Summary:

- Airbnb’s bookings growth rate has slowed considerably, and its outlook for Q3 suggests a further deceleration.

- In terms of room nights booked (not by dollars), rival Expedia is now growing faster than Airbnb, despite having long been a laggard.

- A weaker macro outlook may be denting consumers’ travel budgets, as travel demand has largely caught up with the post-COVID travel frenzy.

- Despite its sharp deceleration and now similar growth performance versus peers, Airbnb’s ~30x forward P/E multiple sits at a hefty premium to the market and to OTA rivals.

- Downgrading Airbnb to a sell rating and recommending investors to look elsewhere for value.

Robert Way

After years of fierce demand post-COVID with the rise of so-called “revenge travel,” the travel industry is finally starting to show cracks in a major way. Maybe it’s the sharp rise in hotel prices, and maybe it’s because consumers are hunkering down in preparation for a potential recession: but whatever the case may be, travel bookings are finally showing signs of fatigue.

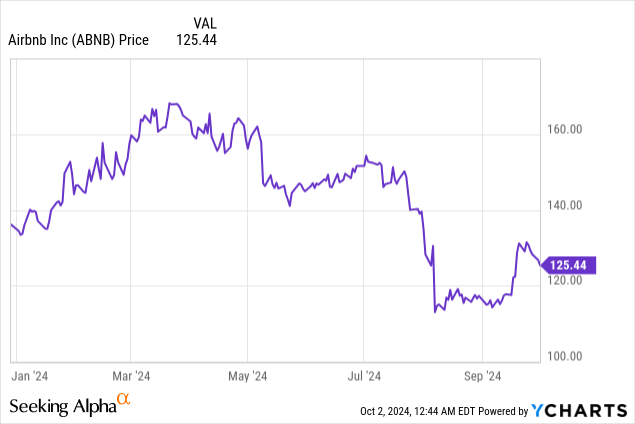

Airbnb, Inc. (NASDAQ:ABNB) is feeling the pinch more than most. In barely a year, its bookings growth rates have been sliced to less than half. And yet despite this sharp reversal in fortunes, the stock is down only single digits for the year, though this has dramatically underperformed the S&P 500.

I last wrote a bullish note on Airbnb in July, when the stock was still trading in the $140s. My buy call was premature, as I didn’t foresee the continued slowing of the company’s growth rates and its dim comments for the future. At the time, I had ascribed to the company’s logic that bookings lead times might have been compressing: as in, customers were waiting until closer to their intended trip times to make hotel reservations, which might have been a driver behind optically slower bookings growth.

Airbnb’s sluggish growth in Q2, however, and its expectations that Q3 results might show even worse trends, have robbed me of that hope, and as such I’m downgrading Airbnb to a sell rating. On top of slowing bookings growth, I’m also finding that the stock continues to trade at a substantial premium to its peers in the OTA (online travel agency) industry, despite the fact that Airbnb’s growth rates have now sunk down to similar levels. With this in mind, I think there’s more valuation in Airbnb’s stock to unwind before we have a more comfortable re-entry point.

Sell here and invest elsewhere, and wait for a deeper correction to buy back in.

Dramatically lower bookings growth rates are a signal of weaker category demand as well as tougher competition

First things first: let’s discuss Airbnb’s sharp reversal of fortune as it concerns both revenue and bookings.

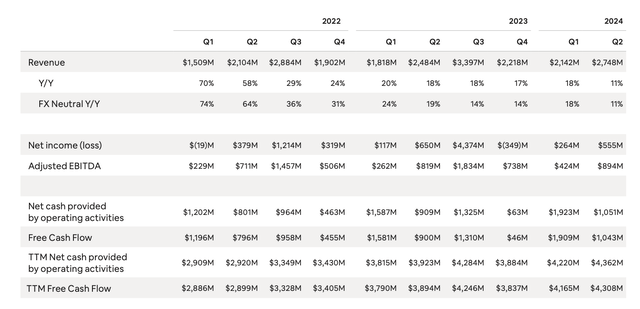

Airbnb Q2 trended results (Airbnb Q2 shareholder letter)

As shown in the chart above, Airbnb’s revenue growth decelerated sharply to 11% y/y in Q2, essentially only in line with Wall Street’s expectations and decelerating sharply from 18% y/y growth in Q1.

