Summary:

- Airbnb has proven its ability to effectively scale, achieving profitability for the first time in 2022 while simultaneously improving margins.

- The company has locked in ultra-low rates on their 2026 convertible notes, while competitors may be left squirming for possible methods of avoiding refinancing into higher rates.

- Efficient use of working capital has positioned Airbnb for success with regards to a potential economic downturn.

- An impending recession in the second half of 2023 could influence market psychology and drive the stock price down in the second half of the year.

Editor’s note: Seeking Alpha is proud to welcome Brett Peskin as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

SrdjanPav/E+ via Getty Images

Thesis

Given the current state of the market, it is difficult to have confidence that Airbnb (NASDAQ:ABNB) will rise throughout the remainder of 2023. Rather, with the expectation that the effects of the Fed’s decisions over the past year will be strongly felt in the second half of the year, I would suggest a wait-and-see approach on ABNB stock. With strong underlying financials, an abundance of cash, and extremely low rates on their debt, ABNB is in no position of financial worry, but the effects of market psychology and the size of the looming recession are yet to be seen. Based on historical data, I anticipate a drop in the value of Airbnb’s share prices by around 28% to around $85/share. Barring any massive changes, should such a move happen, I would gladly revise my stance from a Hold to a Strong Buy, on the premise that Airbnb remains financially sound with massive upside.

Market Conditions

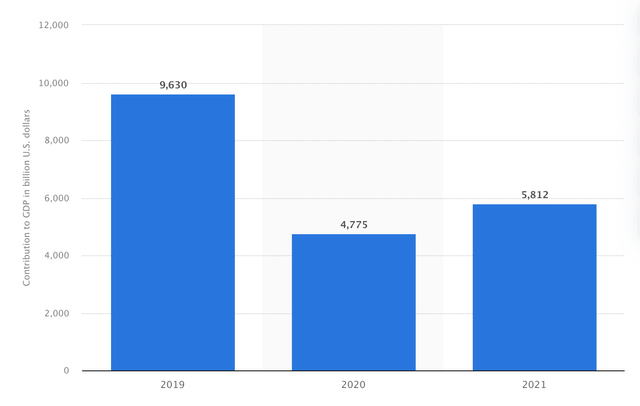

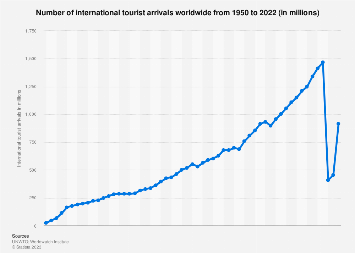

As a travel and leisure product, Airbnb’s ability to generate revenue will inherently be largely driven by demand in the travel industry, one that frequently proves itself susceptible to economic shifts. The COVID-19 pandemic proved catastrophic to the industry as a whole, leaving many wondering if travel would ever return to normal. In the first half of 2020, tourism arrivals fell by 65%, compared to only 8% during the Global Financial Crisis of 2008. However, as the pandemic recedes and travel begins to return, the travel vacuum has created an opportunity for organizations such as Airbnb to thrive, offering services such as interaction-free check-ins and entire places to reduce the infection risk to travelers.

Statista

As a result, 2022 served as a record year for Airbnb, recording profit for the first time as a public company. The return to normalcy has not come without its drawbacks though. The pandemic resulted in mass layoffs across the country, as businesses struggled to generate revenue with people locked in their homes, forcing the Federal Reserve into a complete shift in focus. After 2019 saw a focus on quantitative tightening to combat the effects of the quantitative easing policies designed post-GFC, the plans were immediately reversed once more, as the Fed was forced to lower rates to help stimulate the economy and expand their balance sheet to all-time highs. From Q1 2020 to Q2 2022, the total value of the treasury securities held on the Fed balance sheet rose nearly 130%, from around $650 billion to over $1.5 trillion.

