Summary:

- Airbnb is now lapping tough comparables.

- ADR is likely to come down as supply increases.

- The company has a net cash balance sheet and is GAAP profitable.

- The company stands head and shoulders over peers, but its competitive advantages are likely unsustainable over the long term.

Klaus Vedfelt/DigitalVision via Getty Images

Have we witnessed the peak of Airbnb (NASDAQ:ABNB) stock? ABNB was a strong post-pandemic winner but I have been concerned about the potential for decelerating growth rates after the company lapped the easy comparables. While growth rates are likely to moderate in the near term, ABNB continues to benefit from long term secular trends and retains a high margin profile. Even so, the resilient fundamentals are not enough to justify this valuation. Investors need to be aware of competitive risks which make the stock look dangerously priced at current levels.

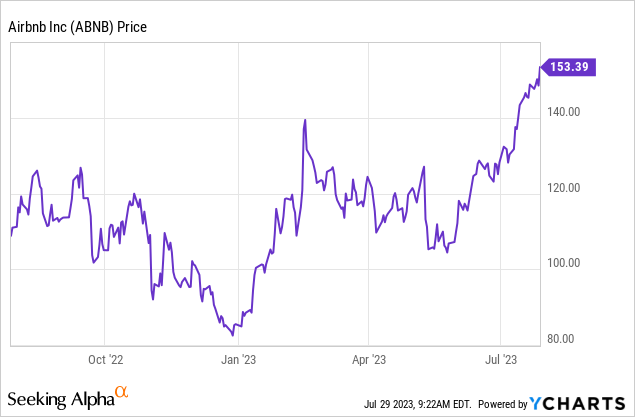

ABNB Stock Price

After experiencing some weakness earlier in the year, ABNB has recovered all of its YTD losses and a is somehow up substantially for the year.

I last covered ABNB in April where I rated the stock a buy but warned about the tough comparables coming ahead. Management’s guidance for the next quarter already hints at such headwinds, but the stock seems oblivious to what’s to come.

ABNB Stock Key Metrics

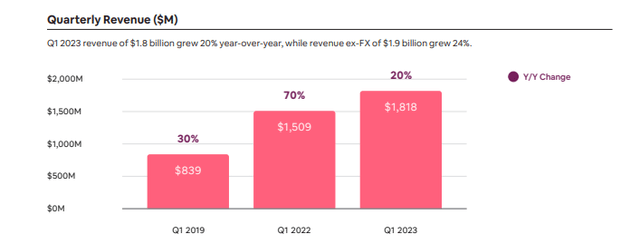

In its most recent quarter, ABNB saw revenue growth decelerate meaningfully to 20% YOY. Unlike in the past few years where the company benefited from rapidly rising average daily rate (‘ADR’) growth, ADR remained stable with the bulk of growth coming from growth in rooms sold.

2023 Q1 Shareholder Letter

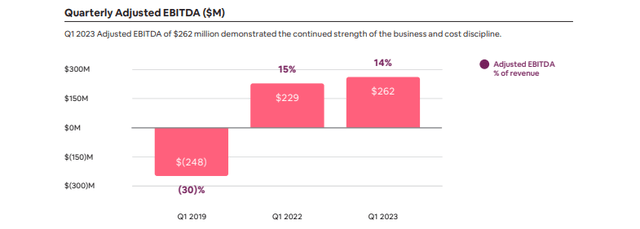

ABNB sustained a respectable 14% adjusted EBITDA margin – for context investors must remember that the first quarter of the year tends to be slower for travel demand.

2023 Q1 Shareholder Letter

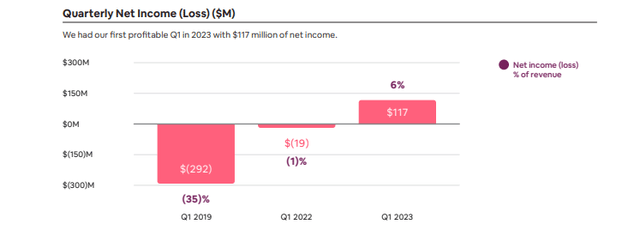

ABNB was able to deliver its first GAAP profitable first quarter with a 6% net margin.

2023 Q1 Shareholder Letter

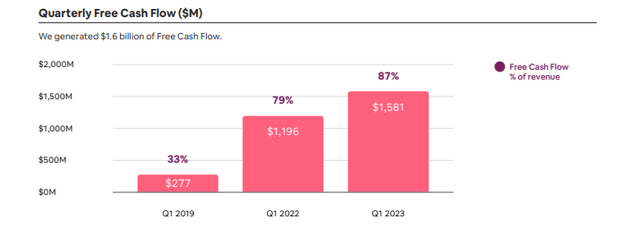

That is a solid achievement – for reference, lodging peer Expedia (EXPE) has not generated positive GAAP net income in its first quarter of the year since 2015, and that quarter benefited from non-cash line items. Given the seasonality, it is not that surprising that ABNB generated $1.6 billion in free cash flow, making up 87% of revenue.

2023 Q1 Shareholder Letter

The company noted that they are now “twice the size as we were before the pandemic on both a GBV and revenue basis—and with considerably higher profitability and cash flow.”

ABNB ended the quarter with $10.6 billion of cash and investments (not inclusive of $7.8 billion of unearned revenues) versus $2 billion of debt. ABNB repurchased $500 million of stock in the quarter and the company announced a new $2.5 billion share repurchase program. Management stated that the primary goal of this share repurchase program would be to offset dilution, but I would not be surprised if they leaned aggressively into the program if the stock price weakness persists. Despite its short-lived time as a public company, ABNB appears to be steadily becoming a mature online marketplace. I expect ABNB to eventually take on net leverage and heavily prioritize share repurchases like EXPE and Booking (BKNG) have.

