Summary:

- Despite an 80% boost in share price year to date, Airbnb’s strong fundamentals give the stock plenty of runway to rise higher.

- Airbnb continues to enjoy double-digit growth in revenue, nights booked, and bookings dollars; while generative both pro forma and GAAP profits.

- Competitor Expedia’s shift to its OneKey Rewards program, broadly seen as a devaluation, may push more market share in Airbnb’s direction.

- The company’s push to improve supply in underpenetrated markets is a key growth tailwind going forward.

NickyLloyd

Amid buoyant markets, it’s a great time for investors to step back and critically re-assess their portfolios to emphasize picking stocks that can outperform the broader indices throughout the rest of the year. And though tech has largely returned to center stage this year powered by enthusiasm for generative AI, many of these stocks still sit well below all-time highs.

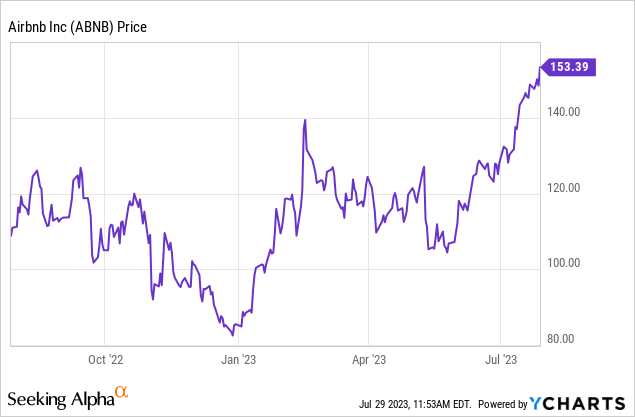

Take Airbnb (NASDAQ:ABNB), for example. The travel lodging giant has seen its share price lift by more than 80% year to date on the back of strong travel demand, yet the stock is still well below 2021 levels above $200. In my view, in spite of Airbnb’s recent rally, there’s still plenty of room for this stock to jump.

The tide is shifting in Airbnb’s favor

I remain bullish on Airbnb, especially in this market. First of all, I’m encouraged by the company’s double-digit growth in revenue and nights booked, which we’ll get into in the next section. The company has cited strong recovery in travel demand to and from Asia as one of the core drivers for its rebound. Travel to urban cities is ramping back up; and in addition to this, many guests are opting to stay in Airbnbs for much longer periods of time, and Airbnb has opted to lower fees for long-term stays as well as offer the option to pay directly out of bank accounts for these rent-like situations.

Second: the competitive landscape, in my view, is shifting in Airbnb’s favor. Earlier this year, major competitor Expedia (EXPE) rolled out its OneKey rewards program. This was largely seen as a devaluation of bookings rewards for one of Expedia’s major subsidiaries, Hotels.com (and speaking from personal experience, I often price compare between options on Hotels.com and Airbnb). Frustration over the perceived drop in bookings incentives on Hotels.com from an effective 10% yield (staying 10 nights at hotels booked on the website earned 1 free night stay, at the average value of the 10 nights used to earn the reward) to 2% may tilt more travelers in Airbnb’s favor, which is well-known for having no rewards program (as of yet).

And third, Airbnb has its eyes set on expansion. Supply is growing: active listings are up 18% in the first quarter versus the prior-year period. The company is citing fast growth in Brazil and Germany and is laser-focused on expanding its presence globally – though the company is already in 220 countries, it is a smaller underpenetrated presence in many of these regions.

Here is my full long-term bull case on Airbnb:

-

Pent-up travel demand. As people get back into the swing of travel, Airbnb is well-positioned to absorb that demand and gain market share, thanks to its growing pool of hosts, its broader network of availability in different regions, and its various “Experiences” offerings.

-

Airbnb may not just be for vacation anymore. With so many companies announcing permanent remote or hybrid work structures, many workers have leaped at the chance to become digital nomads and work from anywhere. In the spirit of this trend, even Airbnb itself has also announced that it is allowing its staff to work from any location (including up to 90 days internationally, limited for tax purposes). This trend may see Airbnb picking up not just travel demand, but essentially “rent” budgets from digital nomads as well. As a result of this trend, average trip lengths are increasing quite substantially.

-

Chance to absorb hotel business through promoted listings. It’s not a great time to be in the hotel game right now. After facing two years of heightened vacancy, hotels have always dealt with high third-party booking fees through platforms like Expedia (EXPE) and Booking (BKNG). Airbnb already allows boutique hotels to list on its platform for a fee; over time Airbnb could fully throw its hat in the ring to compete against the high-fee OTA giants.

-

Profitability in mind. During the immediate aftermath of the pandemic, Airbnb laid off about 20% of its staff. While it is now continuing to hire, this profit-centric mindset and the fact that Airbnb is structurally leaner than it was pre-pandemic has allowed the company to make sizable profitability gains.

