Summary:

- I assert that Airbnb is a compelling investment opportunity, emphasizing its current valuation at approximately 17x forward free cash flow.

- Despite recent investor skepticism, the Q3 2023 report showcases Airbnb’s resilience, marked by a significant increase in active listings and a commendable 17% growth in cross-border nights booked.

- While analysts express bearish sentiments for 2024, I remain optimistic about Airbnb’s potential to reaccelerate its growth to a 20% CAGR presenting a compelling “turnaround” narrative.

AleksandarNakic/E+ via Getty Images

Investment Thesis

Airbnb (NASDAQ:ABNB), the marketplace for individuals to list and book lodging, has fallen out of favor with investors.

As you’ll read here, Airbnb is not a blemish-free investment, but investors’ expectations have moderated significantly, allowing the stock to be a compelling investment.

Ultimately, I make the case that paying approximately 17x forward free cash flow for Airbnb is a very compelling entry point. Here’s why.

Rapid Recap

Back in May, in my previous analysis titled, I Am Not Throwing In The Towel, I said,

[…] underneath 6 consecutive quarters of decelerating growth rates, there’s a business that prints free cash flows.

What’s more, Airbnb today is substantially more diversified than at any point in its history, not only geographically, but in serving both guests and hosts.

I make the contrarian call that this is not the time to throw in the towel.

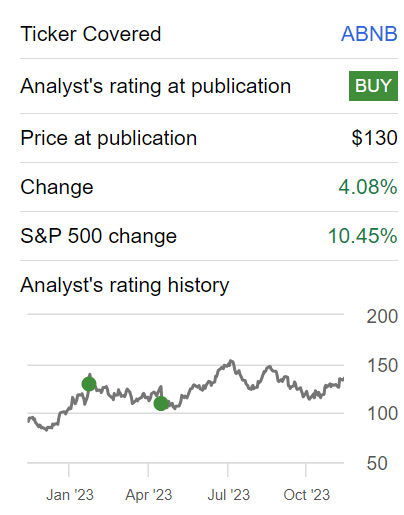

And in the interest of full transparency, I only turned bullish on this stock earlier in 2023. And rather than reverse engineering my buy rating, I’ll openly admit that since I turned bullish on this stock, the stock has lagged the market.

Author’s work on ABNB

Nevertheless, I stand by my assertion that this is a good business with a strong moat. And that, in time, it will regain favor with investors. So let’s get to it.

Airbnb’s Near-Term Prospects

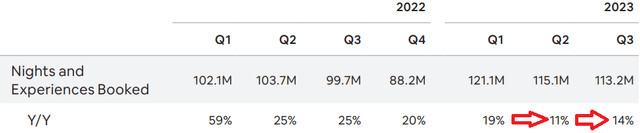

Airbnb’s near-term prospects showcase a robust growth trajectory. Q3 2023 marked a strong performance for the company, with over 113 million nights and experiences booked and a revenue growth of 18% y/y.

The positive momentum extended to various business dimensions, with a notable addition of nearly 1 million active listings, representing a 19% growth in supply compared to the previous year. The record-breaking travel season, especially in international expansion markets such as Asia Pacific, contributed to a 17% increase in cross-border nights booked. Airbnb’s strategic priorities, including making hosting mainstream, refining core services, and expanding beyond its core offerings, have yielded tangible results.

This included progress in international markets, showcasing strong recovery post-pandemic, and a continuous focus on product innovation.

However, amidst its impressive performance, Airbnb faces notable near-term challenges that warrant careful consideration. One key challenge is the varying landscape of regulatory environments globally.

Airbnb acknowledges the complexity and diversity of regulations at the municipal level, posing an ongoing challenge for the company operating in 100,000 cities. New York City’s distinct regulatory approach, which has diverged from other locations, presents a cautionary tale, potentially impacting Airbnb’s operations in a significant market.

Additionally, the company grapples with the volatility observed in early Q4, attributed to macroeconomic factors. The uncertain nature of these influences introduces an element of unpredictability.

Moreover, while the company has maintained strong occupancy levels overall, the challenge lies in sustaining this stability, particularly as it continues to expand its inventory at an accelerated rate. As the dynamics of travel preferences evolve, Airbnb must continuously adapt to ensure consistent occupancy rates.

Next, consider the following.

Close followers of my work will know that I find the growth in customer adoption to be the most insightful consideration when appraising a business’ long-term prospects.

Simply put, if the customer or user is moving at a rapid rate and in a sustainable manner to a certain product or platform, this implies that there’s concrete value in the underlying offering.

Indeed, I’ll note that in investing, it’s simply too easy to get distracted and misguided with an attempt to overcomplicate what should be relatively straightforward. In fact, I’ve also stated that a simple and straightforward thesis is more weighty than a long and drawn-out one.

Back on Airbnb, what you see above is that there’s around mid-teens growth in nights and experiences booked (keep this figure in mind, as I’ll return to this soon). I’ve often extolled that I would vastly prefer a company to grow its revenue line by increasing the number of customers, rather than resorting to pricing power. Why?

Because you can only raise prices so high for so long. After all, Airbnb operates in a fiercely competitive landscape of the accommodation sector, where Airbnb faces formidable rivals such as Booking.com (BKNG), which offers a vast array of traditional hotel options.