Looking ahead, management has guided for up to 16% YOY revenue growth to $2.45 billion in the second quarter. That is in spite of an expectation for take rates to expand YOY. Management blamed the decelerating growth as being due to tough comparables as many quarters in 2022 benefitted from pent-up demand following the Covid Omicron variant. What’s more, adjusted EBITDA is expected to remain constant YOY, implying some margin contraction. Management stated intentions to increase its marketing spend relative to the prior year. On the conference call, management stated that 90% of their search traffic is organic or unpaid, but investors are right to fear eventual disruption by none other than Alphabet (GOOGL). Management warned that sales and marketing expenses would be 400 bps higher as a percent of revenue than in the prior year. While it is possible that this increase proves to be one-time or seasonal in nature, I am spooked by the Google risk.

Management expressed optimism with regards to how artificial intelligence can boost their business. Among other use cases, management noted the great challenge for its service reps to “adjudicate between 70 different user policies.” AI may be able to help augment their service agents to provide faster and more effective service. As management stated, “One of the strengths of Airbnb is that Airbnb’s offering is one of a kind. The problem with Airbnb is our service is also one of a kind.”

ABNB did lay off 30% of its recruiting staff earlier this year, but for the most part has avoided the mass layoffs seen across the tech sector. This is mainly because the company already laid off 25% of its headcount amidst the pandemic. Like other companies hit hard during pandemic lockdowns, ABNB has emerged from the crisis with a stronger financial position.

One of the company’s near term initiatives has been to address a common complaint from customers regarding opaque pricing. If you have ever stayed at an ABNB property, you can likely relate to the sticker shock of cleaning fees and other expenses. ABNB is rolling out a “total price display” feature which should help ease this issue. Management gave hints to long term projected growth rates for the company. While faster demand growth can lead to rapid increases in price, ABNB benefits most from supply growth. ABNB’s long term priority is to continue rapidly growing its supply, which may help the company sustain some competitive advantages for some time.

Is ABNB Stock A Buy, Sell, Or Hold?

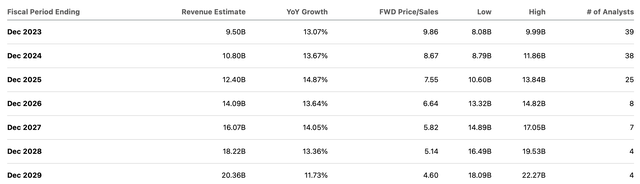

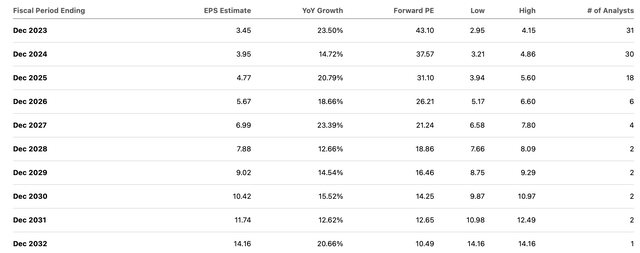

At this point, traveling on Airbnb can be considered mainstream. Management believes that there is a disconnect between traveling and hosting on the platform. ABNB has been working hard on providing resources to make onboarding new hosts easier. The long term opportunity for ABNB can go beyond just travel stays, as long term stays are becoming a bigger and bigger part of the business, making up 18% of total gross nights booked in the quarter. Management believes that some hosts may be more comfortable with long term stays and others with short term stays, so improving both ends of this funnel can help increase supply growth all around. While travel lodging is arguably a highly competitive and mature business, it is hard to argue against the long term secular growth story of long term rentals moving toward its platform. Yet it is hard to explain why ABNB continues to trade at a premium valuation, with the stock trading at around 10x sales in spite of modest double-digit revenue growth moving forward. That kind of premium valuation is typically reserved for names like Microsoft (MSFT).

Seeking Alpha

ABNB’s earnings multiple also represents a steep premium to the 12x multiple seen at EXPE. In fact, ABNB is not expected to trade at that multiple until the year 2031.

Seeking Alpha

I assume that the company can sustain 30% net margins over the long term. Based on 14% revenue growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at around 6.3x sales, implying that the stock may be dead money over the coming years.

There are many risks to consider besides valuation. I emphasize that the competitive advantages enjoyed by the company today – the most important being its high degree of organic traffic – are likely not sustainable over the long term. I have already mentioned that one challenge faced by the company is making prospective hosts comfortable with sharing their home. I find it plausible if not likely that ABNB’s efforts in this arena will benefit not just themselves but also their competitors as I see little reason why a host would only list on one platform. ABNB is benefitting mainly from a first mover advantage, but as has been seen in e-commerce and also at competitors like EXPE, such advantages prove transient. Analysts appeared quite concerned about competition on the conference call, with many analysts asking about the company’s efforts to stave off competition. One cited EXPE’s new loyalty program, something that ABNB thus far does not have. While the company’s technological advantages may help insulate it from competition in the near term, I expect consumers to be highly price sensitive and ABNB is likely to see difficulty in further expanding profit margins. It is likely that ABNB can afford deeper cost cuts than its more mature competitors, but such levers are one-time and not repeatable long term. I see it being several years before competitors can catch up, but ABNB stock is still trading too richly regardless. I am downgrading my rating from buy to hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!