Summary:

- Airbnb reported great Q4 earnings and also reported its first profitable year of $1.893B.

- It faces expected headwinds and potential fluctuations in demand due to the macro environment and the possibility of a COVID-related resurgence.

- Competitors are making the playing field more competitive by offering great prices, deals, and locations at mid-to-high-end hotels.

imaginima/E+ via Getty Images

On February 15, 2023, Airbnb (NASDAQ:ABNB) announced its fourth-quarter 2022 earnings report, beating analysts’ expectations on both the top and bottom lines.

Airbnb, the popular online vacation rental marketplace, posted Q4 2022 results that exceeded expectations on both the top and bottom line, as travel bookings rebounded after a difficult year due to the COVID-19 pandemic.

Stellar Q4 and full year 2022 earnings

Airbnb’s fourth-quarter revenue increased by 24% compared to the same period the previous year. The company’s net income for the quarter was $319 million, a significant improvement from $55 million in the previous year, while the adjusted earnings before interest, taxes, depreciation, and amortization totaled $506 million, exceeding analysts’ expectations of $432 million.

The results reflect the continued recovery of the travel industry, as demand for travel rebounds after the COVID-19 pandemic. Despite this positive news, there are several factors that may affect Airbnb’s future earnings potential.

The good news is that the travel industry is recovering, and Airbnb’s Q4 was solid. Let’s first dive into the positives. There are reasons to be optimistic about Airbnb’s future earnings potential. The company’s Q4 2022 earnings report showed that it was able to exceed expectations, indicating that there is still strong demand for vacation rentals. Additionally, while some markets may be saturated, there are many areas where Airbnb is underpenetrated, which suggests that there is still significant growth potential for the company.

Competition is heightened and demand is slowly diminishing

First, demand and booked nights are becoming increasingly saturated. According to Yahoo Finance’s report, many Airbnb hosts and managers are reporting that the market is oversaturated, with a surplus of inventory available for rental. For example, an Airbnb manager in Arizona with 95 short-term units reported that just days before the Super Bowl, 50% of his inventory was already booked, but he had to cut his prices by about 50% from $1000 during special events to fill the remaining inventory. This highlights the intense competition in the market, and the challenges hosts and managers face in filling their available rentals.

In addition, the introduction of a category called OMG has also led to challenges for some hosts, as they have had to lower their prices in order to attract guests.

Despite these challenges, Airbnb has continued to experience growth, with active listings increasing by 16%. However, this growth has outpaced demand, leading to falling occupancy levels, hence the competition is fierce. This competition is not only coming from other short-term rental listings but also from hotels, which are increasingly listing their inventory on Airbnb’s platform.

Finally, regulatory risks remain a potential threat to Airbnb’s business. As we have seen in Palm Springs, California, officials have passed legislation to restrict short-term rental units in certain neighborhoods. Other cities may follow suit, but Airbnb has a global reach and presence that should help to soften the downside impact.

Expectation for 2023 amid growth in travel demand

In terms of Airbnb’s Q1 and Q2 2023 earnings potential, there are several factors to consider. On the positive side, the lowering risk of COVID-19 is likely to lead to increased travel demand, particularly in markets that were previously hard hit by the pandemic. Additionally, as travel restrictions continue to be lifted, it’s expected to see more people booking vacations and utilizing Airbnb’s platform.

In January 2023, web traffic to global travel sites demonstrated a strong rebound in travel and accommodation demand, with double-digit growth across the board, signaling a solid recovery.

|

Company |

Total Visits (Nov) |

Growth (Nov to Dec) |

Total Visits (Dec) |

Total Visits (Jan) |

Last Month Growth (Dec-Jan) |

|

Airbnb (ABNB) |

84.1m |

6.30% |

89.4m |

105.8m |

18.29% |

|

Booking Holdings (BKNG) |

464.3m |

2.73% |

477m |

563.8m |

18.02% |

|

Expedia (EXPE) |

70.7 |

6.35% |

75.2 |

92.2 |

22.61% |

|

Hotels.com |

45.1m |

-1.33% |

44.5m |

53m |

19.33% |

|

Marriott (MAR) |

45.3m |

5.94% |

48m |

53.1m |

10.44% |

|

Hilton (HLT) |

29.5m |

8.81% |

32.1m |

37.3m |

15.95% |

In terms of market cap, revenue, net income, and P/E ratio, Airbnb and Booking Holdings are the most comparable peers in the sector.

Currently, market consensus expects Airbnb’s EPS in 2023 to be $3.45 for the full year, representing a 23.5% YoY increase. While this expectation is on the higher end, it is a reasonable pullback from the 40.2% YoY growth seen in 2022. Observations of website traffic and visit growth in January, which exceeded December’s travel season, suggest a decent growth trajectory.

