Summary:

- Q2 2024 financials show a 12% YoY increase in gross booking value and $2.75 billion in revenue despite rising costs and shorter booking lead times.

- Key growth drivers for Airbnb include product innovation like co-hosting, high-quality listings, relaunching Experiences, and international expansion in under-penetrated markets.

- Regulatory risks and competition from VRBO and hotels persist, but Airbnb’s unique offerings and strong cash flow position it well for future growth.

Flashpop/DigitalVision via Getty Images

I reviewed Airbnb, Inc. (NASDAQ:ABNB) nearly a year ago. Since that time, the stock has increased by nearly 15%, although it’s trailing the broader market as the S&P 500 has returned nearly 40% YTD.

Long-term investors shouldn’t fret as I am still as bullish on the business as I was a year ago. Like Google and Kleenex, Airbnb has turned into a noun and a verb in the travel industry. Also, the company is still led by an exceptional founder and CEO, Brian Chesky. In my view, Airbnb maintains their moat in the travel industry.

Now, let’s dig into some details including company updates and the organization’s recent financial results.

Product Innovation & Future Outlook

On their Q2 earnings call, CEO Brian Chesky gave some updates on a few of Airbnb’s strategic priorities. The first I’ll mention is hosting. The company is providing more tools to hosts and in Q2 this led to over 8 million active listings. Chesky also noted soon the company will be launching a new “co-hosting” service. This was what Chesky had to say about the new feature, “This fall, this October, we’re going to be launching a really important new host service. It’s essentially a co-hosting marketplace. So, there are people who have homes, but they don’t have time. There are other people in the world that have time, but they don’t have a home. And so, there’s a Venn diagram of people today who have both that get host. But what if we can match those two people together? That would unlock a lot more inventory.”

I will be curious to see how this co-hosting service evolves as I could easily see some people not having the time to host, and other individuals might be looking for a side hustle but don’t have the rental property or second house to rent out.

Another key focus is ensuring the listings are of high quality. Chesky noted removing over 200,000 listings that didn’t meet guests’ expectations. Personally, I think it’s great to see Airbnb reviewing guest reviews as often I see bad experiences mentioned on social media. I’m glad to see subpar hosts are being removed from the platform.

Chesky also noted Airbnb is relaunching Experiences. Airbnb is hoping to make these experiences more unique, and more affordable and the company needs to do a better job of marketing these unique experiences. Experiences have continued to be a disappointment I would say, but I’m hopeful that Airbnb can grow from past learnings and make this a better, more interconnected feature within Airbnb’s ecosystem. If experiences can follow the success of “Icons” which has had over 40 million views since being launched and is more discoverable to consumers, I think this can be another avenue for growth if unique and differentiated experiences can be found.

Another interesting aspect of the call was talking about further international expansion. Currently, Airbnb has five deeply penetrated markets which are the United States, Canada, France, Australia, and the United Kingdom. Chesky noted numerous countries where there are growth opportunities which include Italy, Spain, Switzerland, Belgium, and the Netherlands in Europe, Columbia, Peru, and Argentina in South America, and China, India, Korea, and Japan in Asia. On international expansion related to these countries, Chesky went on to state, “I literally think there are tens of billions of dollars of gross booking value increase just by getting all the aforementioned countries to the current market penetration of Canada or Australia. If we can get those countries to Canada, Australia there are tens of billions of dollars, and it’s just something we’ve had to focus – we’re going to focus on. It’s something we hadn’t focused on in the last four years as much.”

From this call, I think there is a lot to be optimistic about from the viewpoint of a long-term investor. The company is trying to create features and enhancements to optimize the core business, but there are numerous ways Airbnb can continue to grow revenue from co-hosting, by creating unique experiences and from further international expansion.

Business and Financial Results

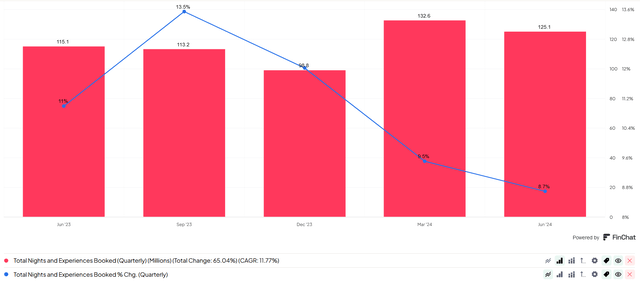

During the quarter, Airbnb had 125.1 million nights and experiences booked which as you can see from the graphic below has steadily increased, up 9%, compared to the prior year, although as the blue line illustrates growth rates are declining:

In Q2 2024 the gross booking value was $21.2 billion which is a 12% increase year over year. The average daily rate was roughly $170 for the quarter which is 3% higher compared to Q2 2023 and the take rate was 13%.

