Summary:

- Airbnb has maintained its competitive dominance in the travel industry in 2023, with a focus on growth and profitability at scale.

- The company has made significant improvements to its business and product offerings, including the launch of Airbnb Rooms and enhancements to guest experience and pricing.

- Airbnb’s disruptive model continues to garner it an edge against competitors. Its expansion ‘Beyond the Core’ should further drive growth in 2024.

- Despite potential travel headwinds and a stock price trading near fair value, Airbnb remains a buy going into Q4 earnings.

Bloomberg/Bloomberg via Getty Images

Investment Thesis

Airbnb (NASDAQ:ABNB) continued to flex its competitive dominance in 2023, remaining atop the travel industry heap. Within the past year, Airbnb’s disruptive business model reached an inflection point, pushing the company into ‘growth and profitability’ at scale. Looking to Q4 and beyond, Airbnb looks poised to deliver further operating leverage and growth thanks to an efficient core business and optionality ‘beyond the core’. Despite potential near-term headwinds and a stock price trading near my estimated fair value, the company remains a buy going into Q4 earnings this week.

2023 in Review

My last article on ABNB was in December of 2022 when the stock was trading at $90, near my estimated fair value. I argued the company was a Buy as it was on the verge of driving tremendous operating leverage, even while generating industry-leading topline growth. Historically, the company focused on reinvestment in its disruptive business model to capture market share. Even though this strategy sacrificed near-term profitability, it allowed Airbnb to take the top spot in the travel industry and amass worldwide brand affinity. What followed in 2020 through part of 2022 was a global pandemic and the company losing near 80% of its business. Yet management took advantage of pandemic-induced structural shifts to implement operational efficiencies and a refocus on perfecting Airbnb’s core offering. This leaner, more disciplined approach led to the beginning of ‘growth and profitability scale’, which we saw play out further in 2023.

Business and Product Updates

Airbnb was pioneer of the alternative accommodations business, and consumer demand for the innovative model helped the company quickly surpass legacy travel firms and OTAs (Online Travel Agency). 2023 was the third year of Airbnb’s Summer and Winter product releases, aimed at refining the company’s core offering. Since the releases were started, more than 350 new features and upgrades were launched. The upgrades have been focused on guest experience and service (Categories, ‘I’m Flexible’, split-stays, user interface) and making hosting as seamless as possible (Host insurance, Setup, Superhosts) – most of which were prompted by guest and host feedback. In addition to more of the same improvements, the 2023 Summer release shifted its focus slightly to affordability. The most significant feature was Airbnb Rooms, which allows guests to rent a private room within a larger building. Even with more than 1 million Rooms listings, more than 80% are under $100/night with the average rate coming in at only $67/night. This allows the company to compete more directly with hotels across all levels, which averaged a nightly rate between $100-200 in 2023, and attract younger travelers with limited budgets. The company also improved pricing display and added discounts on longer-term stays. Management’s goal is to be as reliable and affordable as hotels and still sees a long growth runway within accommodations:

… the hotel industry is more than about 10 times the size of Airbnb. And I think that almost anyone that stays in a hotel could consider staying in an Airbnb. I mean, the spaces are one of a kind. They’re often better value, but we need to make sure that we continue to drive value. And I think the next big focus for Airbnb is reliability. We can make Airbnb even nearly as reliable in many markets and hotels. I think you’re going to open up a whole new generation of travelers to Airbnb. So I think there’s a lot more runway just in the core business.

Ultimately, leadership has sought to squeeze as much juice out of its core offering as possible while ramping up operational discipline. The first three quarters of 2023 underscore the efficacy of this approach.