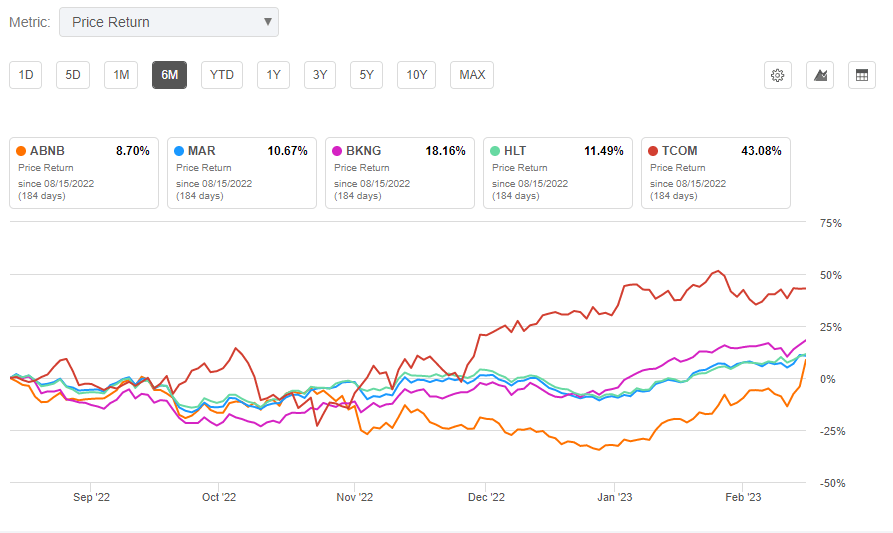

Regarding price action, BKNG has seen an over 18% upside in the past six months while ABNB has only risen by 8.7%. Both stocks have relatively expensive forward P/E ratios of 39.76 and 37.57 for ABNB and BKNG, respectively. Additionally, BKNG’s total revenue in 2022 exceeded $16.02B, while ABNB only reached just over $8.40B. However, ABNB’s net income margin in 2022 was 22.54%, 47.9% higher than BKNG’s 15.24%.

Overall, ABNB has more room to expand its product and service offerings, providing room for top-line expansion.

6-month price performance for ABNB and peers (Seeking Alpha)

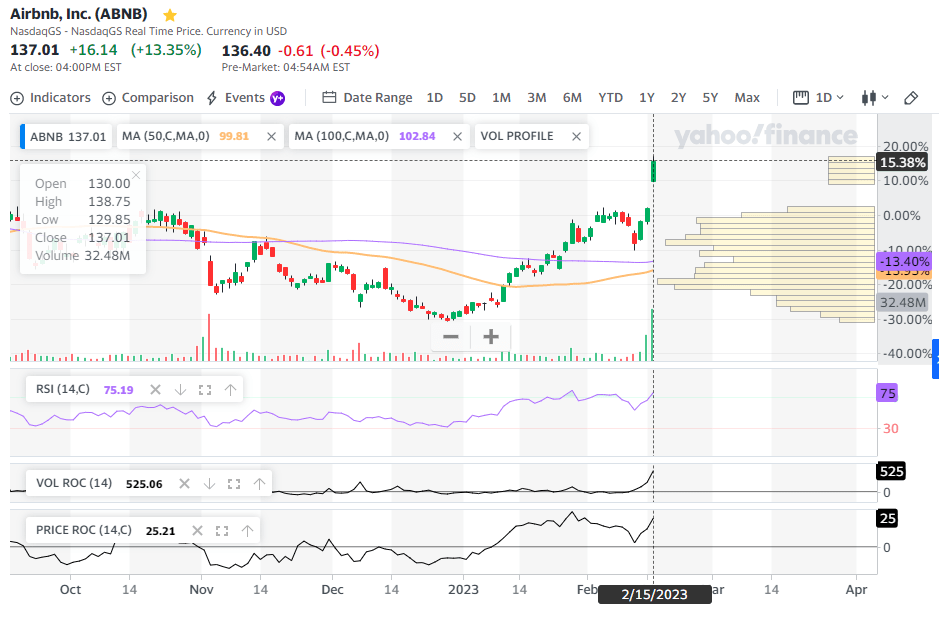

However, the recent price increase in ABNB’s stock after Q4 earnings has pushed it to an overbought position, as per the 14-day RSI reading. As a result, investors should expect some volatility in the ABNB stock. On February 16th premarket, the stock price had declined by -0.45%.

ABNB price in overbought territory based on 14-day RSI (Yahoo Finance)

Takeaways: A cautious buy rating

In 2022, Airbnb experienced a great rebound and recovery. The overall rebound in travel demand presents an excellent growth opportunity and tailwind for Airbnb, particularly when compared to its peers and competitors. However, there are also potential risks to consider.

In general, the higher-than-expected CPI, ongoing tightening cycle and monetary policy by the Federal Reserve, and the probability of a recession and challenging macroeconomic environment could weaken ABNB’s business further.

As previously noted, regulatory risks could continue to impact Airbnb’s business, particularly in areas where there is political pressure to limit short-term rental units. Additionally, the continued growth of hotel inventory on Airbnb’s platform could lead to increased competition and lower prices, which would impact Airbnb’s revenue and earnings.

While there are certainly risks to Airbnb’s future earnings potential, the company has shown that it is capable of weathering these challenges and continuing to grow. As such, it’s expected that the company’s Q1 and Q2 2023 earnings will likely show growth, although the rate of growth may be tempered by some of the challenges outlined above.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.