Summary:

- I’m reiterating my sell rating on Airbnb post-earnings, as the company faced a further deceleration in bookings growth rates while peers have improved.

- The company is issuing a more upbeat outlook for Q4 that suggests trends may accelerate, but this is far from guaranteed in an inflation-weary environment.

- Airbnb’s adjusted EBITDA margins are also weakening, a symptom of the company’s boosted spending on marketing and R&D to release new features like Icons and Co-Host.

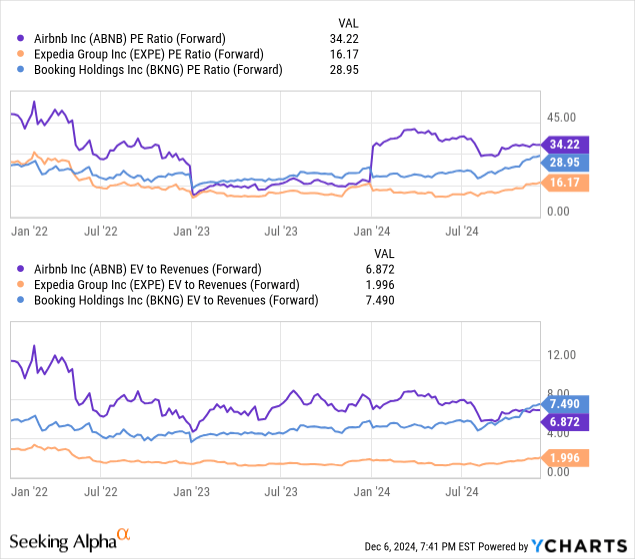

- The stock’s valuation at ~34x forward P/E sits well above its hotel OTA peers, despite the fact that its competitors now have very similar top-line growth rates.

Thomas Barwick/DigitalVision via Getty Images

If you’re like me, you’ve been scouring the stock market looking for good growth stocks to invest in that don’t feel “too late” to get into. Many of the highest quality software and internet stocks have run up dramatically this year, some enjoying a doubling or more in their valuation.

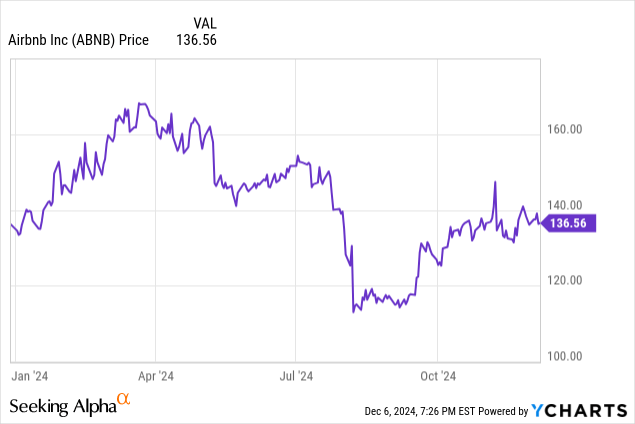

But among the holdouts that haven’t seen tremendous gains, fundamental issues left in their wake, and Airbnb (NASDAQ:ABNB) is one example. The global leader in vacation rentals has been suffering under a recent trend of weaker bookings and lower consumer spending on vacations, alongside growing competition from its classic competitors: hotels. The company recently released lackluster Q3 results (which produced a post-earnings dip), bringing the stock to just about flat YTD. The question for investors now is: does Airbnb have further to fall in 2025, or can it make a rebound?

I last wrote a sell rating on Airbnb in October when it was trading around $125, at the time giving the stock a double-downgrade from a prior buy recommendation. Since then, Airbnb’s booking trends have continued to weaken, in spite of innovative new feature releases that have so far not been able to provide a bump in bookings growth rates. Meanwhile, hotel competitors from OTAs like Expedia (EXPE) and Booking.com (BKNG) seem to have achieved better stabilization in bookings growth rates, despite a tough macro for all travel companies. With this in mind, I’m reiterating my sell rating on Airbnb.

To me, the biggest long-term risks for Airbnb are:

- Airbnb isn’t exactly the hotel-killer that many bulls may have envisioned it to be. It turns out, there’s a strong use case for hotels, too. When travelers want amenities, a 24-hour front desk, a stay that doesn’t feel like home – the answer is usually a hotel. Airbnb usually serves a different type of traveler: those who want more space than a hotel room and/or those who want to stay in more local neighborhoods. But this being said, Airbnb can’t fully capture 100% of global travel demand.

- Slower bookings growth rates: is the macro finally catching up with Airbnb? After the “revenge travel” phenomenon that carried the travel industry for several years after the pandemic, bookings are finally slowing down, despite a number of new feature releases and continued supply expansion for Airbnb.

