Summary:

- ABNB continues to record profitable growth trends and a healthier balance sheet, with its tailwinds remaining robust through 2024.

- Combined with the optimistic forward guidance, we are not surprised by the promising consensus forward estimates through FY2025, with a projected expanded profit margins.

- However, this has also inflated ABNB’s stock valuations, with it trading well above its fair value and pulling forward much of its upside potential.

- With the SPY retesting its all-time high and the market entering extreme greed territory, it remains to be seen if the ABNB stock can sustain its upward momentum ahead.

Daniel Grizelj

We previously covered Airbnb (NASDAQ:ABNB) in October 2023, discussing how the supply glut was part of the management’s strategy to drive affordability across its listings, which was especially important during these uncertain macroeconomic environment.

However, despite its growing profitability, we had maintained our Hold rating then, since it remained to be seen if the stock was able to justify its premium valuations compared to the sector medians and its travel booking peers.

In this article, we shall discuss why we are maintaining our Hold rating on the ABNB stock, despite the growing profit margins, healthier balance sheet, and near-term travel tailwinds through 2024.

Despite the pulled forward upside potential, it appears that bullish sentiments remain supportive of its premium valuations, attributed to the stock’s higher highs and higher lows since the early 2023.

The ABNB Investment Thesis Remains Expensive Here

For now, ABNB has reported a double beat for FQ3’23 on its earnings call, with revenues of $3.39B (+36.6% QoQ/ +17.8% YoY), GAAP EPS of $6.63 (+576.5% QoQ/ +271% YoY) after taking account into the one-time income tax benefit of $2.8B, and adj EPS of $2.54 (+159.1% QoQ/ +41.8% YoY).

Much of its tailwinds are attributed to the expanding Gross Booking Value of $18.3B (-4.1% QoQ/ +17.3% YoY) and Nights and Experiences Booked at 113.2M (-1.6% QoQ/ +13.5% YoY), triggering an improved Average Daily Rate [ADR] of $161.66 (-2.5% QoQ/ +3.3% YoY).

Readers must also note that ABNB’s ADR is still elevated compared to the average US Hotel ADRs of $158.03 in Q3’23 (based on September 2023 number of $160.16, August 2023 number of $153.60, and July 2023 number of $160.31) and the global Hotel ADRs of $150 as of September 2023.

While the North American region remains its revenue driver at $1.47B (+23.5% QoQ/ +11.3% YoY), the EMEA region at $1.53B (+62.7% QoQ/ +21.4% YoY) has recovered drastically. The APAC region has also grown by +23% compared to FQ3’19 levels and China by over +100% YoY, partly attributed to increased cross-border travels and monthly stays of over three months by nearly +20% YoY.

In addition, ABNB’s remote work strategy has streamlined its assets, while contributing to its minimal capital expenditures, naturally triggering its expanded FCF profitability of $1.31B (+45.5% QoQ/ +36.7% YoY) by the latest quarter.

As a result, it is unsurprising that the company reports improving balance sheet health, with a growing cash/ short-term investment of $10.96B (+5.9% QoQ/ +13.9% YoY) and stable long-term debts of $1.99B (inline QoQ/ YoY).

The ABNB management has also taken advantage of the higher interest rate environment and generated robust net interest income of $186M (-1.2% QoQ/ +244.4% YoY) from its available liquidity, naturally contributing to its profitability fly wheel.

Lastly, the management has opted to return value to existing shareholders, as observed in its consistent share repurchases and share retirement to 660M by the latest quarter (-5M QoQ/ -20M YoY).

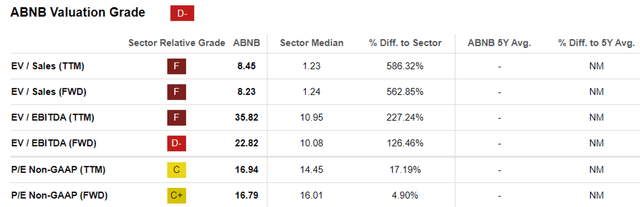

ABNB Valuations

For now, ABNB’s FWD EV/ EBITDA valuations of 22.82x and FWD P/E valuations of 16.79x appear to be mixed, compared to its 1Y mean of 20.52x/ 32.53x and the sector median of 10.08x/ 16.01x, respectively.

