Summary:

- Airbnb went public at $68 a share and opened at $146 in 2020. Its stock prices have fluctuated since, impacted by macroeconomics and interest rates.

- Q1 2024 saw Airbnb’s bookings surge to $22.9 billion, driven by mobile growth and user-centric upgrades, leading to increased revenue and profitability.

- The travel industry is rapidly rebounding and the global travel spending is forecasted to reach $8.6 trillion by the end of the year, driven by strong consumer spending.

- Airbnb outpaces competitors in unique stays and revenue growth. It focuses on quality listings, appeals to millennials, and invests in product development and innovation.

- $750 million in Q1 buybacks, $6 billion remaining for future repurchases, reflecting strong cash position and shareholder value focus.

Dreamer Company

Investment Thesis

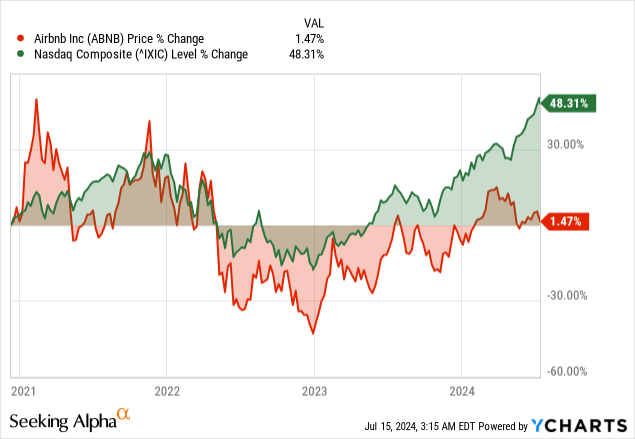

Airbnb, Inc. (NASDAQ:ABNB) went public at $68 a share but opened trading at $146 in December 2020 when the pandemic was raging. The company boomed as people disregarded hotels and began booking private homes for stays. Still, the stock barely changed hands below its opening price four years later and lags the broader market.

Though the stock is up about 9% this year, it is down over 30% from all-time highs during the pandemic. Sentiments around the stock are getting impacted in the market due to the deteriorating macroeconomics over the last year, which is considered against the backdrop of a high interest rate environment taking a heavy toll on consumers’ spending ability.

However, the company’s powerful positioning within the high-growth travel industry, strong network effect, and unique millennial appeal drive sharp growth in bookings and revenue. Therefore, Airbnb’s strategic AI integration and expanding global footprint make it highly competitive in the long run, earning a buy rating.

Q1 2024 Sees Bookings Surge to $22.9 Billion Amid Mobile Boom and User-Centric Upgrades

