Summary:

- Airbnb’s stock is performing well due to the travel industry’s recovery and strong fundamentals.

- The company has a fortress balance sheet, strong revenue growth, and stellar profitability metrics.

- ABNB stock is undervalued and has the potential for double-digit upside, making it a “Strong Buy”.

Hero Images Inc/DigitalVision via Getty Images

Investment thesis

Airbnb’s (NASDAQ:ABNB) stock is on fire this year as the travel industry experiences renaissance after the global lockdown. The business demonstrates solid revenue growth momentum, and its profitability metrics are stellar despite the company’s relatively young age. Airbnb’s balance sheet is a fortress, which means the company has more than enough resources to innovate and fuel growth either organically or via acquisitions. Last but not least, my valuation analysis suggests that the stock is still cheap with double-digit upside potential. All in all, I assign ABNB a “Strong Buy” rating.

Company information

Airbnb is an online platform for short-term accommodation rentals. The platform ABNB provides allows explorers to explore and book a wide selection of rental properties offered on the site by various hosts. Apart from that, the platform enables tourists to reserve ‘experiences,’ like distinct tours and culinary workshops, across numerous global destinations.

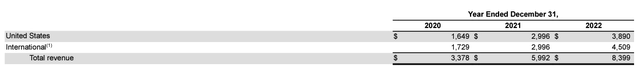

The company’s fiscal year ends on December 31 with a sole reportable and operating segment. According to the latest 10-K report, the company generates more than half of its sales outside the U.S.

Financials

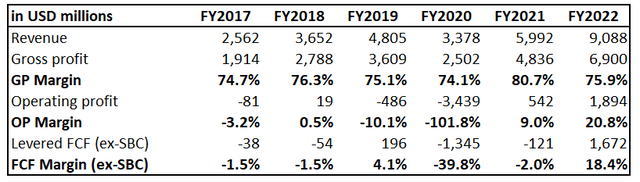

The company went public in late 2020. Therefore, the earnings history is relatively short, but still, we can see clear long-term trends in the company’s financial performance. Airbnb’s financial performance over the past five years has been stellar, with revenue compounding at almost 30% CAGR. The operating margin improved significantly as the business scaled up and achieved a stellar 21% level in the latest full fiscal year. The free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] in FY 2022 also demonstrated a staggering 18% level.

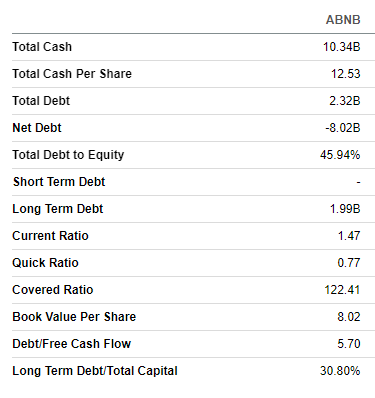

Having strong profitability metrics allows the company to maintain a fortress balance sheet with a massive $8 billion net cash position. The leverage ratio is relatively low and current liquidity is in solid shape. The company also conducts stock buybacks, which is a good sign for investors. I do not expect the company to pay dividends in the foreseeable future because it would be more efficient to reinvest heavily to fuel further revenue growth and profitability expansion. Having a strong balance sheet with a wide FCF margin makes the company well-positioned to sustain its impressive revenue growth trajectory for longer via organic growth or strategic acquisitions.

Seeking Alpha

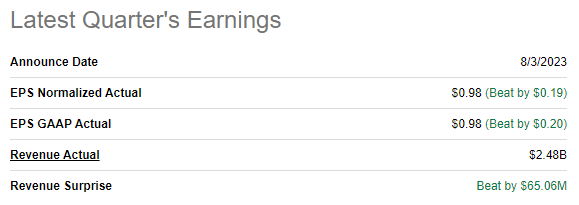

The latest quarterly earnings were released on August 3, when the company topped consensus estimates. Revenue demonstrated strong growth momentum with an 18% YoY growth. The topline strength allowed for significantly improved profitability. As a result, the adjusted EPS expanded YoY from $0.56 to $0.98.

Seeking Alpha

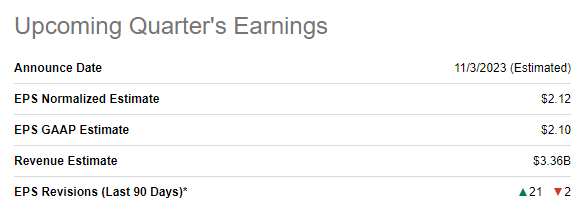

The upcoming quarter’s earnings are scheduled for release on November 3. Quarterly revenue is expected by consensus at $3.36 billion, which signals a solid 17% YoY growth. The adjusted EPS is expected to follow the bottom line and expand from $1.79 to $2.12. I want to emphasize that there were 21 upward consensus revisions in the last 90 days, which is a bullish sign.

