Summary:

- Airbnb’s recent performance has been supported by a number of tailwinds, which are now beginning to unwind.

- The Company’s third-quarter results were solid, although management commentary suggested demand may be deteriorating.

- Continued strong supply growth and weak demand growth are likely to undermine ABNB’s growth and margins in 2024.

- A relatively small shift in the balance of supply and demand could have a large impact on profits due to the leverage inherent in Airbnb’s business.

Sean Anthony Eddy

From an operational perspective Airbnb (NASDAQ:ABNB) has had an extremely strong multi-year period. Rapid growth has led to higher gross profit margins and significant operating leverage, with free cash flow used to repurchase stock. While Airbnb’s shareholders haven’t been rewarded for this so far, the stock now looks more reasonably valued based on both earnings and cash flows.

While this could be a good entry point for long-term investors, there are growing near-term risks. The factors that led to the dramatic increase in Airbnb’s earnings over the past few years could soon begin to work against the company. There are mounting signs of a supply/demand mismatch that could pressure pricing and Airbnb’s margins. This situation would likely require Airbnb to invest more in sales and marketing, further reducing profits. If cash flows drop significantly, Airbnb’s ability to repurchase stock will also decline and undermine the share price.

Third Quarter Results

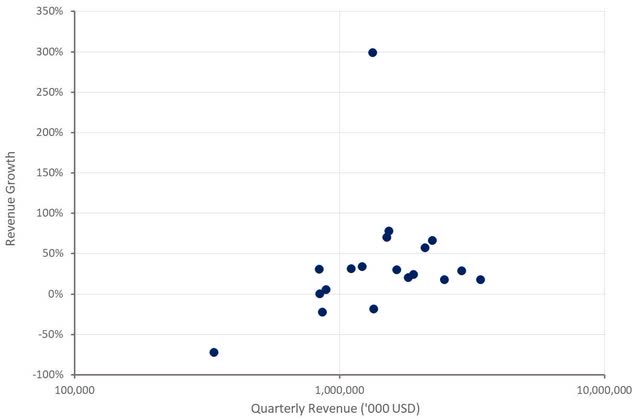

Airbnb’s third quarter revenue was 3.4 billion USD, increasing 18% YoY. While growth continues to fall, these are still solid results, although management commentary suggests that weakness could be ahead. The reason for this isn’t really clear, but demand softness was seemingly attributed to macroeconomic and geopolitical volatility.

Airbnb’s Asia Pacific business has now fully recovered to pre-pandemic levels, with gross nights growing 23% in Q3 2023 compared to Q3 2019. This region has historically been reliant on cross-border travel and hence has been supported by China’s reopening. China’s outbound travel in the third quarter increased in excess of 100% YoY. Smaller Asia Pacific markets such as Taiwan, the Philippines, Thailand, Hong Kong, and Indonesia have been areas of strength.

Airbnb recorded solid growth in Nights and Experiences Booked in North America in the third quarter. ADR in North America decreased by 1% YoY though. The majority of Airbnb’s bookings in North America are due to domestic travel, but the company saw continued strong YoY growth in cross-border nights booked in the third quarter.

EMEA saw a sequential improvement in the YoY growth rate of Nights and Experiences Booked. Excluding the impact of FX, ADRs in EMEA were up 6% YoY. This appears to be at least in part due to strong growth in cross-border nights booked.

In Latin America, Nights and Experiences Booked increased 24% YoY, with continued strength in Mexico and Brazil.

Fourth quarter guidance is for 2.15 billion USD revenue at the midpoint, which would represent a 13% YoY growth rate. Underlying third and fourth quarter growth are actually expected to be fairly similar, with the difference primarily due to FX. Given that Airbnb is not expecting a meaningful growth deceleration, guidance is either optimistic or demand headwinds are modest.

Figure 1: Airbnb Revenue Growth (source: Created by author using data from Airbnb)

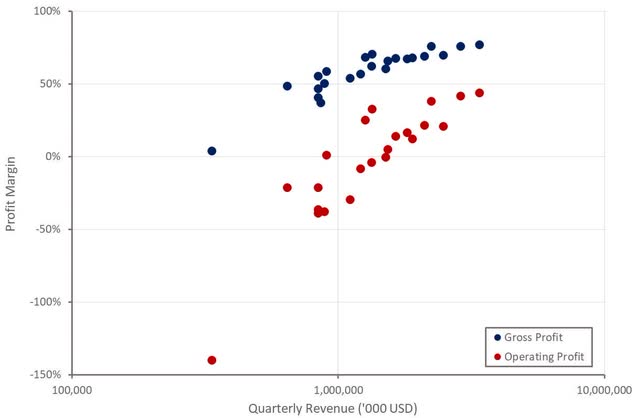

Strong growth, along with stable ADRs, supported further gross profit and operating profit margin expansion in the third quarter. While gross profit margins appear to be reaching a plateau, Airbnb could feasibly continue to drive margins higher as the company scales. For example, international expansion should help to reduce seasonality in the business and lower the burden of operating expenses during off-peak seasons.

