Summary:

- Airbnb reports solid Q2 results, but the stock is down due to slowing growth, declining margins and the rising possibility of an economic contraction.

- Airbnb is becoming more serious about strengthening its business, by expanding its offerings for travelers and introducing new tools and services for hosts.

- While this is supportive of long-term growth and margins, investments are likely to undermine profitability in the near term.

- Even after the post-earnings drop, Airbnb’s revenue multiple is still relatively high, meaning declining margins could see the stock fall much lower.

Jessie Casson

Airbnb (NASDAQ:ABNB) reported solid second quarter results, but the stock continues to fall as investors digest the company’s slowing growth and declining margins, along with the rising probability of an economic contraction. While I believe that Airbnb has a strong business and that the stock should do fairly well longer term, I have been negative about the company’s short-term prospects due to the fading of pandemic related tailwinds. Airbnb’s business has a lot of inherent leverage, which is becoming problematic as the demand environment continues to soften. While the stock may appear reasonably priced based on its P/E ratio, and has done for some time, this won’t provide a cushion for the stock while profitability is under pressure.

Market Conditions

Airbnb’s growth continues to moderate, driven by fairly flat ADRs and slower growth in nights and experiences booked. This trend looks set to continue, with Airbnb suggesting it is seeing some signs of slowing demand from guests in the US.

I would not attribute any of this to competition, though. Airbnb believes that its market share, based on total nights across all accommodation types, continues to increase at a rate consistent with prior quarters.

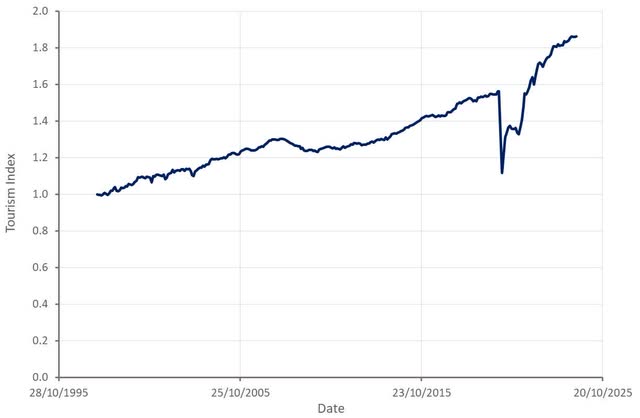

Figure 1: Tourism Activity Index (source: Created by author)

Problems caused by softening demand growth could be exacerbated by a growing supply of housing units in some markets. This is important as supply could eventually find its way into the short-term rental market, pressuring pricing.

A large decline in construction activity is also an important driver of recessions, as it is central to a significant amount of economic activity. Construction activity will continue to decline, which may be enough to break the labor market, triggering a recession. If this occurs, short-term rental demand will face far more serious headwinds than it has so far.

Figure 2: Housing Units Under Construction in the US (source: Created by author using data from The Federal Reserve)

Airbnb Business Updates

Airbnb has a strong brand, which is one of the company’s primary advantages. There remains a gap between people who have heard about Airbnb and those that regularly use it, though. Airbnb believes that it can capitalize on this by improving the reliability of the Airbnb experience. In support of this, Airbnb is removing lower quality listings and improving the visibility of higher quality listings. Since the launch of Guest Favorites, over 150 million nights have been booked as Guest Favorite listings.

Airbnb is also trying to drive growth of its core business in markets where it is underpenetrated (primarily outside of the US, UK, France, Australia and Canada). The company is also trying to drive adoption in the center of the US and amongst the Latinx population. Airbnb’s expansion playbook includes localization of the product and marketing. Growth in nights booked in expansion markets is significantly outperforming Airbnb’s core markets. The company expects to continue investing more in expansion efforts in 2024 and beyond, which will drive operating expenses higher and pressure margins.

Airbnb is now also making a more concerted effort to expand its offerings. One of the company’s first major efforts in this area is Icons, a category of extraordinary experiences that was launched in May. As I have written previously, due to the nature of the product this is more of a marketing exercise than a direct revenue growth driver, though. Airbnb is also set to relaunch experiences and eventually introduce a more end-to-end range of travel services.

