Summary:

- Airbnb buyers received a pleasant surprise as the news of ABNB’s impending addition to the S&P 500 helped it recover most of its August losses.

- It has strengthened the market’s confidence in Airbnb’s growth story as the alternative accommodation leader as it continues to gain operating leverage.

- Despite expectations of slowing revenue growth, Airbnb’s asset-light model is expected to drive significant margin accretion and profitability growth.

- I argue why bearish views on ABNB are no longer defensible, as buying sentiments point to an impending recovery.

ferrantraite

Airbnb, Inc. (NASDAQ:ABNB) buyers have demonstrated that I was too cautious in my position on the leading alternative accommodation company since my previous upgrade in early April 2023.

As a reminder, I tagged ABNB with a Sell rating in late February, as I noted that buyers could be lured into a bull trap given the significant surge then. That thesis played out accordingly, as ABNB underperformed the S&P 500 (SPX) (SPY) before my upgrade in April. That underperformance has persisted from my Sell rating, although ABNB has continued to gain upward momentum.

My analysis suggests that ABNB buyers who aggressively bought into its May lows have been rewarded. The company’s second-quarter or FQ2 earnings release demonstrated that Airbnb’s operating leverage growth story remains in its infancy as it builds on its underlying growth drivers and leadership in alternative accommodation.

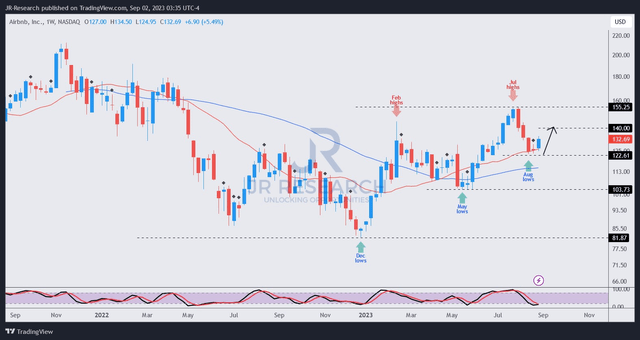

While ABNB topped out in July, as it fell steeply over the past three weeks, buyers returned to defend robustly at the $120 zone, helping to sustain its medium-term uptrend bias. It marked a significant bottom for ABNB, suggesting investors remain confident of Airbnb’s execution prowess despite its implied growth premium.

Dip buyers who added exposure at its August lows were likely pleasantly surprised yesterday, as ABNB is slated to be added to the S&P 500 before trading starts on September 18. The post-market surge of nearly 6% as ABNB closed for the week brought it back to the $140 level, as it recovered most of its August losses.

It’s a pivotal development for Airbnb investors, corroborating their confidence in Airbnb to carry on its operating leverage growth thesis with the addition to the S&P 500. Companies must meet stringent criteria to be added, including “high liquidity, a market capitalization of at least $14.5 billion, and adherence to profitability, liquidity, and share-float standards.” I believe the post-market optimism makes sense as the market prices in the potential upside from the addition, as passive investment funds are expected to gain exposure to ABNB moving ahead.

Analysts’ estimates suggest that Airbnb’s revenue growth is expected to slow further as it matures. Nevertheless, investors must consider that Airbnb’s asset-light model is well-primed to deliver significant margin accretion in the medium term through the forecast period ending FY26. Accordingly, Airbnb is projected to deliver a 4Y revenue CAGR of 14.4% from FY22-26. In contrast, its adjusted EBITDA is expected to register a marked increase of 17.8% over the same period, demonstrating its ability to continue growing its profitability.

Management’s commentary suggests that the company remains in a growth mode, stressing that the company’s priority “is to focus on growth, market share, and cost rationalization.” Seeking Alpha Quant’s growth grade of “B+” suggests that Airbnb should be considered a growth play among its peers, justifying its premium.

ABNB price chart (weekly) (TradingView)

ABNB has recovered its medium-term uptrend, as seen above. Holding a bearish view against robust buying sentiments doesn’t make sense to me (note that I’m not bearish).

The steep decline from its July highs was met with robust buying support in August and further lifted by the post-market surge to the $140 zone. Seeking Alpha Quant’s “F” valuation grade underscores the high valuation that investors need to consider when assessing the buying opportunities in ABNB.

However, with robust buying sentiments undergirding ABNB’s ongoing recovery to retake its July highs, investors looking to add exposure can consider taking advantage of its next steep pullback.

Rating: Maintain Hold. (On the watch for a rating change). Please note that a Hold rating is equivalent to a Neutral or Market Perform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!