Summary:

- Airbnb’s Q1 2024 results have led to a sharp drop in the share price, and this might look like a good time to buy.

- The sell-off, however, was justified as Airbnb’s high growth story is coming under more scrutiny.

- Even though it still trades at similar levels to its IPO price, Airbnb’s stock is not a bargain.

Iryna Melnyk/iStock via Getty Images

Airbnb, Inc. (NASDAQ:ABNB) just reported its Q1 2024 results and the market has reacted negatively on the slightly disappointing outlook. The stock fell nearly 7% on the day of the earnings release, and it seems that 2024 is shaping up to be a difficult one for the online platform.

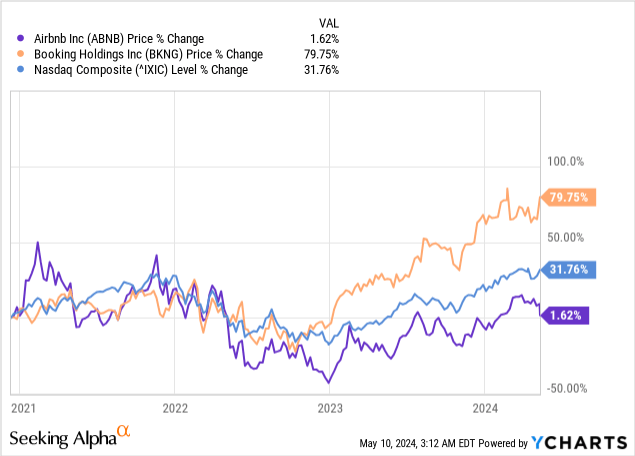

The more concerning part, however, is that ABNB is still trading at levels seen at its IPO in late 2020 and has significantly underperformed its main peer Booking Holdings (BKNG) and the Nasdaq Composite Index.

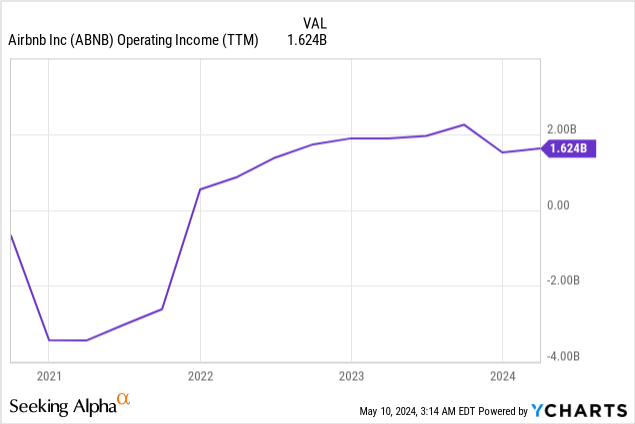

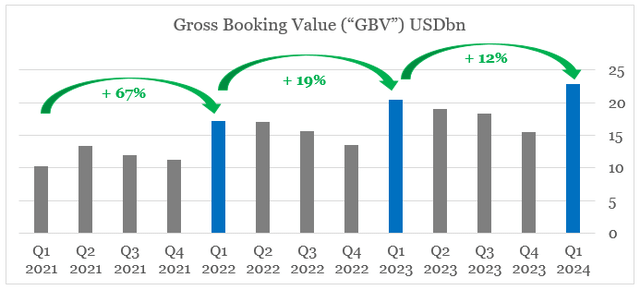

Contrary to the share price performance, the underlying business continued to prosper during the aforementioned period. Gross bookings, for example, skyrocketed from $10bn in the first quarter of 2021 to $22.9bn as of the first quarter of this year. Operating profitability has also improved dramatically, going from an annual loss to $1.6bn in profits as of the last 12-month period.

This divergence between the share price performance and actual business results could be interpreted in two different ways:

- Either ABNB is now significantly undervalued and an attractive opportunity;

- Or the stock was significantly overvalued at its IPO in 2020 and now holds significant risks as ongoing tailwinds fade away.

In my view, the latter scenario better describes the current situation, and investors should be careful when buying the dip.

Fading Tailwinds

The first reason why I am skeptical on ABNB share price ability to outperform the market and deliver satisfactory shareholder returns in the coming years is that the business is now faced with fading macroeconomic tailwinds.

