Summary:

- Following disappointing Q3 results, AQN has slashed its full-year guidance and prepared investors for challenging quarters ahead.

- With Algonquin down over 45% YTD, investors are looking for clarity on the company’s plans to return to sustainable growth.

- Algonquin’s exposure to floating rate debt is a serious liability that is likely to strain cash flow in the coming year.

- With a cash flow deficit looming and a payout ratio set to exceed 100%, it is likely that AQN will need to cut its dividend to fund its capital program.

hrui

Author’s note: all figures in USD unless otherwise noted.

Algonquin Power & Utilities Corp.(NYSE:AQN) blindsided the investor community on November 11, 2022 by reporting weak Q3 earnings, reducing full year guidance and removing longer term targets. Algonquin reported a Q3 2022 adjusted EPS of $0.11, below consensus estimates of $0.17 and adjusted EBITDA of $276M compared to consensus estimates $312M. In the days that followed, shares of AQN plummeted over 30%.

With cash flow impacted by poor operating results and the spectre of additional floating rate debt piling up with the closing of the Kentucky Power acquisition in January 2023, Algonquin has a difficult path ahead. The company will likely need to reduce its capital program, sell assets and or reduce its dividend. So for investors like myself who own AQN for its growth profile and steady dividend increases, now what?

The Role of AQN in My Portfolio

I have held Algonquin for a long time and have continued to add to my position periodically on share price weaknesses over the past few years. I selected Algonquin because I was looking for a utility with upside. Algonquin’s aggressive capital program and history of growing through acquisitions has provided stronger dividend growth than its peers. With the time horizon available to me, I was comfortable seeking a name with more volatility and potential growth than a more mature utility.

I expected that Algonquin’s exposure to renewables and other non-regulated utilities would provide more upside than comparable firms with higher concentration in the regulated utility space. I built a position in Algonquin with the understanding that as a “growthy” utility, it would be more volatile and have higher risks than a fully regulated utility. These risks stem from higher M&A risk and greater leverage. While I am comfortable with these risks, part of Algonquin’s 30% slide in November was due to poor operating performance and project execution.

I don’t like surprises of this magnitude from the “boring corner” of my portfolio. Utility stocks are meant to be set and forget; boring vehicles for steady dividend income that don’t require frequent review. Shares of Algonquin are down 46% YTD. For comparison the S&P 500 Utilities Index (SP500-55) has been relatively flat, down 2% YTD, while the Canadian S&P/TSX Capped Utilities Index (XUT:CA) is down around 9% YTD.

Floating Rate Debt

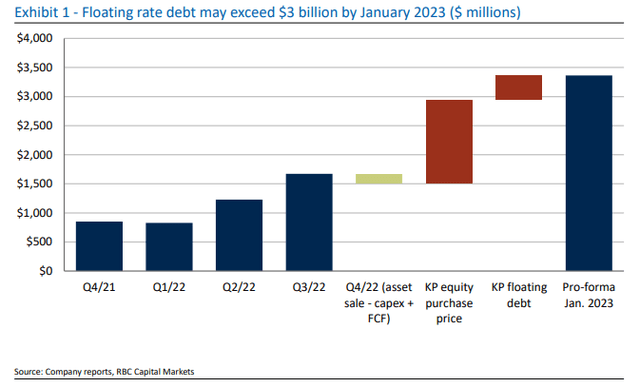

The most significant challenge Algonquin cited in its recent Q3 earnings report was the impact of rising interest rates. On the November 11th earnings call Algonquin Chief Financial Officer Darren Myers explained that each 100 basis point increase in the variable interest rate would impact interest expense by approximately $16M annually. At the end of Q3 2022, Algonquin maintained approximately $2.1B of available liquidity, mostly in revolving credit facilities.

Algonquin’s exposure to variable interest rates is significant with approximately 22% of consolidated debt outstanding subject to variable interest rates. This current $1.7B in floating rate debt has more than doubled from approximately $800M at the start of 2022. With the expected closing of the Kentucky Power acquisition in early 2023, Algonquin is expected to use its credit facility to complete the $1.43B equity purchase and assume $1.22B of debt, of which approximately $400M is variable rate. This increase will see Algonquin servicing over $3B in floating rate debt by January 2023.