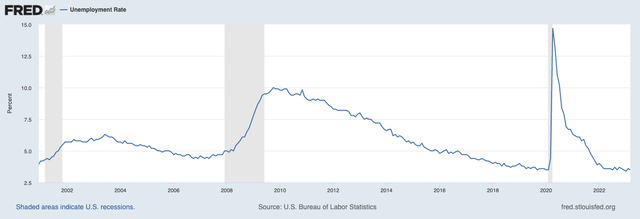

While the Fed’s policies may have proved crucial at the time given the circumstances, as the impact of the COVID-19 pandemic has died down and people are able to return to work, the excessive stimulation of the economy has created inflationary levels not seen since the 1980s. In response, the Fed has completely changed course once more, having raised the federal funds rate by 475 basis points over the last year. The goal in doing so has been clear: target a reduction in inflation to around 2%. While the size of rate hikes has slowed in recent months, the unemployment rate has moved very little.

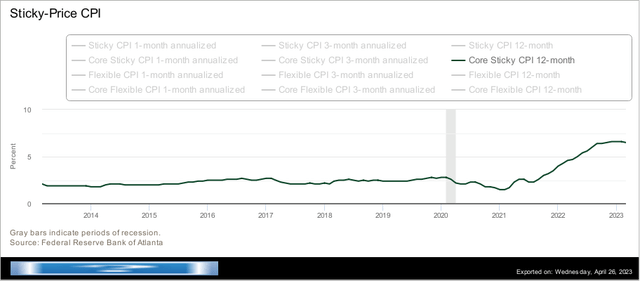

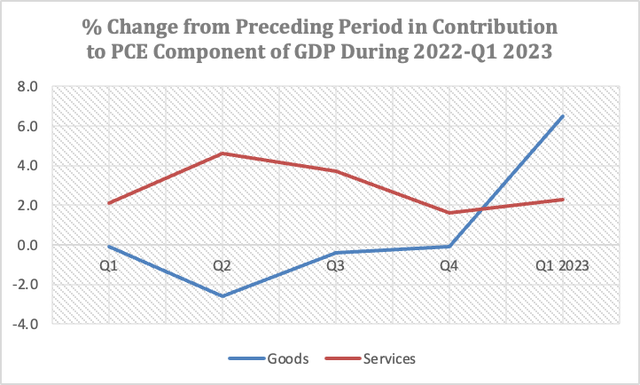

The Core Sticky CPI refers to less-elastic components of GDP such as services, including employee wages. When the unemployment rate remains too low, wages may rise due to a limited supply of workers, helping drive the Sticky Inflation rate higher. The Fed has established that the primary measure used in quantifying inflation is Core PCE. The Goods component of PCE actually drove lower during 2022.

As services make up a significant portion of Core PCE, the Fed’s goal of taming inflation will not occur without a rise in unemployment. So far, little movement has occurred, and unemployment has remained steady since the beginning of the rate hike cycle last year. The current non-cyclical rate of unemployment is 4.43%, almost a full percentage point higher than the unemployment rate of 3.5% as of March. Consumer prices for services have continually risen throughout 2022 and into 2023 as a result, per the chart above. Coupled with a significant rise in the price of goods in the first quarter of 2023, I don’t envision a cut occurring for at least several months, likely towards the end of 2023.

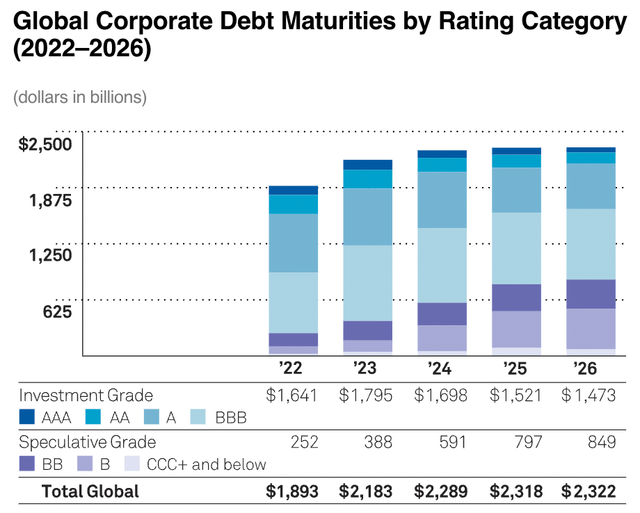

As we move into the second half of the year with rates still elevated and corporate debt expiring, businesses will be forced into situations where they will have to refinance in higher-rate environments than in years passed. Making matters worse, the proportion of issued debt that is either BBB-rated or high yield grows by the year. As a result, a number of corporations may find themselves on the “fallen angels” list, making it even more difficult to find affordable financing.

