Summary:

- Airbnb’s lack of supply is leading to high ADRs and potential guests choosing other services.

- Its small moat, exceptional management team, and the long-term economics of its business model will lead to strong growth and improved margins.

- At ~$107 per share, I’d like to see the stock fall another 10-15% before getting excited about a position.

Giselleflissak

Investment Thesis

Airbnb (NASDAQ:ABNB) has a strong business led by a smart and capable management team. Lack of affordability has led potential guests to begin using the company’s competitors, proof of Airbnb’s thin (but not entirely non-existent) moat. Its primary issue, lack of supply, is largely outside of its control, though the inherent economic opportunity will lead this problem to resolve itself over the long term.

The business model, the management team, and the long-term economics look great, but its price is still too high. Its latest results and mediocre forecast has pushed the stock below $110, but I’d like to see the stock in the mid-$90s before initiating a position.

Where Airbnb Has Been

In 2019, revenue grew more than 30% YoY and the number of active listings reached 5.6 million. Airbnb was clearly the market leader in the alternative accommodations market. But there was a key metric that was less encouraging: Airbnb reported an operating loss of ~$500 million, and the company was showing no signs of operating leverage.

In 2020, after a strong start to the year, March and April gross bookings declined by 49% and 78%, respectively. Airbnb laid off one-third of all employees and raised $2 billion in April which helped it get through the pandemic. Losses in the first 6 months of 2020 reached nearly $1 billion.

Like many growth companies, Airbnb had only figured out one part of the equation. At that time, it was unknown whether or not management could turn a compelling consumer & host proposition into a business that would deliver for shareholders.

The company’s results in 2021 and 2022 are a testament to its management team’s ability and focus. While it has had significant tailwinds coming out of the pandemic (resulting in higher ADRs), a large part of what has happened to the business is attributable to internal evolution.

- The company refocused on its core opportunity: alternative accommodations

- Sales & Marketing Expense made up 18% of revenues in 2022, down from 34% in 2019 (management’s shift toward brand marketing)

- Total Headcount in 2022 was still 5% below the number at the end of 2019, while revenues per employee climbed 80% over the same period

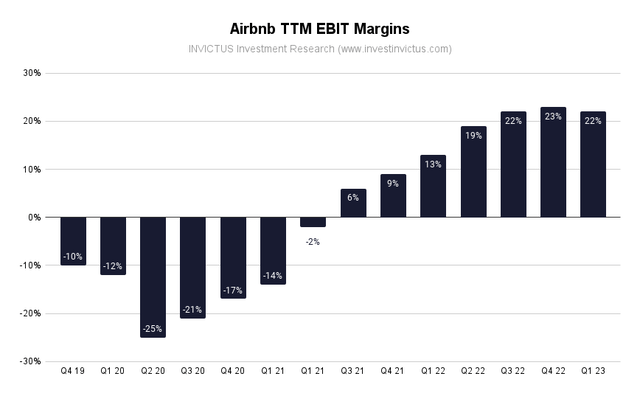

The net result of these efforts is operating leverage:

Margins dropped back to 22% in Q1 due to management’s decision to front-load marketing costs. This will likely continue into Q2, but FY23 margins should be higher than FY22. Reflecting on the company’s evolution since the beginning of the pandemic, CEO Brian Chesky said:

Some of the best companies are born in recessions, they’re born in crisis. Adversity will make great companies better if they can make it through.” – Brian Chesky, CEO

But is ABNB a good investment as it stands today? Here’s are the 3 primary risks I see facing the business today and how I view its long-term prospects.

3 Primary Risks

1. ADRs / Affordability / Profitability

Airbnb reported 20% YoY revenue growth in Q1 FY23. Total Nights & Experiences (N&E) booked over the past year were 413 million, up ~30% from Q4 FY19.

One of the biggest lifts to Airbnb’s profitability, growth, and margin improvement over the last 3-4 years has been ADR (average daily rate) strength. ADRs in Q1 FY23 were $168.45, or 38% higher than in Q1 FY19. North American ADRs are up ~45% over the last 3 years, from ~$165 in 2019 to ~$240 in 2022. For comparison, Marriott’s North American ADRs are up ~13% over the same period.

The strength in ADRs cuts both ways – it has been great for the income statement and hosts, but bad for guests. As noted by Mr. Chesky:

Affordability and great value are key reasons people use Airbnb, and we have to continue to make sure we have that.” – Brian Chesky, CEO

The company has made a few efforts to help with affordability, such as lowering service fees for long-term stays and adding transparency around each booking’s total cost, but the answer to the problem will come by balancing supply and demand (ideally by growing supply). More on this below.

2. The Commoditization of Airbnb

The increasing ADRs and lack of affordability are beginning to show in its bookings data relative to its competition. While Expedia Group (EXPE) reported ADRs in Q1 FY23 of ~$223, down 3.3% YoY, the U.S. hotel segment reported expanding ADRs of ~$158 by May 2023, up from ~$148 in May 2022. Considering Airbnb’s flat ADRs for Q1, this may be an indication guests are rotating out of alternative accommodations into traditional stays.

