Summary:

- Airbnb is experiencing strong post-pandemic recovery momentum, with bookings growing and adjusted EBITDA profitability improving.

- The company has generated $3.8B in free cash flow in the last twelve months, indicating a highly profitable business model. The firm is buying back a ton of its shares.

- Risks include seasonality and potential future pandemics, but the upcoming summer travel season could act as a catalyst for further growth.

SrdjanPav

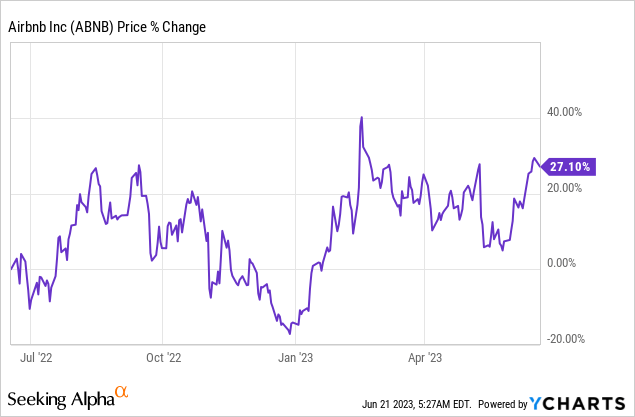

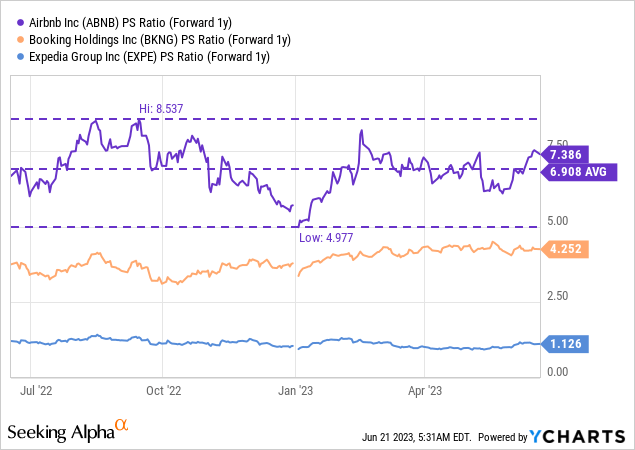

Airbnb (NASDAQ:ABNB) is widely free cash flow-profitable and the travel company is facing a powerful catalyst from the upcoming travel season. As summer travel starts, Airbnb is likely going to experience a seasonal surge in bookings, which could drive the firm’s adjusted EBITDA and free cash flow to new records. While shares of Airbnb are not cheap with a forward price-to-revenue ratio of 7.4X, I believe Airbnb’s high free cash flow margins translate into a risk profile that continues to be skewed to the upside!

Strong post-pandemic recovery creates business tailwinds

COVID-19 obviously was a major challenge for the travel industry including Airbnb which saw a collapse of bookings during the pandemic. The pandemic alone set Airbnb back by approximately two years, but business trends have materially improved since 2022 as the travel sector staged a strong rebound.

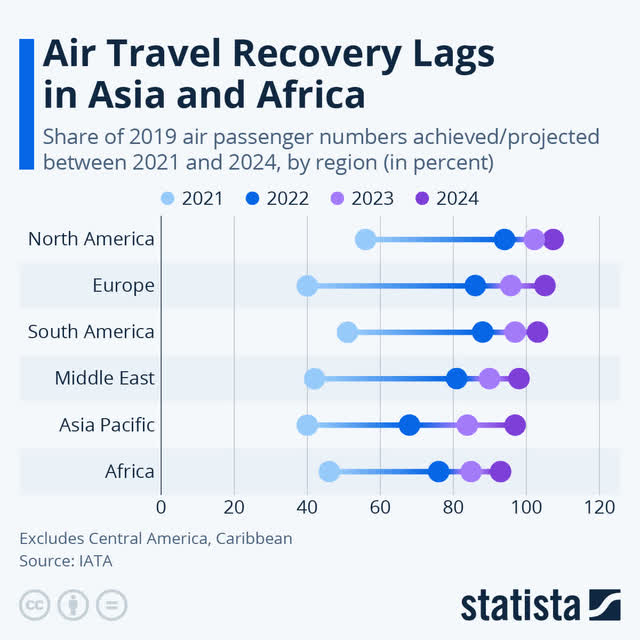

According to Statista, most markets around the world (with the exception of Asia and Africa) are expected to have made a full recovery in air travel passenger numbers by either 2023 or 2024. For Airbnb, this implies procyclical business tailwinds that could result in new records for bookings, revenues and free cash flow.

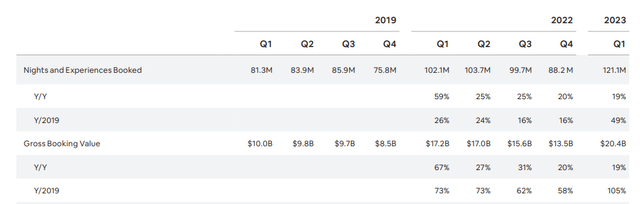

Airbnb’s booking business recovered strongly in FY 2022 and the company now widely exceeds its performance metrics from FY 2019. For the most recent quarter, Airbnb disclosed that it had 121.1M nights and experiences booked through its platform, which translated to a booking value of $20.4B. This means that Airbnb’s booking value, a key metric that measures Airbnb’s operational and financial performance, more than doubled compared to Q1’19.