So how does this relate to the travel industry? To start, if the Fed’s goal comes true, an elevated number of people will find themselves jobless, which in turn forces them to carefully consider every last dollar before spending. Someone without an income will generally not spend their savings on travel. While it still pales in comparison to the decrease in travel during COVID, the fact that the number of tourists worldwide fell by 8% during GFC helps illustrate the impact of an economic recession on buyers’ decision-making.

Market psychology will play a huge role in the impact of the coming recession as well. The companies that generally navigate recessions well are the ones that provide people with basic necessities. That does not include consumer discretionary products, including travel and leisure. Using monthly data dating back to 2004, XLY, the consumer discretionary-tracking ETF, maintains a 0.99 correlation with the S&P 500. Aka, when the market performs poorly, it’s reasonable to assume the consumer discretionary industry follows suit. As a result, any organizations, even those that might perform well financially, could fall victim to market psychology by association.

Financial Analysis

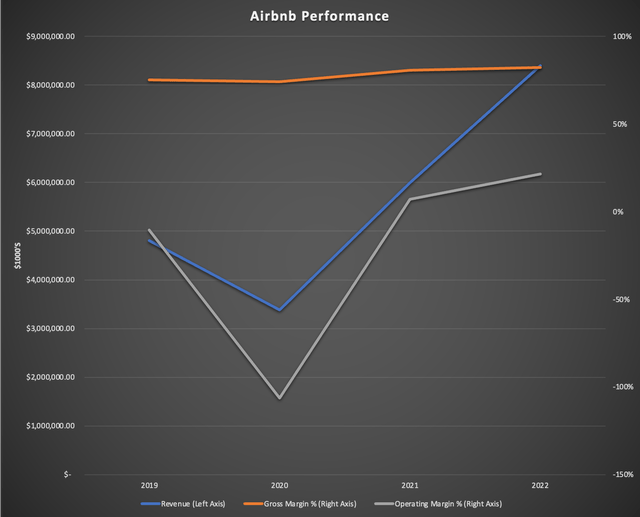

Airbnb achieved profitability for the first time in 2022. This comes just two years after a disastrous 2020, the worst year for travel in recent memory. Even then, gross margins still held consistent, implying an economy of scale.

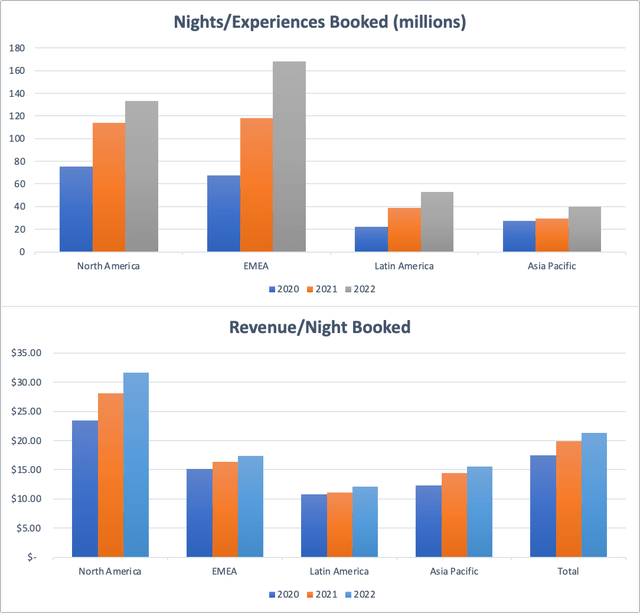

A large portion of the revenue growth and operating margin improvements over the last two years can be attributed to the impact of COVID, which severely deflated 2020 numbers. Even excluding 2020 results as an anomaly, a common practice within industries that were severely affected by the pandemic, results have improved year-over-year since 2019 despite fewer total bookings in 2021 than in 2019, a testament to Airbnb’s improved ability to maximize revenue from individual bookings. With travel returning to normal, Airbnb’s improvements haven’t been the result of growth in a singular particular area. Gross bookings have improved over the last three years across all geographic regions and gross booking values/revenues per night along with it.