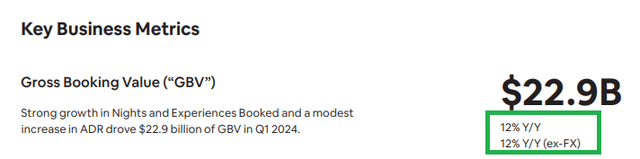

After quickly scaling up in recent years, ABNB gross booking value growth is now returning to more normal levels. It grew by an impressive 67% in Q1 of 2022 as pandemic lockdowns were lifted. Bookings continued their spectacular growth in the first quarter of 2023, registering a 19% increase from a year earlier. During the most recent quarter, however, this fell to 12% and although it is still an impressive growth, we are now moving close to single-digit growth rates for the company.

prepared by the author, using data from SEC Filings

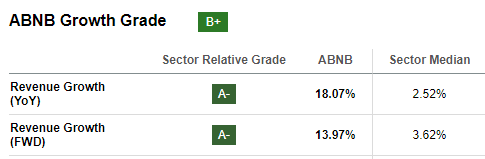

Sell-side analysts also expect a notable slowdown in the company’s sales, with the forward revenue growth rate standing at 14%, compared to 18% reported for the past year.

Seeking Alpha

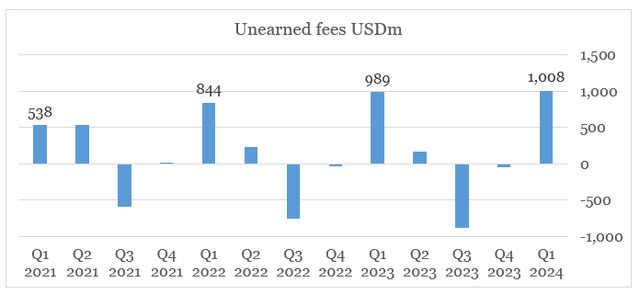

The highly seasonal unearned fees have also confirmed investors’ fears of an upcoming slowdown in bookings. With customers usually planning and booking their summer holidays in the first months of each year, the unearned fees are usually the highest in the first quarter. In Q1 2024 these stood at $1bn, which was not materially different from the same period a year ago.

prepared by the author, using data from SEC Filings

Even though we could speculate about the overall health of consumer spending and the probability of a pending recession, the fact of the matter is that even if an economic slowdown is avoided in 2024, Airbnb’s topline figure is impacted by fading macroeconomic tailwinds.

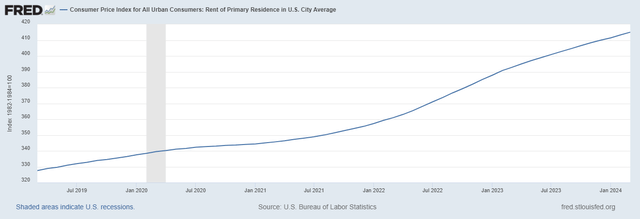

First and foremost is the rate of inflation and especially in rents, which are closely related to the amounts charged by Airbnb hosts. In recent years we saw rents across the U.S. skyrocketing, which had a massive positive impact on the dollar amount of Airbnb fees.

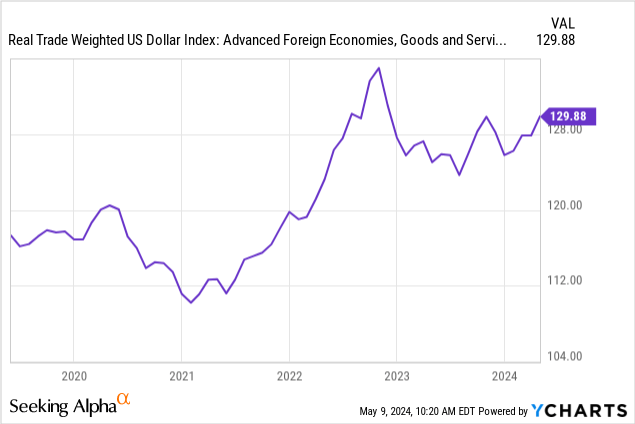

The slightly weaker U.S. dollar in 2023 then came to the rescue in recent quarters as inflationary pressure cooled off during the period.