AQN Floating Rate Exposure (RBC Capital Markets)

Operating Challenges

While rising rates and increasing exposure to floating rate debt are not necessarily a surprise, operating and executing on projects are more within the company’s control. Of particular concern are the results from Algonquin’s core business. In the recent earnings report, Management cited construction delays on projects along with delays in rate decisions. This lowered guidance is approximately 20% of adjusted EPS for 2022. This is all before the Kentucky Power deal closes in January 2023. Some solar projects have been delayed by delays in acquiring solar modules due to U.S. import restrictions, while a rate case decision has been pushed to 2023 by the California Public Utilities Commission.

Capital Deployment

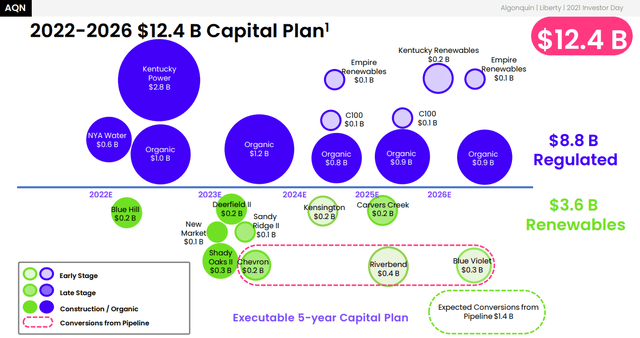

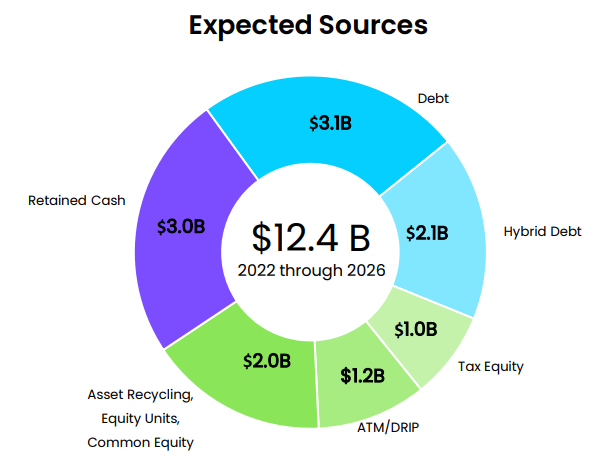

Algonquin has a massive growth profile relative to its size and $5.2B market capitalization. The company plans to invest $12.4B through to 2026. This program is to be funded through a variety of sources including debt, hybrid debt, cash from operations and asset recycling.

AQN Capital Program (Algonquin Investor Presentation )

With approximately one quarter of capital funding planned to come from operating cash flow, it is likely that Algonquin will need to modify its funding sources or reduce its capital program. These will be tough capital deployment decisions for Algonquin’s management team as taking on additional debt will modify the firm’s capital structure. Debt as a portion of total capital is already set to rise from approximately 43% in 2022 to the mid-50% range in 2023 and beyond. In addition to changing funding sources, Algonquin could also defer projects and ramp up its asset sales. However, a smaller and less aggressive capital program dampens the company’s cache as a “growthy” utility and could impact its valuation multiple accordingly.

AQN Capital Funding Sources (Algonquin Investor Presentation )

A Pending Dividend Cut?

Algonquin has grown its dividend every year since 2011. The company has an impressive 10-year dividend CAGR of 9.5%. The most recent increase of 6% was announced in May 2022, moving the company’s quarterly payment to $0.1808.

At current pace, Algonquin’s dividend payout ratio is set to exceed 100% for Q4 2022 and into 2023. As an unsustainable dividend will be a drag on the company’s credit rating, the dividend is the first place the company can look to deal with its cash crunch. According to John Heinzl of the Globe and Mail, Algonquin will prioritize its credit quality over its dividend. This is outlined in the November 17, 2022 letter to shareholders from CEO Arun Banskota:

Algonquin remains focused on driving sustainable long-term profitable growth that supports an investment grade credit rating. Our dividend is an important component of our total shareholder return. We strive to provide a strong and sustainable dividend to our shareholders.