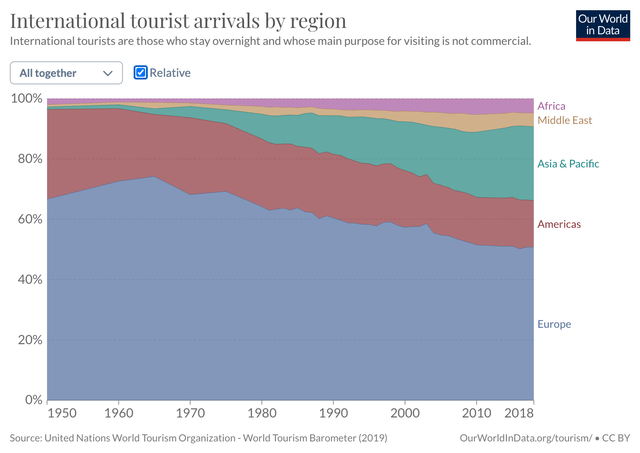

North America remains Airbnb’s top revenue generator, despite fewer total bookings over the past two years than the combined Europe, Middle East, and Africa region (EMEA), earning about twice as much revenue per night booked as any other region ($31.65/night in 2022 in North America compared to $16.05/night in the other regions). Both per-night metrics represent growth. Given the lack of diversity in Airbnb’s revenue streams, growing international presence in terms of both total bookings and revenue generated per booking is a strong priority. Failure to grow into new markets may leave the company susceptible to changing scenarios surrounding their primary revenue drivers. In 2021, the United States was responsible for 50% of the total revenue driven. In 2022, that figure dropped to 46% domestic revenue, and no singular international country represented more than 10% of the total Airbnb revenue. The Asia Pacific region in particular offers Airbnb a strong opportunity for growth.

UN World Tourist Organization, via Our World in Data

In 2022, only 10.2% of all Airbnb bookings were recorded in the Asia Pacific region, indicating a strong potential for growth in a region that continues to build their share of the international tourism market. As the company continues to grow its foreign presence, I expect more stable revenue growth and streams, resulting in less of a reliance on the North American region.

With its asset-light business model, I would not expect Airbnb to return to unprofitability, despite potential economic shifts. Possessing such little reliance on ownership of physical assets reduces exposure to potential declines in the fair value of investments, helping liquidity remain stable. In fact, a high rate environment may serve in their favor compared to competitors for two reasons: less incentive for homeowners to sell and low costs of debt. As rates continue to rise or remain high, homeowners may find a smaller market for potential buyers. Airbnb provides the opportunity for owners to continue generating cash flow, affording flexibility even in times of economic uncertainty. If drops in demand force revenues lower, the company should be able to withstand the hit. Extrapolating operating expenses aside from COGS by their average annual growth rates from 2019 to 2022, operating income would need to drop by 27% for the company to return to unprofitability. For reference, that would drop revenues to around 2021 totals, a period in which the global travel industry was still recovering from the effects of the pandemic.

Should Airbnb somehow return to unprofitability, the company still maintains over $7 billion in cash and cash equivalents, enough to cover virtually all current liabilities, plus another $4.7 billion in receivables and $2.2 billion in marketable securities. The latter two balance sheet items do have the potential to drop in value with the rest of the market, but unlikely by enough to cause serious concern. Should that happen, I doubt Airbnb would be nearly as heavily impacted as essentially the rest of the market. With an Altman Z-Score of 5.08, bankruptcy is hardly on the radar.