Recent trends support the boost in travel demand

After years of COVID-suppressed travel demand, Airbnb is enjoying a record travel surge that is helping the company to soar to new levels of profitability. Take a look at the trended results in the table below:

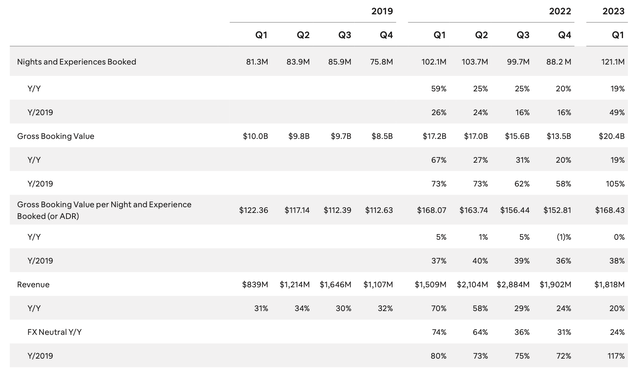

Airbnb key metrics (Airbnb Q1 shareholder letter)

Nights booked in Q1 grew 19% y/y to 121.1 million, roughly at the same pace as in Q4. Versus pre-COVID 2019, however, the business has grown 49%. Bookings dollars, meanwhile, grew 19% y/y to $20.4 billion, while it has more than doubled versus 2019 as average prices have substantially inflated since then.

It is important to note that while ADR growth was prevalent during the pandemic, prices have largely flattened now with 0% ADR grown in Q1 – Airbnb is no longer exactly a budget option, and competing with OTAs necessitates keeping prices in line. But in spite of the lack of ADR tailwinds, revenue still grew 20% y/y, or 24% y/y adjusted for currency movements.

To continue to stimulate growth, Airbnb is experimenting with more formats, including a new rollout of Airbnb Rooms. Per CEO Brian Chesky’s remarks on the Q1 earnings call:

Finally, we also introduced Airbnb Rooms, an all-new take on the original Airbnb Private Room. Airbnb Rooms gets us back to the idea that started it all, back to our founding ethos of sharing. And they’re also one of the most affordable ways of travel, with an average price of only $67 a night. In fact, over 80% of Airbnb Rooms are under $100 a night. And in the current macroeconomic environment, people want to travel affordably. But guests have told us that they want to know more about who they’re staying with before they book. So that’s why every Airbnb Room comes with a host passport, which helps guests get to know their host before they book.

In response to last week and our 2023 Summer Release has exceeded our expectations. Press coverage was overwhelmingly positive, and we got over 3,000 articles.”

Expanding Airbnb’s appeal to more budget-oriented travelers gives Airbnb an edge in gaining market share over hotels and OTAs that can’t offer rooms at price points as low as $67 per night, especially in this labor-inflationary environment.

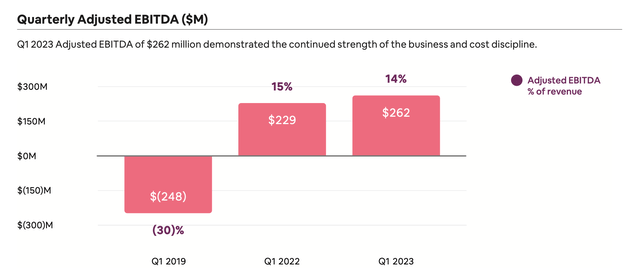

Airbnb’s profitability also remains elevated. Adjusted EBITDA in the first quarter rose 14% y/y to $262 million, also representing a 14% margin – again, note how Airbnb’s profitability picture has changed drastically from a -30% margin in 2019, demonstrating the impacts of scale.

Airbnb adjusted EBITDA (Airbnb Q1 shareholder letter)

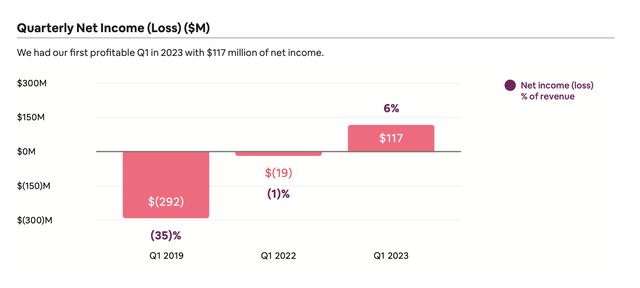

it’s worth noting as well that Airbnb notched a positive GAAP net income of $117 million in the quarter, its first time doing so in a Q1.

Airbnb net income (Airbnb Q1 shareholder letter)

Key takeaways

It’s full steam ahead for Airbnb, in my opinion. The company is enjoying tailwinds from record travel demand, while side forays into offerings like Airbnb Experiences and Airbnb Rooms differentiates the company from competitors and helps it to cement market share. Stay long here and keep riding the upward wave.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.