Summary:

- Airbnb’s stock has cooled off since March, presenting a strong buying opportunity ahead of the Q2 earnings cycle.

- New features like Icons and group trip organization are distinguishing Airbnb from competitors and expanding its market appeal.

- Bookings are continuing to grow at a double-digit pace, while revenue growth accelerated in Q1.

- Airbnb is also enjoying tremendous operating leverage at scale, with adjusted EBITDA margins rapidly expanding.

Martin Puddy/DigitalVision via Getty Images

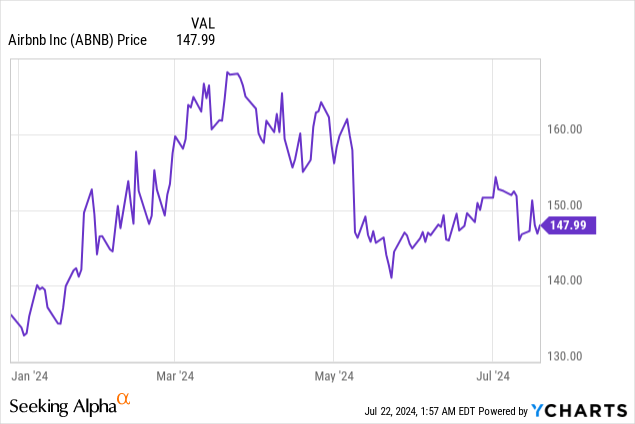

While the S&P 500 has continued to race toward new all-time highs powered by tech stocks, one major large-cap tech stock has started to cede some of its steam: Airbnb (NASDAQ:ABNB), the world’s largest vacation rental platform. Dented in part by rival Expedia’s (EXPE) admission that Vrbo (a core Airbnb rival) bookings are slowing down, shares of Airbnb have been in a downtrend since hitting YTD peaks near $170 in March.

But at the same time: travel demand continues to be robust, and Airbnb’s bookings and revenue are exceeding expectations. The company also continues to roll out significant new features that distinguish it from its competitors and burnish its reputation as the leading vacation-rental and experiences site. Ahead of the company’s Q2 earnings release (due out in early August), it’s a great time for investors to re-assess the bull case for Airbnb.

Major new feature releases underlie a robust long-term bull case for Airbnb

I last wrote a bullish note on Airbnb in mid-March, when the stock was hovering in the $160s. Since then, the company has lost ~10% of its value while posting strong Q1 results and, in particular, releasing what I consider are significant feature updates that have the potential to broaden Airbnb’s appeal. With this in mind, I’m reiterating my buy call on Airbnb and encouraging investors to use the near-term dip as a buying opportunity.

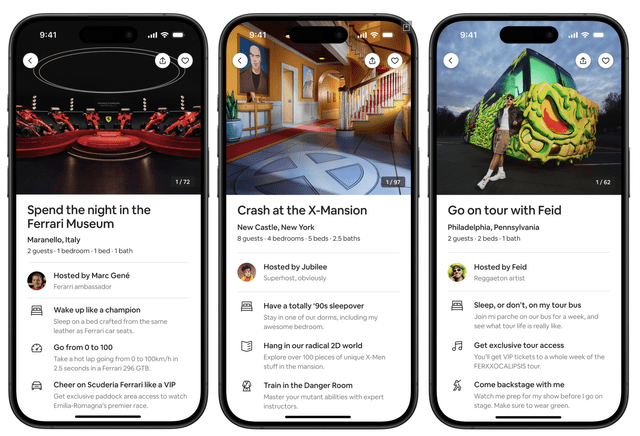

To me, the company’s launch of its latest feature, Icons, went largely unnoticed by the markets: but I believe this will have a sizable impact on Airbnb’s market in the years ahead.

To date, the company has released 11 “Icons”, which are unforgettable, exclusive experiences. Shown above, the company is featuring exclusive stays at museums and mansions, as well as offering exclusive musician experiences. It’s also offering a chance to tour Disney’s (DIS) “Up” floating balloon house.

It’s key to note that for now, these experiences are being treated as a “lucky lottery” system and cost very little (the company is aiming to charge <$100 per Icon). But as this feature rolls out more broadly, it’s easy to envision Icons growing to encapsulate more of the live experiences and ticketing industry, swallowing rivals like Eventbrite (EB) and Ticketmaster.

