Summary:

- In 2020 and 2021, Airbnb traded with a free cash flow to enterprise value (fcf/ev) yield of sub 2%.

- In late 2022, Airbnb’s fcf/ev yield reached 7.3%.

- At that time, we began buying the business after waiting for a couple years.

- Today, we will explore the business as well as the market’s history of exuberance and subsequent depression, which is a cycle that has played out over and over again throughout the history of American capitalism.

- In short, I believe Airbnb has robust moats; principal among which would be its brand, and I believe Airbnb’s “Navy Seals Mindset” and disciplined capital allocation will propel its shares higher in the decade ahead.

ferrantraite/E+ via Getty Images

We had a strong start to 2023. In Q1, Nights and Experiences Booked hit a record high with over 120 million.

Revenue of $1.8 billion grew 20% year-over-year (24% ex-FX). Net income was $117 million—our first profitable Q1 on a GAAP basis.

Adjusted EBITDA was $262 million while Free Cash Flow was $1.6 billion, growing 32% year-over-year. We are now twice the size as we were before the pandemic on both a GBV and revenue basis—and with considerably higher profitability and cash flow.

Brian Chesky, Q1 2023 Shareholder Letter

That being said, our core service is stronger than ever. It’s more profitable than ever. And I think we’re now ready to expand beyond the core. So as we speak, we are working actively on new products and services. These new products and services are going to be shipping. Beginning next year, you’re going to see a number of things ship next May as part of the 2024 Summer Release. And we’re going to see even more things shift later in the year and the years to come.

The Parable Of Henrietta & Houndstooth

Within the Beating The Market community, I often reference a character named Henrietta.

For instance, when Lululemon (LULU) and SentinelOne (S) reported recently, Lululemon ripped even further from our recent entry point of ~$307/share, while SentinelOne fell even further beneath our original entry point of ~$35/share.

In response to which, I stated, “Henrietta wins again!”

While I am very confident S1 will be fine, and, while we know younger, smaller companies are prone to extreme volatility, as has been the case for S1, I do think the divergence provides a good platform to explore this parable of Henrietta and Houndstooth, which was popularized by the great Peter Lynch, on whose shoulders we stand.

I invite you to read the parable via the link below:

In late 2020 and 2021, we struggled a bit to abide by Mr. Lynch’s wisdom because, unlike Mr. Lynch who started running Magellan when the prime rate was 10%+ (implying that valuations were extremely, extremely low/compressed), we began at nearly the peak of ZIRP (suggesting that it was painfully difficult to find good investments as valuations were very expensive).

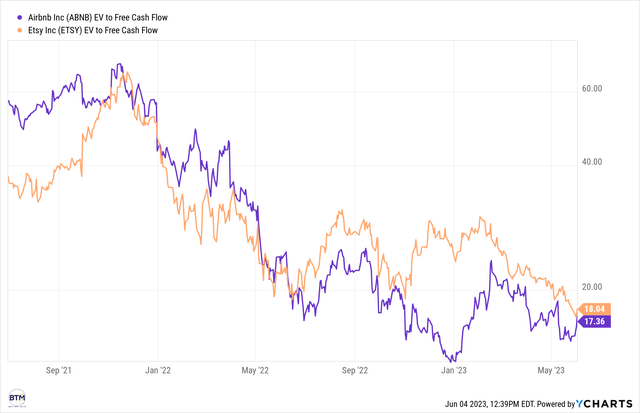

We can see these ideas depicted in the chart below:

Etsy & Airbnb Valuations: EV to Free Cash Flow

Etsy & Airbnb Valuations Relative To The Risk Free Rate

For those that read “The Only Two Ideas You’ll Ever Need In Investing,” the above charts are fairly easy to understand. To put it another way:

- Mr. Market adored Airbnb when it offered a sub 2% fcf/EV yield. Mr. Market loathes it when it offers a ~5% fcf/EV yield.

- Mr. Market adored Etsy when it offered a sub 2% fcf/EV yield. Mr. Market loathes it when it offers a ~5% fcf/EV yield.

And, of course, as we understand well at this point, this represents fairly ironic behavior, and if you don’t take it from me, I would invite you to study Mr. Buffett’s thinking around the aforementioned period in which the prime rate was 10%+, and stocks astoundingly had no buyers.

