Summary:

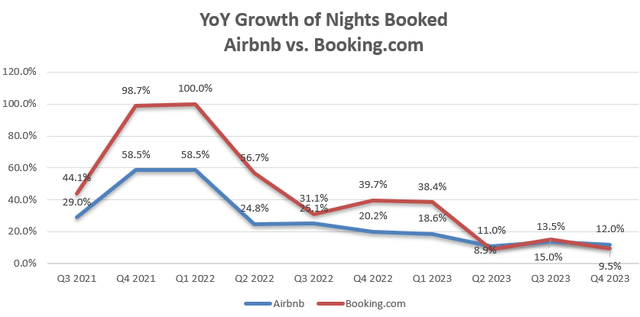

- Airbnb stock has surged over 27% since its Strong Buy rating in June 2023, benefiting from the global travel market recovery and international expansion.

- Both Airbnb and Booking.com have experienced strong growth in nights booked, indicating a strong global travel market rebound.

- Airbnb’s international market penetration strategy and strong brand awareness position them for success in expanding their services to new markets.

Martin Puddy/DigitalVision via Getty Images

I rated Airbnb, Inc. (NASDAQ:ABNB) a ‘Strong Buy’ in my initiation report published in June 2023, and since then, the stock has surged more than 27%. I highlighted their underpenetrated market and the advantages of direct traffic and organic search. I believe Airbnb will benefit from the global travel market recovery and their expansion strategy into international markets. I reiterate a ‘Strong Buy’ rating with a one-year price target of $200 per share.

Strong Global Travel Market Rebound

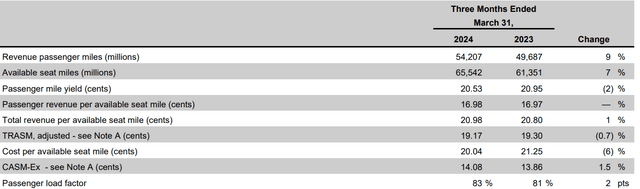

Both Airbnb and Booking Holdings Inc. (BKNG) have delivered strong growth in nights booked over the past few quarters, as illustrated by the chart below. The strong booking growth has been accompanied by a strong global travel recovery in the post-pandemic era.

Airbnb and Booking Quarterly Earnings

How’s the global travel market in 2024? Will the current high interest rate limit consumers’ budgets for domestic and international travelling? These questions are very important to Airbnb’s FY24, as their revenue growth is tied to the overall travel markets.

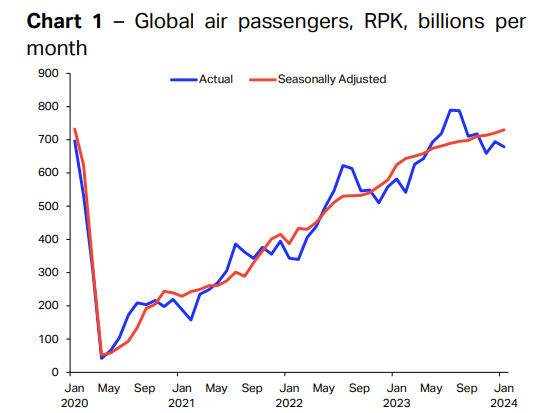

According to IATA’s data, the global travel market has been recovering since 2020. In January 2024, total traffic increased 16.6% YoY and 1.2% month-on-month in seasonally adjusted terms. The industry-wide volume has almost approached the 2019 threshold, as depicted in the chart below.

IATA Report

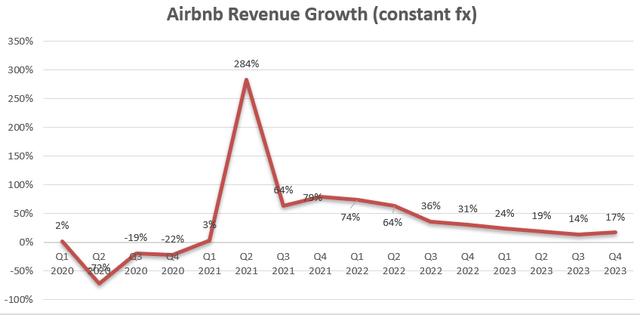

In addition, Delta Air Lines, Inc. (DAL) released their Q1 FY24 result on April 10th, showing a 9% growth in revenue passenger miles and an improving passenger load factor. These data points support quite strong travel traffic growth in Q1 FY24.

