Summary:

- Airbnb continues to see growth in key metrics, with double-digit increases in gross booking values and revenues in Q1’24.

- The company’s strong free cash flow and potential for aggressive capital return make it an attractive investment.

- Despite a high price-to-earnings ratio, Airbnb’s expanding business and FCF profitability could lead to increased cash returns to shareholders in the future.

Dreamer Company

Airbnb (NASDAQ:ABNB) continued to see solid growth in its key performance metrics, revenues and free cash flow in the first fiscal quarter. The key strength of Airbnb is its massive amount of free cash flow it generates from its booking platform, and I believe Airbnb could become a more aggressive capital return play in the future. While shares are not necessarily cheap based off price-to-earnings, the business is expanding, growing its profitability and I can see a scenario in which the company returns more cash to shareholders in the future!

Previous rating

I rated shares of Airbnb a buy almost exactly a year ago, as the booking platform executed well on its post-pandemic rebound plan. I continue to see upside for Airbnb on the back of customers spending more money on the platform (growing gross booking value per night) as well as growing booking volumes in general. Likewise, I also see, given the solid generation of free cash flow, Airbnb as a promising candidate to introduce a dividend or announce a stock buyback to return more cash to shareholders.

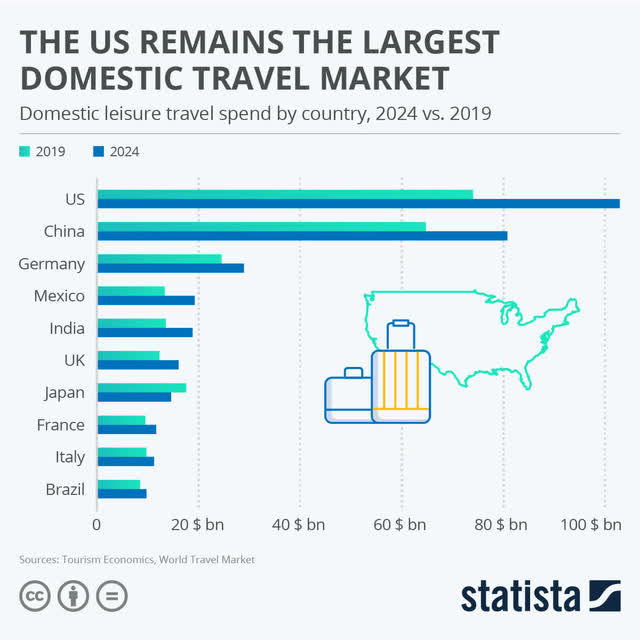

Resilient U.S. economy provides tailwinds for consumer spending

Airbnb does well when the U.S. consumer does well and spends money on travel experiences. The U.S. travel industry has seen a major rebound from the 2020 pandemic, and domestic travelers in the U.S. now spend significantly more than they did even before the pandemic. Support here is provided by a strong labor market, which is backing U.S. economy growth as well as leisure spending. In May, 272k jobs were created by U.S. employers, which, I believe, continues to create favorable spending tailwinds for booking platforms like Airbnb.

Core KPI and free cash flow strength

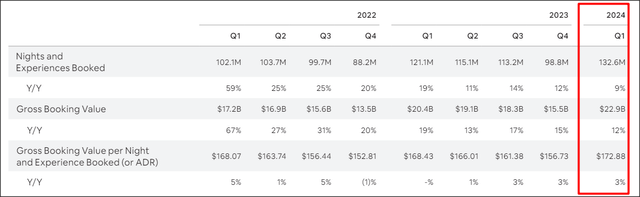

When it comes to Airbnb, the company really has only 3 key performance indicators that matter to investors: the number of nights/experiences booked on the Airbnb platform, gross booking value/GBV and GBV per night. These metrics reflect booking and pricing trends, which explain underlying movements in the company’s free cash flow. In the first-quarter, Airbnb’s generated 9% growth in nights/experiences booked and double-digit (12%) growth in gross booking value.

Gross booking value captures the amount of dollars that are processed on the booking platform, while gross booking value per night shows how much customers are driving the average transaction value per night. The good news is that all metrics showing healthy growth and supporting the company’s free cash flow growth.

