Summary:

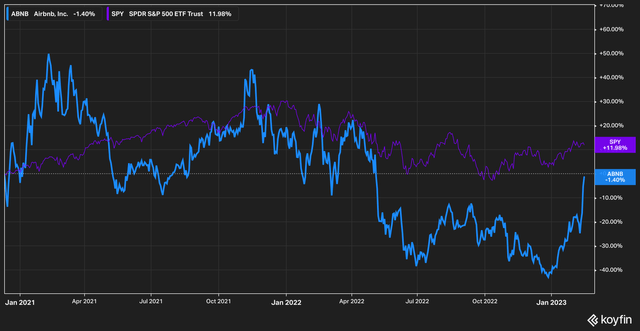

- Airbnb is currently trading near its initial public offering price.

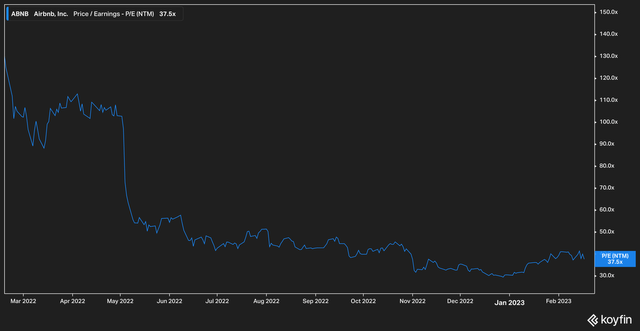

- The company is trading at a historically low multiple.

- The asset-light nature of its business and clear growth runway are a powerful combination.

AJ_Watt

The Little Unicorn That Could

In the world of tech start-ups, it’s a rarity to find a company that makes money. It’s even more rare to find a company that consistently makes money. From that pool, it’s even more rare still to find a profitable company that was once known as a ‘unicorn’ in the halcyon, zero-interest days of the 2010s.

Airbnb (NASDAQ:ABNB), however, is just one such example of this – a multi-billion dollar valued startup that has since gone public and has not only successfully navigated Covid and rising interest rates but has been able to generate profits while doing so. In this article, we will outline why Airbnb stock is one of our top picks for the long haul.

Airbnb recently posted impressive quarterly and full year results, with top-line revenue increasing 71% from 2021 to 2022, and cash from operations jumping by 67% in the same time frame.

Started From The Bottom

Airbnb went public on December 10, 2020, rallied up to around 50% above its listing price, and then making a long, creeping decline to a 40% discount from its price. Since then, the stock has made another swing up, completing a full round turn – the stock now trades right around its IPO levels today.

Airbnb’s business connects hosts with guests to either rent a space in their home or an entire home, offering an alternative to traditional hotels. The business also presents an attractive, and unique, combination: the asset-light flexibility of a software company with the real-world scale of an international travel and leisure company.

We believe it’s easy for investors to write off Airbnb as just another software startup, as a company with a big budget actively but futilely trying to ‘disrupt’ a traditional industry. In this way, we think it’s useful to compare Airbnb to companies like DoorDash (DASH), or Uber (UBER). While an off-hand comparison might seem appropriate, we believe the simple fact that the company has established eight sequential quarters of positive free cash flow demonstrates a degree of consistency that sets it apart from other disruptors.

We also believe that the travel and leisure industry is better suited for disruption than gig-based food delivery or transportation. The food delivery industry as we know it today was, essentially, kind of invented by companies like DoodDash. Regional taxi businesses never really had national or global aspirations the way Uber does, and the local and regional barriers to entry are the biggest pain points. Renting someone’s house, though, poses few such issues.

Share-Based Compensation

One of our most consistent complaints about tech companies surrounds excessive use of share-based compensation. While it is treated as a non-cash expense, share-based comp does come with a price tag for a certain group: shareholders. By issuing large amounts of new shares to compensate employees, the result is effectively a reverse buyback – existing shareholders get diluted and see their representative ownership lose value.

