Summary:

- Once again, Airbnb shares fell sharply following a disappointing quarterly results, thus prompting some investors to buy the dip.

- In a similar fashion to the previous quarter, this 3-month period was marked by a number of red flags.

- Even though ABNB now trades at a relatively low sales multiple, the stock is not a buy yet.

Klaus Vedfelt

Just three months ago in early May of this year, Airbnb, Inc. (NASDAQ:ABNB) shares fell sharply following the release of Q1 2024 results. For many investors, this seemed like a good time to buy the dip and increase exposure to what seemed to be an attractive long-term growth story.

To more prudent investors, however, the first quarter was a major red flag and even though the stock fell sharply following the report, it was clear that rushing to buy the stock was highly likely to be a mistake.

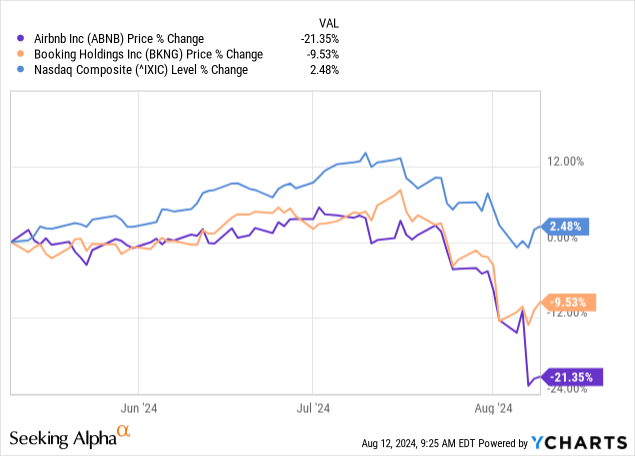

I warned about all of the risks associated with buying the dip in May and since then, ABNB has fallen by almost 22%, thus underperforming both the broader equity market and its major peer – Booking Holdings Inc. (NASDAQ:BKNG).

As we could see from the graph above, ABNB and BKNG were mostly moving in unison in recent months, until the former reported its second quarter results earlier this week. That is why, it is essential to avoid any emotional biases when evaluating the most recent 3-month report and take a fresh look at ABNB’s valuation relative to its actual business fundamentals.

A Disappointing Quarter

The most recent quarter was a huge disappointment for ABNB investors. Not because the company missed on earnings on revenue, but rather because of the disappointing guidance that for some reason came as a huge surprise to the market.

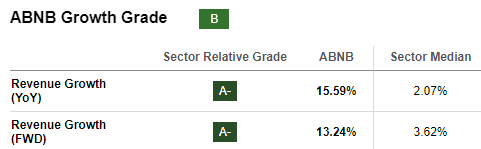

Seeking Alpha

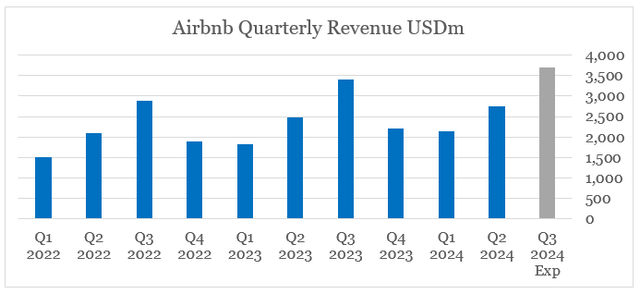

Next quarter revenue growth is now expected to be well-below initial forecasts, as demand is showing early signs of weakening. As disappointing as this sounds, the outlook for Q3 has not been reduced by much – from $3.8bn to a range of $3.67bn to $3.73bn.

In Q3, the company forecast revenue to increase 8%-10% to $3.67B-$3.7B, below expectations of $3.84B due to a sequential moderation in the year-over-year growth of Nights and Experiences Booked relative to Q2. Latin America and Asia Pacific continue to be the fastest growing regions, but the company notes there are signs of shorter booking lead times globally and slowing demand from U.S. guests.