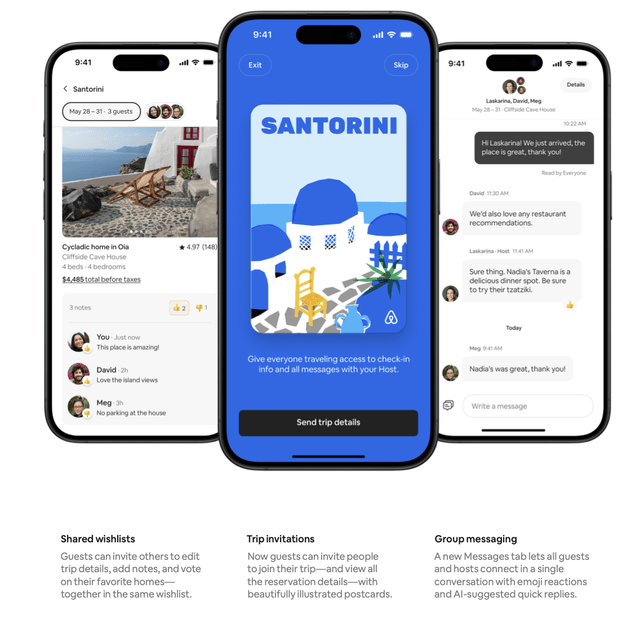

Another feature that was announced as part of Airbnb’s Summer Release was additional functionality for organizing group trips. The company notes that group trips represent 80% of total Airbnb bookings, and new features like inviting friends to trips and enabling group messaging further help delineate Airbnb from more generalized peers like Expedia and Booking (BKNG).

Airbnb new group features (Airbnb Q1 earnings deck)

Beyond these new releases, here’s a roundup of my full long-term bull case for Airbnb:

- Airbnb’s portfolio of offerings continues to expand, pushing it beyond being just a lodging platform and into curating holistic experiences. Airbnb continues to fuel innovation to drive additional monetization opportunities. Examples of these include “Experiences” (which offer local activities with local guides), Icons (even more exclusive Experiences that are currently offered on a lottery basis), and “Airbnb Rooms”, which offers lower-priced rooms in homes in alignment with the company’s original couch-surfing ethos.

-

Picking up share of both travel spend as well as rent spend with longer-term stays. With so many companies announcing permanent remote or hybrid work structures, many workers have leaped at the chance to become digital nomads and work from anywhere. More and more Airbnb bookings come from longer-term stays of 28 days or more. This trend may see Airbnb picking up not just travel demand, but essentially “rent” budgets from digital nomads as well. As a result of this trend, average trip lengths are increasing quite substantially.

-

Opportunity to compete with OTA giants in offering hotels a new listing platform. Hotels have always been under pressure by Expedia and Booking, which are necessary marketing outlets but charge a giant fee. Airbnb already allows boutique hotels to list on its platform for a fee; over time, Airbnb could compete in this more minor segment of its business to take more share from OTAs.

-

Profitability in mind. During the immediate aftermath of the pandemic, Airbnb laid off about 20% of its staff. While it is now continuing to hire, this profit-centric mindset and the fact that Airbnb is structurally leaner than it was pre-pandemic has allowed the company to make sizable profitability gains.

Stay long here and use the near-term dip as a buying opportunity.