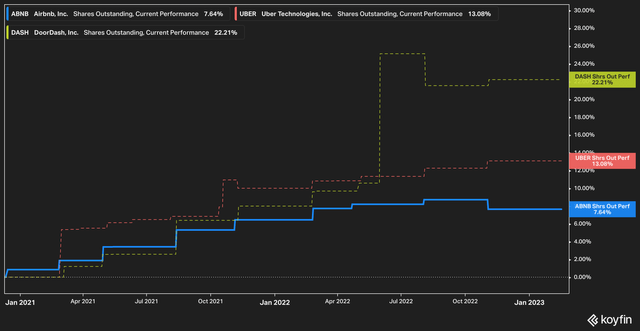

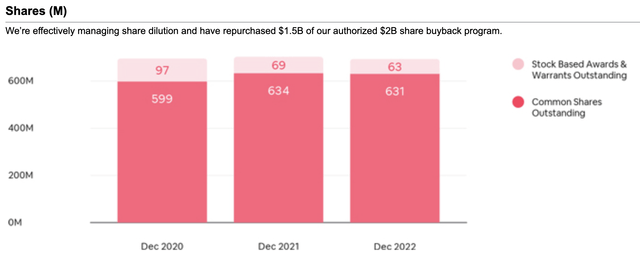

ABNB Shares (Company Presentation)

For its part, management has done well to not allow share-based comp to spiral out of control. While we believe the range of the Y-axis on the chart above presented by the company might help to obscure the fact that growth in the issued share base has taken place, we want to point out that the growth has not been close to that of its disruptor peers.

Since the IPO, Airbnb’s outstanding issued shares have grown by a little more than 7%, while Uber’s and DoorDash’s have increased by 13% and 22%, respectively.

Customer Acquisition Costs

As companies scale, so should efficiencies. All too often we encounter companies that claim to be achieving economies of scale only to find that the growth of their costs outpaces revenue growth, creating an unsustainable situation.

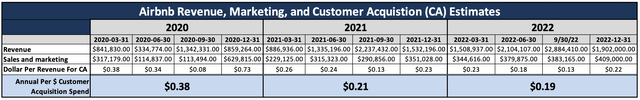

Company Data, Author Formatting

Customer acquisition costs are something we focus on when assessing a growth company more than many other cost metrics for a few reasons. First, it’s a cost that has a direct tie-in to revenue. Since companies feel the pressure to produce top-line revenue and meet investor and analyst expectations, the impetus to overspend on marketing to bring in new revenue is quite strong. Second, a properly scaling customer acquisition cost indicates that the brand and company have strong top-of-mind traction with its customer base and indicates that the brand is likely a leader in its space.

Further, because this is a cost that has a direct impact on revenue – as opposed to, say, office supplies – it provides us with a powerful indication of how efficient a company is. On a more opinionated note, we believe it also gives investors insight into how desperate management is for revenue. Management without an effective way of generating revenue, and who need to meet top-line expectations, can easily be tempted to overspend.

Airbnb does not suffer from this problem. As revenue has increased year over year since 2020, marketing costs have dropped as a percentage of revenue. In 2020, Airbnb spent $0.38 of every dollar on marketing, or customer acquisition. In 2022 that figure dropped to $0.19 of every dollar.

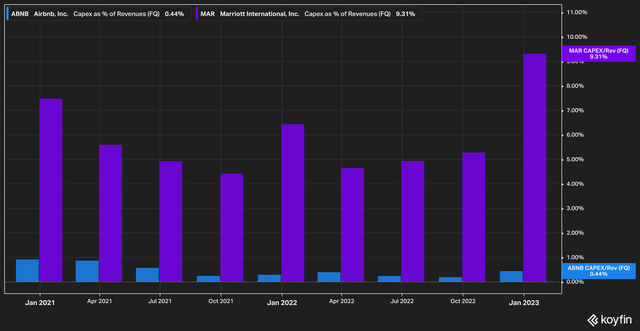

Light In The Assets

In the business of lodging, it’s worth revisiting the advantage that Airbnb as a software business has over traditional hotel chains like Marriott (MAR). Of course, we acknowledge serious differences between Airbnb and the hotel and lodging companies whose business it is disrupting. Airbnb, for example, does not incur enormous labor costs, property maintenance and heavy CapEx.

