Summary:

- Since my previous bullish article on Airbnb in September, the company has lost nearly 20% of its market value, and for good reason.

- Airbnb reported strong Q3 financial results, driven by robust demand and international expansion, but expects moderate growth in the coming quarters mainly due to geopolitical tensions in the Middle East.

- A closer look at the deal activity in the leisure sector reveals an interesting trend that suggests we are entering a phase that would be characterized by lackluster growth.

- I believe investors should buckle up for heightened volatility in the foreseeable future, but with a long-term perspective, I am planning to add to my position in the coming weeks.

Carl Court

In September, at a time when Airbnb, Inc. (NASDAQ:ABNB) faced a fresh challenge from regulatory changes in New York – one of its key markets – I published an article discussing why I had decided to remain bullish on the long-term prospects for the company. Since then, Airbnb has lost almost 20% of its market value, which is not a pretty sight. As a long-term-oriented investor, however, I continue to focus on the long-term prospects for the company, so the recent market selloff is certainly not a good enough reason for me to steer clear of ABNB stock. I was looking forward to the company’s third-quarter earnings report to understand how Airbnb is dealing with recent geopolitical challenges, and after diving deep into these challenges, I believe investors are in for a rough patch in the short term. That said, Airbnb’s long-term outlook remains positive, and I am encouraged by how the company is positioning itself for sustainable earnings growth in the long run. Airbnb is not cheaply valued in the market, but given the prospects for long-lasting competitive advantages in a fast-growing market, I feel comfortable paying a premium to invest in the company.

Prepare For The Aftermath Of A Record Summer Season

The travel sector, once challenged by the far-reaching effects of the pandemic, has shown a remarkable resurgence this year. Despite surging inflation, we have witnessed robust travel spending, most notably reflected in the surging demand for airlines and the impressive growth of Airbnb and other itinerary booking platforms. The summer season saw travel reaching its peak, signifying a strong desire among consumers to explore the world once again.

The U.S. travel industry recently concluded one of its most successful summers, characterized by record-breaking passenger numbers. While the aviation sector soared to new heights, several underlying trends became evident during the third quarter of 2023, offering a deeper understanding of the industry’s dynamics.

Conversely, a moderate rebound in spending by consumers and businesses was observed in the travel and hospitality industry, with the Middle East and North Africa (MENA) region being a focal point of growth. The Mastercard Economics Institute reported a significant increase in Travel and Entertainment (T&E) spending by small businesses in MENA, with a 56% rise in Q1-Q3 2023 compared to the same period in 2022, and a substantial 78% increase compared to March 2019. Large businesses also experienced growth, albeit at a slower pace. Notably, global leisure and business travel began growing at similar rates, with a 42% year-over-year change from 2022 to 2023. Corporate flight bookings caught up with leisure travel in regions characterized by a robust return to office culture in the second half of 2022 and early 2023. Leisure travel bookings in the UAE from January to March 2023 were up by 49.5% compared to the same period in 2022.

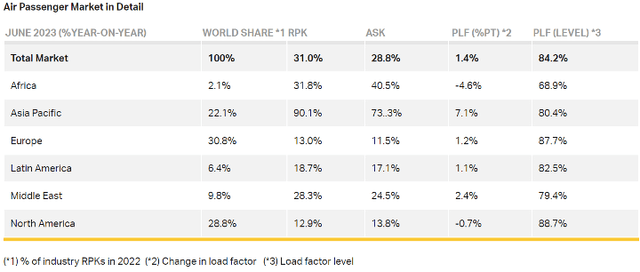

The International Air Transport Association (IATA) reported that the post-COVID recovery momentum persisted in June, with total traffic (measured in revenue passenger kilometers or RPKs) rising by 31% compared to June 2022. Globally, traffic levels now stand at 94.2% of pre-COVID figures. For the first half of 2023, total traffic saw a remarkable 47.2% increase compared to the same period in the previous year. Domestic traffic in June increased by 27.2% compared to the same month in the previous year, surpassing June 2019 results by 5.1%. The first half of 2023 witnessed a 33.3% rise in domestic demand compared to the previous year. International traffic also showed robust growth, climbing 33.7% compared to June 2022, with all markets demonstrating strong growth. International RPKs reached 88.2% of June 2019 levels, and the first half of 2023 witnessed a 58.6% increase in international traffic compared to the same period in 2022.

Exhibit 1: Air passenger market data

IATA

This robust travel demand was reflected in the latest earnings releases from various airlines. Notably, Delta Air Lines (DAL) witnessed a nearly 60% increase in profits, primarily attributed to a robust summer season, particularly for international trips. Similarly, European airline Lufthansa reported record Q3 profits. Despite the positive outlook, there are notable shifts in airfare dynamics. International airfare averaged $962, indicating a 10% increase compared to the previous year and a substantial 26% increase from 2019. Conversely, domestic airfare witnessed a decline, with roundtrips within the U.S. falling by 11% from the previous year and 12% from 2019, averaging $249. The evolving trends extend to the hotel industry as well, with room rates for European hotels averaging $148.88 in the first half of the year, reflecting an increase of almost 14% from the previous year. In contrast, U.S. hotel rates rose by a more modest 6% from the same period in the previous year, reaching $154.45.

On the other hand, the Transportation Security Administration (TSA) reported its busiest summer on record, screening more than 264 million people between Memorial Day and Labor Day, surpassing the 262 million screened during the same period in 2019. This remarkable increase follows a year when TSA screened 238 million people during that time. International travel continued to shine, with Customs and Border Protection reporting an 18% surge in travelers arriving by air in July compared to the previous year.

Airbnb was a big winner of the record summer travel season, but I believe investors should start being more cautious now about the short-term performance of the company.