Strong trends exiting Q1

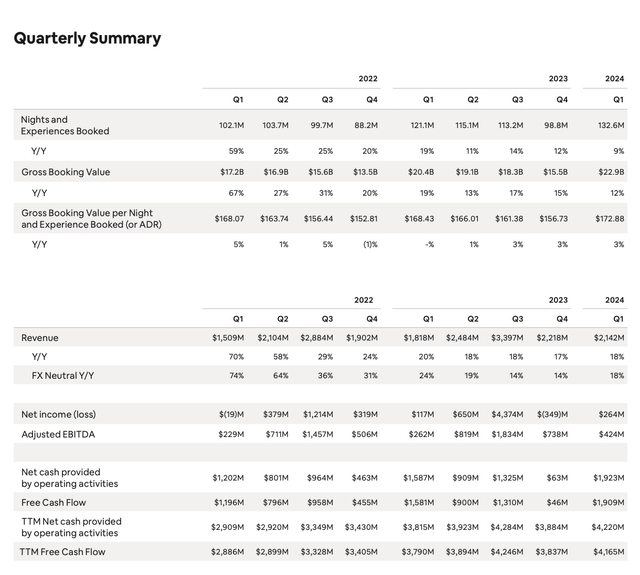

Though near-term trends have started to see some amount of deceleration (especially as prior-year compares get tougher), Airbnb continues to benefit from red-hot post-COVID travel demand and is beating expectations. Take a look at the company’s latest results, trended over time, in the snapshot below:

Airbnb trended results (Airbnb Q1 earnings deck)

Gross bookings in Q1 tallied up to $22.9 billion, up 12% y/y but decelerating three points from 15% y/y growth in Q4. We note that Q1 tends to be the biggest bookings quarter of the year for Airbnb (and the quarter in which the company generates the most FCF) as people plan ahead to their summer vacations.

But despite the bookings deceleration, revenue grew 18% y/y to $2.14 billion, which accelerated versus 17% y/y growth in Q4. On an FX-neutral basis (the company continues to be hurt by sharp currency devaluations in Latin America, similar to many of its rivals), the acceleration is even more impressive, sequentially improving four points versus 14% constant-currency y/y growth in Q4.

Note that the company is implementing a “hidden fee” which will proliferate more broadly in Q2. It’s now charging for cross-border currency bookings, which occurs when guests pay Airbnb in a different currency than hosts set for their listings (a small, ~20% portion of Airbnb’s total bookings). Even if small, this fee will slightly nudge up Airbnb’s take rates.

The company notes as well that interest in the Airbnb platform is soaring, up 60% y/y growth in U.S. app downloads in Q1. Airbnb’s launch of Icons purportedly has also generated more press than its IPO, per CEO Brian Chesky’s remarks on the Q1 earnings call:

Last week, we introduced Icons, a new category of extraordinary experiences by the greatest names in music, film, sports, and more. Icons mark an important next step in helping people understand that Airbnb offers more than just travel accommodations.

Now, before I share a few business highlights, I just want to provide some context on why we actually introduced Icons, because they deliver on three key objectives. First, Icons keeps Airbnb’s brand relevant and top of mind. With new Icons launching throughout the year, we can introduce more people to Airbnb and highlight what makes us unique.

Second, while Airbnb’s brand is already recognized around the world, there are specific segments where we want to accelerate growth. And with a broad range of Icons spanning various geographies, demographics, and fan bases, we’ll be able to reach key segments in a more targeted way. And third, Icons helped change the way people think about Airbnb and what we offer. And this is going to be critical as we expand beyond accommodations in the coming years.

Now, it’s still early, but we’re really excited about the response we’ve seen to Icons so far. In just one week, the Icons launch has generated over 8,100 pieces of global media coverage and 371 million social media impressions. And the coverage has been overwhelmingly positive. Now, just to put this into perspective, Icons has already generated more press than our IPO. It’s clear Icons are resonating with people.”

Airbnb’s profitability also continues to soar, with Adjusted EBITDA growing 62% y/y in the first quarter to $424 million, representing a healthy 20% margin (versus 14% in the year-ago quarter).

Risks and key takeaways

Prominent new features like Icons are preserving Airbnb as top-of-mind on consumers’ travel wish lists. Revenue and bookings continue to grow at a robust double-digit pace, and the company is continuing to gain operating leverage with scale. To me, there are a plethora of reasons to remain invested here.

Of course, there are a number of risks to be mindful of. If Airbnb’s bookings growth continues to decelerate into Q2 and beyond, revenue growth in the year to go will also slow down: which is the biggest watch list item for this stock now. We should also continue to be mindful of competition. Airbnb currently offers no loyalty program or rewards for bookings, which can make booking via Expedia, which offers the One Key rewards program (rewards vary based on customer loyalty level, but generally offer a range of a 2-6% return), potentially more attractive.

Still: I think there are enough unique distinguishers for Airbnb, including and especially Icons, to preserve the company’s brand power. Stay long here and continue to stay invested.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.