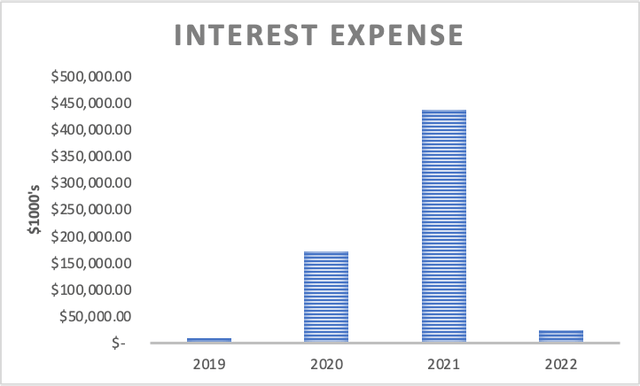

In March 2021, Airbnb paid off $2 billion in debt, previously at effective interest rates of 9.5% and 15.1% with a $200 million prepayment penalty, providing the flexibility to issue $2B worth of convertible notes at a 0.2% rate. This refinancing maneuver, while expensive at the time, has enabled Airbnb to significantly reduce interest expenses, providing the opportunity to divert capital towards potential growth opportunities.

As a result, Airbnb proved far less susceptible to changes in interest rates during 2022. According to their 10-K, “A hypothetical 100 basis points increase in interest rates would have resulted in a decrease of $13.1 million to our investment portfolio as of December 31, 2022”. By comparison, a move half the size in interest rates (50 bps instead of 100) would cost competitor Expedia (EXPE) $115 million in the fair value of their debt.

The notes, which can be converted into common stock at $228.64 per share (a 60% premium) in 2026, also mean that, unlike competitors, Airbnb will avoid the need to refinance later in the year, significantly reducing the possibility of bankruptcy in the near future. Given the limited amount of resources required to run the business, there is unlikely a need for more financing in the immediate future.

Issuing convertible notes does expose investors to potential share dilution risks. The $2 billion fundraising opened the door for the issuance of almost 7 million new shares once the notes are able to be redeemed. The notes are unable to be converted until 2026, giving shareholders plenty of time to exit positions beforehand. There is, however, a clause allowing the company to make the notes redeemable as early as March 2024, but it is unlikely that route will be taken while the stock is trading at a premium, as I would imagine that would open the door for a short squeeze.

A few measures have been taken to help alleviate investor exposure to shareholder dilution. In 2022, the company authorized up to $2 billion in share repurchases, with $1.5 billion of that total being executed in the time since. The company also made attempts to lower risk with “capped calls”, preventing the notes from being converted at prices per share exceeding $360.80. The company is currently trading at ~$120 per share, as opposed to the $180.40 per share the company was trading at when the notes were issued.

In any situation, if an investor finds themselves in a situation where they must worry about potential dilution, then based on an entry at today’s spot price, their position will have already at least doubled in value.