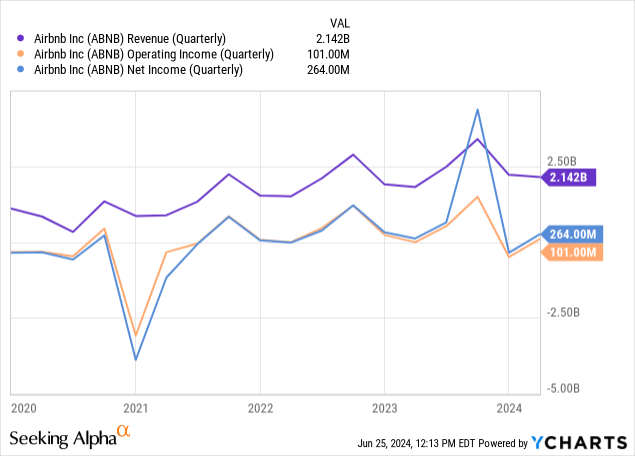

Airbnb generated $1,909M in free cash flow in the first fiscal quarter on revenues of $2,142M. Both revenues and free cash flow increased by double-digits compared to the year-earlier period, with the top-line growing 18% and free cash flowing roaring 21% upwards. Because of the scalability of Airbnb’s booking platform, the firm has very low capital expenditures which, in my opinion, adds to the attractiveness of an investment in Airbnb: in the last year, the firm spent only $55M on CapEx which equals approximately 1.3% of its operating cash flow.

Strong booking activity on the Airbnb platform as well as growth in average book value per night have provided tailwinds for the company’s free cash flow. In terms of free cash flow margin, Airbnb did slightly better than in the year-earlier period, showing a 2 PP margin expansion to 89% in Q1’24.

|

Airbnb |

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

Q1’24 |

Growth Y/Y |

|

Revenues ($M) |

$1,818 |

$2,484 |

$3,397 |

$2,218 |

$2,142 |

18% |

|

Operating Cash Flow ($M) |

$1,587 |

$909 |

$1,325 |

$63 |

$1,923 |

21% |

|

Capex ($M) |

-$6 |

-$9 |

-$15 |

-$17 |

-$14 |

133% |

|

Free Cash Flow ($M) |

$1,581 |

$900 |

$1,310 |

$46 |

$1,909 |

21% |

|

FCF Margin |

87% |

36% |

39% |

2% |

89% |

+2 PP |

(Source: Author)

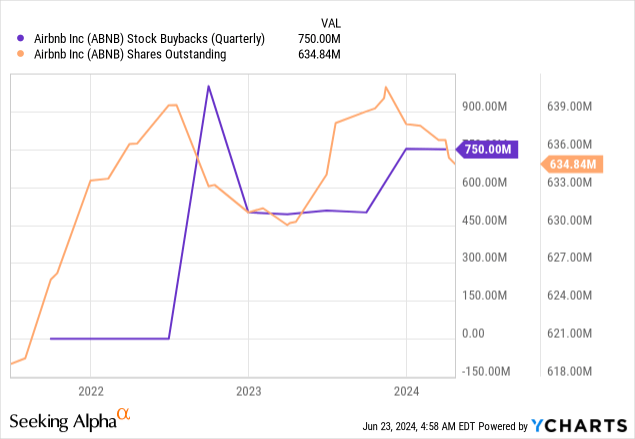

The firm’s high free cash flow has boosted the company’s cash position to $7.8B (plus short-term investments totaling $3.3B) as of the end of the March quarter. This means that Airbnb’s market cap is made up to 12% of cash and investments, which gives the booking platform considerable buyback power.

In Q1’24, Airbnb repurchased $750M worth of its own shares and $2.5B in the last year. Going forward, I expect Airbnb to evaluate options to return more cash of its mounting cash pile to shareholders, which could either results in a dividend introduction or a new stock buyback authorization (the current had $6.0B left as of the end of the March quarter).

Favorable operating income trend and a catalyst for spending growth

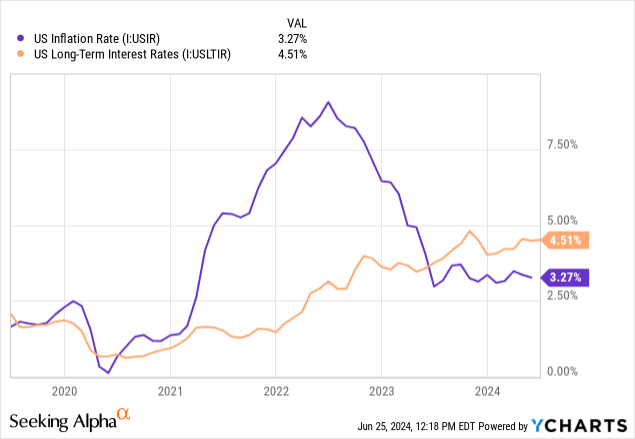

Airbnb’s solid operating income momentum, driven chiefly by its scale and growing gross booking value also works towards its benefit. In the most recent quarter, Airbnb generated $101M in operating income, showing a $106M swing in income compared to the year-earlier period. Going forward, I see continual tailwinds for spending growth for Airbnb’s booking platform, and the catalyst here could be moderating inflation.

