Summary:

- Airbnb has taken several commendable decisions to capitalize on the changing travel trends in the post-pandemic world.

- The company faces a formidable regulatory threat in New York City, and these challenges could extend to other key markets as well.

- Despite regulatory hurdles, Airbnb still has room to grow, with its international business likely to drive growth.

- Airbnb is no longer cheaply valued on the back of a 67% appreciation of its market value this year, but I see no reason to prematurely book profits before the investment thesis fully plays out.

SrdjanPav

Airbnb, Inc. (NASDAQ:ABNB) and Blackstone Inc. (BX) are set to join the S&P 500 on September 18 as part of the index’s quarterly rebalance. Following this announcement, both Airbnb and Blackstone saw their stocks surge, reflecting growing investor confidence in the two companies. As a long-term Airbnb bull, I couldn’t be happier about the company’s S&P 500 inclusion as it opens doors for Airbnb to gain more attention on Wall Street. Airbnb has also been gaining significant attention as it continues to deliver strong financial results in the post-pandemic era aided by stellar demand for travel and leisure. The second quarter of 2023 marked another impressive performance for Airbnb, with the company rapidly rebounding from the pandemic lows to hit record net income and adjusted EBITDA. The recovery in demand is particularly robust in domestic and leisure markets, where Airbnb enjoys a competitive advantage over traditional hotel chains. Although the changing regulatory landscape in one of its most important markets, New York City, casts a shadow over its short-run performance in the City, the company still enjoys ample room for growth in many of its key markets across the world.

Capitalizing On Post-Pandemic Travel Trends

Airbnb’s second-quarter earnings report shows that the company is doing exceptionally well despite macroeconomic challenges. There is clear evidence to suggest Airbnb’s rise has led to significant revenue losses for established hotels in many markets. Airbnb recently introduced Airbnb Rooms, a novel listing category that enables guests to reserve private rooms within a host’s residence. This option presents one of the most cost-effective means of traveling, with an average nightly rate of just $67, a considerably lower cost compared to the average hotel room. While the company’s sharing economy approach, emphasizing affordability and flexibility, has faced its own set of challenges, the pandemic amplified the demand for secluded accommodations, particularly as the trend of remote work and working from home gained momentum. Moreover, with the resurgence of the travel sector, the company has been able to sustain its upward trajectory, as individuals increasingly prioritize allocating more of their budget toward travel and experiences. With over 115 million Nights and Experiences Booked in the second quarter, Airbnb’s popularity as a lodging choice is continuing to soar.

Diving deeper into Airbnb’s data reveals shifting trends in travel behavior. Guests are now willing to venture farther from their comfort zones, as indicated by the 16% increase in cross-border nights booked during Q2 compared to the previous year. This trend is a testament to Airbnb’s adaptability and appeal to the adventurous traveler.

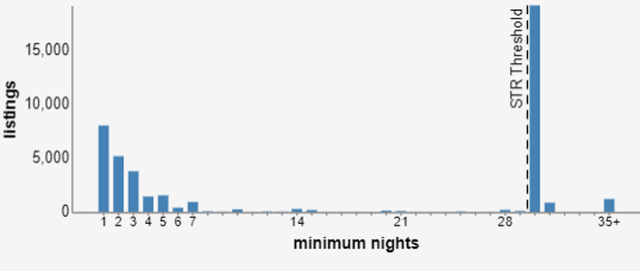

Furthermore, the Asia Pacific region is currently emerging as a focal point for Airbnb’s growth strategy, as the travel industry undergoes a remarkable resurgence. This revival, marked by a staggering 80% spike in inbound international travel, highlights Airbnb’s capacity to navigate and grow amid challenging macroeconomic conditions. In the context of the APAC region, international tourism flows have continued an upward trajectory throughout the first half of 2023. According to S&P Global, international tourism arrivals in Thailand surged to a remarkable 6.5 million visitors in Q1. This staggering figure, more than half of the total international tourist visits in 2022, underscores the rapid pace of recovery in the country’s tourism sector. Malaysia, a country known for its cultural diversity and natural beauty, is poised for a robust revival in international tourism throughout 2023 particularly driven by gradual improvement in Chinese tourist arrivals, a key demographic for Malaysia’s tourism industry. Tourism Malaysia has set an ambitious target of 16.1 million international visitor arrivals for 2023, a substantial 60% increase from 2022. Singapore and Australia also witnessed a strong resurgence in international tourism during the first four months of 2023 with total international visitor arrivals reaching an impressive 4 million and 2.2 million respectively, signifying a robust upturn from 2022. Airbnb, with its extensive network of hosts and unique lodging options, is well-positioned to capitalize on this resurgence of the travel sector.

Exhibit 1: S&P Global Tourism & Recreation Output and New Orders

S&P Global

Interestingly, guests are extending their stays on Airbnb’s platform, with long-term stays accounting for 18% of total nights booked in Q2. The company capitalized on this trend by rolling out more affordable monthly stay options and significantly reducing fees for stays longer than three months. These strategic moves were augmented by the company’s introduction of payment flexibility, allowing U.S. guests to pay with their bank accounts, and facilitating hosts in offering monthly discounts. This concerted effort led to a notable jump in the percentage of new active listings offering monthly discounts, from 22% to an impressive 50%.

Overall, Airbnb has made several strategic decisions to capitalize on the changing travel trends in the post-pandemic era, positioning itself for sustained growth in the foreseeable future.

New York’s Regulatory Challenge And Shifting Domestic Trends

Despite this commendable growth trajectory, Airbnb now faces a formidable regulatory hurdle in one of its key markets, New York City. New short-stay rules, effective from September 6, 2023, are poised to disrupt tens of thousands of short-term listings. Known as Local Law 18, these regulations mandate that short-term rental hosts must register with the city government. This move is aimed at curbing the rampant practice of renting apartments on a weekly or nightly basis to tourists and other short-term guests.