Based on its YTD revenues of $7.68B (+18.5% YoY), the management’s FQ4’23 midpoint revenue guidance of $2.15B (-36.5% QoQ/ +13.1% YoY), and its FY2023 EBITDA margin guidance of 36.1%, we may see the company generate an excellent full year EBITDA of $3.54B (+22% YoY).

Combined with its 660M of shares outstanding in the latest quarter, it appears that ABNB may be able to grow its profitability to an impressive adj EBITDA per share of $5.36 in FY2023 (+24.3% YoY).

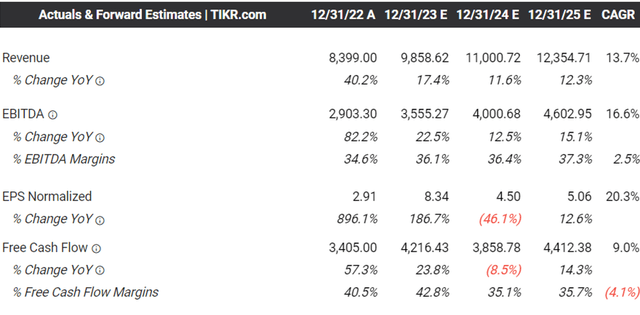

The Consensus Forward Estimates

The optimistic forward guidance may also be why ABNB’s consensus forward estimates are highly promising, with it expected to generate an improve top and bottom line expansion at a CAGR of +13.7% and +16.6% YoY through FY2025.

This builds upon its excellent growth at a CAGR of +26.8% and +178.9% between FY2017 and FY2022, respectively, with the company also recording positive adj EPS profitability in FY2022.

As a result of its profitable growth trend, it appears that ABNB’s premium forward valuations are somehow warranted.

In addition, US Hotel ADRs continued to expand by +3.6% YoY in November 2023, with 75% of the global Hotel ADRs growing at an average of 20% compared to December 2019 levels, implying the robust demand for leisure and travel.

The AITA also reports that global air travel demand is already at 99% of November 2019 levels, with volume projected to exceed pre-pandemic levels in 2024.

Combined with the cooling inflation and the Fed’s speculative pivot from Q1’24 onwards, we can understand why Mr. Market appears highly optimistic as the stock market enters extreme greed territory at the time of writing, similarly lifting ABNB’s inflated stock valuations and prices.

So, Is ABNB Stock A Buy, Sell, Or Hold?

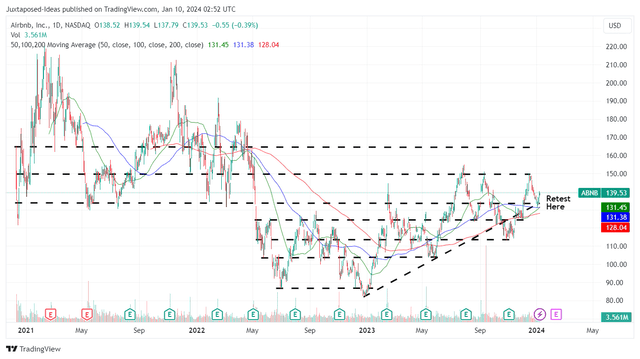

ABNB 3Y Stock Price

However, readers must also note that ABNB is trading well above its fair value of $122.30, based on the FY2023 adj EBITDA per share of $5.36 and its FWD EV/ EBITDA valuation of 22.82x.

At the same time, based on the FY2025 adj EBITDA estimates of $4.6B and the resultant adj EBITDA per share of $6.97, it appears that the stock has also pulled forward most of its upside potential to our long-term price target of $159.

For now, ABNB has rapidly broken out of its 50/ 100/ 200 day moving averages since the October 2023 bottom, with the upward momentum likely to trigger another retest of its previous resistance levels of $140s in the near-term.

It appears that the stock may never come cheap after all, thanks to its highly profitable growth trend. However, we do not believe in chasing high growth stocks at inflated levels, especially with the minimal upside potential as the SPY looks to retest its all-time high at the time of writing.

As a result of the potential volatility, we prefer to continue rating the ABNB stock as a Hold here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.