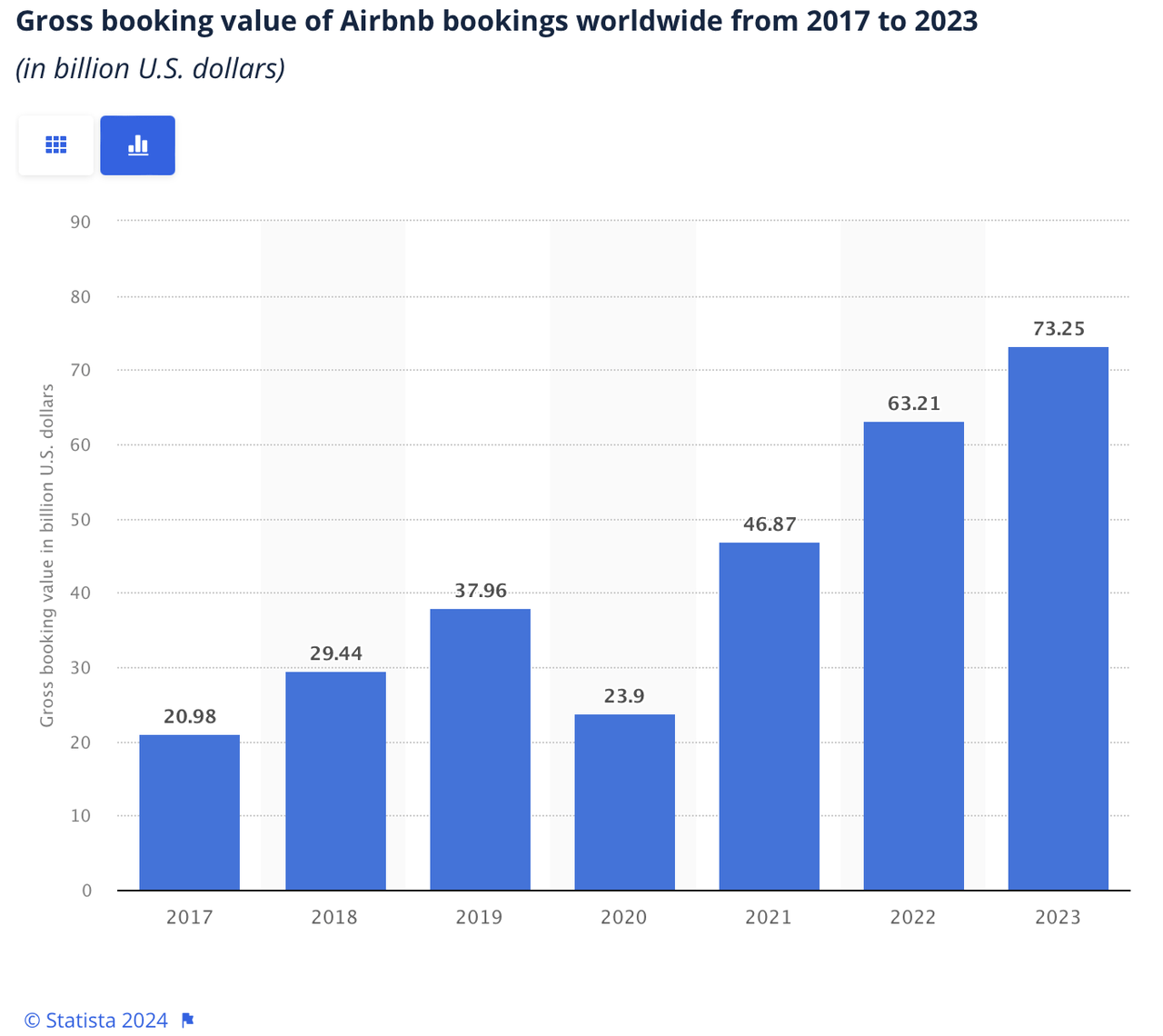

Airbnb has shown it can navigate the turbulent business environment, with gross bookings on its platform surging 12% year-over-year (YoY) to $22.9 billion in the first quarter of 2024, more than double the $10 billion recorded in the first quarter of 2021 after it went public.

Additionally, the number of nights and experiences booked on the platform increased by 9.5% YoY in Q1 2024 to 132.6 million, driven by growth in all regions. The growth stems from mobile downloads accelerating by 60% in the first quarter compared to last year. In addition, global nights booked through the company’s mobile app were up by 21%, accounting for 54% of total nights booked.

Growth in gross bookings also comes from the travel platform, which has made significant changes in response to user feedback. Travelers had raised concerns about the exorbitant fees, including cleaning fees, they were being subjected to by hosts. With the company adopting a total price option that displays post-tax and fee prices, many users have given the move a thumbs up.

In addition to catering to travelers’ needs, Airbnb has also unveiled a ‘Similar Listing‘ tool that allows hosts to compare their houses with those in the surroundings. In return, hosts can settle on prices that reflect the prevailing market conditions in their respective areas, therefore not undercharging or overcharging to scare off customers. The tool has led to enhanced pricing efficiency for hosts and customers.

Revenue Surges 18% to $2.14 Billion Amid Travel Boom and Global Events

The 12% YoY increase in Gross Bookings was the catalyst behind revenue increasing 18% yearly to $2.14 billion. The company also benefited from the strength of travel demand and the timing of the Easter holiday. The company’s profitability has improved significantly, doubling its net income margin to 12% in Q1 from 6% a year ago, delivering its most profitable quarter with a net income of $264 million.

Airbnb’s growth in gross bookings and net incomes comes from improving travel industry activity, characterized by increased spending as a bounce back from the pandemic-triggered slowdown gathers pace. A report by McKinsey indicates that domestic travel is expected to grow by 3% in 2024 and reach highs of 19 billion lodging nights per year by 2030.