Inflation came in at 3.3% in May, down significantly from the year-earlier period. As inflation moderates and no longer saps consumers’ budgets, cash could be freed up for discretionary spending, like travelling. As Airbnb is a leading booking platform for national and international travel, Airbnb could continue to build on its momentum in gross booking values and growing pricing strength in the coming quarters.

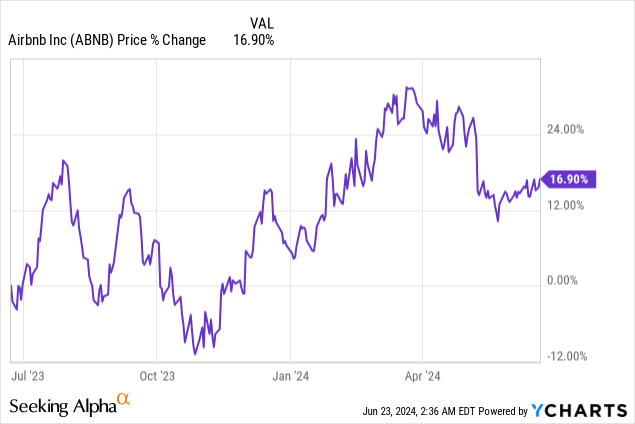

Airbnb’s valuation

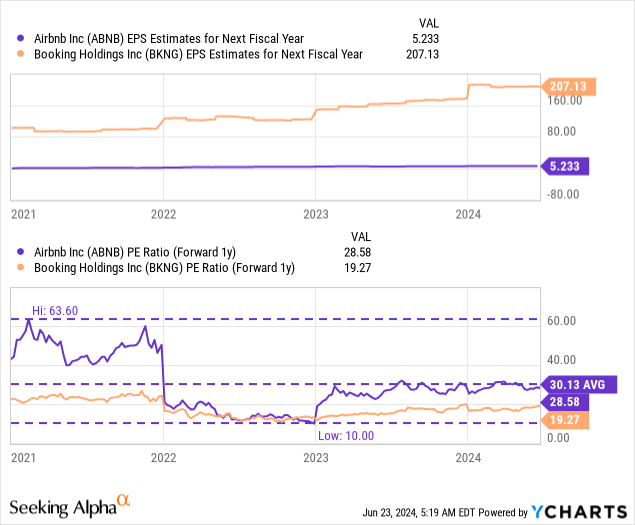

Airbnb is currently valued at a price-to-earnings ratio of 28.6X, which compares against a 5-year average P/E ratio of 30.1X. This longer term P/E ratio, however, is skewed downward due to the impact of the COVID-19 pandemic, which suppressed Airbnb’s business. Rival firm Booking Holdings (BKNG) trades at a lower P/E ratio of 19.3X, chiefly because investors expect stronger FCF and capital return expectations regarding Airbnb.

I believe Airbnb is still undervalued here, especially because the firm is growing its revenues and free cash flows at double-digits and all major KPIs are moving in the right direction. I believe Airbnb could trade at a P/E ratio of 35.0X, given its FCF power, potential for buybacks and strong market position. A fair value P/E ratio of 35.0X, using a consensus FY 2025 EPS estimate of $5.23 (see below) calculates to a fair value of approximately $183. Given a current share price of $150, Airbnb could have up to 22% upside revaluation potential. My fair value estimate is conditional on Airbnb continuing to grow its core KPIs and free cash flow.

Risks with Airbnb

I believe that the company’s rather massive free cash flow limits downside risks for Airbnb’s shares, but there are clearly some risks that investors have to consider. The pandemic set Airbnb’s business back by about two years, as worldwide travel restrictions especially hurt the travel and lodging industries.

A key element of my investment case for Airbnb is the potential for accelerating capital returns through either buybacks or dividends in the future. This may not materialize and Airbnb may decide to use its free cash flow for other purposes, such as debt repayments (Airbnb owes about $2.0B in long-term debt). Additionally, consumer spending tailwinds related to a moderation of inflation may also not be realized, especially if the economy were to skid into a recession.

Final thoughts

Airbnb is doing quite an excellent job right now: it is growing its free cash flow at a quick pace and seeing healthy core key performance metrics (chiefly the number of nights booked on the Airbnb platform) that is underpinning the company’s top-line growth. Airbnb is also well-positioned as a booking platform to benefit from strength in consumer and travel spending, which is backed up by a strong economy in the U.S. Shares are not a completely bargain, I would say, but given Airbnb’s excellent (and growing) free cash flow power, I believe the booking platform could be good for a couple of surprises in the future as far as capital returns are concerned!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.