Additionally, Booking Holdings (BKNG) booked ~270 million global alternative accommodation room nights in 2022 and Q1 growth of 44.3% YoY (Airbnb grew ~22% YoY). Expedia reported growth in the same category of 20.4% YoY.

While Airbnb isn’t distinctly worse in either of these categories, it’s not measurable better, either. It’s not immune to the rest of the industry, and its brand doesn’t seem to be strong enough for guests to pay large premiums for booking on its platform. While I’d still rather own Airbnb than either of these competitors, ADRs are likely having a negative impact on growth, and the best way to fix this problem (supply/host growth) is largely out of the company’s hands.

3. Valuation

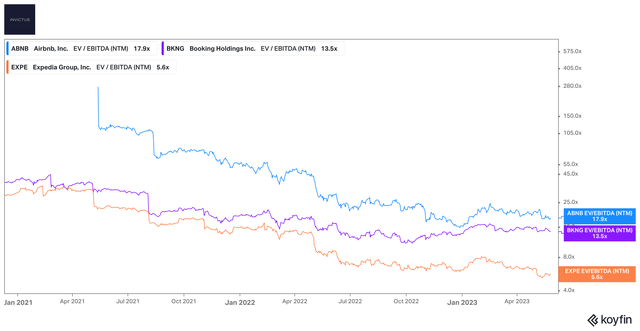

At ~$107 per share, Airbnb has an enterprise value of ~$70 billion (when accounting for the diluted share count). 2023e revenues of ~$9.5 billion and operating margins of ~23%, the business is trading at ~18x EV/EBITDA, a slight premium to its primary competitors, Booking Holdings and Expedia:

Assuming Airbnb grows revenues by ~11% per year over the next 5 years (revenues of ~$16 billion in 2028) and EBIT margins improving to 27%, annual operating income would get to $4.3 billion, or about $5 in EPS (assuming no significant change in share count). Is ~20x 2028e EPS a good price?

Given the competition and the uncertainty of its short-term prospects, my answer is almost. As you’ll read below, I have high expectations for the future of Airbnb and would like to partner with its management team, but the current price is still a bit too high. If Mr. Market gives me a chance to buy in the mid-$90s, my rating would change from HOLD to BUY.

A (Necessarily) Long-Term Investment

Supply & Demand

The single largest metric for Airbnb’s long-term success is the number of active listings on the platform (and balancing supply/demand at a favorable level for guests). This comment from Mr. Chesky on the Q1 FY23 call demonstrates the importance of growing supply:

I think our long-term growth is going to only be as strong as our supply. What happened in 2020 and 2021 was demand grew faster than supply. And initially, this was a great thing. But the problem is that when demand grows faster than supply and there’s supply constraints, prices generally go up. And as prices rose, while that’s been good for the bottom line, affordability in this economy is a major issue [especially for young people]. One of the most important things we can do to make Airbnb affordable is to make sure we have enough supply on the platform.” – Brian Chesky, CEO

The inherent adaptability of the platform (stemming from the economic opportunity available to hosts incentivizing the changes desired by guests) is a great starting point for addressing the supply/demand imbalances. The higher the prices for a given geography or type of listing, the less guests will book and the more hosts will list their homes. As with all supply/demand imbalances, I believe this one will self-correct over time, ideally with an increase in supply.

To that end, supply increased by 18% over Q1 FY22. The company also observed double-digit supply growth across all regions and market types, with the fastest growth in North America (where high ADRs are the highest) and Latin America.

In addition to higher supply, new features like “I’m Flexible”, the “total price” toggle, “Rooms”, “Host Passport”, and more will help alleviate the lack of supply. Each of these initiatives reflects management’s focus on improving the user experience while tackling its major growth hurdle.

The “Moat”

While the service itself (alternative accommodations) is essentially a commodity, there are several things Airbnb has done and continues to do to build its moat:

- Exceptional product design – The Airbnb platform itself is the fastest, simplest, and most user-friendly site to place bookings. Plus, becoming a new host takes just a few hours and many hosts receive their first booking within a few days of their listing going active.

- The Airbnb Brand – Nearly 40% of new hosts start out as guests, which speaks to the importance of Airbnb’s brand and reinforcing its image as the place to go (for both guests and hosts) in alternative accommodations.

- Host quality – Despite the speed at which you can become a host, the background check, host reviews, and other features (like “Host Passport”) help Airbnb maintain its reputation as a clean and safe place to book stays.

At this point, Airbnb has sustainable competitive advantages and a growing moat in alternative accommodations. New tools and features are improving the experience for guests and hosts, and supply continues to grow at an impressive clip. Airbnb ended Q1 FY23 with ~$8.6 billion of net cash and generated free cash flow of ~$3.8 billion in the past year.

That said, I don’t believe Airbnb has a robust moat (it would be extremely hard to build given the capital-light nature of the business model). Still, its platform, team, and management give it as much as much of a moat as a company can have in this space, as evidenced by its leading market position.

Conclusion

Despite being down ~50% from ATHs and strong long-term economics, my decision right now is to wait. As noted in the ‘Valuation’ section above, if there is an opportunity to buy ABNB in the mid-$90s I would happily invest. As it stands today, I do not have a high enough degree of conviction in its future to warrant an investment at this price, regardless of how much I like the management.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.