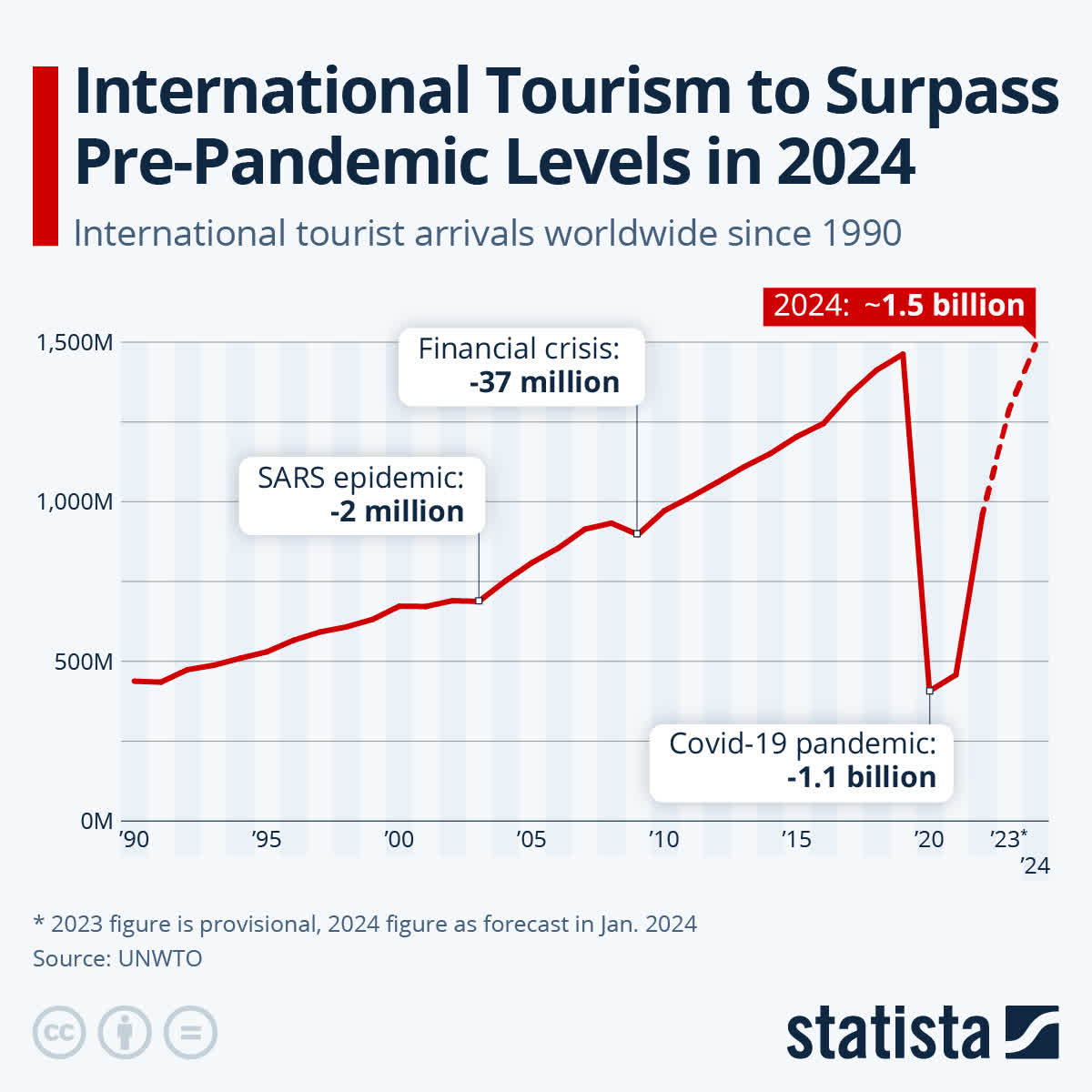

Additionally, international tourism is set to surpass pre-pandemic levels by the end of 2024, according to the UNWTO. The sector, which saw a devastating drop during Covid-19, has been steadily recovering, with 2023 ending at 88% of pre-pandemic tourist arrivals and significant growth anticipated from the reopening of Asian markets, especially China.

Statista

The travel platform is also registering growth in revenues and net income as travel spending increases, and it is expected to reach highs of $8.6 trillion by year-end. The US, Germany, the UK, China, and France are some of the top markets that account for more than 38% of international travel spending, which should help drive Airbnb’s growth in 2024.

Airbnb remains well-positioned to deliver better-than-expected results in the second quarter after recording 500,000 guests staying in Airbnb locations during the solar eclipse. The Euro Championships in Germany is another tailwind increasingly driving bookings, with Airbnb reporting twice the number of nights booked compared to last year.