- “I just said, ‘How could this be?'” [I shared a specific timestamp that introduces a relevant 5 minute segment, but the entire video is worth watching.]

As we read in the parable of Houndstooth and Henrietta, it’s often wise to, at the very least, consider venturing into the realm of women’s fashion, women’s beauty, and women’s health whereby we find interesting and attractive long-term investments.

We’ve been doing our absolute best to embody this wisdom via our investment in Hims Health, which, for me, is also largely an investment in Hers Health. Hims & Hers Health (HIMS) was, indeed, founded by Mr. Andrew Dudum, but it was also founded by a woman named Hilary Coles, who currently acts as the SVP of Brand & Innovation.

With these ideas as our platform, let’s begin our review of the Airbnb (NASDAQ:ABNB) business, which I would say has a more feminine quality to it, which is understandable as I principally use the app to find destinations to which I may travel whereby I make significant other happy!

A Very Straightforward Investment Thesis

To concisely articulate the thesis:

- Airbnb possesses a variety of moats:

- Brand moat: For me, personally, I really don’t know where else to book a stay. Of course, I could think of other ways to find a place to stay, but Airbnb is so embedded into my psyche that I think of it as synonymous with travel. I start my travel journey in the Airbnb app, and only when there is no supply do I turn to a hotel. That said, I’ve actually been considering highlighting Hilton (HLT) as an attractive dividend growth investing idea, as I’ve had very good experiences with Hilton. There’s 8B humans on this earth. That number is growing. The number of earthly citizens achieving levels of income necessary to travel often continues to grow. It’s a very abundant universe, and I believe Airbnb is a highly customer-centric business with a robust brand moat (i.e., customer loyalty). I believe Hilton operates with a similar mindset based on my experiences with the brand.

- Network Effects moat: Airbnb has robust network effects that are also reinforced by Airbnb’s brand moat. That is, because I associate travel with Airbnb, I use the Airbnb platform to search for places to stay. Because I use the Airbnb platform to search for places to stay, hosts use the platform to list their places to stay. Because hosts use the platform to list their places to stay, I use the platform. Because this cycle repeats consistently, I continue to associate Airbnb with travel, and, as such, my identity association with Airbnb continues to build. “I, Louis, start my travel journey on Airbnb. That’s just who I am.” Notwithstanding the divorce rate in the U.S., humans generally tend to dislike change. They “become set in their ways.” This natural human tendency is the ally of the high character business and associated consistent product.

- Embedding moat: Guests build their reputation on Airbnb. Hosts build their reputation on Airbnb. These both represent embedding moats, though, to be sure, it’s stronger for the business owner (for the particularly exemplary hosts, they can be given “Superhost” on Airbnb, which comes with benefits, like added trust or the ability to charge a slightly higher price). Further, Airbnb hosts manage their listings through the Airbnb app, and this creates further embedding moat. Humans appreciate a simple UI/UX that they understand well, and they will simply stick with a good one if it works. “If it ain’t broke, don’t fix it,” so to speak.

- Economies of Scale: I do not believe this moat applies to Airbnb, but please let me know if I am missing something! Many businesses often have hidden moats, and an optimistic eye can identify them.

2. Airbnb is quantitatively very attractive. As we covered earlier, it now has an fcf/EV yield of about 5.5%. And as we covered earlier, Mr. Market adored the business at sub 2% fcf/EV yield, and, today, when the business is easily the strongest it’s ever been, Mr. Market ostensibly loathes the business, as evidenced by the exceptional yield we’re offered in purchasing the business today.

That being said, our core service is stronger than ever. It’s more profitable than ever.

And I think we’re now ready to expand beyond the core. So as we speak, we are working actively on new products and services. These new products and services are going to be shipping. Beginning next year, you’re going to see a number of things ship next May as part of the 2024 Summer Release. And we’re going to see even more things shift later in the year and the years to come.

Airbnb EV to Free Cash Flow

By now, I hope that I have clearly communicated the investment thesis for Airbnb to you. The rest of this note will be devoted to excerpts from the recent Airbnb call that I found particularly compelling.

