Summary:

- Algonquin Power & Utilities Corp. delivered a solid performance from our last update and justified the buy rating.

- The company is in the process of finding a new CEO and selling its renewable division, which may take 2-3 quarters.

- We tell you why we are looking for some more upside but the company’s mediocre performance likely means that you won’t squeeze much more.

cruphoto/E+ via Getty Images

In our last coverage of Algonquin Power & Utilities Corp. (NYSE:AQN) (TSX:AQN:CA) we shifted off the sidelines and offered that there were some reasons to be optimistic. The company had fleas and the broken strategy still needed time for repair. The income investors had flown out as the dividend cut was delivered. But the valuation had finally improved enough that we could make a long pitch at $5.60.

In all likelihood, we will be wrong on it bottoming right here, and it probably will go lower, but it is hard to be negative at this valuation. We are hence upgrading this to a buy and will likely initiate some covered call positions for the portfolio.

Source: Billionaire Says Observe Carefully When The Tide Goes Out

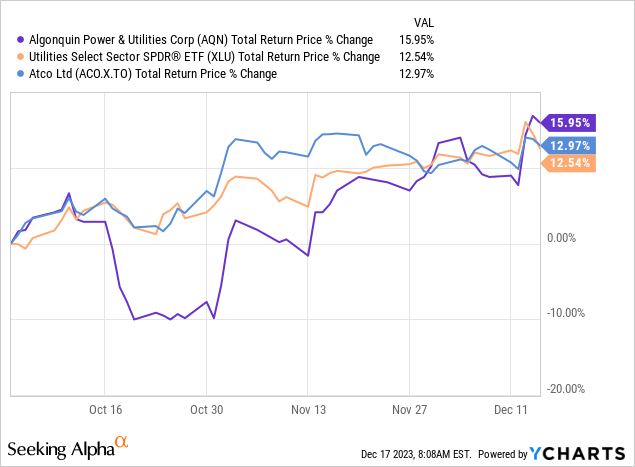

The stock did indeed not bottom right away and gave investors yet another swan dive, before rising from the ashes. As it stands, it has outperformed the Utilities Select Sector SPDR® Fund ETF (XLU) and our favorite utility stock Atco Ltd. (ACO.X:CA) since then.

We look at the Q3-2023 numbers, the 2024 outlook and tell you why there is likely more upside here. We will also weigh in on the preferred shares that just got reset.

Q3-2023

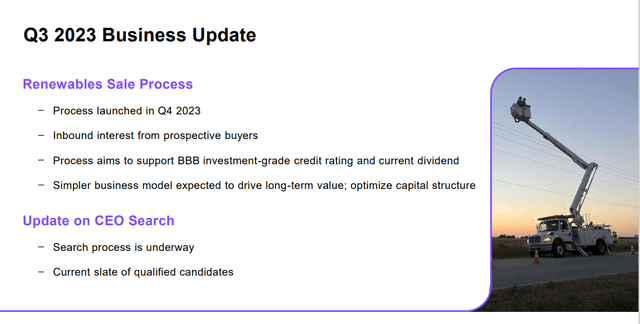

AQN kicked off its Q3-2023 results by reminding investors that they still had their work cut out for it on finding a new CEO. The company did affirm however, that the sale process had officially launched and indicated it is receiving interest from more than one party. Sure, there was interest, but pricing was likely an issue in Q3-2023 as interest rates rose and renewable assets were not competitive with 5.5% risk-free rates. That was likely true, at least at the valuations AQN tried to sell those assets.

AQN Q3-2023 Presentation

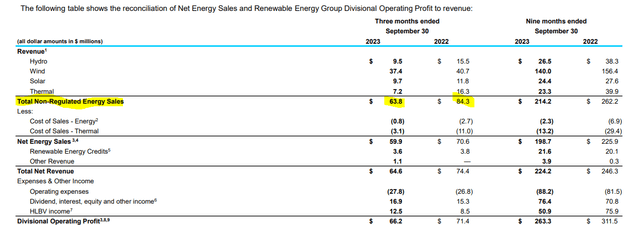

It probably did not help that AQN delivered one of the worst quarters for its renewable energy assets with every single segment coming in below expectations and below last year.

AQN Q3-2023 Presentation

That makes it hard to sell these assets in difficult market conditions.

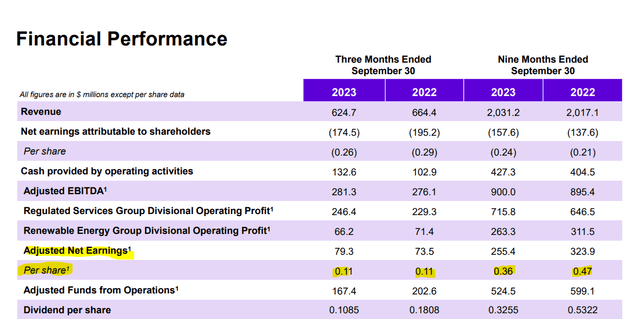

AQN’s overall numbers were just plain awful as well, with adjusted EBITDA of $281.3 million. Consensus estimates were just a shade below $300 million. Earnings per share missed by just one cent, but it cemented a long stretch of underperformance.