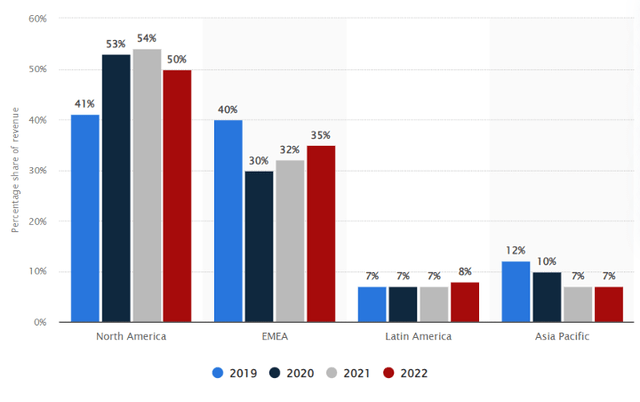

Under the new rules, rentals for less than 30 days are permitted only if hosts register with the city and physically reside in the home throughout the guest’s stay. This regulation effectively prohibits families and groups of more than two guests from utilizing short-term rentals. Hosts found in violation of these regulations could face fines ranging from $1,000 to $5,000.

The enforcement of these rules is a crucial step for New York City in addressing concerns about the dwindling housing inventory. Airbnb and similar platforms, while providing additional income for hosts, have faced criticism for contributing to the scarcity of affordable housing in residential neighborhoods. The city argues that these short-term rentals drive up housing prices, making it more challenging for residents to find affordable accommodation. The debate over short-term rentals extends beyond New York City, with concerns about their impact on housing supply echoing across major markets like Philadelphia, Miami, and San Diego. Data firm AirDNA reveals an increase in short-term rentals in these cities since before the pandemic, contributing to a decrease in available housing for potential buyers. While some argue that short-term rentals are only a small part of the housing price equation, with estimates ranging from 1% to 4% of the increase in housing prices, others contend that the primary reason for high housing prices in the U.S. is the shortage of housing supply. Factors such as the pandemic, supply chain disruptions, and high interest rates have exacerbated this shortage, making it a complex issue with multiple contributing factors.

The path to compliance with these new regulations has been bumpy. As of August 28, only 257 application registrations had been approved out of the 3,250 applications received. This situation implies that a substantial number of listings on Airbnb could be removed, given that the company estimates nearly 15,000 hosts had short-term rental listings in NYC. According to data from Inside Airbnb, there are currently more than 43,000 Airbnb listings in New York City. Notably, Airbnb has strategically shifted a substantial portion of these listings toward longer-term accommodations. Today, there are an estimated 21,132 (48.5%) longer-term rentals while short-term rentals listings come at 22,434 (51.5%).

Exhibit 2: Short-term Airbnb rentals in NYC

Airbnb has been engaged in a legal battle against these rules, asserting that they effectively amount to a ban and would harm visitors seeking affordable accommodation. Despite its objections, the company has now committed to adhering to the new regulations. Airbnb has ceased accepting new short-term reservations without hosts having a city registration number or documentation showing they are in the registration process.

Airbnb guests with reservations scheduled for check-in before December 1 will experience no disruptions, and the company will refund associated fees. This action complies with the new regulations, which forbid booking platforms from facilitating transactions for unregistered listings. However, bookings commencing on December 2 or later will be canceled, and guests will receive refunds. Furthermore, starting from September 5, host listings that allowed bookings of 30 days or more converted to long-term rentals and short-term bookings were deactivated.

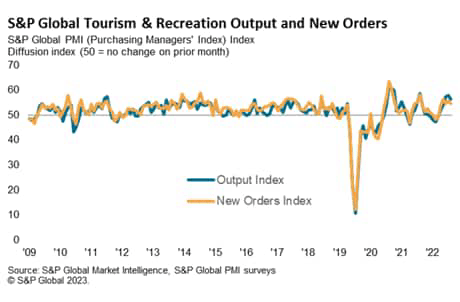

The New York City regulations, slated to impact thousands of listings, have sparked concerns about the availability of Airbnb accommodations. Further, as more U.S. consumers opt for international vacations, the demand for domestic hotels has remained relatively stagnant. Although the NYC regulation on short-term rentals presents a formidable challenge, Airbnb’s global footprint and strategies might offer a buffer against potential supply constraints.

Exhibit 3: Regional distribution of Airbnb revenue

The company, known for its global presence, benefits from its global footprint with international revenue accounting for half of its revenue. A noteworthy aspect of Airbnb’s strategy is its focus on urban markets, where the company maintains a substantial presence. An acceleration in the growth of nights booked in North America highlights Airbnb’s resilience, especially in city-centric areas.

For now, I am not planning to change my stance on Airbnb purely based on the challenges the company is facing in NYC.

Takeaway

Airbnb’s recent progress highlights its ability to adapt and grow in challenging times. The introduction of Airbnb Rooms, coupled with a continued rebound in the travel sector, will help the company grow in the foreseeable future but a slowdown in revenue growth is likely as we reach the end stages of pent-up demand for travel. While NYC regulations pose a challenge, Airbnb’s focus on urban markets positions it well to overcome supply constraints. Although Airbnb is no longer cheaply valued on the back of a 67% market value appreciation this year, I believe the strong earnings revision trends will take the stock to new highs. In any case, as a long-term-oriented investor, I see no reason to book my profits prematurely given that my investment thesis for Airbnb has not fully played out. In the long run, I expect Airbnb to emerge as the clear leader of the online travel booking market and enjoy durable competitive advantages stemming from its scale and network effect.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!