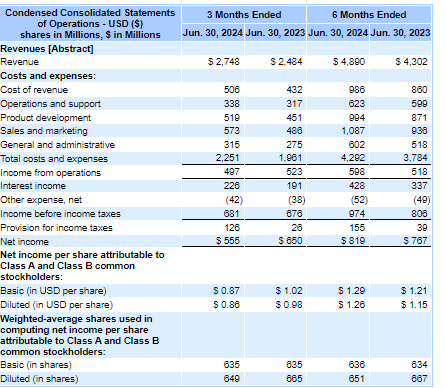

In Q2 2024, revenue for Airbnb was $2.75 billion which is an increase of 11% compared to Q2 2023. Although revenue increased, net income declined for the period as the company’s total costs and expenses increased compared to the prior year as you can see below:

SEC.gov

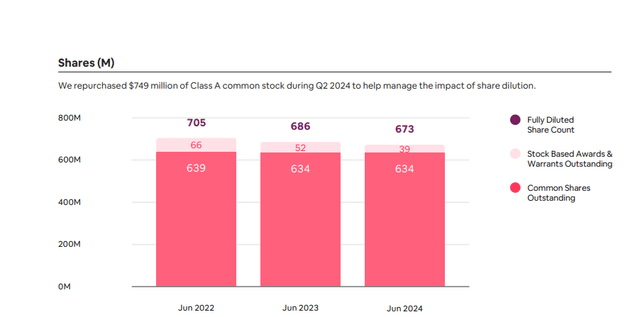

One positive for investors is that the company did repurchase roughly $750 million of Class A during the quarter which is helping to offset stock-based compensation as you can see from the below graphic from the company’s Q2 shareholder letter:

Under the company’s stock repurchase program, the company can still repurchase up to $5.25 billion in stock.

Despite beating revenue expectations for the quarter, the market didn’t particularly like Airbnb’s Q3 2024 outlook. For Q3 2024, Airbnb expects revenues in the range of $3.67 billion to $3.73 billion which would represent an increase of 8% to 10%. Management noted the company is noticing shorter booking lead times for upcoming travel.

Management provided some commentary on this situation as the company’s CFO, Ellie Mertz had this to say about the shorter lead times, “What we’ve seen more recently and in particular in July is a shrinking of the lead times and in particular what we’ve seen is that there continues to be very strong growth of the shorter lead times. So anything from same day to next week to a couple of weeks from now. But what we’re not seeing the same level of strength is in those longer lead times.”

Mertz continued by saying, “I suspect that’s what we’re seeing right now and the – I would say the silver lining with regard to the trends that we see right now, it’s not that consumers are not necessarily going to book that trip for Thanksgiving or Christmas. It just appears that they have not booked it yet. So we’re closely following all the trends on lead times, but it is a factor that informs the outlook that we provided for Q3.”

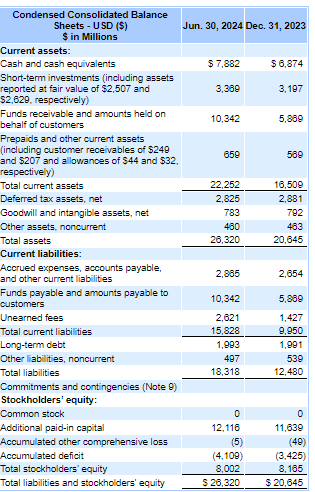

Airbnb still has a fantastic balance sheet with roughly $7.8 billion in cash which greatly surpasses the company’s long-term debt obligations. Furthermore, the company has more have enough current assets to cover their current liabilities as you can see below:

SEC.gov

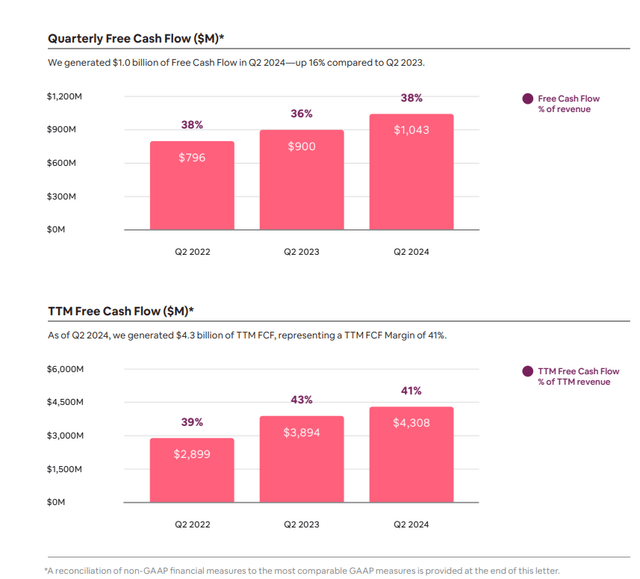

From a cash flow perspective, Airbnb generated $1 billion in free cash flow for the quarter and the company’s total trailing 12-month free cash was at over $4.3 billion which is a record for the company. These are impressive metrics as the company is a cash cow and these amounts have continued to grow as shown in the graphics below:

Risks

As I noted in my prior article, I believe regulation remains the largest risk for Airbnb. Many local, state, and international countries have placed restrictions or regulations in place surrounding short-term rentals. However, few have been as strict as New York’s Local Law 18 (LL18).

Recently, Airbnb published a critical piece on LL18 stating there is no evidence the regulation has benefited New Yorkers. Data from the article states hotel rates grew by over 7% which far surpasses the national average. Rent costs in New York City were also higher than the national average.

Within the article, Brooklyn’s Chamber of Commerce President and CEO stated, “The reality has been a significant setback for Brooklyn’s tourism and local economy, without the corresponding promised increase in rental housing availability the government hoped for. We hope the City Council carefully revisits the law to support the local homeowners and economic development of communities in the outer boroughs.”

Airbnb’s VP of Public Policy went even further by stating, “New York City’s short-term rental regulations have backfired-disproportionately impacting outer borough communities, driving up travel costs, and doing nothing to solve the housing crisis. Instead of improving affordability, these regulations have priced out everyday consumers and left former hosts struggling to make ends meet.”

Despite this being a global issue for the company in the long term I think countries, states, and local governments will realize a strict ban on short-term rentals is not the answer when it comes to creating affordable housing.

Another perceptible risk is Airbnb’s competition with the likes of VRBO and hotels. Regarding VRBO, Airbnb has a first-mover advantage, more inventory, and lets you rent out a single room compared to VRBO, so I think Airbnb has a leg up on VRBO. In terms of hotels, I think Brian Chesky explained perfectly on this earnings call that Airbnb is great for family trips and unique, one-of-a-kind, bookings. Whereas hotels are good for business stays and in general are better for guests looking for reliable features such as having a front desk, cleaning services, etc…

Personally, I’ve found this to be true for my family and numerous friends. Hotels are better for business and one-night stays and Airbnb is great for large outings and for having a differentiated experience a hotel couldn’t possibly provide.

Chesky made an interesting comment regarding hotels on the earnings call stating, “We do think between filling in a network gap and getting more of those one-night business travel stays, there is an opportunity to offer hotels on Airbnb, and we have a lot of hotels. We have hundreds of thousands of boutique hotels and non-home inventory on Airbnb, and we’re going to continue to expand that over the years to come.”

However, Chesky did emphasize adding hotels or one-night options would likely be limited as the company’s key focus is on unique properties you can’t find at hotels, and he wouldn’t want “philosophical misalignment” to occur.