Valuation and Peer Analysis

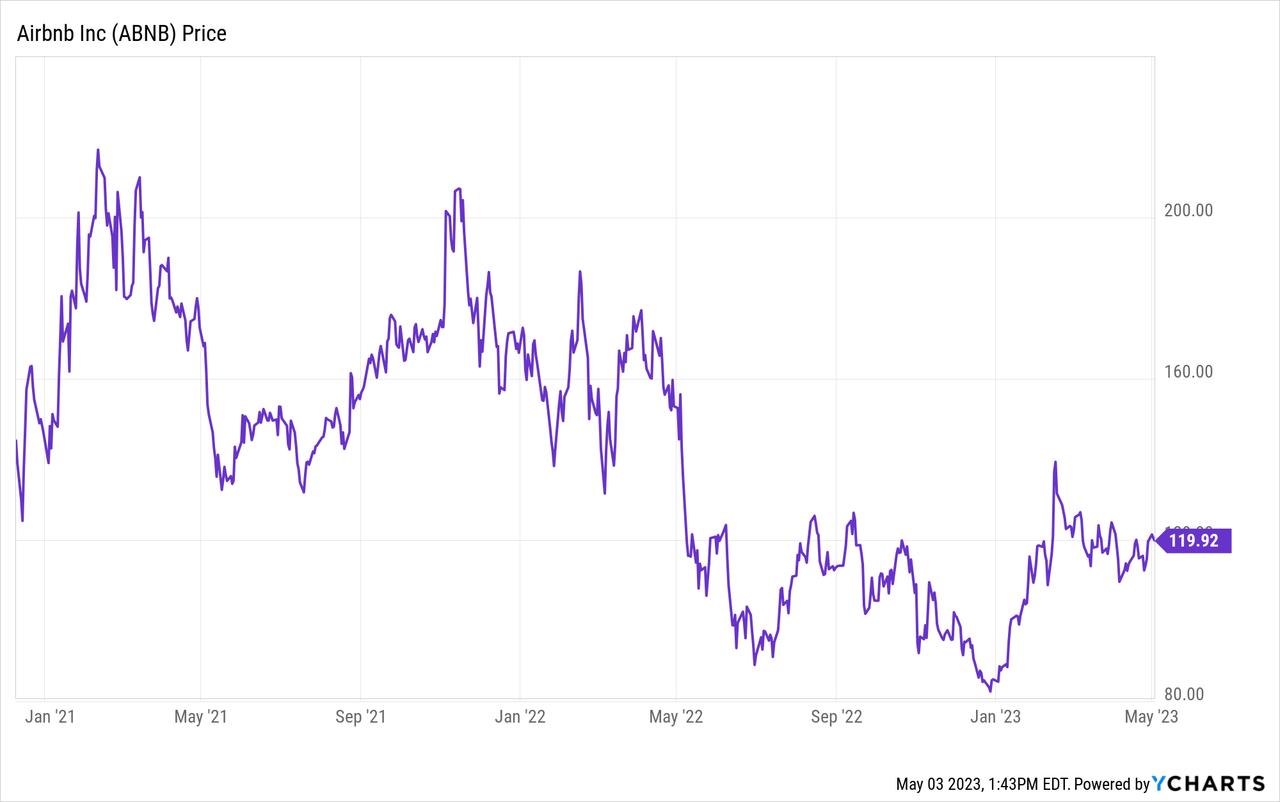

Airbnb did not IPO until late 2020, meaning historical records of the stock’s performance are relatively small. Shares of the company were originally priced at $68/share but traded at $146/share by open, an astounding 115% rise from the original price. Since then, share prices have swung back and forth, and have fallen in value since shares began trading.

For the majority of 2021 and into 2022, ABNB was generally trading between $140 and $210/share. The price drop in the early second quarter of 2022 coincides with the initial Fed interest rate hikes, despite Airbnb’s limited financial dependence on rates remaining low. By summer, ABNB had dipped below $100 for the first time since their IPO and has struggled to break apparent resistance levels of $130 in the time since.

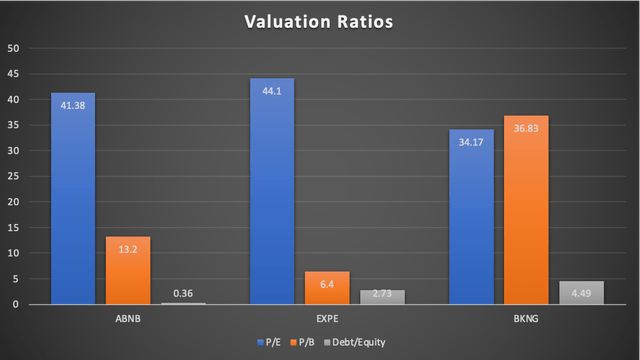

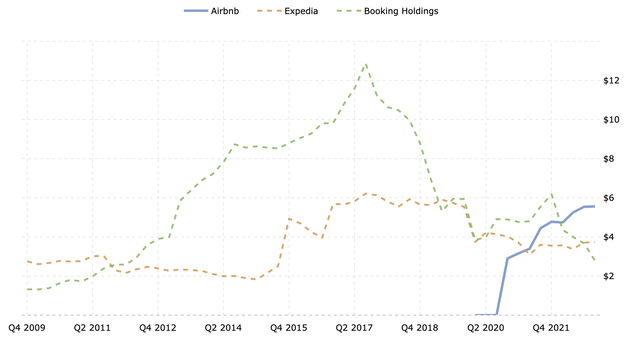

With a Price-to-Book value currently at 13.78, ABNB appears more overvalued than most travel/leisure companies. However, it is also important to keep in mind that Airbnb requires far fewer physical assets than most other companies in the industry, which often require ownership of property such as hotels. Airbnb’s assets on the other hand consist of almost 50% cash. Additionally, their P/B ratio has been dropping over time as shareholder equities have risen, indicating that, despite apparent growth in the company, the share prices have not moved quite in sync. The changes in equity value are even more impressive when compared to competitors, including VRBO, a similar platform owned by Expedia Group and Booking.com, a subsidiary of Booking Holdings (BKNG).