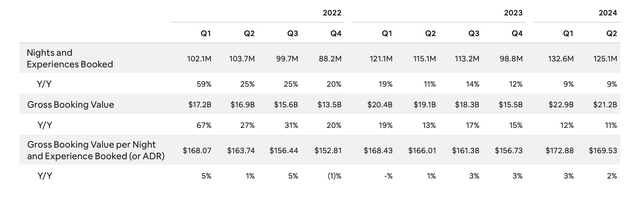

Of course, we knew that revenue growth was set to decelerate because Airbnb had been showing signs of bookings weakness for several quarters now. As a reminder here, Airbnb recognizes bookings when customers make their reservations and put down their deposits, but revenue is only recognized when trips are taken. As such, bookings are always a great forward-looking indicator of future travel revenue. Airbnb had hoped that shorter lead times were the driver behind the bookings slowdown, but after two straight quarters of just 9% y/y growth in room nights (unit count of bookings), I’m not too sure. Gross booking value also grew only 11% y/y, one point weaker than in Q1.

Airbnb Q2 bookings trends (Airbnb Q2 shareholder letter)

This may be further evidence that Airbnb’s pricing power is diminishing. With rising hotel rates, Airbnb hosts have also increased their prices: but the net result is that many would-be travelers are being turned off by high prices. This adds to Airbnb’s existing woes of customers complaining about high cleaning fees (many hosts have removed cleaning fees but simply increased their prices, as in the end cleaning fees are just another bucket element of all-in pricing).

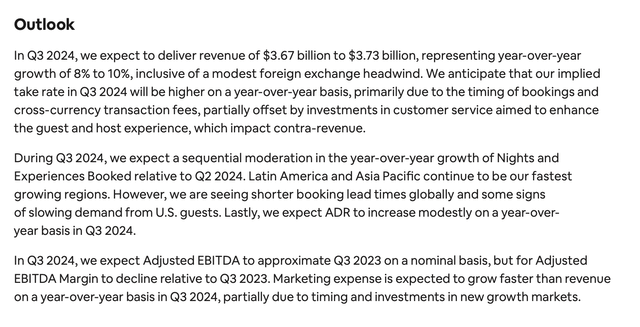

Making matters worse is the fact that Airbnb expects trends to slow down even further in Q3, where revenue growth is expected to decelerate as much as three points to an 8-10% growth range. And though the company didn’t quantify by how much, it is also noting a “sequential moderation” in the y/y growth of bookings.

Airbnb Q3 outlook (Airbnb Q2 shareholder letter)

Per CEO Brian Chesky’s remarks on the Q3 earnings call regarding the company’s early insights into bookings trends:

We’re encouraged by the excitement around the Olympics and the Euro Cup and we’re also encouraged by the relative strength of Latin America and Asia Pacific which continue to be our fastest growing regions. However, we are seeing shorter-looking lead times globally and some signs of slowing demand from US guests, and our Q3 outlook incorporates these recent trends. We are watching these trends closely along with the impact any macroeconomic pressures might be causing.”

Weaker bookings in the U.S., which together with China forms the world’s biggest travel markets, is a worrying indicator of a potential recession-driven pullback in consumer spending. We don’t yet know what the company’s “sequential moderation” will translate into in terms of y/y growth for bookings, but it’s likely that we’ll see Airbnb’s bookings slip to the single digits in Q3. Also making matters worse is the fact that Airbnb expects adjusted EBITDA margins to decline in Q3: not what we typically like to see in a company that is suffering from slowing growth rates.