The Summer Olympic Games in Paris promises to be one of the catalysts that will help accelerate growth in gross bookings with the influx of tourists and other people in the French capital. The online booking platform has already registered a 40% increase in active listings in Paris, which should help meet the expected demand.

Amid the global events, Airbnb expects its fiscal second quarter revenue to increase by 8% and 10% to between $2.68 billion and $2.74 billion. The increase will mostly be driven by growth in the US, where spending in the domestic travel market is expected to reach the top of $1 trillion. Latin America has also emerged as a key market for Airbnb Nights and experiences booked in the region, which increased by 21% in Q1 2024.

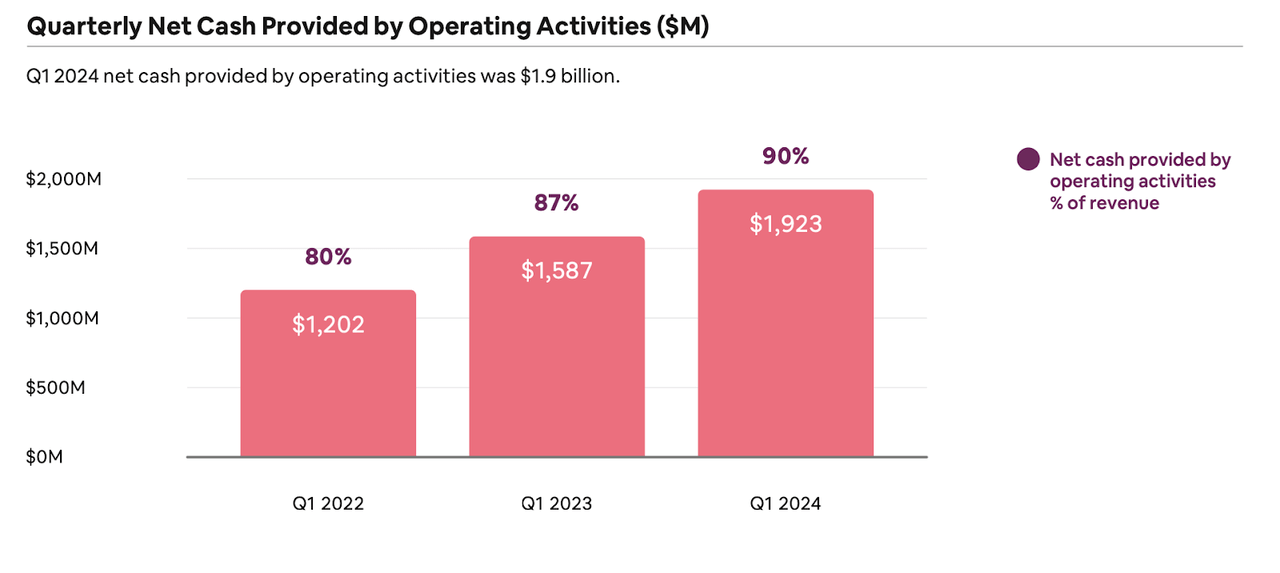

Further affirming that Airbnb improved profitability, it generated $1.9 billion in net cash from operating activities, as free cash flow totaled $1.9 billion. Likewise, it remains in a solid financial position, exiting its fiscal first quarter with $11.1 billion in cash and cash equivalent with debt of about $2.05 billion.

Outpacing Expedia and Booking Holdings in Unique Stays and Revenue Growth

By removing low-quality listings, Airbnb has moved to ensure it remains the preferred booking platform for nights and stays. While its active listings grew by 15% in the first quarter, the company removed thousands of low-quality listings to guarantee quality for its niche market.

Going for quality is part of Airbnb’s push to ensure its listings appeal to millennials, its biggest customers. The company has carved a niche by focusing on the unique market, whereby it provides unique stays, as opposed to its fierce competitors, Booking Holdings (BKNG) and Expedia (EXPE), which focus more on corporate travelers.