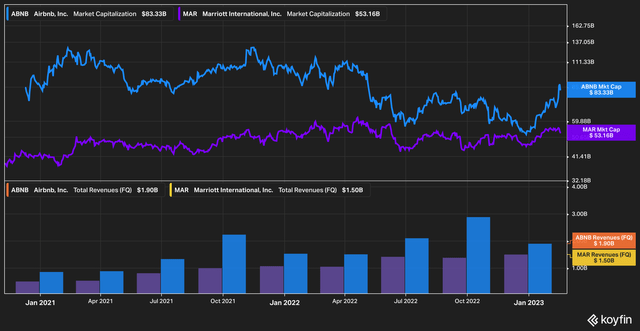

Airbnb bears have made much of the fact that Airbnb’s market capitalization is greater than that of the traditional hotel chain Marriott.

We point out in reply that the figure less publicized about Airbnb is that Its revenue has outmatched Marriott’s for the last nine quarters.

Where we really start to see the difference, however, is when we examine the capital expenditures required to maintain and grow a business like Marriott’s versus Airbnb’s.

Last quarter, Marriott spent 9% of its overall revenue on capital expenditures. Admittedly, the last quarter was higher than average, but all the same what seems to be average for Marriott is over 5% of revenue. These costs cover new property acquisition, expansion, and upgrades: three things Marriott can hardly skimp on.

Airbnb, meanwhile, has consistently had to expend less than 1% of its quarterly revenue on capital expenditures. This level of efficiency structurally cannot be matched by traditional lodging operations.

Operational Issues

As a lodging market-maker, Airbnb facilitates transactions between two parties: hosts who provide lodging and guests who book them. As the middleman, Airbnb allows a significant amount of leeway to its hosts to craft the stay and associated charges (cleaning, etc.), as they see fit. Recently, however, guests have begun to push back against excessive fees and host requests.

This is, of course, the trade-off for not having standardized hotel rooms, and the balance of being a good guest and a gracious host has typically existed on the platform naturally, with guest reviews functioning as a way to weed out hosts with excessive requests.

While not every host presents outrageous requests of guests, Airbnb’s management has thankfully recognized the threat is real, without overreacting. The measured response of highlighting hidden fees prior to guest stays shows us that management is not given to knee-jerk reactions in response to viral guest claims.

We believe that these sorts of public-perception issues are the biggest risk to our thesis over time. In the near term travel could slow and people may delay vacations – but they won’t do so permanently, and as long as there are hosts willing to utilize the scale of Airbnb’s platform to generate consistent booking revenue, the company should thrive.

Thus, a major scandal or event that would cause the company’s reputation to be damaged, the slow erosion of guest and host trust via operational shortfalls, or a rival who can find a way to steal market share, are the things we envision creating serious problems for the brand going forward over the long term.

The Bottom Line

We believe that Airbnb has a structurally attractive and unique business: it operates a software business that has tangible, industry-shaking impacts without incurring the tangible property costs of other players in the space.

Critics point out that Airbnb is not cheap relative to the market. We point out that the valuation has already fallen considerably over the past year.

Not long ago, the stock traded at over 100x forward earnings. Today, it trades at 27x, all while being priced right near its original IPO price.

Thus, we contend that investors who buy Airbnb at these prices are:

- Now buying a more time-tested company with multiple quarters of free cash flow and profits vs a questionable IPO without a profitable track record.

- They are getting Airbnb at a much lower valuation than when it was initially offered.

- They are purchasing for close to the offering price.

Given the large runway and potential growth the company still has, we are quite bullish on Airbnb’s future prospects.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.