Building The Moat (Network Effects)

In the previous section, we considered the nature of Airbnb’s Network Effects moat.

I found the following comment insightful as to this moat:

And finally, supply growth continued to accelerate. In Q1, we grew supply 18% year-over-year, and this is up from 16% in Q4. We saw double-digit supply growth around the world with the fastest growth in North America and Latin America. Urban and nonurban supply growth, in fact, both grew 18%.

This is heartening to hear, as it indicates that the flywheel of network effects continues to spin, and not just spin, it continues to accelerate.

As the flywheel spins, it also increases in size, and I believe that there remains a long runway for this flywheel to expand:

And finally, we’re expanding beyond our core. We have some big ideas for where to take Airbnb next. We’re building the foundation for new products and services that we plan to launch in 2024 and beyond. At the same time, Airbnb is still underpenetrated in many markets around the world.

So we’re increasing our focus on these less mature markets, and we are already seeing positive results. So let me just give you 2 examples. In Germany and Brazil, we rolled out our expansion playbook for accelerated growth. And as a result, we are now 2 — they are now 2 of our fastest-growing markets. And this playbook has, in fact, worked so well. So we are now expanding it to other markets around the world.

Over the last 24 hours, I’ve commented on Airbnb’s growth in APAC, which remains an exceptionally exciting region in which to invest for us.

I shared the following excerpt, within which I interspersed my thinking.

So we’re now looking at bringing this playbook to other markets around the world. And I’ll give you a couple of examples. Number one is Asia Pacific. We think there’s a huge opportunity in Asia. We’re massively underpenetrated.

This is going to be probably the fastest-growing market internationally over the next 5 years.

[As I shared in the chats, (SE) & ABNB: a winning team!]

And the problem with Asia historically over the last few years is Asia market, as you know, is a very much cross-border market. And with the borders being historically kind of locked down and there hasn’t been as much travel, the recovery in Asia has been delayed.

Now people are starting to travel, and Asia disproportionately has a lot of young travelers. And Airbnb, as you know, is very popular among the young travelers. So we think Japan, Korea, China, India and Southeast Asia are going to be huge opportunities for growth.

As we as a global community/species continue to further unite, Airbnb’s global network effect, a component of which we discussed in this section, will continue to strengthen, which will in turn strengthen its brand moat, and I have contended that a brand moat is arguably the most important moat one can have.

I say this to add further clarity, because brand moat is the result of consistent, high-quality service over the course of years and decades. No amount of strategy can replace this.

It is built brick by brick, customer interaction by customer interaction over the course of a lifetime in some cases (it has certainly been the case for Mr. Chesky who has been at this for about 15 years now, starting when he was 26).

Further, humans do not forget consistent, high-quality service, and humans want to be a part of products that provide this. This embeds into psyches and identities and can become a matter of self-preservation.

This is very powerful as a moat, and I believe it’s the holy grail of moats, akin to the answer to this question, “What’s the number 1 premium credit card on earth?”

I believe we all, as a global community, would answer the same answer: American Express (AXP).

The Share Repurchase Program Begotten By Navy Seals Mindset

We obviously reduced our headcount by 25%. We’ve only grown it moderately since. We’ve made substantial changes in our marketing efficiency, continue to make good improvements in our operating costs, anything from community support to cost of payments to infrastructure costs. Basically, we become a better, more rigorous operating company overall. And that kind of progress has been great for us going forward because even as our businesses rebounded, we have stuck to our core strong kind of operating mode.

A component of our thesis for Airbnb has been Airbnb’s commitment to operating like a Navy Seals team: efficient, nimble, and highly effective.

We discussed this in depth in our recent note in which we made Airbnb a Top Idea, so I will not belabor it here.

In short, I believe this Navy Seals mindset has created the following, very exceptional metrics:

This represented a trailing 12-month free cash flow margin of 44%. Because of our strong balance sheet, we were able to repurchase $2 billion of our stock in the last 9 months. And today, we’re pleased to announce that our Board just approved a new repurchase authorization for up to $2.5 billion of our Class A common stock.

