Summary:

- Airbnb reported Q3 earnings after the close Thursday.

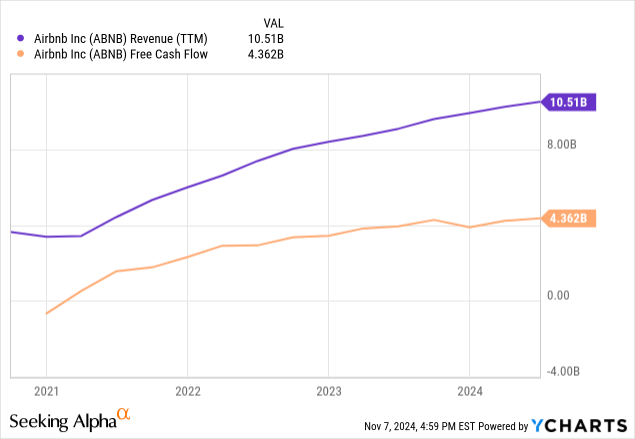

- Growth appears to be marching along nicely and free cash flow generation remains strong.

- The company is great, but the stock is expensive. Wait for a better entry.

Robert Way

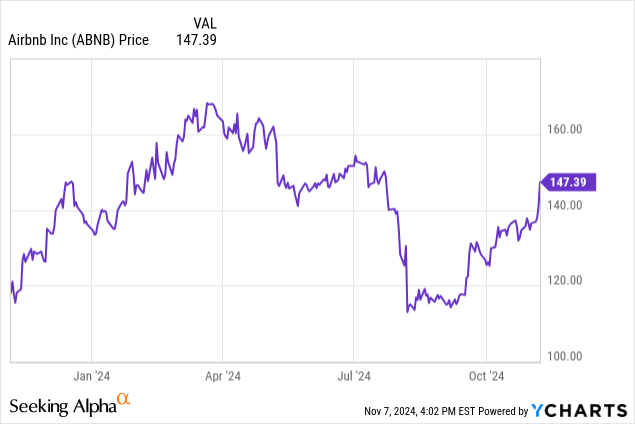

Airbnb (NASDAQ:ABNB) stock is experiencing volatility after the close Thursday following third quarter earnings. The company continues to see increases in bookings and to generate robust cash flow without investing much capital, a winning combo from an investment standpoint. However, the stock is beholden to short-term trends in travel and economic swings, and sports a fairly lofty valuation that makes it hard to recommend a buy at current levels.

ABNB shares have had a volatile 12 months, going as low as $110 in August before rebounding to the high $150 range in after hours trading following the aforementioned third quarter earnings results. Revenue came in at $3.7 billion (+10% YoY), non-GAAP net income of $1.7 billion (-12% YoY due to a higher tax burden), and a net profit margin of 37%. As for business metrics, gross booking value rose to $20.1 billion (+10% YoY, mirroring revenue growth) and nights & experiences booked rose 8% YoY too.

The primary takeaway from these numbers for me is that, despite worries that Airbnb was approaching market saturation, there are still avenues for growth as the company expands its global footprint. The foundations of the business model are already firmly established, and each new geographic area is contributing to operating results while incurring minimal additional expenses. In addition to the impressive profit margin, Airbnb also generated quarterly free cash flow (“FCF”) of $1.1 billion, good for a 29% margin. As revenues continue to grow from international expansion and the gradual uptick in travel spending as developing economies mature, each dollar in sales will be accretive to the bottom line.

Airbnb provided Q4 guidance of revenue between $2.39 billion and $2.44 billion (+8.5% YoY at the midpoint), growth in nights & experiences to increase more than the 8% YoY reported in Q3, and for FCF margin to be “several points above” the expected 35.5% adjusted EBITDA margin, which would be above Q3’s 29% margin and in line with the 38% TTM FCF margin.

With concerns over where new sales will come from in the future, each quarter there is the potential risk that Airbnb’s growth rate will show signs of slowing down, and fortunately for shareholders, the Q4 outlook shows yet again that this fear is unfounded. FCF margin projected to reach around the TTM number for FY 2024 is an encouraging sign as well after the dip in Q3.

While the stock jumped initially after these numbers and then gave up those gains (as I write this article, it’s down 2% after rising 4.5% in regular trading), I think investors should ignore the noise here and just look at the fundamentals. Revenue continues to rise despite competition and concerns over market saturation, FCF and margins are sturdy, and organic growth is strong. The business model appears sustainable, my only issue is with the valuation.

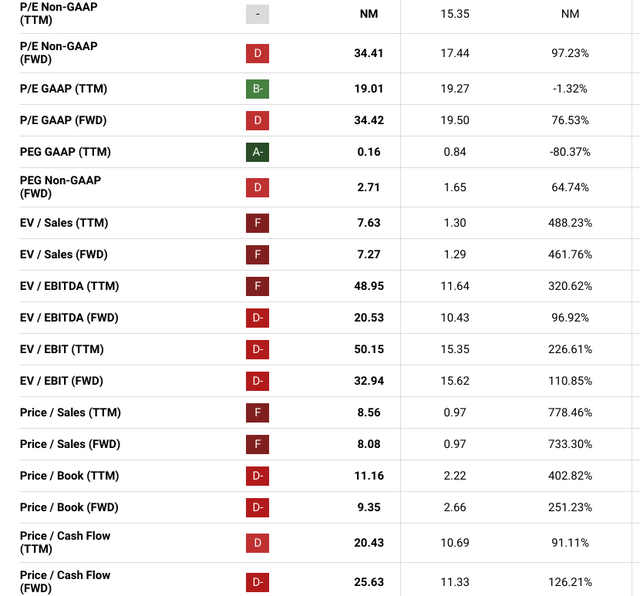

There are very few bright spots here, and even two metrics that look passable are inflated by a $2.8 billion one-time tax benefit that were factored into GAAP metrics. While the balance sheet is clean with $11.2 billion in cash & equivalents & short-term securities relative to just $2 billion in long-term debt, the inflated EV/EBITDA ratio and the P/FCF ratios are my biggest concerns.

It is possible that the company will grow into this valuation as the last few years, despite only being up around 5% from its IPO price, have seen a steady march upwards in core metrics:

With a valuation, this detached from operating results, perhaps predicated on sustained long-term growth and success in the international market, the stock is more vulnerable to short-term demand shocks like those caused by an economic slowdown. I think investors that believe in the business model and have a high risk tolerance might consider holding on to ABNB if they already own it as a small, speculative position in their portfolios.

That said, I haven’t seen anything that would compel me to buy shares while so much of the company’s future growth is already priced in. I do like the company in a vacuum, and it will be on my watchlist to pick up should there be another significant pullback. For now, I think investors should wait and see, and I’m rating ABNB a Hold.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.