Airbnb’s growth is primarily driven by the growth in the global travel market, as well as the share gains from hotel operators. Historically, their growth has outpaced that of the global travel market growth, as they continued to penetrate the global accommodation market. As mentioned in my initiation report, Airbnb’s current business only represents <2% of the global share. As disclosed in the Q4 FY23 earnings call, their active listings increased by 18% year-over-year, approaching 7.7 million. The strong growth in supply is a good indicator of robust demand, as well as increasing brand awareness of the Airbnb platform.

International Market Penetration

In recent quarters, Airbnb’s management started to emphasize their international expansion strategy. They have started to invest in Germany, Brazil, and Korea and plan to roll out their services in Switzerland, Belgium, and the Netherlands. It is quite normal for Airbnb to incur additional client acquisition costs in these new countries; however, I think Airbnb can leverage their existing IT infrastructure, platforms, and back office with minimal incremental costs for their market expansion. As long as they can reach a certain scale in these new markets, their international operations would be quite profitable as there would be no need for additional IT infrastructure.

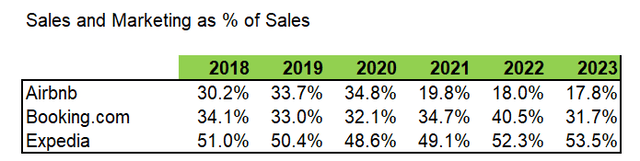

As mentioned in my initiation report, Airbnb has a well-known site with 90% of their traffic coming from direct channels. In other words, the company doesn’t need to pay search engines, like Alphabet Inc. (GOOGL) (GOOG), for indirect traffic. As shown in the table below, the total sales and marketing expense as % of total sales is the lowest among their peers, and spending has presented a declining trend over the past few years.

The strong brand awareness could be very helpful for Airbnb to expand similar services to international markets, in my view.

Recent Result and FY24 Outlook

They released their Q4 FY23 results on February 13th with 13% gross booking growth, 17% revenue growth, and 45.8% adjusted EBITDA growth, reflecting a very strong financial result indeed.

In FY23, they generated $3.77 billion in FCF and bought back $2.2 billion of their own shares. Their board approved another $6 billion share repurchase authorization. A quite strong cash flow generation and capital allocation policy!

For the growth in FY24, I consider the following:

-Global travel market rebound: As discussed previously, despite the current high interest rates, the demand in the global travel market remains robust. In addition, the Fed is more likely to cut rates at some point this year, as predicted by the market. Based on the data points I provided previously, I forecast the global travel market to grow by 10% in FY24.

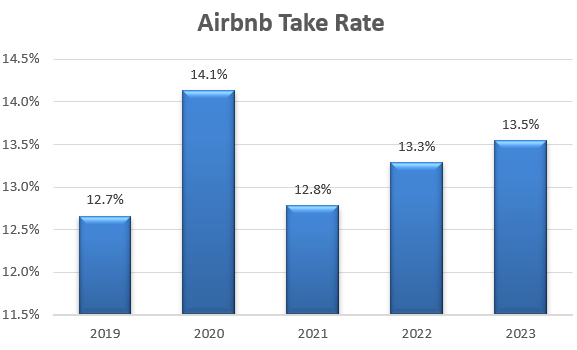

-Take Rate: Airbnb has done an exceptional job of further monetizing their bookings. I calculate their take rate as the gross booking value (GBV) as a percentage of total revenue. Excluding the abnormal year of COVID-19 in FY20, their take rate has steadily improved over the past few years.