Heinzl points out that the language is important here. The company remains “focused” on an investment grade credit rating and it will “strive” to provide a dividend.

AQN has relied on equity issues to fund growth in recent years. With investor confidence shaken and the stock price pummeled, AQN will want to avoid going to the equity market for additional funding, instead preferring to borrow. This means, that credit quality and maintaining an investment grade credit rating is imperative to fund the company’s (reduced) capital program.

So if a dividend cut is likely, investors are all wondering how much. It is certain that Management is running a number of scenarios ahead of their Investor Day to assess cash flow needs.

According to RBC Dominion Securities Analyst, Nelson Ng:

Our forecast includes a ~38% dividend cut in Q1/23 to an annualized level of $0.45/share (67% payout ratio based on our 2023 EPS forecast), and we believe a payout ratio lower than management’s 80-90% target is needed to reduce the company’s reliance on the capital markets to fund growth.

In its most recent quarter, Algonquin paid out approximately $96M in dividends on common shares. A 38% cut could save the company approximately $145M over the next 12 months. A reduction in the dividend will also have an impact on DRIP financing. Currently AQN is that DRIP and at the market equity issues would provide $1.2 B in capital through to 2025. A reduced dividend will reduce the value of DRIP proceeds accordingly.

Management and Insider Ownership

Looking for a way to change the narrative, Algonquin executives have broadcasted that there has been some insider buying activity on the recent share price weakness. CEO Arun Banskota again in the November 17, 2022 letter to shareholders:

I strongly believe in the company and continue to be excited by its future potential. I purchased a total of 131,000 Algonquin common shares on November 14 and 15, 2022, along with other members of our Board of Directors, who similarly put their own money behind their conviction in Algonquin.

CEO Arun Banskota’s transaction was significant with approximately CAD $1.5M being invested. A handful of other directors have also made material purchases, including Christopher Huskilson who purchased approximately 29,000 shares in November 23.

While it is always encouraging to see insider buying, overall insider ownership at Algonquin remains relatively low. Even with the insider transactions in November since the quarterly results were announced, insider ownership is just .09%, or under 600K shares.

All may not be well in the C-Suite however as AQN’s Chief Financial Officer departed suddenly at the end of August, 2022.

This follows the decision of Arthur Kacprzak to step down from this role effective immediately. Mr. Kacprzak has agreed to remain with the Company in an advisory capacity through the end of 2022 to support a smooth transition to his successor.

I don’t know the reason for Mr. Kacprzak’s departure, however with the perspective of the Q3 earnings considered, the timing doesn’t look great.

What Happens Next?

I love the opportunity to buy a battered down dividend stock (e.g. the Canadian banks in 2020). However, with the end of dividend growth all but priced in, Algonquin will no longer meet my portfolio criteria for a dividend growth stock. There are lots of other option out there to collect a decent yield without having to endure as much volatility.

There may be an opportunity here to buy the turnaround, particularly after the dividend announcement is made. It could be a chance for patient investor to see some upside as Algonquin does the heavy lifting of executing and rebuilding investor confidence in the coming years. Once the expected dividend cut is announced, reasonable dividend growth could resume in the following years as Algonquin adds incremental cashflow with smaller renewable projects.

There is a great deal of work required to restore investor confidence along with the trust of fund managers and analysts who scrambled to downgrade Algonquin and author new reports following this surprise quarter.

My Take

While this quarter has shaken my confidence in the company, I continue to like Algonquin’s assets. I will continue to hold my current position as well as continue to DRIP shares for the time being. However, at this time, I will not consider adding more to my position until after the Investor Day in early 2023.

Although there is likely upside from these levels, Algonquin no longer meets the goals under which I had selected it for my portfolio. My decision to continue to hold over the long term will be determined by Management’s ability to demonstrate a path back towards sustainable growth.

Disclosure: I/we have a beneficial long position in the shares of AQN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.