It’s important to note that these strong quarterly reports are now followed by warnings that cite higher fuel and maintenance costs, labor agreements, and, notably, conflicts in the Middle East as potential factors that could dampen travel demand in the upcoming fall season.

One of the key trends in Q3 was the noticeable drop in deal activity within the global travel and tourism sector, especially when compared to the same period in 2022. Although an evaluation of deal activity may not reveal the strength of the travel market, I have often found these data to reveal important trends in the making. Data from GlobalData reveals that a total of 558 deals were announced in the first three quarters of 2023, marking a substantial 33% decline from the 833 deals announced in the corresponding period last year. Notably, North America and Europe experienced more pronounced declines, while China emerged as the sole major market that saw an increase in deal volume. The factors driving this decline were manifold, encompassing geopolitical tensions, inflation, concerns about a global recession, interest rate hikes, and labor shortages. The drop in deal activity, in my opinion, serves as a warning sign for a challenging period ahead for the leisure sector as a whole, and Airbnb may see its growth wings being clipped before its long-term growth story starts gaining traction again.

Airbnb’s Q3 Earnings: Strong Performance And International Expansion

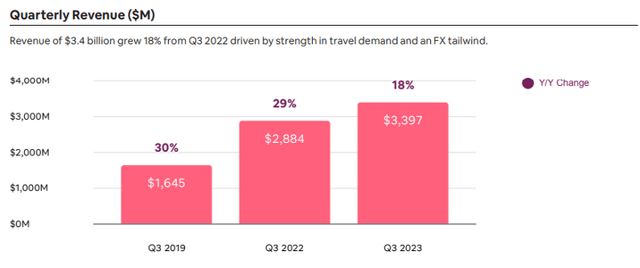

In the third quarter of 2023, Airbnb reported robust financial results, underscoring the company’s resilience and commitment to international growth. The company’s revenue for the quarter reached an impressive $3.4 billion, reflecting an 18% increase from the same period in 2022. Net income, including a one-time income tax benefit, stood at $4.4 billion, with $1.61 billion as the adjusted quarterly net income. The growth was driven by robust demand, with a total of 113.2 million nights and experiences booked during the quarter, exceeding market expectations. Further, active listings on the platform grew by 19% compared to the previous year, signifying the resilience and appeal of Airbnb for both hosts and travelers.

The company also took steps to make longer stays more affordable for guests. These efforts included reducing the guest service fee after the third month and introducing pay by bank for U.S. guests. This has resulted in a nearly 20% year-over-year increase in nights booked for stays of three months or longer in Q3 2023. Additionally, the percentage of new active listings offering monthly discounts has increased from approximately 22% to over 50%.

Exhibit 2: Quarterly revenue trends

Shareholder letter

The company’s performance in different regions revealed interesting trends. In North America, nights and experiences booked saw a modest acceleration even as ADR decreased by 1% compared to Q3 2022. Cross-border travel witnessed strong year-over-year growth, with a 25% increase in gross nights booked to North America by guests from outside the region.

In Europe, the Middle East, and Africa (EMEA), nights and experiences booked improved compared to the corresponding quarter. Excluding the impact of foreign exchange, ADR in EMEA increased by 6% compared to Q3 2022. Similar to North America, cross-border nights booked showed strength, with an 11% increase in gross nights booked to EMEA by guests from outside the region.

Latin America also experienced robust growth, with nights and experiences booked registering a 24% YoY growth aided by the strong performance in Mexico and Brazil. Asia Pacific witnessed a substantial acceleration of 27%. This region, historically reliant on cross-border travel, is showing signs of recovery in international travel, which bodes well for Airbnb’s expansion efforts.

One of the main challenges for the company was the implementation of Local Law 18 which went into effect in New York City in September, essentially imposing a ban on short-term rentals. This has had a notable impact on Airbnb’s business in the city, which represented approximately 1% of the company’s global revenue before the ban. Brian Chesky, CEO of Airbnb, emphasized that regulations are not a new phenomenon for Airbnb, with 80% of their top 200 markets already having some form of regulations in place. In many of these markets, these regulations have offered workable solutions that have allowed Airbnb to continue its growth and thrive. He highlighted examples like France, which passed national legislation favorable to Airbnb, and cities like Seattle and San Diego which have enacted supportive regulations. However, New York City has taken a different approach, which CEO Chesky found to be concerning. Despite these challenges, the CEO remains optimistic about overall demand and regulatory trends. Airbnb has been proactive in working with cities, providing a city portal for self-service and data monitoring in over 400 cities. Overall, the company has seen positive developments in working with cities, and while New York remains an outlier in its regulatory approach, Airbnb continues to engage constructively with municipalities to navigate the diverse regulatory landscape.

On the bright side, the company has been actively investing in underpenetrated international markets, and this strategy is yielding positive results. Countries like Germany, Brazil, and Korea have become notable success stories. Korea, in particular, has experienced rapid growth, with gross nights booked 54% higher in Q3 compared to the same period in 2019.

Despite the robust growth experienced so far, the company expects moderate growth in the coming quarter because of the Middle East conflict. The company warned of economic volatility dampening the travel demand, and I believe the Middle East conflict will be the first of many macro-level challenges the company will be facing in the foreseeable future. Travel demand is very likely to moderate in the coming quarters even without a conflict in the Middle East, and I believe investors should prepare themselves for a few quarters of lackluster growth until geopolitical tensions subside and consumer spending patterns normalize.

Takeaway

After digesting Airbnb’s third-quarter earnings, the evolving global travel landscape, and the company’s premium valuation, I believe we are entering a period of slow growth and lackluster stock market returns. To put it simply, I think we are past the peak demand for Airbnb in the short term. I will use this phase to accumulate more ABNB shares as I am making no changes to my bullish stance on the company based on the expected weakness in the short term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!