Summary:

- The rate of growth for ABNB’s bookings has decelerated drastically compared to its travel peers, suggesting its underperformance compared to industry-wide metrics.

- Combined with the underwhelming forward guidance, it is unsurprising that ABNB stock has declined as it has, already retesting its current support levels.

- Then again, there are still multiple long-term growth drivers for ABNB, attributed to the Airbnb-Friendly Apartment and Airbnb Rooms, tapping into its growing moat in alternative stays.

- Unfortunately, we believe the retracement may not be over yet, especially given the uncertain macroeconomic outlook through 2024. This dip may keep dipping.

marrio31/iStock via Getty Images

The ABNB Investment Thesis May Be Improved At $90s

It seems that the rising inflationary pressures have impacted Airbnb’s (NASDAQ:ABNB) performance in FQ1’23. The company reports decelerating gross margins of 76.5% (-5.4 points QoQ/ +0.5 YoY) and an accelerating operating expense of $1.39B (+5.7% QoQ/ +20.8% YoY), naturally negating the expansion in its revenue at $1.81B (-4.7% QoQ/ +20.6% YoY) then.

Therefore, it is unsurprising that its operating margins have been impacted, coming in at only -0.3% (-12.2 points QoQ/ in line YoY) by the latest quarter. It is also worth highlighting that its first-ever GAAP profitability of $117M (-63.2% QoQ/ +722% YoY) is only attributed to the gain in its investments of $146M.

Despite these numbers, ABNB has yet to embark on any large-scale cost optimizations, with the most recent layoff only affecting 0.4% of its workforce, approximately 27 staff. Furthermore, there are already hints of higher Research and Development expenses through the integration of GPT-4 capabilities in the customer service, media interface, and developer tools over the next twelve months.

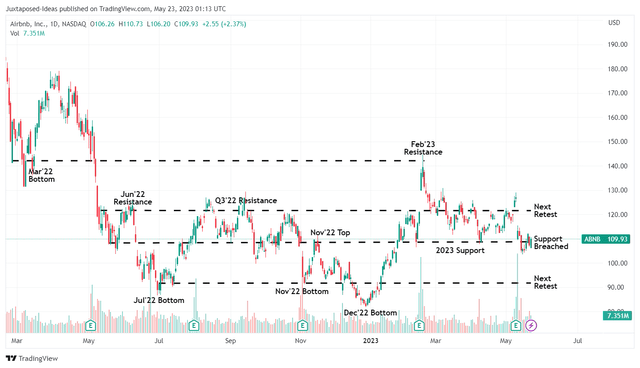

ABNB 1Y Stock Price

TradingView

As a result, we suppose the pessimism embedded in ABNB’s stock prices is to be expected. For now, the stock is nearing and is likely to retest the 2023 support levels over the next week. With the economic downturn likely to only lift by 2024, the company’s performance may remain somewhat impacted over the next few quarters.

As a refresher, the company reports an ADR of $168.45 (+10% QoQ/ inline YoY) and adj. EBITDA margin of 14.5% in FQ1’23 (-12.1 points QoQ/ -0.7 YoY) in FQ1’23.

Moving forward, ABNB guides FQ2’23 revenues of $2.4B at the midpoint (+33.3% QoQ/ +14.2% YoY), though with “lower ADR and adj. EBITDA margin” compared to FQ2’22 numbers of $163.93 and 33.8%, respectively. Combined with its underwhelming guidance of inline adj. EBITDA margin in FY2023, it appears that the reduced discretionary spending may have caught up to its top and bottom line expansion temporarily.

We must also remind investors that the same deceleration in Gross Travel Bookings is not visible with its peers, Booking (NASDAQ:BKNG) at +44.3% QoQ/ +44.3% YoY and Expedia (NASDAQ:EXPE) at +43.3% QoQ/ +20.4% YoY in the recent earnings call.

In addition, the US hotel segment reported expanding ADRs of $157.62 by early May 2023, compared to the $153.30 reported in early April 2023 and $148.13 in early May 2022, suggesting that the moderation in ABNB’s numbers may not be industry-wide. This comparison is especially acute compared to EXPE’s FQ1’23 ADR of $222.80 (+11.7% QoQ/ -3.3% YoY).

Nonetheless, we remain carefully optimistic about ABNB’s moat in the alternative stays, especially witnessed in the 121.1M (+37.3% QoQ/ +18.6% YoY) of Nights and Experiences booked in FQ1’23. This is compared to EXPE at 94.5M (+33.4% QoQ/ +22.7% YoY) with no similar metrics published for BKNG.

Besides, its balance sheet remains more than healthy to weather the short-term uncertainty, with $10.59B of cash/ short-term investment (+10% QoQ/ +13.6% YoY) by the latest quarter. Assuming a similar cadence in FY2023, we may also see ABNB record revenues of $9.56B (+14% YoY), triggering adj EBITDA of $3.3B (+13.7% YoY) and Free Cash Flow of $3.87B (+13.8% YoY), based on its above guidance.

Therefore, while bookings and ADRs may decelerate for ABNB thus far, we suppose there are still multiple growth drivers in the long-term, attributed to the Airbnb-Friendly Apartment as discussed in our previous article here and Airbnb Rooms launched on May 03, 2023. Both unique strategies tap into its growing moat in alternative stays, suggesting its resilience despite the economic downturn.

So, Is ABNB Stock A Buy, Sell, or Hold?

ABNB, BKNG, and EXPE 1Y P/E Valuations

S&P Capital IQ

ABNB is currently trading at an NTM P/E of 31.03x, lower than its 1Y mean of 39.77x. The stock appears to be trading at a premium as well, compared to its peers, BKNG at 19.11x and EXPE at 9.22x. Then again, we remain convinced that the premium valuation is somewhat warranted, with the stock likely to stay above its peers’ median P/E of 20.96x at the time of writing.

Therefore, long-term investors may consider adding here, only if the exercise consequently matches or reduces their dollar cost averages. Otherwise, we prefer to prudently rate the ABNB stock as a Hold here, due to the potential volatility ahead.

Bottom-fishing investors may want to observe the situation a little longer, since another retracement to the July/ November 2022 bottom of $90s may be possible due to the peak recessionary fears. Those levels may also offer an improved upside potential to our price target of $120, based on the market analysts’ projection of FY2025 EPS of $4.83 and a more moderate P/E of 25x.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.