Summary:

- Investors didn’t welcome Airbnb’s decelerating revenue growth rates.

- And yet, Airbnb reports very strong free cash flows, even considering a slowdown in revenue growth rates.

- I walk through its capital allocation strategy and how investors should think about its 16x forward free cash flow multiple.

Paul Bradbury

Investment Thesis

Airbnb’s (NASDAQ:ABNB) Q2 outlook didn’t quite ooze excitement for new investors. But underneath 6 consecutive quarters of decelerating growth rates, there’s a business that prints free cash flows.

What’s more, Airbnb today is substantially more diversified than at any point in its history, not only geographically, but in serving both guests and hosts.

I make the contrarian call that this is not the time to throw in the towel.

Why Airbnb? Why Now?

Airbnb kicks off the meaty part of its shareholder letter reminding investors that,

We are now twice the size as we were before the pandemic on both a GBV and revenue basis—and with considerably higher profitability and cash flow.

And yet, when all is said and done, today’s share price is down at least 50% from its peak. Investors’ enthusiasm for the asset-light and rapidly diversifying hosting platform has been reset lower.

Revenue Growth Rates Slow Down, So What’s Next?

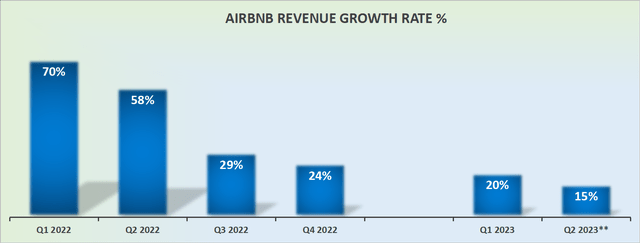

Note, the revenue growth rates shown above are as-reported, GAAP revenues. Not adjusted for FX.

Next, let’s get to the core reason why the share price is down 10% y/y. Airbnb’s guidance was less than enticing. Even considering the tough comparables with the prior year, investors wanted to be positively surprised by Airbnb’s revenue outlook for Q2.

With its growth rates pointing to mid-single digits, this is the sixth consecutive quarter of decelerating revenue growth rates. What was once perceived to be a high-flying secular growth story is now seen in quite a different light. A business that is still growing, but not really gushing growth.

Profitability Profile, The Crown Jewel

Airbnb guides for approximately similar levels of EBITDA in Q2 2023 as in the prior year. Considering that Airbnb is likely to be in building some level of conservatism, we are likely to see this translate into approximately $800 million of free cash flow when everything is said and done.

This implies that Airbnb is likely this year to see around $4.5 billion of free cash flow. Now, allow me to highlight an important element of Airbnb’s business model. Airbnb operates with negative working capital. Its unearned fees is derived from bookings Airbnb collects upfront and then pays out to hosts at the time of guest check-in, which means that Airbnb’s free cash flows always look very strong relative to underlying profitability.

That being said, this free cash flow can only grow alongside the growth in revenues. And if Airbnb’s revenues were to slow down, then we should similarly expect Airbnb’s free cash flows to also slow down.

Airbnb declares that it should see some bumpiness in its EBITDA margin profile throughout 2023, as its marketing spend moves into Q2 rather than Q3 as in 2022. Nevertheless, for 2023 as a whole, EBITDA margins should come in line with 2022, at approximately 35% of EBITDA margins.

Consequently, I believe that investors would do well to base their valuations on approximately $4.5 billion of free cash flow for 2023.

This implies that Airbnb is being priced at approximately 16x this year’s free cash flows.

How Should Investors Think About ABNB’s Stock Valuation?

I recognize that many investors were hoping for stellar growth to emerge from Airbnb. It now appears that “the great reopening” may have fizzled out quicker than many investors had hoped for.

That being said, I’m inclined to believe that most rational investors would be quick to acquiesce that even if Airbnb points to middle-of-the-road growth rates, the business does indeed have a considerable and lasting moat.

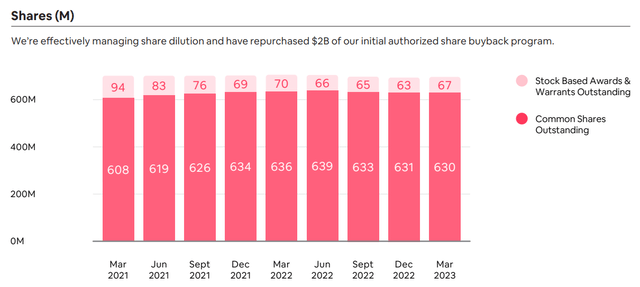

On the other hand, bears will be quick to remark that after Airbnb spent $2 billion in share repurchases or approximately 2.8% of its market cap, the total number of shares outstanding has reduced by 1.3%.

Meaning that yes, Airbnb makes a lot of free cash flow. But after deploying considerable sums, Airbnb’s total number of shares doesn’t appear to be reduced to a great extent.

On yet the other hand, note that Airbnb ended Q1 2023 with more than $8.5 billion of net cash, up more than $1 billion in twelve months, despite buying back around $2 billion of its own shares.

The Bottom Line

Airbnb is a free cash flow machine. Yes, the business may be up against tough comparables. And yes, investors’ expectations were high as investors craved even stronger growth rates to emerge near-term.

But all considered, even though this was not the strongest outlook coming out of Airbnb, I recommend that investors do not throw in the towel.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.