Summary:

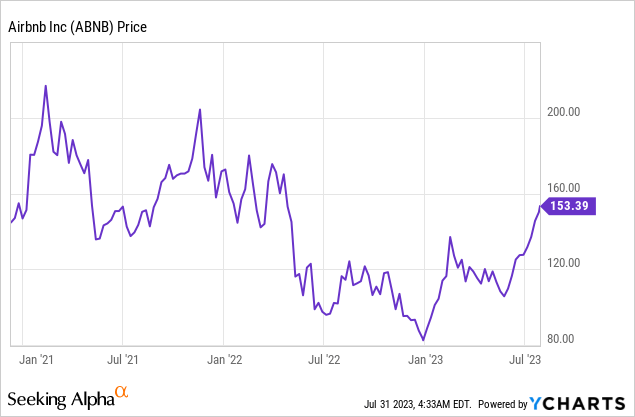

- Airbnb’s stock has risen nearly 50% from its May lows and 81% for the year, but its high valuation and lack of competitive moat have caught short sellers’ attention.

- I’m a frequent user of Airbnb and believe that the platform provides value for money. I disagree with much of the negative media perception of the company.

- However, there are challenges for Airbnb in terms of competition from other platforms and the need to grow earnings substantially to justify its valuation. Recession resilience is also a concern.

igoriss

Airbnb Inc. (NASDAQ:ABNB) is up nearly 50% off its May lows and up roughly 81% for the year. That’s a huge rise, and a steep valuation to match at 44.5x 2023 earnings estimates. The company lies firmly in the crosshairs of politicians and activists for its perceived role in fueling increases in homelessness and social problems in cities. Short sellers too are keyed in, taking notice of the company’s high valuation, lack of competitive moat, and high expense structure.

There’s also the issue of the Airbnb hosting gold rush and subsequent “Airbnbust.” The bust is real. Airbnb’s former largest host is a company called Sonder (SOND). Sonder is on the verge of NASDAQ delisting and going out of business, losing $263 million in the last 12 months on only $501 million in revenue. On the other hand, Airbnb itself is profitable, making about $2.03 billion over the past 12 months. Airbnb came public at a huge valuation and has traded up and down since its IPO, having been underwater on its IPO price the vast majority of the time. So without further ado, let’s take a qualitative and quantitative look at Airbnb.

Airbnb Is A Good Product

I’m a frequent user of Airbnb in the US and Europe, and the good experiences have strongly outweighed the bad. I’ve met cool hosts, visited countries I wouldn’t have been able to go to otherwise, and have otherwise gotten a ton of value for my money out of the product. I generally don’t agree with much of the sensationalism about Airbnb ruining the world or being some sort of sociopolitical monster. Like with Uber (UBER), I’d argue that your options as a consumer are much better than before Airbnb existed. If you’re just staying a night or two don’t use it because the cleaning fees will crush you, but for longer stays it’s great.

My friends are also heavily involved in Airbnb in various countries as hosts, largely because it was a no-brainer business model to borrow to buy property at a 3-4% mortgage and put it on Airbnb. Smart people got into this early, and dumb people followed at thinner margins and higher interest rates, including dumb people backed by venture capital. For savvy hosts as well, Airbnb is a good platform. For example, this is my friend’s vineyard in North Carolina that he rents on Airbnb. He does great business and likely always will because it’s a unique property. Compare this with the typical profile of the Airbnbust victims, corporate operations who signed dozens to hundreds of 12-month leases on identical apartments in Texas, Florida, and Arizona. Now they’re 30% occupied in many cases and they’re on the hook for all the rent.

Though Airbnb is a good product, there are limits to how much they can monetize this, the main issue being that other platforms are happy to provide a similar product for less money. Booking.com, VRBO, etc. are all vying for a piece of the action. And unlike Uber, there’s less urgency to transactions so it makes it easier for other platforms to advertise and get customers. The other issue is that the most profitable vacation properties that get return guests tend to see a greater share of bookings made directly with the host over time.

To sum it up for Airbnb, we have a solid product with some structural long-term profitability issues. Airbnb should always be able to stay in business and make some money, but competition from competitors and the hosts themselves mean that earning large and growing profits year after year will be a challenge. Airbnb’s main approach to dealing with this seems to be to invest in R&D to the tune of about $1.5 billion per year, but R&D doesn’t really solve the structural issues with the business model in my mind. If I were a shareholder I’d personally rather them spend $150 million per year on R&D and make a more solid profit. It’s clear that Airbnb needs to grow earnings substantially to justify the valuation, but as a consumer, I don’t get the feeling that Airbnbs are scarce.

We’ll find out more when the company reports earnings this week after the bell on Thursday, August 3. Summer travel has been strong, and expectations are obviously high for these levels of profit to not only continue, but grow sharply from here. Analysts expect about $0.77 of GAAP earnings.

But How Should We Value The Stock?

In a vacuum, I’d love to own a bunch of marijuana dispensaries and the latest VC-backed AI companies. But the problem with these types of “sexy” businesses is that everyone else wants to own these too, so the valuations skyrocket until your return on capital is low or negative. If all that you had to do in investing was to choose the most popular businesses, then it would be an easy game to play. In the long run, earnings vs. invested capital drive returns and valuations work like a point spread does for NFL games. If you want to make money, it’s not enough to say “Aaron Rodgers is the man and no one can stop him,” you have to determine whether he’s really 9.5 points better than the Cleveland Browns on the road or not.