With robust free cash flow and a giant cash hoard, we can confidently assert, “The more it declines, the more we benefit!” And this is the case because Airbnb operates very efficiently, which allows it to generate very robust free cash flow, with which it’s begun repurchasing shares in healthy amounts. We can see the impact of these share repurchases in the chart below:

Brian Chesky, Q1 2023 Shareholder Letter

For those who would like to learn more about why we seek out companies that repurchase shares while growing at healthy rates, e.g., Chipotle (CMG), Airbnb, or Lululemon, I would invite you to read this note:

International Expansion

Next is Europe. We’re very big in France. We’re very big in the U.K. We’re now seeing great growth in Germany. But there’s a lot of markets in Europe. We haven’t ever really run robust brand marketing campaigns. Now we’re getting more aggressive in Italy. We’re getting more aggressive in Spain, and we’re now looking at other markets in Northern Europe. And I think there’s actually a lot of greenfield in Europe because we’ve really only focused on a few of the really big markets. And when we see we focus the big markets like France and U.K., we are now really strong. And I think we can have similar penetration in other countries in Europe.

One of the central bear theses for Airbnb is that international growth will be hamstrung by Booking.com (BKNG). While formidable, I found the following quote, shared by Booking’s CEO insightful:

Thoughts From The CEO of Booking.com

Booking.com Conference Transcript

This is “The Innovator’s Dilemma 101.”

Mr. Chesky added further thinking to Airbnb’s international expansion in the following exchange:

Justin Post: Great. A couple of questions. I guess the first thing about competition. As you move into Europe, you might see a big competitor in booking. Can you talk about your model where you charge both the host and the guest versus there’s more heavily weighted to the host? Do you think that works well in Europe? And how do you think about the differences there?

Brian Chesky: Yes. And maybe, Justin, before I answer about our model in Europe, I just want to also add something. So with most travel companies, their strategy is like basically paid marketing, right, performance marketing and brand marketing. I think a callout I just want to make is PR social media is a huge benefit to Airbnb. Historically, we have the largest share of voice in travel. Last week, we got 3,000 articles. I mean that was like more than 1/3 of the amount of press we got for IPO. So we think that there’s a lot of opportunity for Airbnb to continue to be front and center in people’s minds, in PR and social media and even in pop culture on TV shows, movies, songs, et cetera, et cetera.

So I think the name of the game is both paid media and then earned media. And earned media is a really important part of the international story and international expansion because earned media really creates trust more than paid media.

Now with regards to Europe, the one thing I just want to point out is we actually have both models. We have a model where we have a guest fee and host fee. We also have a model where we have a host-only fee. And host can choose, and we have this kind of choice for hosts, especially for larger property managers. Ultimately, especially with our total price display, I don’t think it’s a major issue for guests. I think ultimately, they’re going to be looking at the total price. And we’ve not seen a major behavior change. I think, yes, they’re most sensitive to total price. They’re becoming more savvy. They’re getting trained on total price. And that is partly why we moved our product towards an option of showing people total price. As long as we remain competitive, as long as we offer the best product and we offer the overall best value for the total price, I think that’s ultimately what guests are going to care about.

Concluding Thoughts: Airbnb’s Evolution

One of the benefits of owning younger companies is that they can very dynamically adapt and excel during periods of change.

To this end, virtually all of our business of owning a business is a bet on younger-ish companies and AI. To this end, I found the following exchange to be one of the best I’ve heard in terms of “explaining the evolving landscape incisively.”

Justin Patterson: So if I can, first, to follow up on Eric’s question around the Summer Release. Brian, you recently made some comments about AI being a meaningful opportunity for Airbnb going forward. Could you talk about how that just reshapes or helps you reimagine the travel experience going forward and some of the initiatives you might lean into around AI?

And then Dave, I appreciate you only give guidepost on the full year versus explicit guidance. Given the room night comp and expense shift in Q2 as well as the dynamic around new pricing tools in the Summer Release, could you help us understand a little bit more some of the assumptions that go into the second half and about flattish year-over-year margin?

Brian Chesky: Great. Well, why don’t I start, Justin, with AI. This is certainly the biggest revolution and test since I came to Silicon Valley. It’s certainly as big of a platform shift as the Internet, and many people think it might be even bigger. And I’ll give you kind of a bit of an overview of how we think about AI.