Valuation premium versus peers is looking more difficult to justify

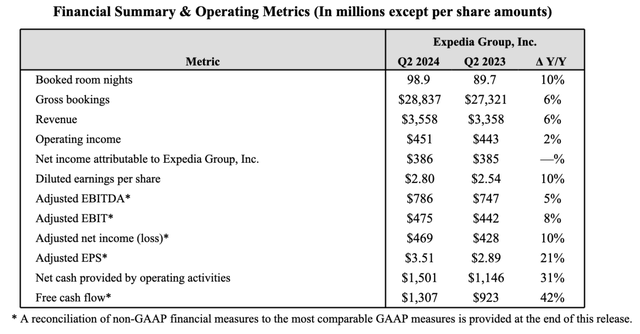

Meanwhile, it’s worth pointing out that while Airbnb had long been appearing to take market share from hotels, the core OTA giants, Booking Holdings Inc. (BKNG) and Expedia Group, Inc. (EXPE) are now showing very similar bookings growth rates to Airbnb. Both of these companies posted 6% constant-currency booking growth rates in Q2.

Expedia, in particular, is a company that is clipping closely at Airbnb’s heels. Its room nights booked in Q2 stood at 10% growth, which surpassed Airbnb’s 9% growth. ADRs might be receding here, but with Expedia’s much vaster inventory of lower-cost options, this site might continue to gain more steam with budget-conscious customers.

Expedia Q2 key highlights (Expedia Q2 earnings release)

It’s worth noting that Airbnb stands alone among the major booking options in not offering a loyalty program. Booking has its Genius loyalty program, and Expedia is even more of a threat with its OneKey program that offers a percentage cash back (2% for entry-tier members, and up to 6% for the highest tier) on all bookings across all of its sites. And we note as well that Expedia has a vacation-rental home option in Vrbo, while Booking.com and Priceline have also always offered apart hotel/vacation rental type stays directly on their own sites.

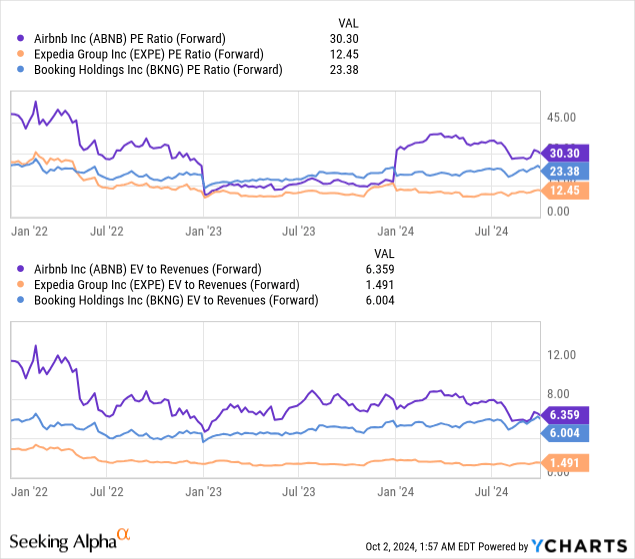

So now we get to the question of valuation. Despite the fact that Airbnb’s growth advantage over its peers seems to have receded dramatically, it still trades at a hefty premium to these OTA stocks: on both a top and bottom line basis.

In particular, as shown above, Airbnb’s forward P/E multiple of ~30x is 30% higher than Booking.com’s, and more than double Expedia’s multiple (which has been long undervalued due to Expedia’s historical slower growth and the time it took for the company to converge its apps and backend infrastructure through One Key).

This valuation gap, to me, represents a major correction risk for Airbnb that I can’t ignore.

Key takeaways

Airbnb’s sharp fall over the past year owes to a number of factors, including slowing bookings growth rates that put it closer in line with OTA peers, the risk of contracting margins, and a colder global macro climate that is starting to eat into travel bookings. But more threatening of all to Airbnb’s stock, however, is the fact that it still sits at a substantial premium to peers despite having little fundamental advantage over them anymore.

It’s time to cut losses on this trade and move on.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.