Summary:

- ABNB’s execution remains excellent, with discretionary travel spending proving robust in the December CPI reports.

- The company’s healthy balance sheet may also temper some of the growing recessionary fears and declining Gross Booking Value.

- ABNB’s speculative entrance into the long-term rental property market may also lift some of the regulatory headwinds, while similarly expanding its TAM by $226.4B in 2023.

Feverpitched

We have previously covered Airbnb (NASDAQ:ABNB) here as a post-FQ2’22-earnings article in September 2022. At that time, market analysts were concerned about its lower Gross Booking Value of $17B, suggesting a potential deceleration in consumer demand. Due to its baked-in premium, the company may also face temporary headwinds through 2023, attributed to the worsening macroeconomics and the Fed’s continued rate hikes. True enough, the stock has plunged by -28.2% by the end of December 2022, before recovering tremendously by 22.5% at the time of writing.

For this article, we will focus on ABNB’s recovery tailwinds, boosted by the robust balance sheet and excellent management team. While bookings may take a temporary hit, no recession lasts forever, with sentiments likely to lift from H2’23 onwards. Notably, the nimble team continues to prove why the stock deserves its premium, attributed to multiple recessionary initiatives that may resonate well with hosts, renters, and consumers alike. Its speculative entrance to the long-term rental property market may also lift some of the regulatory headwinds faced by short-term rentals thus far.

The Recession-Driven Innovation May Expand ABNB’s Market Offering

Despite market analysts’ pessimistic concerns, the rising inflationary pressures have yet to overly impact discretionary travel spending. The December CPI reported a decent uptick in the other lodging away from home at 1.7% sequentially and 3.2% YoY, likely attributed to the year-end seasonal travels.

While it remains to be seen whether the trend will sustain over the next few months, the December labor report proved robust, with jobs growing by 223K and unemployment remaining stable at 3.5%. This suggests sustained salary growth supporting discretionary spending for the time being.

While there have been many teething issues in both problematic hosts and consumers alike, these are potentially tempered by ABNB’s raised insurance coverage from $1M to $3M moving forward. The company’s unique proposition may also be further strengthened with an uplifted premium segment, differentiating it from the competitors in the market, such as VRBO, Booking (BKNG), and Expedia (EXPE). Notably, the former features multiple intriguing experiences, including castles, yachts, tiny homes, farm stays, and even whole private islands for rental. In fact, ABNB’s alternative branding and robust moat helps set it clearly apart from multi-chain hotels.

While there were some rumors of a notable decline in ABNB’s bookings in Q4’22, it is most likely attributed to the massive growth in its US listings by 23% YoY to 1.4M rentals, with a similar trend observed globally. These suggest the smashing success of the company’s onboarding efforts, balanced by the normalization of pent-up travel demand.

It is unsurprising that we are optimistic here. The fact that more hosts are choosing to list their properties with ABNB suggests that more are realizing the economic benefits of hosting, especially during this uncertain macroeconomic outlook. Notably, the company highlighted that long-term stays of over 28 days have stabilized at 20% of its bookings in the latest quarter, suggesting a notable shift in consumer demand and hosting trends. Naturally, it mirrored the company’s origin story back in 2009. Nathan Blecharzyck, Airbnb Co-Founder, said:

Airbnb was founded during the Great Recession when Brian and Joe needed help affording their rent, and now Airbnb-friendly apartments build on that founding story by making it easier for people to reap the economic benefits of hosting. As the cost of living continues to rise, renters can use the extra income earned by hosting part-time on Airbnb to contribute to their rent, save for a home, or pay for other living expenses. (Airbnb)

This is why it made sense that ABNB went further and launched a new apartment platform, allowing tenants to share their rentals on a short-term basis. While the company has battled global regulatory pushbacks on its impact on affordable housing, this initiative may potentially ease some of those concerns, since the building owners and local regulators would be involved as well.

Assuming a smooth regulatory process, we posit that this new model may expand the company’s offerings into the annual rental segment, against the current vacation and short-term rentals. Impressive indeed, since the US rental market represents a massive $226.4B of untapped Total Addressable Market in 2023.

Notably, over 34% of US households are renters, with a national median rent of $2K in 2022. With the rising home prices and elevated mortgage rates, this new segment may be in high demand among renters and prove to be highly profitable for ABNB. This is especially aided by the company’s excellent relationship with 400K hosts in the US and over 4M hosts globally.

Naturally, these are speculations on our part, since it is unknown if ABNB may truly enter the long-term rental market, attributed to the complex licensing processes and regulatory approvals. However, the potential is unlimited indeed, since the company does not need to own any of these rental properties compared to REITs, while simultaneously earning highly profitable service fees.

ABNB currently collects a ‘platform tax’ of up to 15% of the consumer booking fee and 3% of the hosts’ fee, netting the company a handsome $6B in service fees annually. That does not differ too much from the current management fees earned by real estate agents of up to 15%. Only time will tell how things develop, though we expect the management to perform well in its potentially new segment.