Additionally, it contends with Vrbo (Vacation Rentals by Owner), specializing in vacation rentals, and the rising influence of hotel chains like Marriott and Hilton, which have expanded their digital presence to compete directly with online platforms. Airbnb must navigate this hyper-competitive environment by continually innovating to attract both hosts and guests in a dynamic market.

Given this context, let’s delve into its financials.

Revenue Growth Rates Have Stabilized, 2024 Discussed

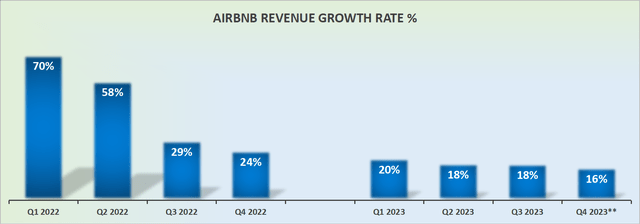

Despite it being a household name and increasingly being the ”default” place to list and search for short-term accommodation, this business’ growth rates have suddenly moderated.

There was once a lot of buzz around Airbnb, and it was so highly coveted. I’ll also confess that I’m surprised to see just how much its growth rates have in actuality fizzled out.

SA Premium

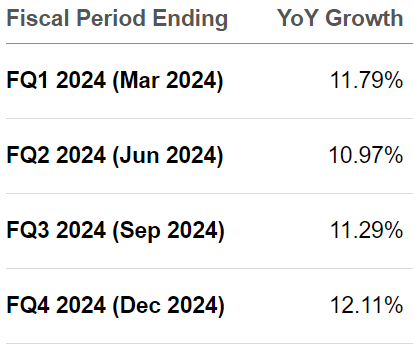

Furthermore, looking ahead to 2024, the analysts community finds itself particularly bearish on Airbnb’s prospects.

Will it truly be the case that in 2024 Airbnb’s topline growth rates will fizzle down further to sub 15% CAGR? I find this very hard to believe.

As it stands right now, Airbnb has delivered 2 quarters of sub-20% CAGR growth and is guiding for the next quarter to also be sub-20% CAGR. But given the easier comparables next year, it should be possible for Airbnb to reaccelerate back to 20% CAGR.

I base my assumption of an approximately 20% CAGR on two straightforward aspects.

Firstly, Airbnb is comparing against H1 2023, a period when Airbnb delivered at its highest point a 20% CAGR. In contrast, H1 2023 was compared against H1 2022, a period when Airbnb was delivering +60% CAGR in H1 2022. Naturally, this means that given the much lower hurdle to cross it will be a lot easier for Airbnb to deliver 20% CAGR.

Furthermore, the volume of bookings are already around the midteens (remember that figure I mentioned before?). This means that on the back of just single digits pricing power, Airbnb should be able to deliver around mid-20s% CAGR or very close to it.

And if that were to take place, this high-quality business that is presently out of favor with investors would be able to set forth an attractive ”turnaround” narrative.

ABNB Stock Valuation — 17x Forward Free Cash Flow

As we look ahead to Q4, Airbnb’s EBITDA is expected to increase by approximately 26% y/y to approximately $640 million.

The problem here is that there’s only so much more that Airbnb can increase its underlying profit margin. As it looks ahead to Q4, Airbnb already assumes that its EBITDA margin will reach close to 30% margin.

In other words, the vast majority of the operating leverage has already taken place.

Consequently, Airbnb is expected to finish 2023 with approximately $3.6 billion of EBITDA. If we presume that next year this EBITDA were to grow by approximately 20% y/y, this would see Airbnb deliver $4.3 billion of EBITDA.

Altogether, this leaves Airbnb priced at 20x forward EBITDA. This is a very reasonable entry point for investors. What’s more, as you know, unlike many businesses that have very high EBITDAs but rather unimpressive free cash flows, Airbnb is highly free cash flow generative, with its free cash flow being higher than its EBITDA. Why?

Because Airbnb collects cash from bookings upfront, but only gives the hosts the cash for the rental when the guest checks into the property. Therefore, creating free cash flows in excess of its EBITDA.

This implies that Airbnb is actually priced at 17x forward free cash flows, which is a very attractive entry point.

The Bottom Line

In conclusion, despite the recent decline in favor among investors, I firmly assert that Airbnb presents a compelling investment opportunity. The stock, currently trading at approximately 17x forward free cash flow, represents an attractive entry point for investors seeking long-term value.

Despite facing challenges such as regulatory complexities and Q4 volatility attributed to macroeconomic factors, Airbnb’s strategic priorities have resulted in a substantial addition of active listings and a commendable 17% increase in cross-border nights booked.

The growth in customer adoption, particularly in nights and experiences booked, signifies concrete value in the platform’s offering.

While the growth rates have moderated, the mid-teens growth rates remain noteworthy, especially considering the hyper-competitive landscape in which Airbnb operates.

Looking ahead to 2024, despite analysts’ bearish sentiments, the potential for a reacceleration back to a 20% CAGR could position Airbnb as an attractive investment with a compelling “turnaround” narrative.

This valuation, coupled with the company’s strategic resilience and potential growth trajectory, underscores my confidence in Airbnb’s prospects and my expectation that it will regain favor with investors over time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.