Summary:

- Management expects to see mid-single-digit declines in ADRs, with the declines expected to accelerate through 2023.

- As a result of the relaxing of covid-19 restrictions in China, this could bring a strong rebound in outbound travel from China.

- One headwind that Airbnb could face in 2023 is the macro backdrop. As the macro backdrop worsens, it is likely to affect the travel industry too.

- Excluding the Mainland China listings removal, Airbnb grew supply by 900,000 listings, up 16% from a year ago.

- Airbnb’s valuations look fairly valued at the current levels but I am looking to enter a position in the company at the right levels.

Giselleflissak

This article was first posted in Outperforming the Market on April 13, 2023.

Travelling in a post pandemic world likely involves the consideration of Airbnb (NASDAQ:ABNB). Airbnb has been seen as an alternative to hotels as it provides a unique value proposition to both hosts and guests. I previously shared with members of Outperforming the Market my ideal entry price for Airbnb at a more reasonable valuation as I think that the company is the top pick in the travel industry for me.

In this article, I will share more about Airbnb and how it is faring in the post pandemic world. I will share why I think Airbnb remains a top pick for me in the travel industry although its current risk reward perspective is balanced.

Brief introduction

As a two-sided global marketplace for travel, Airbnb enables hosts to provide guests with alternative accommodations and experiences.

In 2007, Brian Chesky, Joe Gebbia, and Nathan Blecharczyk founded Airbnb. Today, Brian Chesky is the CEO of the company, while Joe Gebbia is the chairman of Airbnb.org and Nathan Blecharczyk is currently the Chief Strategy Officer.

Hosts are able to list anything from private rooms, entire homes, luxury villas and even treehouses on the Airbnb platform. Guests can then search for their ideal lodging or experience of their choice using filters like data, location, type, and price.

Through each successful booking, Airbnb profits via commissions earned from each booking.

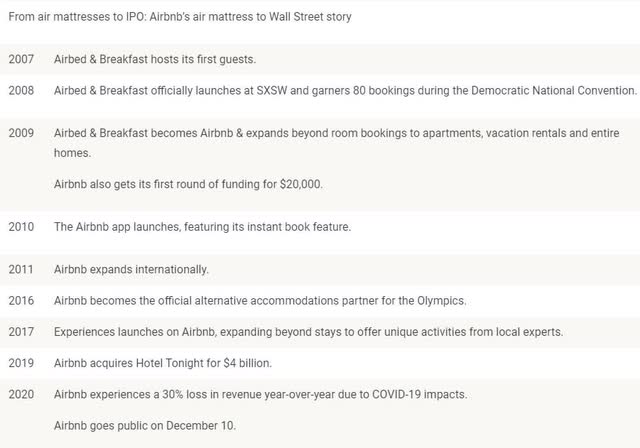

Today, Airbnb has about 5.6 million active listings in 220 countries. Almost 60% of its users are millennials. As can be seen below, the firm has had an incredible growth journey from Airbed & Breakfast to a publicly listed company.

ADRs to decline through 2023 while adjusted EBITDA margin could have upside

Management expects to see mid-single digit declines in ADRs, with the declines expected to accelerate through 2023. The lower ADR is a result of the shift in mix towards lower ADR bookings like urban and cross border, new pricing and discounting tools for hosts and the algorithm changes prioritizing better value in search results, among others.

That said, management could be overly conservative on the 2023 estimates as they expect 1Q23 ADRs to decline very slightly and 1Q23 room night growth to be about as strong as 4Q22 growth of 20% year on year growth. This could help reduce concerns that we could see a sharp deceleration in revenue growth trends for Airbnb in 2023.

During the recent earnings call, I thought that management sounded confident in being able to meet their flat year on year adjusted EBITDA margin guidance. Even if ADRs end up declining over the year, management stated that they have sufficient cost levers in 2023 to ensure that adjusted EBITDA margins are not affected.

As such, I am relatively optimistic that Airbnb’s adjusted EBITDA margin expansion continues, with about 120bps of adjusted EBITDA leverage in 2023.

China rebound opportunity

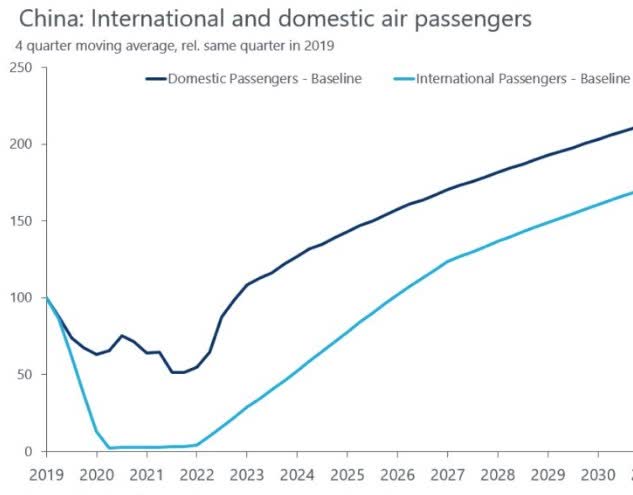

As a result of the relaxing of covid-19 restrictions in China, this could bring a strong rebound in outbound travel from China.