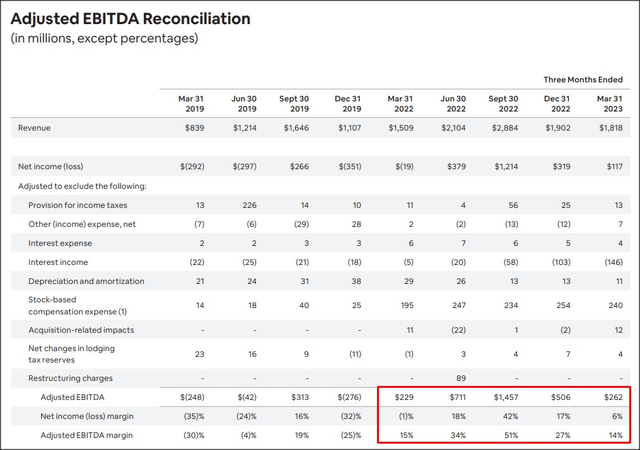

One of the best reasons to buy Airbnb is that the booking firm is now consistently profitable on an adjusted EBITDA and free cash flow basis: ever since the first-quarter of 2022, Airbnb has achieved positive adjusted EBITDA as well as strong EBITDA margins of up to 51%. The second- and third-quarters are typically strong quarters for Airbnb, as seasonality (summer vacations) positively influence business performance.

Airbnb is now a highly profitable free cash flow business

Due to the recovery of Airbnb’s booking business after the pandemic, the company has achieved impressive free cash flow profitability as well. Airbnb generated $3.8B in free cash flow in the last twelve months, which calculates to a free cash flow margin of 44%. In the first quarter of FY 2023, the booking platform achieved a FCF margin of a massive 87%, although investors must expect this margin to normalize throughout the summer months as people pre-pay for their trips. However, a FCF margin around 40-50% is insanely impressive, and it proves that Airbnb is running a highly profitable enterprise.

|

Airbnb |

Q1’22 |

Q2’22 |

Q3’22 |

Q4’22 |

Q1’23 |

Growth Y/Y |

|

Revenues ($M) |

$1,509 |

$2,104 |

$2,884 |

$1,902 |

$1,818 |

20% |

|

Operating Cash Flow ($M) |

$1,202 |

$800 |

$965 |

$463 |

$1,587 |

32% |

|

Capex ($M) |

-$6 |

-$5 |

-$6 |

-$8 |

-$6 |

0% |

|

Free Cash Flow ($M) |

$1,196 |

$795 |

$959 |

$455 |

$1,581 |

32% |

|

FCF Margin |

79% |

38% |

33% |

24% |

87% |

— |

(Source: Author)

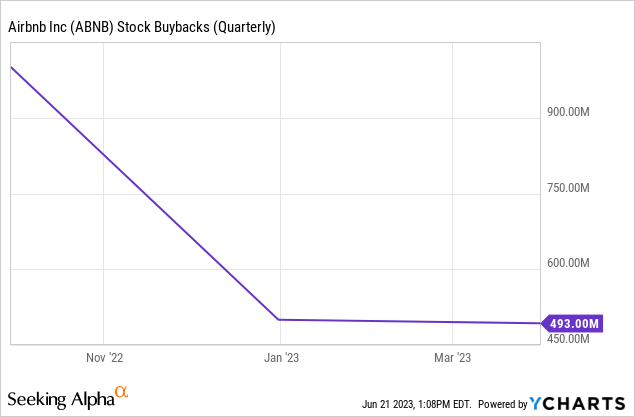

A lot of this free cash flow is being returned to investors as well: through stock buybacks. In the first-quarter, Airbnb announced that its board of directors approved a stock buyback authorization of $2.5B and the company repurchased $493M of its common shares. Therefore, Airbnb returned 31% of its FCF to shareholders as stock buybacks in the first-quarter.

I expect Airbnb to repurchase about $400-500M quarterly until the buyback authorization is completed. Assuming $1.0B in normalized average quarterly free cash flow, Airbnb could return between 40-50% of its free cash flow as buybacks, each quarter, until the buyback authorization is exhausted.

Airbnb’s valuation is high, but justified

Airbnb is growing rapidly and projected to see 13-15% annual top line growth in each of the next five years. The travel company is currently valued at 7.4X forward revenues, which is above the valuations of other travel companies such as Booking Holdings (BKNG), which owns Booking.com and Agoda, and Expedia (EXPE). Airbnb is also, at least right now, more expensive than its historical average: the 1-year average P/S ratio for Airbnb is 6.9X.

Despite the higher valuation, I believe Airbnb’s free cash flow margins justify the high price tag. With a free cash flow margin converging on 50%, Airbnb is an extremely profitable booking platform that has great potential to expand its valuation, in my opinion.

Risks with Airbnb

The biggest risk inherent in Airbnb’s business model is seasonality. COVID-like pandemics that shut down the entire travel industry are risk factors as well that investors must be able to handle. What would change my mind about Airbnb is if the company were to scale back its stock buybacks, saw lower free cash flow margins or decided to return a lower percentage of its free cash flow to shareholders.

Final thoughts

Airbnb is a well-run business with consistent adjusted EBITDA profitability and the upcoming holiday/travel season could drive Airbnb’s business to new records in bookings, revenues and free cash flow. Additionally, Airbnb is now generating very high free cash flow margins closing in on 50%, indicating that the booking platform has reached critical scale. Key performance metrics show that the company has moved on from the pandemic and is now a much larger business than before the pandemic. While shares of Airbnb are not a complete bargain, high free cash flows and stock buyback potential could drive a continual upward revaluation of Airbnb’s shares, in my opinion!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.