So all of this is going to be built on the base model. The base models, the large language models, think of those as GPT-4. Google has a couple of base models, Microsoft reaches Entropic. These are like major infrastructure investments. Some of these models might cost tens of billions of dollars towards the compute power. And so think of that as essentially like building a highway. It’s a major infrastructure project. And we’re not going to do that. We’re not an infrastructure company. But we’re going to build the cars on the highway. In other words, we’re going to design the interface and the tuning of the model on top of AI, on top of the base model. So on top of the base model is the tuning of the model.

And the tuning of the model is going to be based on the customer data you have. And I’ll just paint a picture for you. If you were to ask a question to ChatGPT, and if I were to ask a question to ChatGPT, we’re both going to get pretty much the same answer. And the reason both of us are going to get pretty close the same answer is because ChatGPT doesn’t know that it’s between you and I, doesn’t know anything about us. Now this is totally fine for many questions, like how far is it from this destination to that destination. But it turns out that a lot of questions in travel aren’t really search questions. They’re matching questions. Another is, they’re questions that the answer depends on who you are and what your preferences are.

So for example, I think that going forward, Airbnb is going to be pretty different. Instead of asking you questions like where are you going and when are you going, I want us to build a robust profile about you, learn more about you and ask you 2 bigger and more fundamental questions: who are you? And what do you want?

And ultimately, what I think Airbnb is building is not just a service or a product. But what we are in the largest sense is a global travel community. And the role of Airbnb and that travel community is to be the ultimate host. Think of us with AI as building the ultimate AI concierge that could understand you. And we could build these world-class interfaces, tune our model. Unlike most other travel companies, we know a lot more about our guests and hosts. This is partly why we’re investing in the Host Passport. We want to continue to learn more about people. And then our job is to match you to accommodations, other travel services and eventually things beyond travel. So that’s the big vision of where we’re going to go. I think it’s an incredibly expanding opportunity.

I’ll just end by giving you some tactical things we’re going to be doing in the next 12 months. Number one is customer service. This is going to be one of the biggest benefits to Airbnb. One of the strengths of Airbnb is that Airbnb’s offering is one of a kind. The problem with Airbnb is our service is also one of a kind. And so therefore, historically less consistent than a hotel. I think AI can level the playing field from a service perspective relative to hotels because hotels have front desk, Airbnb doesn’t. But we have literally millions of people staying on Airbnb every night. And imagine they call customer service. We have agents that have to adjudicate between 70 different user policies. Some of these are as many as 100 pages long. What AI is going to do is be able to give us better service, cheaper and faster by augmenting the agents. And I think this is going to be something that is a huge transformation. It’s a bit all hands on deck, and used to be improvement later this year into next year. That’s number one.

Number two, we are now building AI into our product. And let me just give you an example. A few months ago, OpenAI launched plug-ins. And in fact, we were actually supposed to be one of the launch partners for the plug-ins on OpenAI ChatGPT. But I told Sam, we were literally one of the first to work with him that before right before our launch, I decided to pull the plug on it. And the reason why is I decided that the interface of pure tech space with widgets at the bottom was probably not the right interface for travel. Ultimately, I think the right interface for travel is multimodal. It’s rich media. It’s photo. It’s video. It’s much more immersive. And GPT-4 is available in our app. So we’re going to be building GPT-4 into our interface. And I think that’s the real opportunity for us. So you should see some big changes next year with AI built into our app.

The final thing I’ll say is developer productivity and productivity of our workforce generally. I think our employees could easily be, especially our developers, 30% more productive in the short to medium term, and this will allow significantly greater throughput through tools like GitHub’s Copilot. So all of this is to say, I’m really excited on the short term and the long term.

And the last thing I’ll just say is I think the companies that will most benefit from the shift of AI are going to be the companies that have the most innovative cultures. That’s kind of what happened in the ’90s with the Internet. And if the last couple of years is any indication, having launched over 340 features of innovations, I think we’re definitely going to be right at the forefront of this revolution.

As always, thank you for allowing Beating The Market to serve you in building your business of owning businesses!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB, LULU, S, SE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.