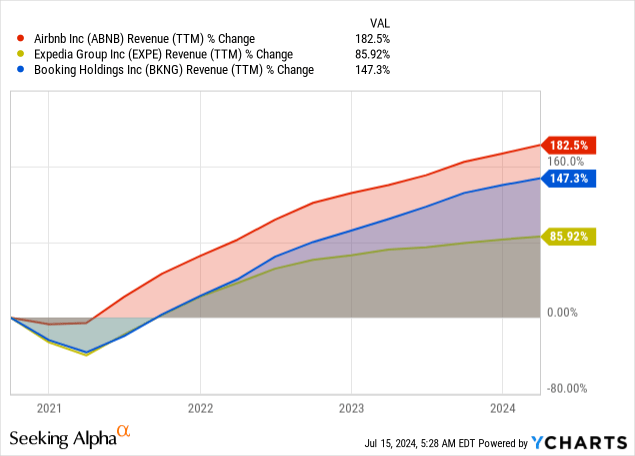

Airbnb’s push to focus on offering unique and excellent accommodation has significantly impacted gross bookings on its platform. Likewise, it is one of the reasons the company boasts a much superior revenue growth rate to its peers, as shown in the table above. On the other hand, Airbnb boasts a much lower earnings per share growth rate than Expedia and Booking Holdings, partly because it is aggressively expanding internationally. The company has prioritized international expansion to achieve its growth targets.

The company also spends on product development and marketing to strengthen its competitive edge. Its expenditure for product development surged to $475 million in the first quarter from $420 million a year ago as total costs and expenses hit the $2 billion mark from $1.8 billion a year ago. The higher spending explains why the company lags in earnings per share growth.

Increased product development and innovation spending support Airbnb’s expansion beyond just being a lodging platform. Consequently, the company is increasingly unlocking new monetization opportunities, including Experiences, whereby it offers local activities and guides. It has also started offering Airbnb Rooms, which are lower priced in homes and, therefore, able to target the mass market.

Bookings with AI: Predictive Search, Pricing, and Safety Enhancements

Airbnb has also moved to strengthen its competitive edge and make it easier for customers to search for listings and make bookings by integrating artificial intelligence features into its travel platform. Predictive search, one of the new features powered by AI, provides more tailored search recommendations, increasing the likelihood of customers making bookings.

Airbnb has also integrated predictive pricing, which analyzes location seasonality and demand to suggest optimum price points for hosts. In the end, hosts end up with price points likely to attract bookings and maximize their returns.

To ensure and guarantee the safety of customers and hosts, Airbnb has also started leveraging AI for profiling. Machine learning has made it possible to conduct background checks for customers by scanning social media profiles to identify guest’s traits.

Premium Valuation, Strong Buybacks, and Growth Potential

Economic instability amid the high interest rate environment is still a short-term concern for Airbnb, though it’s considered a minor risk. While inflation has shown signs of sticking around and economic expansion has slowed, consumer spending and business profits are still strong. However, consumers’ moods have taken a slight downturn, and the amount of money people save has decreased since the pandemic relief measures were introduced. Therefore, the prospect of customers shelving traveling plans threatens to affect Airbnb’s key revenue stream.

ABNB is trading at a premium, with a forward price-to-earnings multiple of 32. The average for consumer cyclical stocks is 23, and the sector’s median is 17. The premium valuation is not surprising, as the stock is growing at an impressive rate based on revenue and earnings growth. However, based on its PEG ratio of 0.13, which accounts for the growth prospects, ABNB seems undervalued compared to the sector’s median of 0.57. Nevertheless, the company’s higher revenue growth rates justify the premium valuation.

In addition, the company returns value to shareholders through stock buybacks. Backed by a strong cash position, the company repurchased $750 million worth of stocks in Q1, spending nearly $2.5 billion over the past 12 months to reduce its diluted share count to 677 million. Lastly, the company has $6 billion remaining for buybacks of the Class, a joint stock. Its buyback program is a critical component of a broader strategy for managing capital, which focuses on investing expansion, making strategic purchases when appropriate, and returning money to investors.

Bottom Line

Airbnb has remained resilient amid a challenging environment exacerbated by heightened inflation and high interest rates, significantly affecting its consumers’ purchasing power. Nevertheless, the company benefits from global events, including the European Cup Easter holidays and the upcoming Paris Olympics.

Growth in gross bookings, driven by increased bookings for nights and experiences, underscores the company’s offerings, which are in solid demand amid the challenging environment. The company’s posting of one of its best quarters of net income growth underlines its operational efficiency.

While the stock is trading at a premium, it is expected of a company backed by solid underlying fundamentals and increased innovation to strengthen its competitive edge.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.