- Regulation- Airbnb faces a complex patchwork of local regulation and has made municipal enemies across the globe. The company recently tangled with the local government of Barcelona, which is tightening up its Airbnb enforcement in the wake of anti-tourism protests earlier this year.

Making matters worse: despite the fact that Airbnb’s growth rates are no longer that much higher or equivalent to OTA peers, Airbnb continues to trade either in-line against Booking or at a substantial premium to Expedia, exposing further valuation risk:

Meanwhile, the company continues to buy back stock aggressively (spending $1.1 billion on buybacks in Q3), which may prove to be poor timing if the stock is indeed bloated and faces a further correction. In my view, it’s best to sell Airbnb and invest elsewhere.

Q3 download

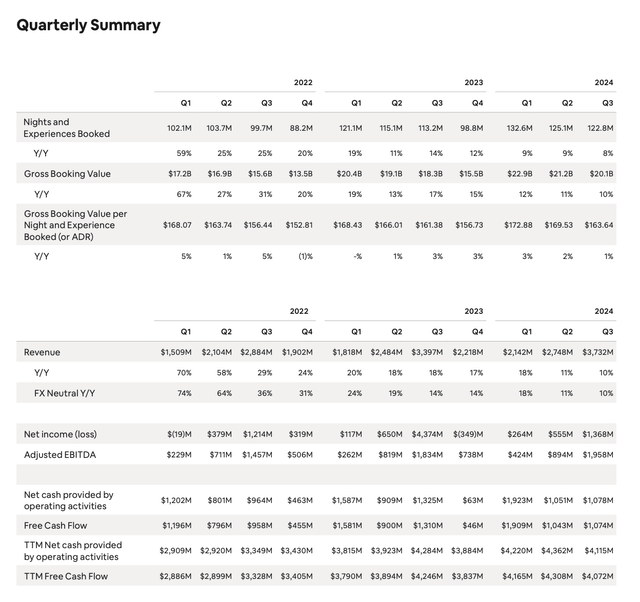

In my view, Airbnb’s latest quarterly earnings exposed even more risk for the vacation-rental platform, especially when we compare it vis-a-vis its rivals. Take a look at the Q3 earnings summary below:

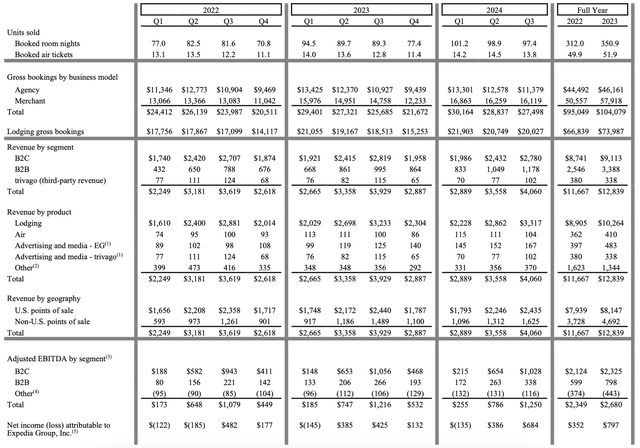

Airbnb Q3 trended metrics (Airbnb Q3 shareholder letter)

Revenue grew 9.9% y/y to $3.73 billion, only slightly ahead of Wall Street’s $3.72 billion (+9.4% y/y). And most importantly, bookings trends continued to soften, with gross bookings value of $20.1 billion up 9.8% y/y, decelerating 120bps from 11.0% growth in Q2.

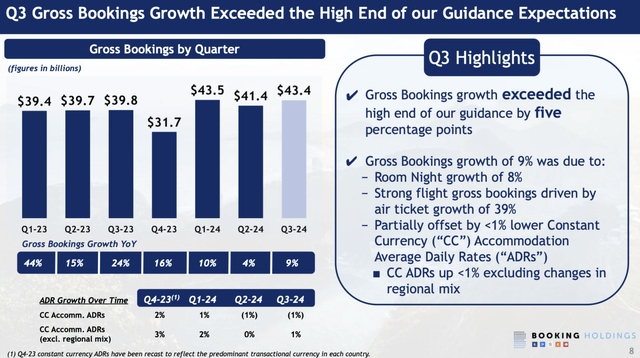

Against this backdrop, Airbnb’s rivals have seen better performance. Earlier this year, all OTA companies and Airbnb reported a sharp slowdown in bookings, which Airbnb attributed to slower booking lead-times (implying that bookings may re-accelerate later as travelers got closer to their intended vacation dates). This did not play out for Airbnb, but certainly did for its rivals.