Growth

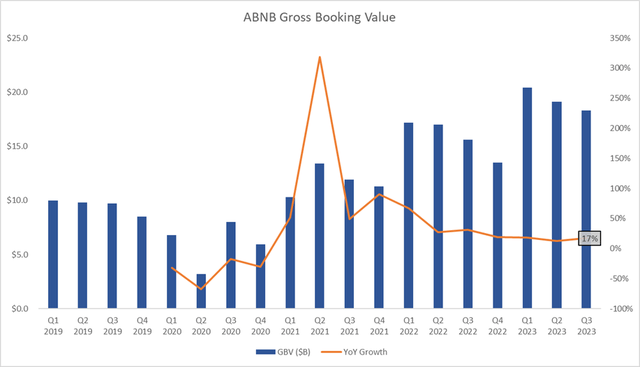

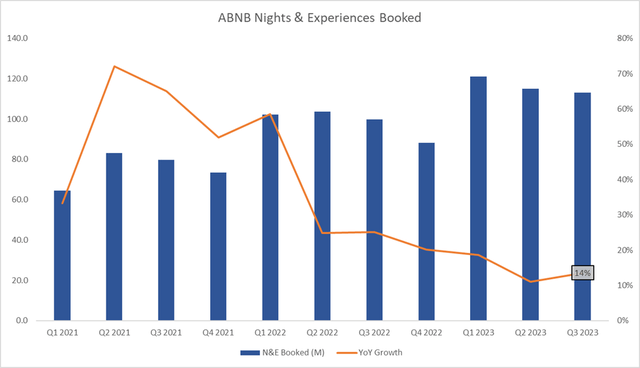

Despite normalizing travel demand after the surge in 2021-2022, Airbnb continued to grow its gross bookings meaningfully in 2023 – reaching record Nights & Experiences (N&E) booked and Gross Booking Value (GBV):

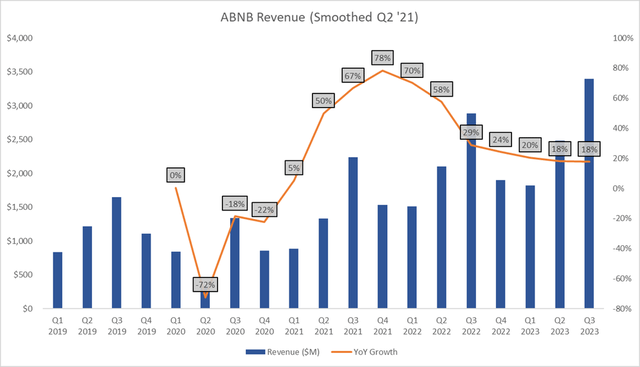

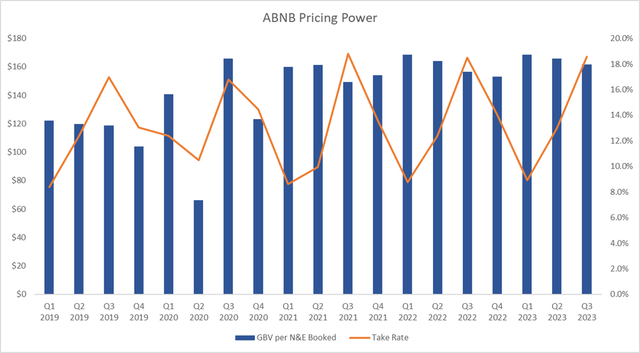

The company adjusts its take rate (Revenue as % of GBV) to navigate the seasonality of its business, peaking in Q3 and troughing in Q1 of each year, but has expanded its annual average overtime from about 12% to currently above 13%. The result is much of gross bookings growth making its way down to the company’s revenues:

Cross-border revenue was a highlight in 2023, growing 36% in Q1 and tapering down to 17% in Q3. Asia-Pacific, Latin America, and a few European countries led the way as Airbnb has sought to expand into these underpenetrated markets. On the supply side, Airbnb crossed 7 million active listings in Q3, averaging 19% growth through the first three quarters. The company’s ability to balance supply and demand growth is indicative of its network effects (more on this later). Volume is clearly growing for Airbnb, both in supply and demand. But the company has also been able to pass on inflationary prices via an expanding average take rate and nightly rate (GBV per N&E booked) – even while improving the platform’s affordability.