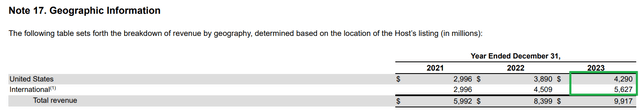

The reason why the strength of the U.S. dollar is so important is that ABNB now derives the majority of its revenue from its overseas markets (see below). Thus, a weaker dollar makes overseas sales more valuable and more importantly, it benefits profitability.

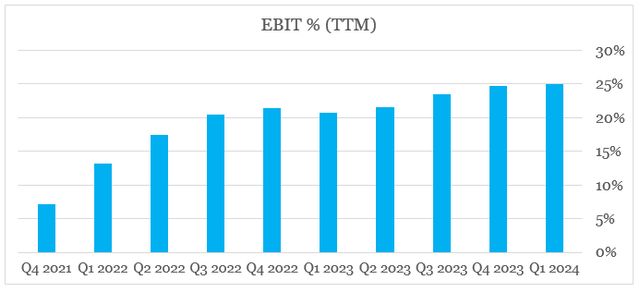

In spite of all that, we have seen Airbnb operating margin growth slowing down in recent quarters and settling around 25%. Note that the numbers below are adjusted for $935 million of non-recurring tax withholding expenses and lodging tax reserves made in the last quarter of 2023.

prepared by the author, using data from SEC Filings

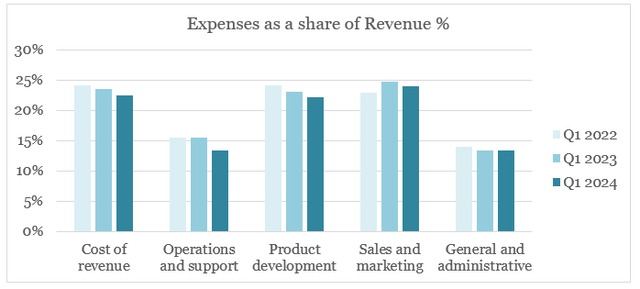

The reason being that the benefits from economies of scale for Airbnb’s business model are slowly diminishing. In recent years, all major expenses have been gradually declining as a share of ABNB’s revenue, with the exception of sales and marketing, which is going in the other direction.

prepared by the author, using data from SEC Filings

As the company now prioritizes its international expansion in order to achieve its growth targets, it is also likely to spend much higher amounts on product development and marketing due to the need to adapt its platform for each market.

We have to localize the product, and then we have to have a global marketing strategy to go one market at a time.

Source: Airbnb Q1 2024 Earnings Transcript

Expanding beyond the core service offering would also be a major stepping stone for Airbnb’s long-term growth, which would require higher spend on product development.

Pricing Is Still An Issue

The other major point that leads me to the conclusion that Airbnb is not a bargain at this point in time is the pricing of ABNB shares. The stock is no longer overpriced as it apparently used to be during its IPO, but it is not a bargain either.

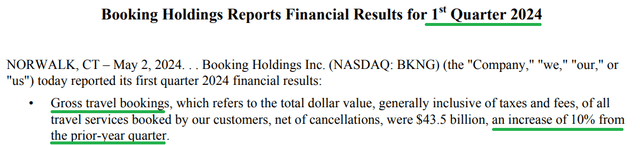

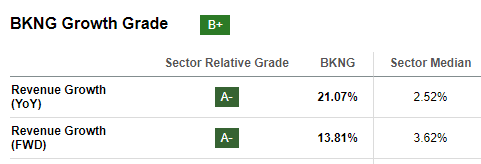

For example, Airbnb’s major peer – Booking Holdings, recently reported an increase in gross travel bookings of 10% on a year-on-year basis.

Booking Holdings Earnings Release

This is not materially different from the 12% growth of ABNB during the same period.

In terms of forward revenue growth, BKNG is expected to grow at a rate of 13.8%, which is also at par with that of ABNB we saw above.