Seeking Alpha

Despite its relatively short history, the company has already faced the challenge of the century called “pandemic lockdown”. Airbnb demonstrated solid resilience during this extremely harsh period for businesses servicing travelers, and its operating margin was even positive in FY 2021. It is a solid bullish sign to me because it is difficult to imagine the worst scenario for a company like Airbnb apart from the global lockdown. Near-term prospects look bright thanks to the resurgence of international travel as pandemic restrictions eased. The company’s broad portfolio of domestic and international destinations makes the company well-positioned to absorb near-term tailwinds by tapping into diverse traveler demographics and preferences.

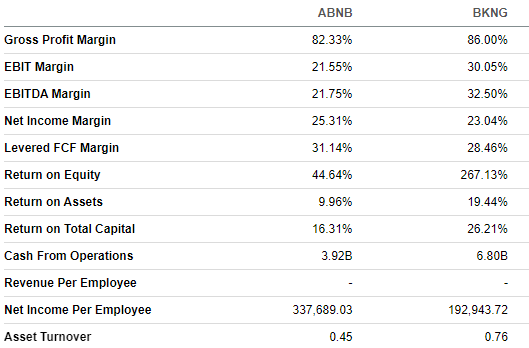

Airbnb is well-positioned to grow over the long term with its strong brand recognition and reputation for providing unique experiences for travelers. It is also crucial that the company has an extended network of hosts, which attracts more travelers. And vice-versa, due to the rapidly growing number of travelers, the platform becomes more and more attractive for hosts. Having a larger scale drives down costs, and that is the reason why Airbnb has the highest possible “A+” profitability grade from Seeking Alpha Quant. The company’s profitability metrics are mostly lower than its closest rival, Booking Holdings (BKNG). But if we add context that Booking’s revenue is more than two times higher, I think that Airbnb has the potential to outperform BKNG in terms of profitability as the gap in business scale narrows.

Seeking Alpha

Valuation

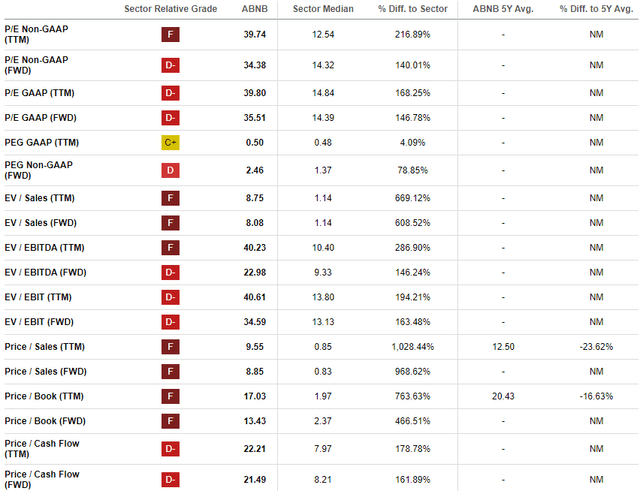

The stock rallied 52% year-to-date, significantly outperforming the broader U.S. market. Seeking Alpha Quant assigns the stock the lowest possible “F” valuation grade because most ratios are multiple-fold higher than the sector median. But Airbnb is a cash machine, which disrupted the industry and has vast brand recognition. That said, a substantial premium might be fair.

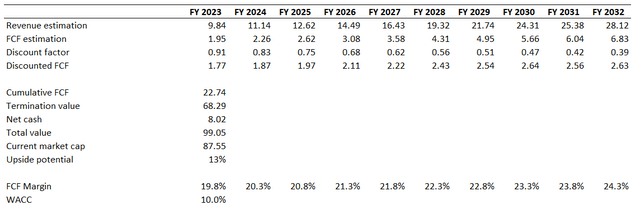

To get a more fair view regarding the valuation attractiveness, I want to simulate a discounted cash flow [DCF] model. I use a 10% WACC for discounting. Consensus revenue estimates project a 12% CAGR for the next decade, which I consider conservative enough to implement here. I use the 19.8% TTM FCF margin and expect it to expand by 50 basis points yearly.

According to my DCF simulation, the business’s fair value is very close to $100 billion. That said, the stock is about 13% undervalued and the target price is $147.

Risks to consider

As an aggressive growth stock, Airbnb faces a substantial risk of underperforming ambitious revenue growth and profitability expansion expectations, which are priced in its current market cap. Even slight hints regarding notable revenue growth deceleration or missing quarterly earnings consensus estimates might disappoint investors. This will likely lead to a stock sell-off, and it might take several quarters before the stock regains positive investor sentiment.

Airbnb’s business is asset-lite, meaning that entry barriers are low. Other companies can enter the market without needing significant capital expenditure. This makes it relatively easy for potential competitors to establish similar platforms. The ease of entry for new players will lead to higher market saturation, possibly diluting Airbnb’s market share and competitive advantages.

Bottom line

To conclude, Airbnb is a “Strong Buy”. It is a high-quality business that disrupted the accommodation booking industry and now enjoys massive revenue growth and wide profitability metrics. The company easily sustained a massive headwind called “the global lockdown” and is well-positioned to absorb the post-pandemic solid resurgence of international travel. Airbnb’s stellar financial position gives the company multiple choices of fueling further strong revenue growth through in-house innovations or strategic acquisitions. It is also crucial that the valuation is very attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.