Airbnb 10Ks

The increasing take rate could accelerate both revenue and profitability growth in the future. Airbnb had $73.2 billion gross bookings for FY23, and 20bps take rate improvement could generate an additional $146 billion in total revenue, I think the majority of additional revenues could drop to the bottom line, contributing to a 9.6% growth in operating profits, as per my calculations.

-Market Penetration: this represents a long-term growth tailwind for Airbnb, as they can tap into the massive global accommodation market. Their management provided a very interesting data point during the earnings call: Airbnb’s average listing price dropped 2% in FY23, compared to a 7% increase in average hotel prices. The variety of room listings with different price points would benefit Airbnb in different macro environments, in my view.

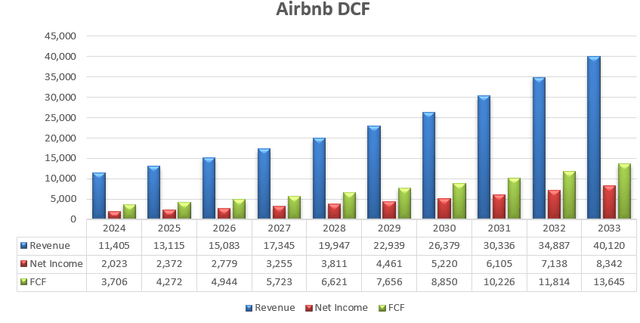

Valuation Update

As analyzed above, I assume 10% global travel growth, 2% revenue growth from the take rate, 2% growth from share gains from hotels, and 1% growth from international market expansion. As such, the total revenue is forecasted to grow by 15% in FY24.

Airbnb delivered 15.3% of its reported operating margin in FY23, and I think their margin expansion could be driven by the following factors:

-Sales and Marketing: The expense as a % of total revenue has decreased by 200bps over the past three years, as Airbnb’s brand awareness continues to improve, and they rely less on third parties for acquiring traffic. I forecast Airbnb will generate 20 bps margin expansion from the sales and marketing leverage.

-Take Rate improvement: As discussed, the majority of additional revenue could drop to the bottom line. To be conservative, I assume a 10 bps take rate improvement per year, leading to 30 bps margin expansion for Airbnb.

As such, I forecast Airbnb will realize a 50 bps annual margin expansion in the near future.

Airbnb DCF – Author’s Calculation

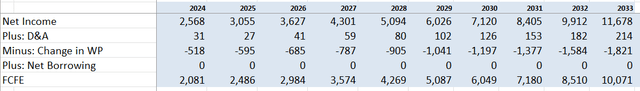

I calculate their free cash flow from equity by adjusting the net income with depreciation/amortization, change in working capital, and net borrowings.

Airbnb DCF – Author’s Calculation

The cost of equity is calculated to be 16.3% with the following assumptions: risk-free rate 4.22% (US 10Y Treasury yield); Beta 1.72 (‘SA’s DATA‘); Equity Risk Premium 7%.

Discounting all the future FCFE at the rate of 16.3%, the one-year target price is estimated to be $200 per share.

Key Risks

VRBO competition: VRBO is another popular short-term rental website, with 2 million properties listed and 48 million users as reported by the media. Similar to Airbnb, VRBO is a pure player in the alternative accommodation market. Airbnb has 7.7 million of active listings, as disclosed over the earnings call. Although Airbnb is much bigger than VRBO currently, investors should watch out for all the news related to VRBO.

SBC: Airbnb has allocated heavily to their stock-based compensation, with 11.1% as a percentage of total revenue in FY22 and 11.3% in FY23. The high SBC payout could limit their margin improvement in the future. Their total headcount went up 1% in FY23, and it is planned to increase by low to mid-single-digits in FY24, which could further burden their SBC spending.

To My Readers:

I favor Airbnb’s leadership position in the alternative accommodation market, and I believe they can continue to gain market share from the traditional accommodation market. I expect a strong growth year for the global travel market, and their expansion into the international market could contribute additional growth to Airbnb. I reiterate my ‘Strong Buy’ rating with a one-year price target of $200 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.