Source: Seeking Alpha

If the high-end of this guidance is achieved, this would mean that ABNB will grow its topline at double-digit rates during the most important quarter of the fiscal year.

prepared by the author, using data from SEC Filings

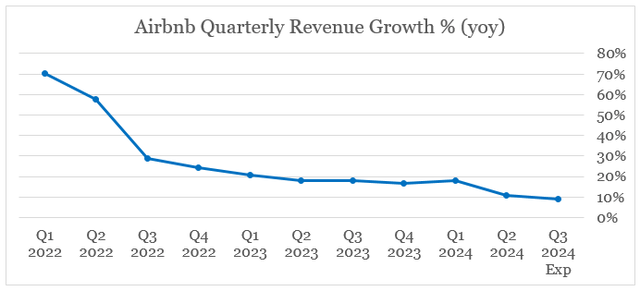

The large drop in share price following the release, however, clearly indicates that investors were not anticipating any slowdown in revenue growth. This is quite surprising given the fact that year-on-year quarterly revenue growth has been trending down for quite some time as Airbnb’s main markets are becoming saturated.

prepared by the author, using data from SEC Filings

And yet forward revenue growth is still in the low teens which could be an indication that analysts’ consensus estimate is still way too optimistic, and we could soon see a wave of downgrades for the company’s forward growth.

Seeking Alpha

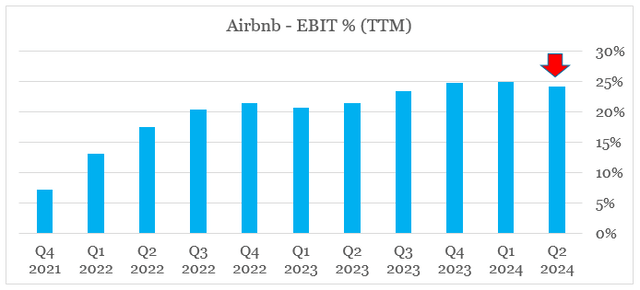

Another cause of concern for Airbnb’s investors has been the sudden drop in operating profitability during the last reported quarter. Although a drop from 25% in Q1 of 2024 to 24% during the last reported quarter is not much, the market was anticipating a gradual improvement in margins going forward.

prepared by the author, using data from SEC Filings

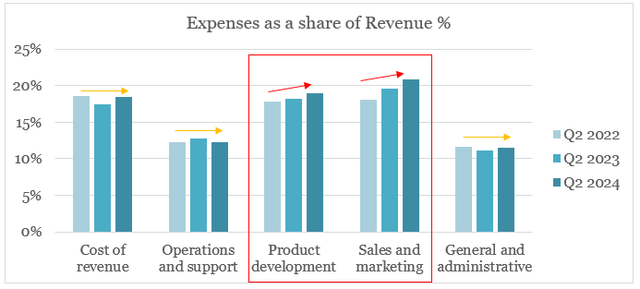

The drop came as a result of increasing fixed costs relative to sales, which is concerning given the faltering revenue growth. More specifically, increases in product development and sales & marketing costs continued to outpace revenue improvements during the last quarter when compared to the same 3-month period in 2023 and 2022.

prepared by the author, using data from SEC Filings

Limited Upside

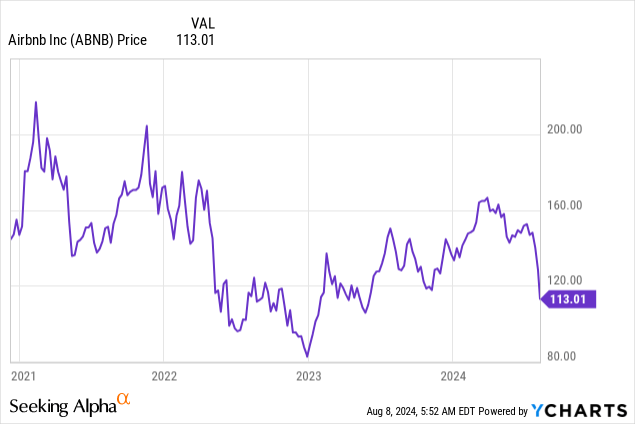

Following the disappointing second quarter results, ABNB’s share price now trades at levels last seen in early 2023 which is naturally leading some investors to the conclusion that the stock is now undervalued.

