Summary:

- Airbnb delivered record financial results in 2022, while the stock sold off amid concerns over a slowing growth outlook.

- Shares have rebounded sharply to start 2023, supported by an improving macro backdrop as a tailwind for operating conditions.

- We are bullish on the stock and see room for earnings to outperform going forward.

Riska/E+ via Getty Images

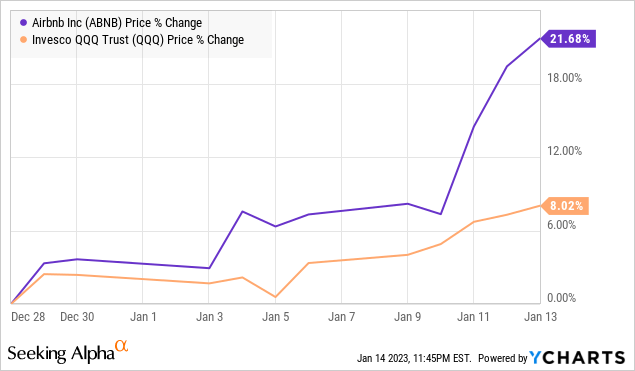

Airbnb Inc (NASDAQ:ABNB) is starting the year with a new wave of positive momentum as shares are up more than 20% in recent weeks, and back above $100. This follows what was a year to forget for investors as ABNB lost nearly 50% in 2022 amid challenging macro conditions and the broader market selloff. High inflation and rising interest rates with their impact on consumer spending added to concerns regarding growth for the home share marketplace leader.

While Q4 earnings are only due out next month, there are plenty of reasons to turn bullish and expect this rally to continue. The upside here considers ongoing operating and financial momentum with an expectation of recurring profitability going forward. In our view, the stock looks attractive with its valuation reset on a path for earnings set to trend higher. Signs that the economic environment can improve going forward can make ABNB a big winner in 2023.

ABNB Business Remains Very Strong

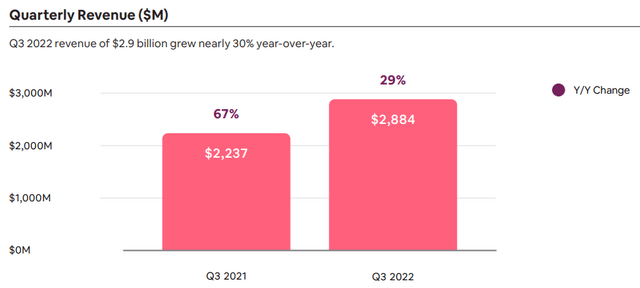

The takeaway from us when looking at Airbnb is that despite the stock price performance over the past year, the business has been booming. The company last reported its Q3 results in early November noting revenue was up 29% year-over-year, or even 36% on a constant currency basis, with nights booked climbing 25%. The context here considers the post-pandemic tailwind with the ongoing recovery in travel across most regions compared to the environment in 2021 that still faced various Covid restrictions.

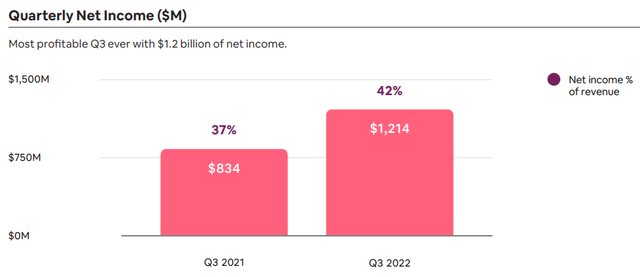

Management noted Q3 broke records across most operating and financial indicators including adjusted EBITDA at $1.5 billion, while net income accelerated higher by 46% or an FX-neutral 61% to $1.2 billion. The top-line momentum and scale benefits are driving expanding margins. The company also generated $960 million in free cash flow.

By this measure, the explanation for the stock selloff in 2022 is not so much because of poor trends, but more so that the strength may have failed to live up to more exuberant expectations at the start of last year.

During the earnings conference call, one of the points emphasized was that Airbnb guests are staying longer on average globally, with “long-term stays” representing 20% of gross nights booked. For many people, Airbnb represents more than simply an overnight or vacation rental and is increasingly being used more for alternative housing arrangements and even business travel.

Hosts have responded by shifting offerings or marketing depending on the setting. Urban markets, in particular, are leading growth. The return of international travel with cross-border nights booked outpacing broader categories supports a runway into 2023 as that side of the demand has otherwise lagged the recovery in leisure since the pandemic.

In terms of guidance, management expects Q4 to be a continuation of the Q3 trends, targeting revenue growth of around 20%, or 26% on a constant currency basis. The levels here are impressive considering Q4 2021 was an exceptionally strong period for travel. The forecasted Q4 growth is also between 62% and 70% above Q4 2019, as a pre-pandemic benchmark.