Operating Leverage & Capital Allocation

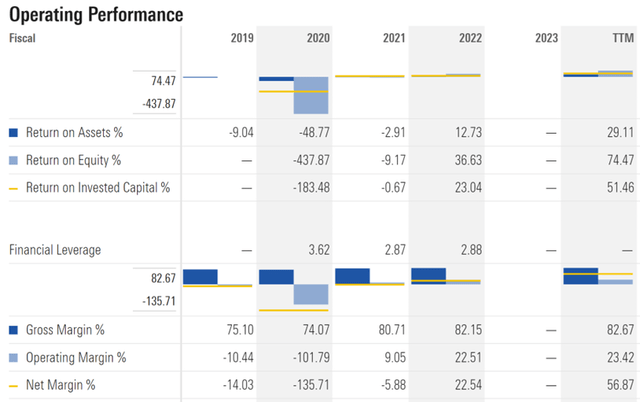

As discussed, management used the pandemic to lean-down operations and improve cost discipline. 2023 showed continued fruit in the endeavor as margins expanded all the way down the income statement and returns on capital doubled (see TTM):

Reported free cash flow also hit a quarterly record in Q1 and is on pace to reach almost $4B in full year 2023.

Meanwhile, management doubled-down on this operating leverage by building a cash pile near $11B and using a chunk of it to buyback stock to offset dilution from stock-based compensation (SBC). This allows shareholders to reap the full reward of surging returns on capital and gives management dry powder to invest in more growth. The buybacks have actually begun to reduce shares outstanding from 698 million to 681 million as of Q3 and more are planned for 2024. Airbnb has been flexing the underlying strength of its scalable, high margin business model as shown so far in 2023. And this trend shows little sign of stopping.

A Look to Q4 and Beyond

Q4 Expectations

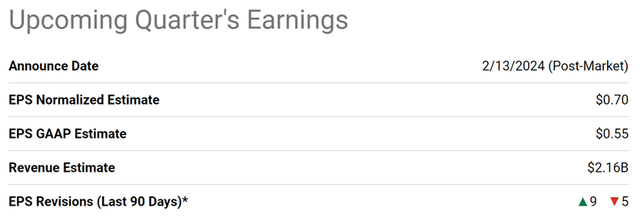

Management expects softer revenue growth in Q4 of 12-14% YoY as travel demand has softened some, mainly driven by macroeconomic uncertainty and geopolitical conflicts in addition to tougher prior year comparables. Expedia (EXPE), an OTA and close peer to Airbnb, saw a near 20% drop in shares after beating Q4 estimates but announcing a CEO departure. The company saw softer growth of 6% YoY in bookings and 10% in revenues and expects slower growth in 2024 as omicron-induced tailwinds are lapped. Booking Holdings (BKNG) also expects cooler growth in Q4, hinting at impacts from geopolitical factors on consumer appetite for travel. Overall, Q4 looks like softer growth across the board – but Airbnb tends to surpass expectations. Upward analyst revisions even outweigh downward revisions going into Q4 results:

2024 and Beyond

A travel industry outlook by Deloitte confirms expectations for volatility in demand going into 2024 as consumers wallet share for travel remains strong but economic uncertainties pose risks. Despite mixed expectations for 2024, Airbnb’s growth opportunities and competitive differentiation position the company well for continued success.

I expect an increasing strategic focus ‘Beyond the Core’ in 2024, as management prioritizes three key areas for future growth:

1. Underpenetrated markets

… we made significant progress in the past few years in building a strong and profitable business. And in addition to laying the foundation for new services and offerings, we’ve been focused on international expansion. We are investing in underpenetrated international markets and we’re seeing great results…

2. Ancillary products like Experiences

It was always our intention to do much more than just short-term housing for travelers…ultimately, there are actually quite literally dozens of services, guests and hosts that we could build on top of the Airbnb system…

3. Integrating generative AI

… we are thinking about generative AI as an opportunity to reimagine much of our product category and product catalog. So if you think about how you can sell a lot of different types of products and new offerings, generative AI could be really, really powerful. It can match you in a way you’ve never seen before.