Shareholder Equity Values for ABNB, EXPE, and BKNG in $ Billions (Macrotrends)

The industry is projected to grow at a 5.3% compound annual growth rate until 2030, opening the door for further revenue and equity expansion. The biggest driver in accomplishing more market share will undoubtedly be Airbnb’s ability to diversify revenue, both geographically and increasing their revenue mix.

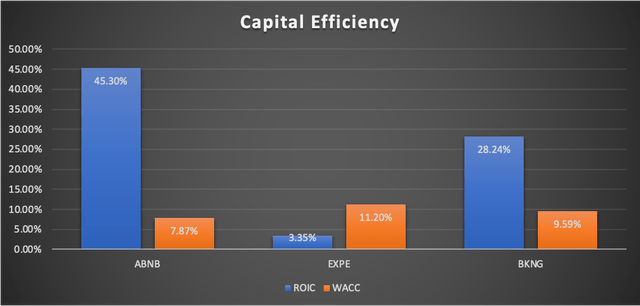

Two aspects provide a unique edge to Airbnb in the context of the looming recession: capital efficiency and future debt obligations. Airbnb has used their capital in a very efficient manner over the past few years, concentrating on driving revenue from their primary source and achieving profitability in the process. With a ROIC that far exceeds WACC, Airbnb has provided themselves the ability to explore new avenues of growth.

Notably, while Booking Holdings has achieved a similar level of capital efficiency, Expedia appears to be using their resources at unsustainable levels. As the market starts to turn and liquidity dries up, efficient use of capital will become crucial, setting Expedia at a disadvantage. On the other hand, Booking Holdings and Airbnb appear more primed for success despite financial turmoil. This may help explain why, despite occupying the same industry, BKNG is trading near all-time highs, while EXPE is approaching all-time lows. Airbnb stock, however, appears to still have room to run despite operating more efficiently than both.

From the above graph, two things in particular stand out: BKNG is trading at a complete overvaluation compared to the fair value of their equity, while ABNB maintains a much lower debt/equity ratio than both. The primary driver for the massive rise in Booking Holdings’ P/B ratio is largely due to a massive rise in liabilities and total debt on their balance sheet over the course of 2022, reducing total shareholders’ equity in the process: total liabilities rose 29.3%, while debt rose 14%. Asset values only rose 7.2% over the same timeframe. Meanwhile, the stock has continued to rise, resulting in shares trading for a premium. Despite a refinancing in November 2022, reducing short-term debt in favor of longer-term financing at elevated rates, current liabilities rose on their balance sheet by 35.7%. Booking Holdings is not necessarily in financial trouble, but their struggles with debt could hamper potential growth prospects, opening the door for Airbnb to potentially steal market share. Booking does possess a larger cash balance than both Airbnb and Expedia, but they may be forced to apply that cash towards future debt obligations as opposed to growth.

Expedia, meanwhile, possesses an Altman Z-Score of 0.94, indicating financial trouble. With a credit rating on the border of high yield (Baa3 with Moody’s and BBB- with Fitch’s), finding further financing could spell trouble, and the company runs the risk of entering “fallen angel” territory. EXPE is trading at a better value than BKNG, and possibly even ABNB, but based on their financial situation, the lower valuation may be warranted.

Conclusion

Those looking to appropriately value the share price of ABNB must carefully consider the state of the economy and where markets are headed. Given the looming recession, market psychology could drive the share price further down. The 12-month trailing P/E of the S&P 500 is currently 23.85. That figure generally drops as low as ~18x during recessions, which would imply at least a ~25% fall in market levels at current EPS levels. With a beta of 1.14, the move would instead become an estimated 28% drop for ABNB given the strong correlation of consumer discretionary equities with the S&P 500, from the current price of $120 down to around $85/share, just over previous lows. Depending on your level of risk tolerance, I would look for an entry should the price fall to anywhere in the $75-90 range. Those in search of a pairs trade/arbitrage opportunity might instead opt to go long ABNB and short BKNG.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.