Booking.com, also the parent company behind Priceline and Agoda, saw the sharpest acceleration in bookings growth rates to 9% y/y, a 5 point acceleration from 4% growth in Q2:

Booking Q3 trends (Booking Q3 earnings deck)

Meanwhile, the second-largest OTA rival Expedia, which also owns a vacation rental platform called Vrbo, accelerated its sequential pace of bookings by 150bps y/y to 7.0%:

Expedia Q3 trends (Expedia Q3 earnings deck)

Of the two, I consider underdog Expedia to be the fiercer long-term concern to Airbnb. That’s because of Expedia’s successful integration of all of its platforms under the “One Key” rewards program, which offers travelers a cash-back rate of between 2-6% (depending on the member’s loyalty tier and property type) paid out as “One Key Cash” credits toward future bookings. Airbnb has no loyalty program whatsoever, while Booking offers one but without a direct cash-back scheme. In my view, the longer this disparity continues, the more market share will gradually shift toward Expedia (as a personal anecdote: I also use Expedia most frequently now for my travels, as I often not only find the best rates on similar properties on Expedia but also get additional One Key Cash on top).

Now, to take a slightly more positive view on Airbnb: it is true that the company’s absolute pace of bookings growth is still faster than its two rivals (though Airbnb’s ~$20 billion in quarterly bookings is also at a smaller base than Expedia at ~$27 billion and Booking at ~$43 billion). This implies that Airbnb is still taking some market share, but growth rates between the three platforms are fairly close to converging.

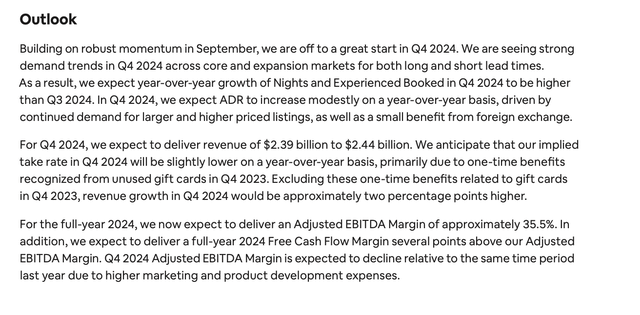

Airbnb also has a robust outlook for Q4. The company has seen an improvement of the “shorter lead time” phenomenon, which is causing it to guide to Q4 Nights and Experiences Booked to improve slightly on a y/y basis compared to Q3:

Airbnb outlook (Airbnb Q3 shareholder letter)

Discussing this view on the Q&A portion of the Q3 earnings call, CFO Ellie Mertz noted as follows:

What we shared in the letter was that for your line to where we were back at the time of the last earnings call, we called out that there was a bit of softness globally related to lead times is specifically what we shared with that. We were seeing continued strength of last minute bookings, but relative softness in terms of the longer lead times. And what we saw over the course of the quarter, specific to both the regions that you called out, but globally was that lead times over the course of July, August and September normalized and came back almost in line to where we were in ‘23. I think you saw that most notably in EMEA and I think probably some of the, long lead time softness that we were seeing in EMEA was certainly related to some distraction around the Olympics because we certainly saw the bookings pick up after the Olympics pass, but more broadly that acceleration was seen across all four major regions.”

Still: an improvement in vacation bookings trends is far from guaranteed, especially in an inflation-weary environment where many Americans are still worried about the economy, as evidenced by the discourse of the 2024 elections.

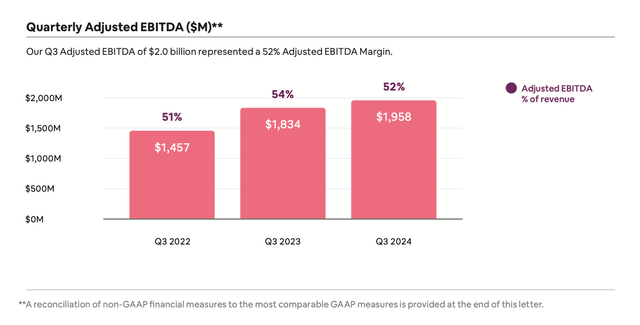

In the meantime, we note that Airbnb’s profitability is slipping as well. The company’s adjusted EBITDA margins slipped 2 points to 52% in the quarter.

Airbnb adjusted EBITDA (Airbnb Q3 shareholder letter)

Even to maintain this level of bookings growth, the company has had to invest more heavily in sales and marketing costs (+28% y/y on a GAAP basis in Q3). It has also accelerated spending on R&D (+25% y/y) to deliver new features like Co-Host (the ability for property owners to select a Co-Host to help manage their listings). As bookings slow down, Airbnb may face pressure from investors to slow down expense growth as well.

Key takeaways

To me, Airbnb remains a solidly unappealing investment. The stock’s valuation looks full at ~34x forward P/E and ~7x forward revenue, especially as the company’s bookings growth rates grow closer to converting with its hotel booking platform peers. Longer term, the company also continues to tangle with a number of local governments with anti-Airbnb sentiment, which caps the company’s expansion in many markets. All in all, I see a bumpy road ahead in 2025, and investors would do well to remain on the sidelines here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.