Helping to support Airbnb’s growth is the company’s competitive differentiation, which I covered more extensively in my prior article. Airbnb has first-mover and scale advantages in the alternative accommodations category, with triple the amount of listings and as EXPE’s Vrbo (alternative accommodations) and nearly matching Expedia’s total gross booking value which includes hotels. The Airbnb app also is consistently the number one travel app in the U.S. and 90% of the company’s site traffic is direct or unpaid. This scale and brand awareness allows Airbnb to leverage word of mouth marketing and network effects. As demand for Airbnbs increase, so does the incentive for hosts to create supply. This cycle allows the company to grow both supply and demand as we’ve seen in addition to retaining hosts through the platforms’ range of benefits. Lastly, Airbnb’s disruptive model enables it to compete at all price points while providing an entirely unique experience for each listing, which are assets in themselves.

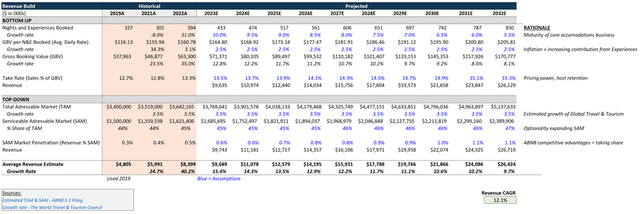

The combination of forward growth opportunities and competitive durability will help keep Airbnb’s topline growing as the company expands margins. I took the liberty of forecasting Airbnb’s revenues using the average of top-down and bottom-up approaches. My forecasts and rationale are the following:

Valuation

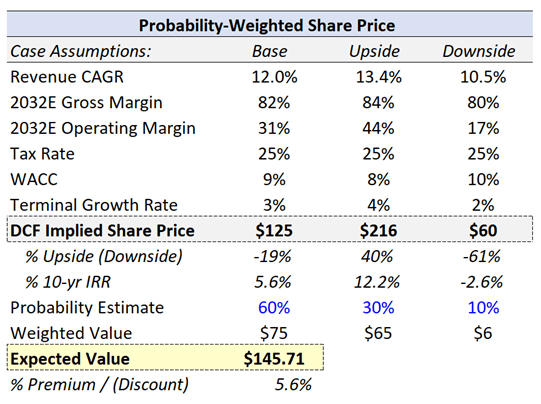

Starting with the revenue estimates above as my base case, I forecasted Airbnb’s financial statements and free cash flows as inputs for a DCF valuation. I expect the company to maintain high gross margins in the low 80’s thanks to its proven pricing power. My base case also holds that operating margins will continue to expand from the low 20’s to the low 30’s by 2032, driven by cost disciplines and a scalable business model. Additionally, I expect fixed and working capital investment will moderate as the company continues to mature.

- Capex at 0.4% of revenues.

- Depreciation & Amortization averaging 125% of capex.

- Change in Net Working Capital averaging 1.2% of revenues.

Lastly, I introduced an upside and downside case and assigned probabilities to each. This allows us to test a range of assumptions and estimate the likelihood of potential outcomes. Additionally, I assigned a probability to each case, with the heaviest weight given to my base case. As you can see from the below results, each case has wide variability in implied share price but an expected value near the current price.

Author Estimates

Risks and Uncertainty

In addition to macroeconomic and geopolitical uncertainty impacting the broader travel industry, Airbnb’s primary risk is regulation. In September 2023, a law went into effect in New York City putting a ban on short-term rentals. Though NYC represented about 1% of the company’s global revenue, similar regulation has been a risk across major cities. Management is not concerned though, as most cities are favorable to Airbnb:

And then on the regulation side, I mean, I think it’s a lot of what Brian said earlier that 80% of our top 200 markets already have regulation. I think the headlines, they tend to make good headlines when people are highlighting kind of issues with short-term regulation. But in many ways, outside of New York City, I’ve never been — felt better about our overall regulatory landscape on a global basis. We have really good partnerships with many cities around the world and things like our City Portal and other things has made us continue to collaborate extremely well with the vast majority of cities. So, I think those are outliers.

Is ABNB a Buy?

Airbnb’s differentiated business model, competitive moats, and future growth potential continue to make it a long-term buy, despite the stock’s premium valuation. There are few stocks of high enough quality and with a proven ability to outperform expectations that I’d be willing to pay up for, but Airbnb is on that list – its performance since my last article is exhibit A of that fact. Q4 and 2024 could be volatile for the stock as the market ingests travel industry volatility, but this may present an even more attractive buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.