Summary:

- Airbnb is well-positioned to benefit from long-term travel trends and a large TAM.

- The increasing adoption of alternative accommodations among consumers is expected to drive robust revenue growth for Airbnb.

- ABNB already trades at a significant premium to the peer group, which is justified through its margin profile and positioning in the sector.

- However, I believe the valuation upside is limited, leading to my hold rating on the stock.

Klaus Vedfelt/DigitalVision via Getty Images

Thesis

Airbnb, Inc. (NASDAQ:ABNB) operates in a large and expanding Total Addressable Market and benefits from favorable long-term trends, such as the rise of alternative accommodations, which has been accelerated by the COVID-19 pandemic. Additionally, the company has identified new opportunities in areas like extended stays, road trips, and remote work. ABNB commands a premium multiple compared to the average valuation for other online travel agencies, justified by ABNB’s dominant position in the faster-growing Alternative Accommodations sector, its global presence, a substantial Total Addressable Market (TAM), and a robust adjusted EBITDA margin of around 35%. However, despite these positive factors, I consider the risk-reward balance to be balanced, as ABNB’s shares are already trading at a significant premium compared to OTAs and other leading companies in the same category.

Airbnb Focusing on Affordable Offerings & International Growth

Airbnb is poised to benefit from the recovery of international travel following the pandemic, particularly in the APAC region. The company experienced a significant increase in nights booked in APAC, with a growth rate of over 40% in the last quarter. As borders reopen and there is pent-up demand for international travel, cross-border nights booked also rose by 34%. Airbnb’s expansion into Brazil and Germany has been successful, resulting in these countries becoming its fastest-growing markets. The company plans to replicate this strategy in other regions, such as Asia, Latin America, and Europe. With its popularity among younger travelers, especially in Asia, where there is a younger demographic, Airbnb has the potential for strong international growth throughout the year. However, to maintain its market share against other online travel agencies and hotels that are rebounding post-pandemic, Airbnb will need to introduce new product offerings focused on affordability. The company’s sustained double-digit revenue growth is expected to rely on robust expansion in international markets and steady growth in high-quality listings.

Airbnb recognizes the need to enhance affordability for its customers, especially as hotels and other online travel agencies (OTAs) offer cheaper accommodations. To address this, Airbnb has introduced Airbnb Rooms, which allows guests to rent a single room at a competitive price point. The majority of these rooms are priced under $100, with an average price of $67. Moreover, the company has formed partnerships with Stripe and Klarna to offer a buy-now-pay-later option, providing consumers with more payment flexibility.

As rivals offer more affordable alternatives, Airbnb’s strong brand loyalty is being put to the test. To maintain and strengthen this loyalty, Airbnb is focusing on its new offerings and revitalizing the host community. These initiatives aim to retain brand loyalty, especially as peak travel season approaches in the upcoming summer months.

Key to Airbnb’s Growth Against Traditional Hotels

To sustain its rapid growth compared to traditional hotels, Airbnb may need to prioritize consistency and quality of experiences. The company’s strong organic growth in terms of individual hosts, a diverse range of listings, broad geographic presence, and the advantage gained from longer stays have enabled it to capture market share from hotel bookings, particularly during the pandemic. Unlike its larger competitors, such as Booking Holdings and Expedia, which heavily rely on specific regions (Europe for Booking Holdings and North America for Expedia), Airbnb’s geographic diversification positions it favorably.

Even without significant contributions from experiences and flight bookings, Airbnb could surpass $70 billion in bookings in 2023. However, to sustain double-digit revenue growth, it is increasingly likely that the company will venture into ancillary travel categories. This expansion into additional travel-related segments would help Airbnb maintain its strong top-line growth.

Financial Outlook & Valuation

Even if Airbnb sees further top-line deceleration amid increased competition and tougher comparisons, the company’s cost discipline could pave the way for more margin expansion. Airbnb indicated a pull-forward in marketing spending in 1H, alleviating some operating-margin pressure for the rest of the year. Workforce reductions have allowed for a slight slowdown in G&A, though regulatory risks in some cities around Airbnb’s business model might offset some cost cuts.

Airbnb’s lofty $1.6 billion in free cash flow from 1Q provides further cushion for disciplined investments and growth opportunities, especially in areas like AI, which can further reduce costs and boost employee productivity, specifically within customer service.

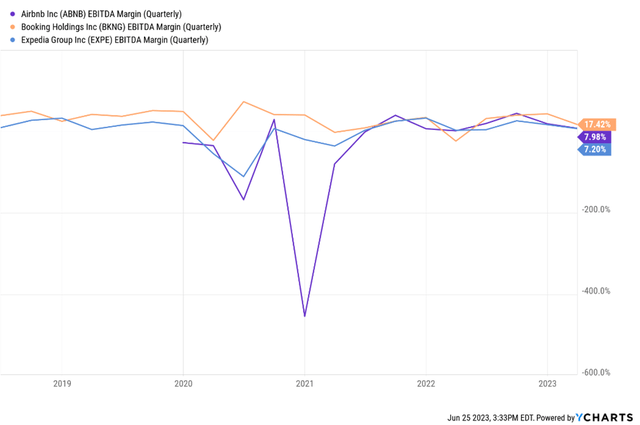

YCharts

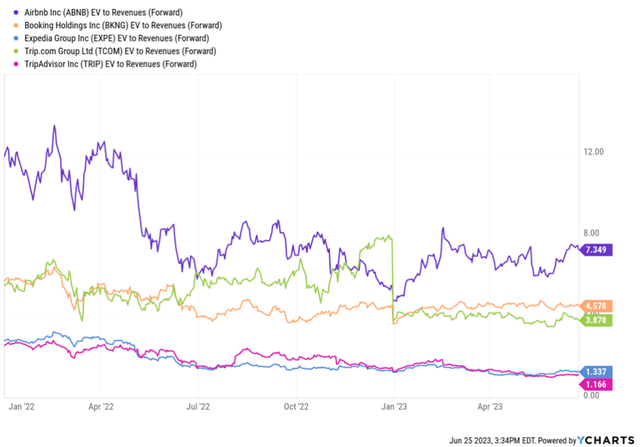

I believe ABNB deserves a premium to the average for the OTAs, including Booking Holdings Inc. (BKNG), Expedia Group, Inc. (EXPE), Trip.com Group Limited (TCOM), and Tripadvisor, Inc. (TRIP) because of its leadership position, global footprint, large TAM, and strong ~35% Adj. EBITDA margin. However, I believe the risk-reward is balanced, and there is limited multiple upside given the shares already trading at a substantial premium to the OTA peers.

YCharts

Risks

The aftermath of the COVID-19 pandemic continues to disrupt the travel industry, resulting in lower EBITDA and free cash flow for Airbnb in the near term. The company is struggling to catch up to its peers in terms of unit economics, and there are long-term pressures on monetization. Additionally, geopolitical tensions in certain regions and broader macroeconomic factors may dampen the demand for alternative accommodations, which would adversely affect Airbnb’s stock performance.

Conclusion

Airbnb holds a prominent position as a global marketplace for alternative accommodations and experiences, leveraging its community of individual hosts and strong brand as key competitive advantages. I anticipate robust revenue growth driven by the increasing adoption of AA among consumers, allowing Airbnb to maintain its leadership in the market. Overall, Airbnb is well positioned to capitalize on long-term travel trends, despite a potential temporary shift towards hotel bookings during the reopening phase. It is worth noting that ABNB already trades at a significant premium to the peer group, which is justified through its margin profile and positioning in the sector. However, I believe the valuation upside is limited, leading to my hold rating on ABNB stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.