Seeking Alpha

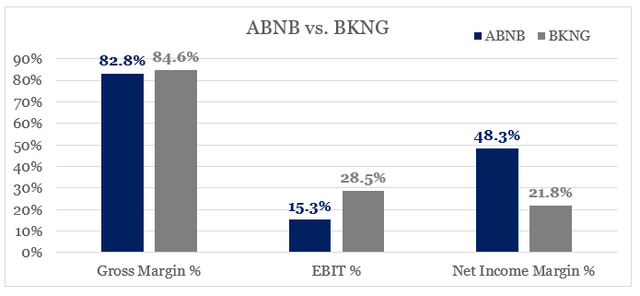

In terms of GAAP profitability, there are certain differences between the two companies, with BKNG having higher gross and operating margin than ABNB.

prepared by the author, using data from Seeking Alpha

But these figures could be misleading, as ABNB’s adjusted EBIT margin for the non-recurring tax expenses stands at 25% – still below that of BKNG. Net income margin for ABNB would also be much lower going forward, as the non-adjusted current one is boosted by a one-time tax benefit in 2023.

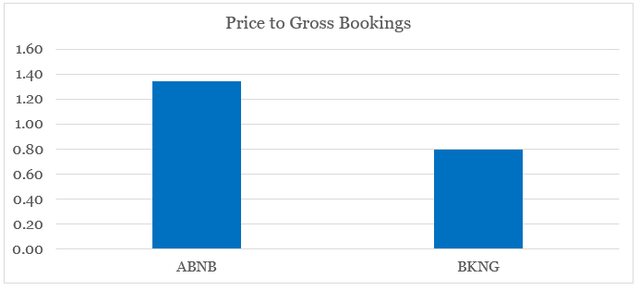

At the same time, however, the two companies trade at very different multiples. Starting with the forward Non-GAAP earnings multiple, which is nearly twice as high for ABNB.

The same goes for the price to gross bookings multiple for ABNB, which is nearly twice as high as that of BKNG.

prepared by the author, using data from SEC Filings and Seeking Alpha

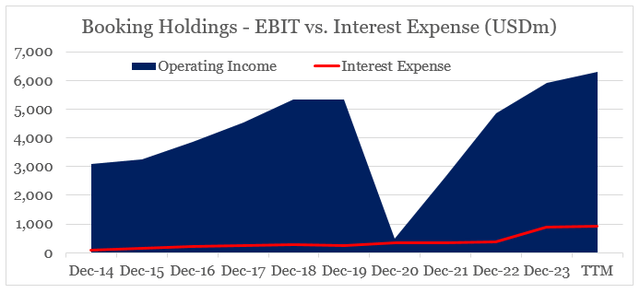

When evaluating these differences, we should mention that BKNG has higher leverage than its major peer, but this is by no means a problem for the company.

prepared by the author, using data from Seeking Alpha

With that in mind, unless Airbnb could surpass its main peer in terms of GAAP profitability and achieve much higher revenue growth going forward, the stock appears to be trading at a significant premium that is hard to justify.

Conclusion

Airbnb’s share price remains closely linked to the prevalent long-term growth narrative and with that shareholders are still exposed to downside risks. Provided there are no external shocks to the economy, the underlying business should continue to do well, but growth is slowly normalizing. With that, the positive impact of economies of scale is also fading away, and it remains questionable whether or not Airbnb would be able to achieve higher margins than its peers. In the meantime, the stock is still priced at a significant premium to that of Aribnb’s major peer – Booking Holdings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the technology space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

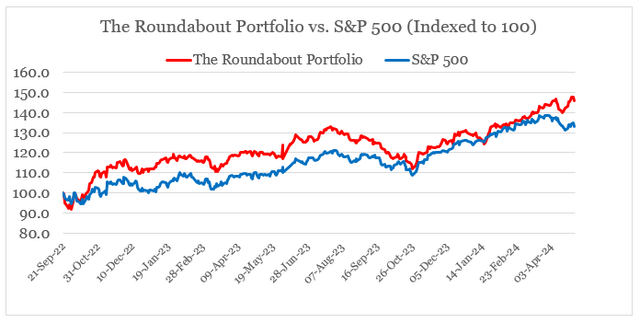

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.