Summary:

- Algonquin has been the poorest performing utility.

- Unwieldy debt load and empire building have come with a big cost.

- But that empire building just got a mandatory stop as FERC denied the Kentucky Power deal.

- Does this change the dividend cut probability?

Kentucky Coal Mine

Luke Sharrett/Getty Images News

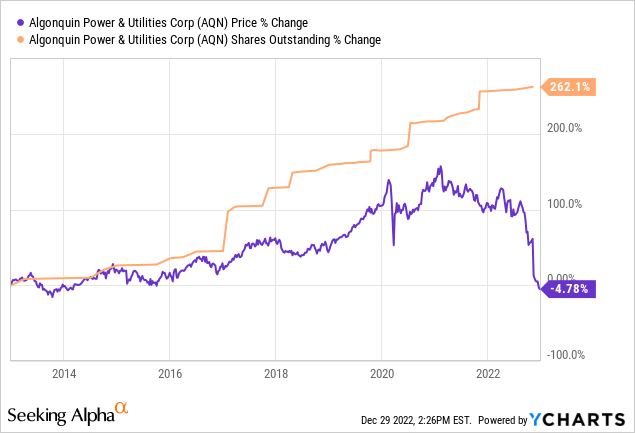

We have seen many companies do it. Focus on the topline and not the bottom one. Rapid expansion with an eye only on total numbers and ignorance of how it impacts things on a per share basis. Algonquin Power & Utilities Corporation (NYSE:AQN) was certainly in that category as it took on asset after asset to grow at a breakneck speed.

And “breakneck” it did as it ran into multiple issues simultaneously. When we last looked at this, we suggested investors wait for the dividend cut, to buy the stock.

Identical dates not withstanding (that cut came on December 13, 2018), we think a 60% drawdown from the 2022 starting price looks likely. That puts us closer to $5.60 for a final bottom. Watch for the dividend cut announcement which we think is two shoes in for 2023.

Source: Discounted Utilities With Ominous Similarities

Of course, we had not anticipated the FERC ruling which was announced after that and denied AQN their biggest acquisition.

In their ruling issued Dec. 15, FERC’s five members said officials with Algonquin—which would buy Kentucky Power via their Liberty Utilities Co. subsidiary—haven’t adequately outlined their commitment to guarantee that some of those customers’ rates will be protected “for a significant period of time following the merger” or that any such cost increases be offset in other ways.

“Applicants’ commitment to hold their customers harmless from costs related to the Proposed Transaction is not a substitute for identifying the effects of the Proposed Transaction on rates and demonstrating that such effects are not adverse,” the commissioners wrote, noting that their decision is without prejudice, which leaves the door open for the companies to revise or add to their application. “As the Commission noted in the Hold Harmless Policy Statement, an increase in rates that results from a transaction is not the equivalent of a transaction-related cost.”

A number of utility customers and advocacy groups early this year filed protests against the planned sale of Kentucky Power. After a number of subsequent filings, FERC said in June it was extending its timeframe to hear the case. In October, the customer group said its concerns had still not been adequately addressed and pushed for regulators to deny the transaction.

Source: TD World

Does this change things?

Analysts are currently split on the issue as to whether the deal gets done. Some think that this gets pushed out to Q3-2023, while others think that AQN will have to jump through hoops before it is let off the hook by the counterparty. Our read here is that AQN will be able to complete the acquisition only if it concedes more ground. In other words, if there are more guarantees that prevent future rate hikes. This would be a strong negative by itself. If this is combined with delays and those look almost inevitable here, we could see a very negative impact on the earnings per share for 2023 and even beyond.

If AQN’s persuit of FERC is to their best of their ability and still fails, we think AQN’s base case becomes a bit better. The biggest delta will be in their debt to EBITDA for year end 2023. The difference could be at least 2.5 multiples of debt to EBITDA and would make a big difference in how credit markets perceive risks here. A further benefit would be that asset sales could be slowed down and AQN would have some breathing room to come up with their longer term strategy.

On the dividend front, if outcome one happened, that is they were able to close the deal in late 2023, we are certain the dividend will be cut. In fact, in such a scenario we would likely see a 50% cut to rebalance the cash flow.

In the case of outcome two, we still think the dividend will be cut, but we are less certain. There is a possibility that the dividend could be maintained, though we give that less than 10% chance. The key reason here is what happens to capex requirements. Kentucky Power came with a boatload of capex requirements and these are due to be conducted between 2023-2026/2027. Removing the Kentucky Power acquisition out reduces total capex by about by $4 billion over four years. Assuming a 50:50, debt to equity funding, it means AQN requires $2 billion less in equity issuance. So even if AQN does cut the dividend, the size is likely to be far smaller. AQN will have more room to be a little lax on their cash flow and try and retain some more of the dividend crowd.

Verdict

This little FERC maneuver could turn out to be positive, but it could also significantly hurt AQN. If AQN has to compromise to make it happen, you can take an axe to 2024 and beyond earnings estimates.

Our base case here is that AQN will make about 60 cents in earnings per share in 2023 and will be allowed to walk away from the Kentucky Power Acquisition. Earnings likely move up in 2024, but don’t cover the old dividend rate. AQN will see this and proactively cut the dividend by a third within 1-2 quarters from now. While there are slightly more positive outcomes here for AQN, the uncertainty will likely keep the big money sidelined. We continue to stay out and that includes the equally risky mandatory convertible issue Algonquin Power & Utilities Corp – Units (NYSE:AQNU). AQNU’s returns should mimic owning AQN. What you make extra in dividends today on AQNU, you lose on the 3.333X conversion.

AQN also has baby bonds that trade, Algonquin Power & Utilities Corp. 6.875 SB NT A 78 (NYSE:AQNA) being one. While the interest rate may seem appealing, their float feature and subordinated nature (BB+ rating) make them poor investments in our view.

From 10/17/2023, on every Interest Reset Date until 10/17/2028, the interest rate on the Notes will be reset at an interest rate per annum equal to the three month LIBOR plus 3.677%. From 10/17/2028, on every Interest Reset Date until 10/17/2043, the interest rate on the Notes will be reset on each Interest Reset Date at an interest rate per annum equal to the three month LIBOR plus 3.927%. From 10/17/2043, on every Interest Reset Date until 10/17/2078, the interest rate on the Notes will be reset on each Interest Reset Date at an interest rate per annum equal to the three month LIBOR plus 4.677%.

Source: Prospectus

At present we are relegated to watch mode and think better opportunities might come ahead.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Covered Call Portfolio is designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.

Stanley Druckenmiller on mental flexibility and the ability to be both bearish and bullish.

Stanley Druckenmiller on mental flexibility and the ability to be both bearish and bullish.