For Airbnb’s APAC business, 4Q22 was a strong year as N&E bookings grew 40% year on year. While the travel figures may not reach 2019 levels in 2023, we are likely to see strong growth as a result of relaxation of restrictions and revenge travel from China.

China international and domestic air passengers (Tourism Economics)

Worsening macroeconomic environment

One headwind that Airbnb could face in 2023 is the macro backdrop. As the macro backdrop worsens, it is likely to affect the travel industry too.

Before the reopening of China, the Economist Intelligence Unit was forecasting that global tourism arrivals will grow 30% in 2023. This follows the 60% growth in global tourism arrivals in 2022. The figure will stay below pre-pandemic levels as a result of Russia’s invasion of Ukraine and the macro backdrop, which remains headwinds for the industry today.

While there were talks of revenge travel, it looks like the macroeconomic environment is having a negative impact on the travel industry as there are multiple reports that tourists are spending less, as concerns about the economy curbs tourism growth.

Addressing the supply side of the equation

In 2022, Airbnb had 6.6 million active listings. Excluding the Mainland China listings removal, Airbnb grew supply by 900,000 listings, up 16% from a year ago. This was also an acceleration in listings growth compared to the third quarter.

This increase in supply was also attributed to both the increasing demand as well as product improvements made in 2022. In 2022, demand was strong as the travel recovery took place. As a result of the additional income that can be earned from Airbnb, hosts took to Airbnb as an additional source of income. Also, in 2022, Airbnb made it easier and more attractive to host on the platform. Late 2022, Airbnb introduced Airbnb Setup, where new hosts could work with Super Hosts for guidance all the way until their first reservation. As a result of the product launch, the new active hosts recruited by Super Hosts increased 20%.

Product expansion

Airbnb plans to increase its investment in expansion verticals. These includes long-term stays, apartments, and hotels.

As a result of these product expansion opportunities, this should further support a modest top-line deceleration pace.

In addition, Airbnb’s insurance rollout could drive a take-rate expansion as it continues to scale across markets in 2023.

In general, I like the product expansion story beyond core as it helps to drive take-rates up in the long-term.

First, Airbnb is looking to start prioritizing investments outside of its core business. These includes the Airbnb-friendly apartments and hotels effort.

The Airbnb-friendly apartment is a new program that allows hosting on Airbnb on a part-time basis. I think that this could help unlock incremental supply of new hosts and experiences into the Airbnb platform, which is a positive for the company.

Similarly, the listing of hotels on Airbnb may seem counter intuitive given that hotels are the anti-thesis of Airbnb, but the platform has been bringing on hotels to its platform. This will bring added supply on the platform as well. Hotels serve an important role in being able to fill network gaps and ensuring that every user gets to leave the platform with a booking.

While the longer stays business boomed in the pandemic, there are currently still no signs that the business could unwind from the pandemic era behavior. In the fourth quarter of 2022, long-term stays remained stable at 21% of total gross nights booked in Airbnb.

Upfront pricing

After rolling out upfront pricing, Airbnb states that this has been neutral so far in the short-term. However, management thinks this will have a positive impact on bookings in the long-term as a result of a better user experience and giving the user more control in the decision process.

3 strategic priorities in 2023

The first will be to make hosting mainstream. This means to increase awareness, make onboarding easier and enhancing host tools.

The second is to perfect the core service. This includes improving the user experience, improve the matching of accommodations to customers and providing better value and variety on the platform.

Lastly, Airbnb looks to expand beyond its core business by going into new products and services, like travel insurance, ramping up Experiences and introduce newer forms of travel bookings.

Valuation

My 1-year price target for Airbnb is $129, implying 13% upside from current levels. This implies 30x 2024F P/E for Airbnb. The reason for the P/E assumption is because Airbnb is expected to grow at an EPS CAGR of 23% over the next 3 years, surpassing peers within the travel industry. As a result, I do think that Airbnb deserves a premium on its valuation multiples relative to peers in the industry as a result of its faster earnings growth, competitive moat and strong branding.

Airbnb currently trades at 26x 2024F P/E and 16x 2024F EV/EBITDA. The relative valuation seems fairly balanced, in my view. Given the worsening macro backdrop that will likely affect the travel industry, I am looking to enter Airbnb at about 20x P/E, a 23% discount from current levels.

Risks

Slower recovery of travel activity

If the travel activity slows more than expected, this could result in slower growth for Airbnb. Given the uncertainty in the macro backdrop as highlighted earlier, this could hit the travel industry negatively as travelers hold back on spending.

Competition

While Airbnb has a unique moat given its large network of hosts and users, there are risks that traditional players and new alternative players may rise and take up market share from Airbnb.

Supply constraints

The main bottleneck in the Airbnb model has always been supply. As a result, Airbnb needed to ensure that it constantly increases supply on the platform to match demand. At the end of the day, any customers that leave the platform without a booking is more likely to book an accommodation from a competitor.

Conclusion

I do think that Airbnb has a strong moat as an innovator in the travel industry. It has a unique proposition to both hosts and guests that will continue to enable share gains in the future.

In the near-term, there are macroeconomic environment risks to consider given that the travel industry and thus, Airbnb, is vulnerable to economic contractions and recessions. Although this could be subdued by the product expansion and increased outbound travel from China, this remains a near-term macro risk for the business. As a result, I think that the near-term risk reward perspective is balanced.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 51% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!