The sustainability of profit margins is an important part of the Airbnb story at this point in time, as a reduction in ADR or a need for greater investment in sales and marketing could reduce cash flows significantly.

Figure 2: Airbnb Profit Margins (source: Created by author using data from Airbnb)

Business Developments

While things have been going well for Airbnb, the company is not resting on its laurels, potentially recognizing the risk of saturating what have historically been its core markets. Initiatives include introducing new features to improve the user experience, product expansion to increase the company’s TAM and international expansion of the core service.

for every person who stays in Airbnb, approximately 9 people every night stay in a hotel or about 9 bookings.

Over the past year, Airbnb has launched more than 350 new features and upgrades, including:

- Total price display – aims to make pricing more transparent and help travelers identify better value properties. Since this was introduced, 260,000 listings have removed or reduced their cleaning fees.

- Tools to make adding discounts and promotions easier (almost two-thirds of hosts offer weekly or monthly discount).

- Similar-listing tools make it easier for hosts to compare prices to similar nearby properties, leading to more competitive pricing.

- Lower fees after 3 months to encourage longer stays. In the third quarter, roughly 25% of nights booked for long-term stays were for trip durations of three months or longer.

These features should support the long-term health of Airbnb’s platform but several of them could add to pricing pressure in the near term.

Progress on product expansion has been slow so far but Airbnb is working on new products, including sponsored listings. Guest travel insurance is one successful expansion area, which is still small but growing steadily. Other adjacent verticals that Airbnb could target include car rentals and long-term apartment rentals.

International expansion will be an important growth driver for Airbnb in the future. Airbnb is already in 220 countries, which means that the company’s footprint is already large, but penetration often significantly lags what has been achieved in the US. Airbnb already has higher penetration in Canada, Australia and France and has had recent success in Germany and Brazil which it is trying to repeat in other markets. Brazil is now double the size it was pre-pandemic. Korea is another growth market, with gross nights booked 54% higher than they were in Q3 2019. Asia Pacific and Latin America are likely to be focus areas going forward.

Initiatives to drive expansion in underpenetrated markets include:

- Product optimization

- PR

- Local marketing

- General optimizations on the ground

Given that marketing is a large part of international expansion, operating expenses could begin to rise if Airbnb makes this a priority.

It should also be noted that regulation is still an evolving issue for Airbnb. For example, in September 2023 Local Law 18 went into effect in New York City resulting in a de facto ban on short-term rentals. Prior to September, New York City represented approximately 1% of Airbnb’s global revenue. Airbnb has a presence in roughly 100,000 cities and nearly all regulations happen at the municipal level, making this a complex problem. The company doesn’t believe that regulation is a particularly important issue at this point in time though as most of its important markets already have regulations in place.

In addition, an Italian judge recently ordered the seizure of over 800 million USD from Airbnb due to an alleged failure to withhold 21% of landlords’ rental income and pay it to Italian tax authorities. If this is a one-off incident, it is not material to Airbnb’s valuation, but there is downside risk if this is not an isolated incident.

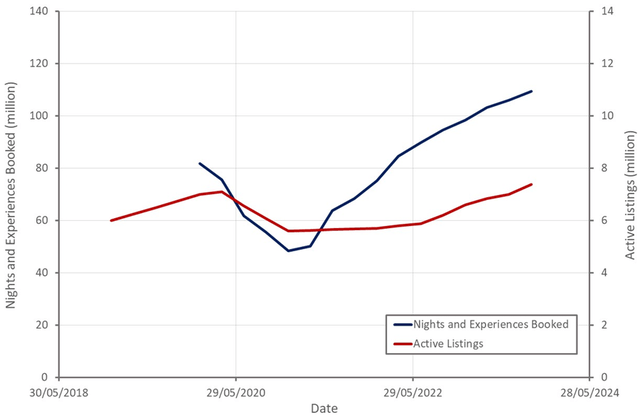

Supply and Demand

Airbnb must maintain a healthy balance between nights booked and active listings to support ADR and the health of its platform. A surge in demand and relatively high ADR over the past few years are contributing to strong supply growth. Airbnb has added nearly 1 million active listings this year, with supply growing 19% YoY in Q3, and supply growth appears to be accelerating. In comparison, Nights and Experiences Booked only grew 14% YoY in the third quarter and growth appears to be decelerating. While Airbnb has stated that occupancy has been fairly stable on a global basis, another few quarters of excess listing growth will likely cause problems.