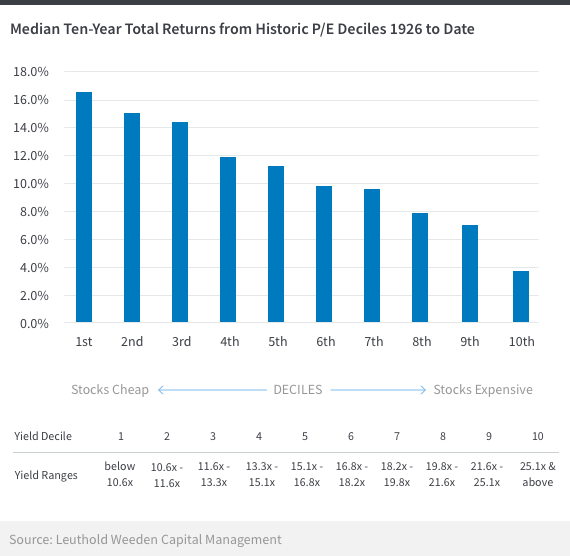

It’s the same thing in investing. Invest in a random company in the Midwest at 11x earnings and 8% annual growth and you’ll do very well in the long run. Invest in the stock-du-jour at 50x to 100x earnings, and historically it goes poorly. Stocks really do represent underlying businesses, and the higher the valuation you pay, the lower your future return.

Valuations vs. Returns (Time Series)

Valuations Vs. Returns (Time Series) (Leuthold Weeden)

Valuations Vs. Returns (Cross-Sectional)

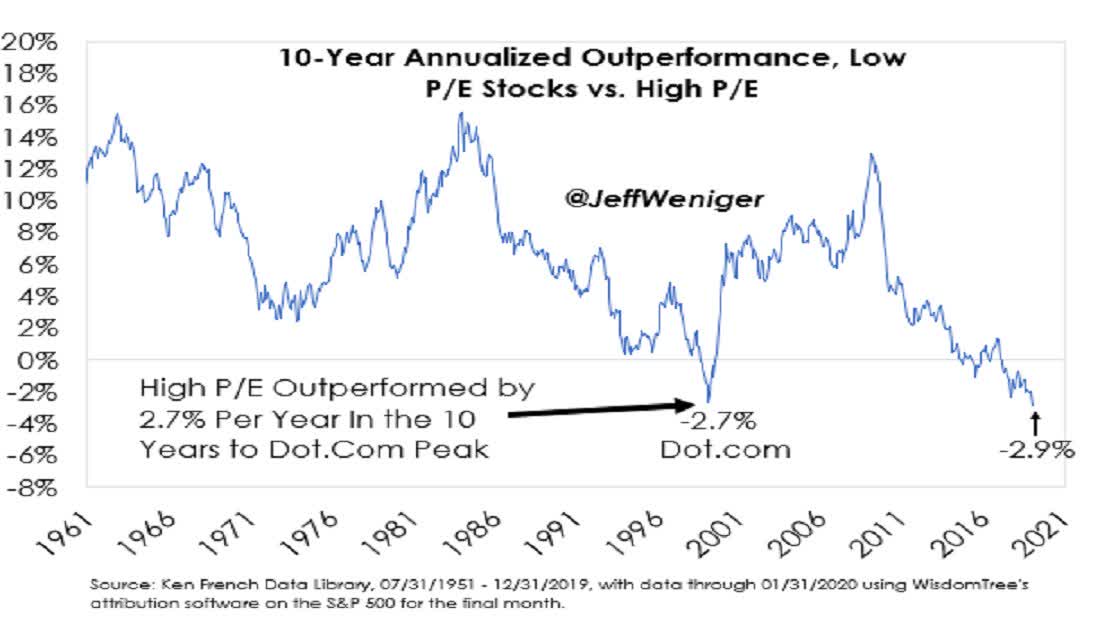

Fama French Value Vs. Growth (WisdomTree)

Paying high valuations for stocks is inherently speculative. It works great when you can flip the shares to someone else for an even higher valuation, but in the long run, on average you will lose to those buying for value, and often by a large margin. When you win, you won’t win as big on average because you bought after the run-up or from insiders selling their shares at IPO at huge valuations. This should be fairly intuitive– generally, no one is looking at the 10-year Treasury and seeing that the yield has dropped from 4% to 2%, and deciding to ship all their money in, but this happens all the time in the stock market. Historically many of the best-returning stocks are chronically cheap due to something called the disposition effect. Investors tend to sell winning stocks more than is optimal. This is either because they’re biased and want to pile into their losers, or simply because they’re cashing out to live the good life. Exceptions to this general rule include the go-go bubble in the 1960s, the dot-com bubble, and the 2020s tech bubble.

Airbnb is trading for 44.5x its 2023 earnings here. This may be somewhat of a dumb way to put it, but it means if they can’t grow earnings it’ll take 44.5 years to get your money back. With the stock up 81% for the year, this is a clear pass. Student loans kick back in on October 1, and the pandemic is now a distant memory. It’s not a strong assumption that next year will be softer for travel than this year. It’s also not a strong assumption that Airbnb sees profit decline with increased competition. It’s not as if the company can simply raise prices 20-30% on its customers without driving them to competitors en masse. On the bright side, one thing that has helped Airbnb is interest income. Customers pay upfront and Airbnb pays hosts after they check in, earning net interest on the float to the tune of about $305 million over the past year. That’s a lot of money, but not against a valuation of $98 billion.

Bottom Line

When looking at stocks with high valuations, one other factor is recession resilience. In general, you can pay higher multiples for stocks with less earnings variability. And Airbnb is clearly not a recession-proof stock– they have about $8.7 billion in revenue against $5.3 billion in operating expenses. It’s quite conceivable that consumers could cut back enough to pressure Airbnb to near breakeven. If that’s the case, Airbnb probably should be worth $30-$40 billion, not $98 billion.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.