So, Is ABNB Stock A Buy, Sell, or Hold?

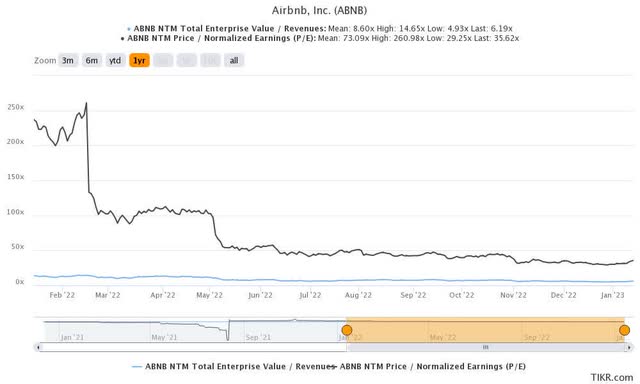

ABNB 1Y EV/Revenue and P/E Valuations

ABNB is currently trading at an EV/NTM Revenue of 6.19x and NTM P/E of 35.62x, drastically moderated against its 2Y peak of 33.26x and 721.59x, respectively. Otherwise, still lower than its 1Y mean of 8.60x and 73.09x, respectively. Based on its projected FY2024 EPS of $3.49 and current P/E valuations, we are looking at an aggressive price target of $124.31. This mirrors the consensus estimates target of $118.91 as well, suggesting a minimal 18.47% upside potential from current levels.

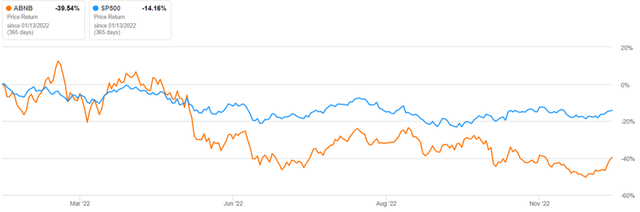

ABNB 1Y Stock Price

The drastic moderation is of little surprise, since ABNB is expected to record a notable deceleration in the top and bottom-line growth through FY2024, at a CAGR of 14.8% and 5.4%, respectively, against the hyper-pandemic revenue CAGR of 20%. However, we reckon Mr. Market is overly bearish, since the company is expected to expand its EBIT and Free Cash Flow margins by 3.2 and 3.6 percentage points to 24.2% and 37.8% by FY2024, respectively.

These numbers are impressive indeed, despite the 70% chance of a recession in 2023, the supposed Fed pivot from 2024 onwards, and, consequently, prolonged interest pain over the next few quarters. The success is primarily attributed to ABNB’s aggressive cost management since the start of the pandemic, remarkably expanding its EBIT/net income/FCF margins by 27.6/25.9/53.4 percentage points by the latest quarter. These are significantly aided by the remote work strategy implemented since April 2022, consequently reducing its net PPE assets by -32.8% over the past two quarters.

While Gross Booking headwinds may persist over the next few quarters, investors need not fear, since ABNB continues to report a robust balance sheet thus far. Its cash/investments have been growing remarkably by 21.4% YoY to $9.62B in the latest quarter, with minimal long-term debts of $1.98B. Its quarterly Stock-Based Compensation has also remained stable at $234.3M, with more than $1.54B of stock repurchased over the last twelve months. The founder-led management has been steering the ship very tightly indeed.

ABNB’s Average Daily Rates [ADR] have been outperforming at $156.46 in the latest quarter as well, compared to the US hotel average of $154.96 at the same time (for the months July, August, and September 2022). Its cross-border gross nights booked have also increased by 58%, pointing to the sustained travel demand similarly witnessed in the air travel industry. Recent tracking data by early January 2023 has shown that commercial flights in the US and the EU have expanded beyond 2019 levels by 4.3%.

We reckon that China’s pent-up demand may also boost ABNB’s outbound segment, once the Chinese New Year festivities are over and COVID-19 infections possibly peak by Q2’23. The same has been observed in the US post-reopening cadence, with travel spending recovering by 23.6% in 2021 and another 17.9% in 2022. Lastly, China’s outbound tourists have tremendous spending power with up to $255B reported in 2019, compared to the Americans at $135B at the same time. The ABNB management has similarly commented on this:

The crown jewel of our China business was always and we thought always was going to be the China outbound business. And the reason why is the take rate was higher for the outbound business than it was for the domestic business. The inventory is more unique. There is less competition and the average daily rate is a lot higher. So, the outbound business was always the price part of our business. And that’s what we are focused on. (Seeking Alpha)

Therefore, we choose to optimistically rate the ABNB stock as a Buy, with the caveat that it should consequently lower investors’ dollar cost average. Considering the short-term volatility, that strategy may offer an improved margin of safety for long-term investors indeed.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.