Finally, we note that ABNB benefits from a solid balance sheet, ending the quarter with $9.6 billion in cash and equivalents against $2.0 billion in long-term financial debt. The company still has $1.0 billion remaining under its share repurchasing authorization announced last August.

What’s Next For ABNB?

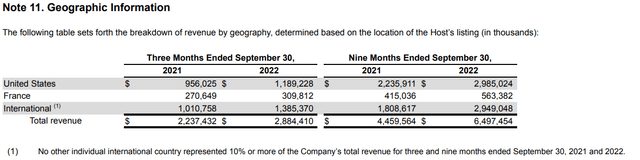

In our view, ABNB is a high-quality stock that is still in the early stages of long-term growth, particularly when looking at its opportunity internationally. In Q3, the United States represented 45% of the business which to us means the rest of the world, even at 55%, has yet to realize its potential. It’s curious that the only other country outside the U.S. where Airbnb breaks out the revenue contribution is France, representing 11% of total revenue by geography in Q3. No other country is above the 10% reporting threshold.

The argument we make is that many other countries have room to eventually rival and overtake France’s share which would be achieved as more hosts and guests in various regions become familiar with the platform.

Just considering “developed markets”, there are still travelers utilizing Airbnb for the first time, beginning to recognize home sharing as a viable alternative to traditional hotels. This group can convert to recurring guests as a runway for the business long-term.

The point here is that the outlook for the model is positive with Airbnb benefiting from its brand familiarity and growing supply of hosts connected to the marketplace. Beyond the sometimes headline-making debates where certain cities move to ban short-term rentals, the reality is that the business model serves an important function within real estate and is proving to be successful for Airbnb.

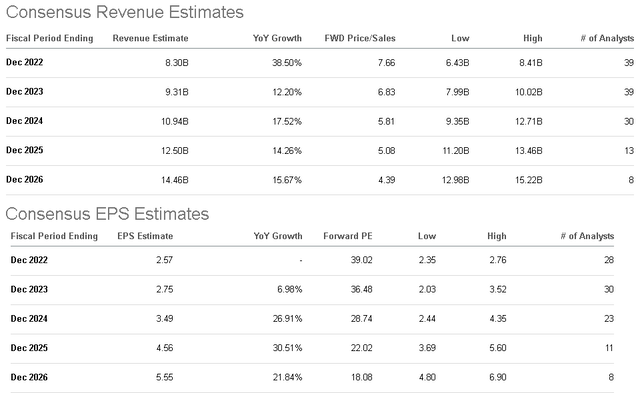

According to consensus, the company is expected to reach an EPS of $2.57 for fiscal 2022 with the yet-to-be-reported Q4 results. This would reverse a loss in 2021 and place the company firmly on track to consistent and recurring profitability.

For 2023, the current outlook is for revenue growth to moderate to 12%, which again, considers the very strong comparable trends from 2022. That’s the same dynamic for the 2023 EPS estimate at $2.75, an otherwise modest 7% higher result than the 2022 trend. The pace is then expected to accelerate in 2024 and beyond.

Putting it together, the bullish case for the stock is simply that these estimates starting with 2023 may prove to be too conservative, opening the door for the company to outperform which would send shares higher. We have a few reasons why that may be the case.

Going back to the Q3 results, the strong dollar was a major financial headwind last year given the company’s global profile. Favorably, the Dollar has reversed sharply in the last few months which not only adds a boost to financials but is also positive for the broader macro operating environment.

The dynamic ties into the favorable headlines of easing inflationary pressures not only in the U.S. but also as a global theme. The development has been reflected in a pullback in interest rates as helping to improve financial conditions.

So when we see a strong rally in stocks to start 2023, including through the shares of ABNB, the signal is a path for better-than-expected global growth, particularly against a low base of expectations. ABNB is well-positioned to benefit from these tailwinds.

ABNB Stock Price Forecast

We rate ABNB as a buy with a price target for the year ahead at $140, representing a 50x multiple on the current consensus 2023 EPS. In our view, ABNB deserves the premium valuation not only based on its long-term growth potential, but also the quality of its cash flow as a structurally high-margin tech platform.

The way we see it playing out is that with another strong Q4 result and positive trends into Q1, the market will have room to revise higher forward EPS estimates, ultimately making the stock appear increasingly cheap. The Dollar pullback and easing inflationary trends are also positive on the demand side for bookings. We expect ABNB to outperform the broader market to the upside.

As it relates to risks, a more concerning deterioration in the macro outlook from the current baseline would undermine any bullish thesis. Weaker-than-expected growth in a scenario where consumer spending retreats sharply would open the door for the stock to reprice significantly lower. In the near term, the $90 stock price is an important level of support shares will need to hold for the bulls to maintain control.

Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets the big picture right. Click here for a two-week free trial.