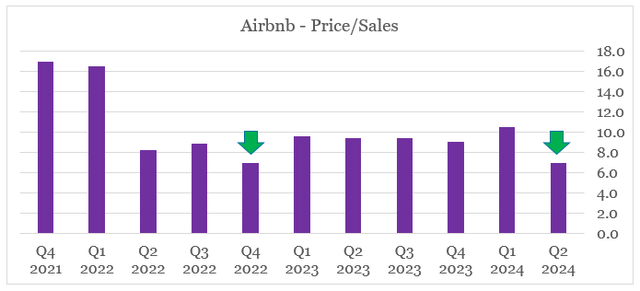

On a price-to-sales multiple basis, ABNB trades at one of its lowest levels since the IPO in late 2020. The last time when the sales multiple was at such low levels was in late 2022, which, as we could see from the graph above, marked a short-term bottom in the share price. Then in 2023, ABNB’s stock appreciated by almost 60%.

prepared by the author, using data from Seeking Alpha and SEC Filings

Based on everything said so far, it would be hardly a surprise that some investors would be willing to make an analogy between now and late 2022 and consequently to expect double-digit returns in the following year.

For a number of reasons, however, this is a highly unlikely scenario and I don’t see ABNB’s currently low multiples as a reason to buy the stock in anticipation for 2023 returns to repeat once again.

The number one reason for that is the fact that topline growth is gradually normalizing and the management is now forced to expand the Airbnb brand beyond its traditional travel services. The success of this strategy is still highly uncertain, and in the meantime we are already witnessing strong indications of weaker demand ahead.

(…) we are seeing shorter looking lead times globally and some signs of slowing demand from US guests and our Q3 outlook incorporate these recent trends.

Source: ABNB Q2 2024 Earnings Transcript

The second reason is that expansion in these adjacent areas would be associated with higher levels of product development and marketing spend, as the company would have to adopt a more localized approach.

And finally, perhaps most excitingly, we are expanding beyond our core. We continue to drive growth by investing in underpenetrated markets. In Q2, growth of gross nights booked on an origin basis in our expansion markets significantly outperformed our core markets on average. Our core markets again are US, UK, France, Australia and Canada.

This is largely due to the success of our global expansion playbook which includes a more localized product and marketing approach. We’re also expanding Airbnb’s brand positioning beyond travel accommodations with the launch and roll out of Airbnb Icons which is a new category of extraordinary experiences that we launched in May.

Source: ABNB Q2 2024 Earnings Transcript

As mentioned during the last conference call, Airbnb Icons is a good example of the company’s current strategy to expand into new and adjacent categories. This niche service offering of themed experiences, however, is unlikely to have a profound impact on Airbnb’s topline figure.

So far, management expectations for Q3 seem to indicate that margin compression would continue in the near-term, but the risk of a more sustained drop in profitability seems to be largely ignored at this point in time.

In Q3 2024, we expect Adjusted EBITDA to approximate Q3 2023 on a nominal basis, but for Adjusted EBITDA Margin to decline relative to Q3 2023. Marketing expense is expected to grow faster than revenue on a year-over-year basis in Q3 2024, partially due to timing and investments in new growth markets.

Source: Airbnb Q2 2024 Shareholder Letter

Conclusion

Airbnb has fallen sharply following the recent quarterly earnings announcement, and many investors seem to have been caught off-guard. The downside risk of such a quarter was both significant and hard to miss just a couple of months ago, when the first red flags emerged following the Q1 2024 earnings release. Even though ABNB has fallen by more than 20% since then, the stock is not a buy yet, and rushing to buy the dip could easily lead to more disappointment for investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the consumer discretionary space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.