Figure 3: Airbnb Nights and Experiences Booked and Active Listings (source: Created by author using data from Airbnb)

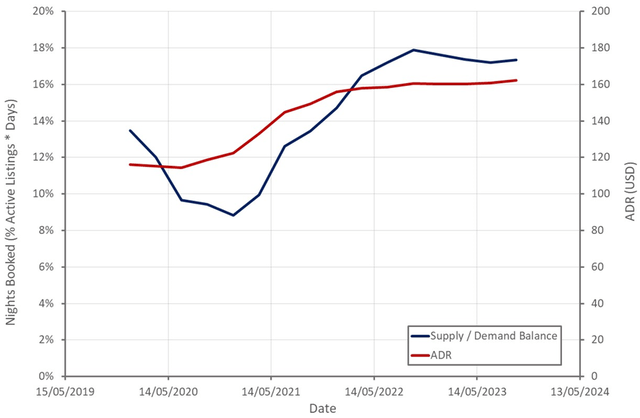

ADR surged during the pandemic and has remained elevated since, although this was likely predominantly due to mix shifts. In North America, Airbnb’s prices are down 3% YoY on a mix shift and FX neutral basis. In comparison, hotel prices were reportedly up around 10% YoY in September. There is already mounting pressure on ADR but so far this hasn’t spilled over and caused wider problems.

Figure 4: Airbnb Supply/Demand Balance and ADR (source: Created by author using data from Airbnb)

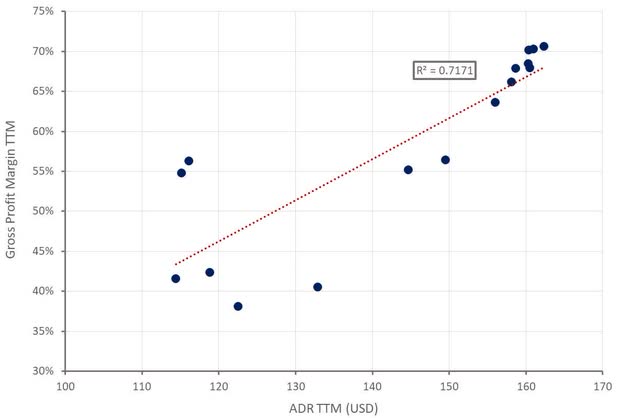

This is important as a high ADR helps to support Airbnb’s gross profit margins. A significant decline in ADR would likely be associated with a meaningful fall in profitability.

Figure 5: Airbnb Gross Profit Margins (source: Created by author using data from Airbnb)

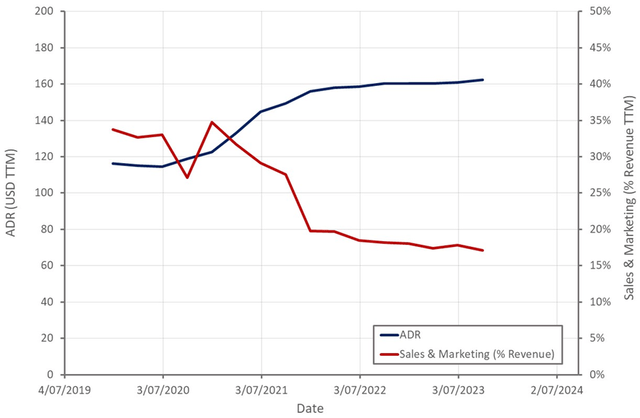

Strong demand has also meant that Airbnb has been able to reduce the burden of sales and marketing expenses. If ADR begins to fall significantly, Airbnb will likely be forced to spend more on marketing to try and stimulate demand. This would increase the burden of operating expenses and further reduce profitability.

Figure 6: Airbnb Sales and Marketing Expense (source: Created by author using data from Airbnb)

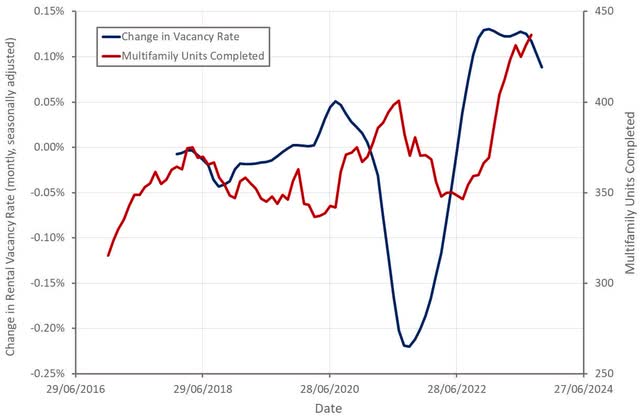

Reasons to be concerned about an oversupply of STR properties include the large supply of housing under construction and rapidly rising rental vacancy rates. The large supply of housing under construction means that vacancy rates are likely to continue rising for the foreseeable future. Landlords that are unable to rent their properties may turn to the STR market, supporting active listing growth.

Figure 7: US Rental Vacancy Rate and Multifamily Units Completed (source: Created by author using data from Apartment List and The Federal Reserve)

Conclusion

Airbnb’s stock is now beginning to look more reasonably valued but there is potential for the company’s financial performance to take a large hit in the near term. Accelerating supply growth, coupled with weaker demand growth, could begin to impact both revenue growth and margins in coming quarters. Rising vacancy problems in rental markets, along with mounting pressure on consumer spending, are reasons to think this is a likely scenario.

Figure 8: Airbnb EV/S Multiple (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.