Summary:

- Despite positive revenue growth year-on-year, Airbnb, Inc. trends have been in decline for two years now. Income from operations and net income trends show high swings.

- Airbnb’s bid to disrupt the industry stalls as negative user experiences and high fee variability impact user monetization, with legacy industry becoming net beneficiaries.

- Entering additional highly-catered territories is an interesting choice but will likely be an uphill and costly battle.

svetikd/E+ via Getty Images

Airbnb, Inc. (NASDAQ:ABNB) started out with the goal of being “different” from mainstream hotels and lodges by offering experiences via what could be construed as “VERY short-term leases” with the lowest amount of hassle from end users. In a time of “revenge spending,” i.e., an incremental increase in consumer spending after an unprecedented adverse economic event, the company was supposed to do well. Despite this, the stock’s Q4 earnings per share (EPS) missed analysts’ consensus expectations of $0.70. The reasons why the company failed to meet them are an interplay of a number of ancillary factors paired with key line item trends.

Deep Trend Drilldown

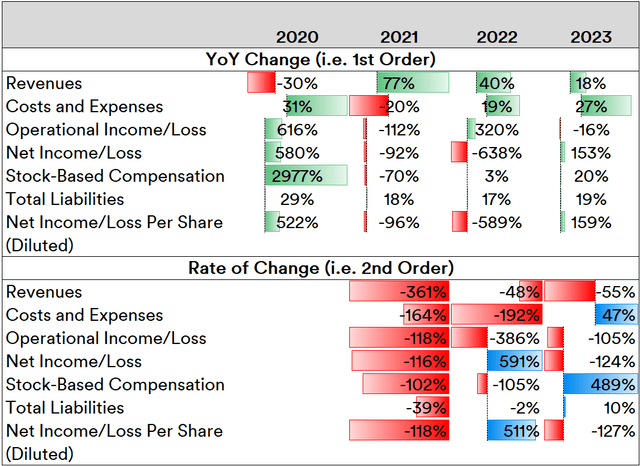

In absolute terms, the company’s line item trends are a decidedly mixed bag when comparing yearly trends (“1st-order”) vs. trend growth changes (“2nd-order”):

Source: Created by Sandeep G. Rao using data from Airbnb’s Financial Statements

While revenues have risen for three years, the company’s costs have not been nearly as proportional. What’s concerning is that revenue growth (2nd-order) has been halving for two years straight. On the net income front, it has been a roller coaster in both 1st and 2nd order terms. The same goes, of course, for net income attributable on a per-share basis. In the most recent year, however, the per-share net income growth trend is negative while the 1st-order trend doesn’t recover nearly as much ground as was lost in 2022. Now, the company registered a net income loss of $349 million in Q4 2023, a large factor for which is the $620 million payout made to settle a tax claim from the Italian government. Overall, this is 41% of the net income earned by the company for the entire year. While this would certainly buck the net income trend, the rest of the trends inferred would have been unchanged.

Given the company’s relatively recent “public” status, stock-based compensation might be a concern for some investors, given its potential (obligatory) impact on the bottom line. In this item, there has been a substantial uptick in expenditure relative to the general downtrend over the past two years. However, this is not as substantial as in 2020.

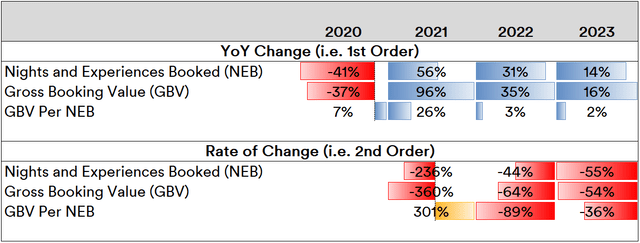

For a “gig economy” company, volume is everything, as it seeks to quell the growth of new rivals and disrupt the industry it is operating in. Given this paradigm, it could be argued that massive spending is required to maintain revenue growth that is necessary to outline the value it offers to end users. The company’s published key business metrics don’t necessarily reflect this.

Source: Created by Sandeep G. Rao using data from Airbnb’s Financial Statements

After 2021, the number of nights and experiences booked does tend to march in lockstep with gross booking. In 2nd-order terms, however, the growth of these metrics has been in double-digit negatives since. The derived “booking per night or experience” ratio is an indicator of the premium for the experience the company purportedly offers end users: after the massive boom in 2021, there has been a slip to a level well under half of that in 2020. 2nd-order terms indicate that it is less worse than in 2022, but that’s no small comfort given the modest ratio contribution.

Customers Sour, The Model Breaks

Early in 2021, American comedian Tim Dillon described in his popular podcast an incident involving an Airbnb property wherein he was charged an additional cleaning fee. In a subsequent appearance on Joe Rogan Experience podcast on Spotify, the events that transpired in the course of his booking ultimately resulted in him being permanently banned from Airbnb. “Events that transpired” notwithstanding, casual observation shows the digital footprint of negative experiences with the company’s offerings appears to significantly outweigh the positive in nearly every major social media forum (even on the AirBnB subreddit, which is a Top 1% channel on that platform).

Mr. Dillon’s experience highlights a key problem with the service Airbnb offers: even if the property were to be as advertised, add-on fees have a high potential to sour a user’s experience and impact their budget. Numerous surveys indicate that favor towards the company’s offerings has been slipping since 2019, which was reaffirmed in 2021 as well as in 2022. This is a far cry from 2015 when Goldman Sachs reported overall favorability tilted towards Airbnb (and away from traditional hotels) after a first-time user avails its services.

Given the vast outlay of host properties across a large number of nations and regions, it’s entirely logical to assume that manually ensuring a high quality of experience and effectively adjudicating issues would be prohibitively expensive (if not impossible). Further personnel costs would also likely elevate the pricing for the end user (or “guest”) well above the average cost charged by most hotels. In other words, the operating model would break.

In Conclusion

Taking into account survey trends vis-à-vis line item trends, it’s evident that the company is struggling with onboarding new users and maintaining a high level of repeat business from those already on the platform despite the company reporting that two-thirds of its platform hosts now offer weekly or monthly discounts. The company is working on expanding its footprint in Switzerland, Belgium and the Netherlands. Given that at least two of these territories are traveler favorites that are exceptionally well-catered by hotels, lodges and hostels, it remains to be seen if this will turn the company’s growth outlook around without significant additional costs. Added to that is the fact that a stalling in “vacation splurging” trends, highlighted in the middle of last year, delivers a macroeconomic bearish impetus that would likely weigh down the company’s growth.

All in all, Airbnb, Inc. definitely is a “wait and see.” Current trends indicate that the industry Airbnb is operating in does not face a significant disruption from its operations, while end user preferences do not show significant monetizable upticks. Stock price corrections wouldn’t entirely be out of order.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.