Valuation

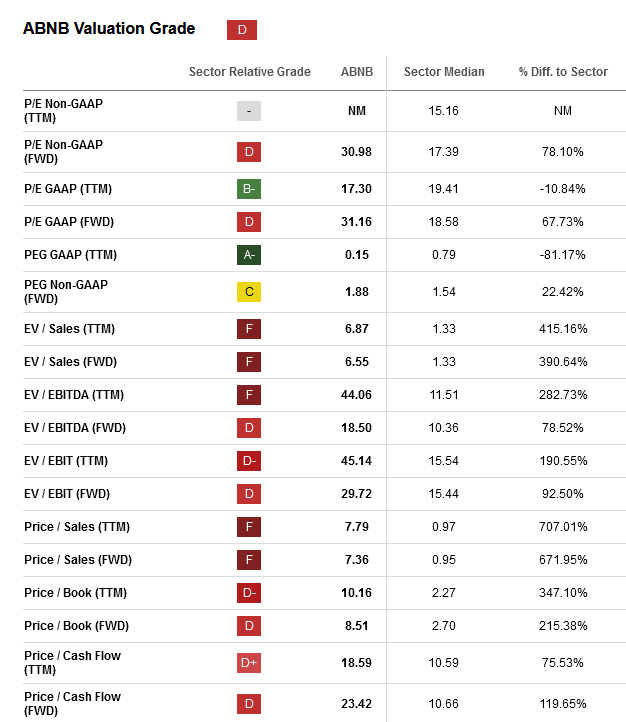

Seeking Alpha’s valuation grade for Airbnb is a “D” as you can see below:

Seeking Alpha

As Airbnb is profitable, I think the P/E ratio is the best valuation metric to view this company.

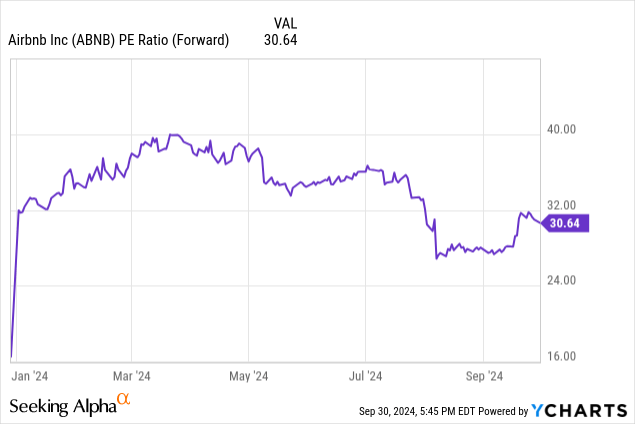

Although Airbnb’s forward P/E ratio is still above the sector median, it is to come down compared to when the ratio was near 40 in Q1 of 2024:

While this metric shows Airbnb isn’t especially cheap, I think it’s reasonable given that analysts can still expect double-digit growth in the years to come.

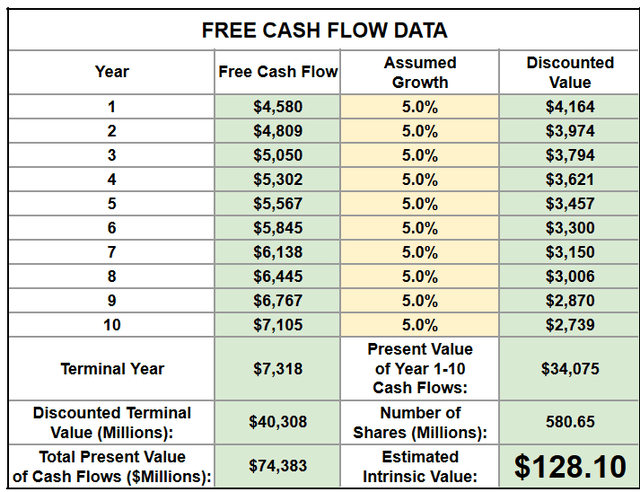

Also, using a reverse discounted cash flow model with a discounted rate of 10% and a terminal rate of 3% and assumed growth of only 5%, I come to an estimated intrinsic value near the current share price:

I think certainly think Airbnb will grow by more than 5%, so I am a buyer at these prices.

Conclusion

Airbnb is a wonderful founder-led growth that continues to grow and is a cash cow as the company had a record total trailing 12-month free cash flow of over $4.3 billion for the quarter. Although the growth in nights and experience booking is slowing and in the short term, there is some uncertainty regarding booking lead times, the company has numerous growth opportunities in both the near and distant future.

Regulation will continue to be worth following as this could hamper the company’s growth opportunities, especially as the company looks to gain share in less penetrated markets. However, I believe the situation in New York City illustrates that such a strict ban on short-term rentals is not a magic fix for solving the complexities surrounding affordable housing.

Airbnb seems reasonably priced, and I will continue to add to my current position at these levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.