The company also continues to make small changes to its platform to try and improve usability and conversions. Related to this, Airbnb has seen a sharp rise in the usage of its app, with app downloads up 25% YoY in the second quarter, and nights booked on the app increasing 19%. Nights booked through the app now constitute 55% of total nights booked. This is potentially important longer term as it helps ensure Airbnb isn’t dependent on others for lead generation and should help to limit competition.

Airbnb also continues to introduce new tools and services for hosts. This includes pricing tools and support for new hosts. Airbnb also plans on introducing a co-hosting marketplace in October that connects people with a property they want to place on the platform but don’t want to manage with people who want to manage a property but do not have one.

Introducing foreign exchange fees is a small step towards Airbnb extracting more value from hosts. In time, this will also probably include paid placements. Airbnb is rightly being prudent in this regard, though, prioritizing the health of the platform over short-term financial gains.

Regulatory Risk

While regulatory risk has always been a threat to Airbnb’s business, the spotlight appears to have moved back onto this following Barcelona’s announcement that it would not renew any tourist apartment licenses after they expire in 2028. This may not be material in isolation, but if other cities follow, Airbnb could be severely impacted.

There is a tension at the heart of Airbnb’s business, which becomes apparent when the company achieves scale in a particular location. Growth in short-term rentals places pressure on home prices and rents for locals, and previously residential neighborhoods can be flooded with tourists.

The US, UK, France, Australia and Canada represent the vast majority of Airbnb’s business, with Airbnb’s penetration in these markets an order of magnitude higher than many other markets. Coincidentally, housing affordability has reached crisis levels in the UK, Australia and Canada.

I think the near-term importance of regulatory changes is overstated, but Airbnb must diversify its business outside a handful of megacities that face housing affordability problems as much as possible. For example, low penetration means that markets like Italy, Spain, Germany and LATAM are a large growth opportunity.

I also expect to see a drift towards professional hosts and properties specifically built as STRs over time. This could undermine Airbnb’s differentiation somewhat, though.

Financial Analysis

Airbnb generated 2.75 billion USD revenue in the second quarter, an increase of 11% YoY, driven by growth in nights stayed on the platform. Gross booking value was also up 11% to 21.2 billion USD. While Airbnb still has a number of levers it can pull to support growth, it will take time for most of these to pay off. In the short term, this is likely to mean that growth continues to decelerate while margins remain under pressure.

Airbnb expects 3.67-3.73 billion USD revenue in the third quarter, representing 8-10% YoY growth. This moderation in growth is anticipated despite the tailwind provided by the Olympics and a modest bump from the introduction of cross-currency transaction fees. There will be a headwind from investments in customer service that will be recorded as contra-revenue, though.

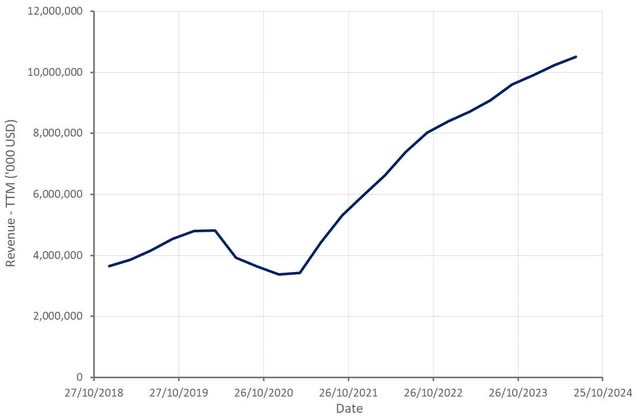

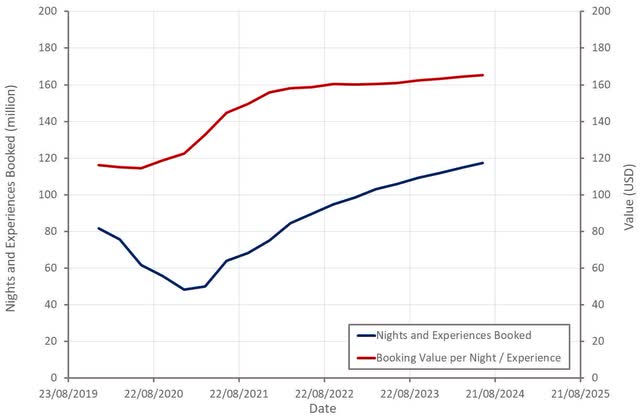

Figure 3: Airbnb Revenue (source: Created by author using data from Airbnb) Figure 4: Airbnb Nights Booked and ADR (source: Created by author using data from Airbnb)

Accommodation prices are materially higher than they were pre-COVID, and Airbnb believes it can capitalize on this by trying to ensure inventory on its platform represents value for users. Based on comparable inventory, Airbnb’s pricing continues to decline slightly.

