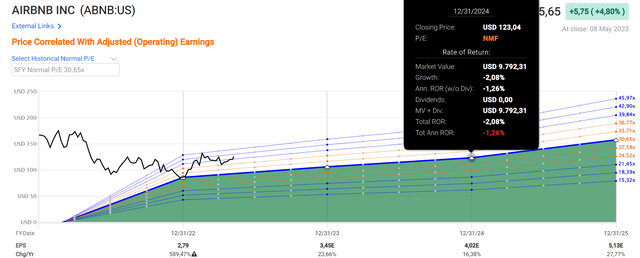

Overall, there’s a lot to like about Airbnb and a lot to dislike. Insider sales and SBC are a massive dilution for shareholders. Even after today’s 10% plunge, the stock is still expensively valued with a forward P/E of 37, meaning that the PEG ratio is close to 2.0, which is considered overvalued. According to fastgraphs, the stock will not bring any profit until the end of 2024, the P/E ratio is 30. In other words, the return depends very much on the future P/E ratio and whether the market will continue to attribute an above-average premium valuation to the company. And this is not guaranteed for any company, especially when consumers have to start saving.

fastgraphs

The risk-reward ratio for Airbnb is not right at the current valuation and with regard to the economic pressure on a significant percentage of the population. The return is too dependent on keeping the high valuation in the future; if not, the shareholder is threatened with return-free years. I hope there will be better entry opportunities this year when the market in the tourism sector prices in more pessimism. Travel boomed in the post-Covid era because everyone missed it; but now everyone who wanted to travel has done so. With ongoing inflation and geopolitical challenges, many people will try to keep their money together. Maybe this has been factored into the share price for the first time today because the company is talking about falling margins. Airbnb’s stock is a buy for me in the long term, but I hope for better prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.