The ongoing appreciation of ADR is being driven by mix shift, with users gravitating toward larger and more expensive properties. It is hard to see ADR being a growth driver in the near-term though, particularly with Airbnb’s explicit affordability strategy, meaning growth must be driven by nights and experiences booked.

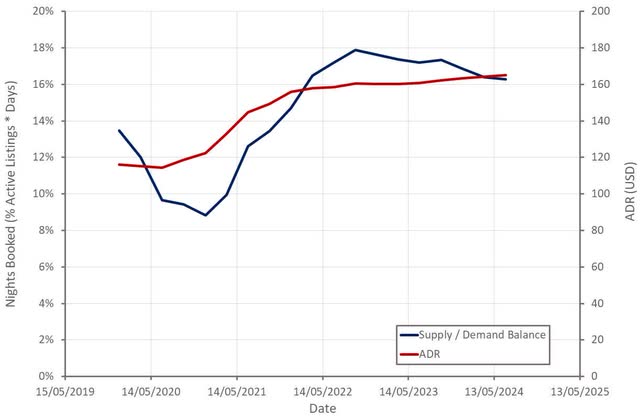

Figure 5: Balance of Supply and Demand on Airbnb’s Platform and ADR (source: Created by author using data from Airbnb)

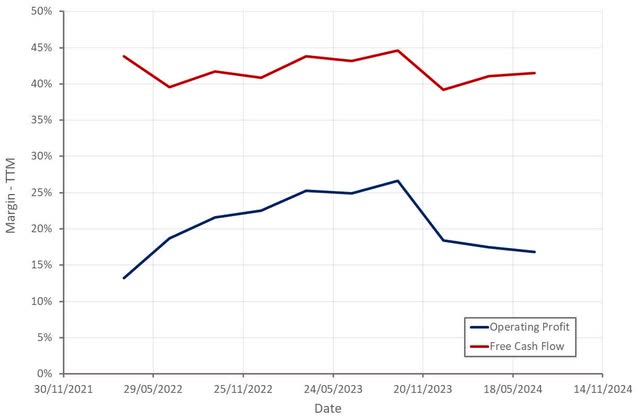

Airbnb’s gross margins continue to drift lower, although this has been fairly modest so far. There could be significant downside in the event of a recession, though, as margins are dependent on both scale and ADRs.

Airbnb’s operating expenses are now also rising faster, as the company is being forced to work harder to generate growth. Marketing expense is expected to grow faster than revenue in the third quarter, in large part due to investments in growth markets. As a result, adjusted EBITDA is expected to be fairly flat YoY in the third quarter.

Figure 6: Airbnb Profit Margins (source: Created by author using data from Airbnb)

Conclusion

Increased marketing spend, the introduction of foreign exchange fees and a greater focus on ancillary services indicate that Airbnb’s business is maturing. Despite this, I think that the company still has a long growth runway if it can execute on its strong competitive position.

There are near-term headwinds, though, and there is a risk that these get significantly worse before they get better. Demand growth continues to moderate as consumer spending power weakens, and growth in the number of active listings on Airbnb has been outpacing growth in the number of nights booked. If this begins to impact ADRs, Airbnb’s margins could move materially lower.

Airbnb’s strong balance sheet and ability to generate free cash flow leave it well positioned to weather any downturn. Airbnb repurchased 2.75 billion USD of stock over the past 12 months, reducing its fully diluted share count from 686 million to 673 million. The company still has authorization to purchase up to 5.25 billion USD of Class A common stock. Given where the stock now sits, it is not clear that this has been a prudent use of capital, though.

Airbnb may appear reasonably priced based on its trailing PE ratio, but the leverage inherent in the business means that with modest headwinds, profits could drop significantly. Even after the post-earnings drop, Airbnb still has an EV/S multiple of over 6, making it relatively expensive for a company with low growth and declining margins.

Figure 7: Airbnb EV/S Ratio (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.