AQN Q3-2023 Presentation

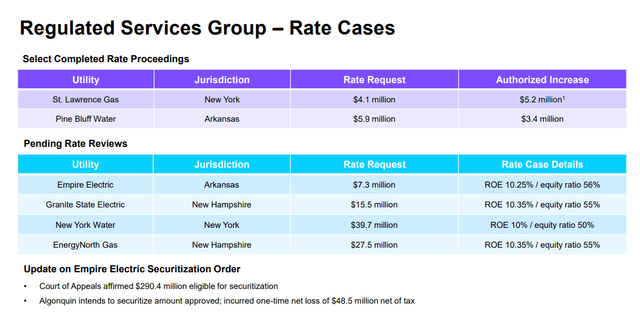

The bright spot was that the regulated business was still doing well and continued to provide a stable source of cash. There were no real surprises on the rate cases either.

AQN Q3-2023 Presentation

Outlook

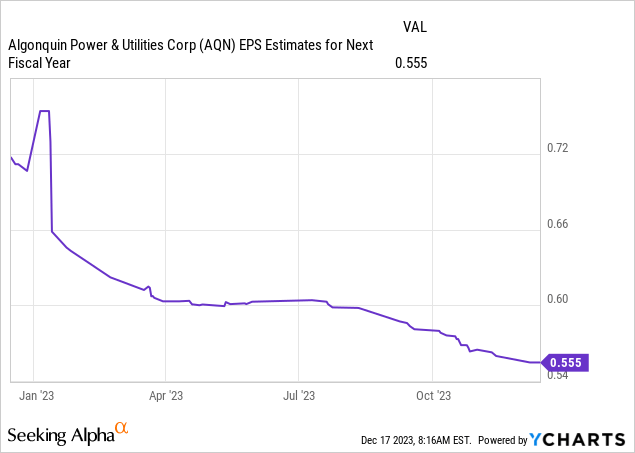

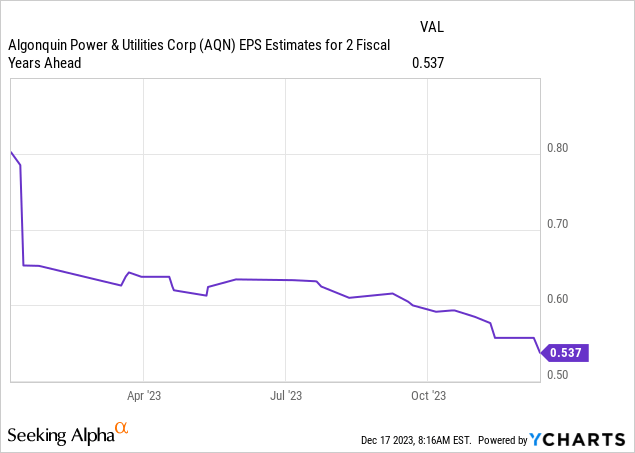

As we write this, there is no new CEO in place and that process as well as the renewable division sale, could take 2-3 quarters. The latter aspect is likely going to be helped by the enormous drop in risk-free rates and the Fed “pivot”. Whether that pivot lasts or not remains the question, but for now, AQN likely can push for slightly higher multiples than what it did in Q3-2023. That asset sale aside, the company’s level of disappointment has been off the chart. We will still try to quantify it, on an actual chart. Below are the earnings estimates for the next fiscal year.

Note that they started valiantly in 2023 near 74 cents and now we are at 55.5 cents. What about 2025? Same story. Here the perpetually optimistic analysts had penned this at 80 cents. They are now expecting 53.7 cents.

If there was one real reason why we avoided losses here, it was because we got the earnings picture correct. We did not “buy” the 75-80 cents estimates for 2023-2025.

There is a very huge delta in earnings as you move from $1.50 billion in EBITDA to $1.375 billion. You have about 683 million shares outstanding so the delta on the earnings is about 18 cents a share if we are correct. So, the $0.734 consensus is looking more like a $0.55 number to us.

Source: 4 Insiders Step Up To Buy, November 18, 2022

So as AQN continues to disappoint, the upside potential gets compressed. Sure, you have that big valuation push from risk-free rates moving lower. But a reminder is appropriate that the Fed has not yet actually cut. Even cheering that possibility to its maximum, we cannot go further than 14X our 2024 earnings estimate of 50 cents. So $7.00 is our ceiling.

Verdict & A Note On The Preferred Shares

You are likely to get $7.00 here. There might some selling into year-end tax loss booking, but January or February 2024 should get you your $7.00 per share. Beyond that, you really need the company to start to deliver with a modicum of certainty for additional upside. Valuation push can only go so far when earnings estimates keep falling. We maintain our buy rating from the original $5.60 and suggest investors keep an eye on the exits. We will move to a “hold” if $7.00 is hit at any point. Our personal position here is in Atlantica Sustainable (AY) where AQN has a controlling stake. We think that one offers a slightly better setup at this point. We also have a large position in the earlier mentioned ACO.X.

We had previously suggested that investors interested in AQN would do well to carefully look at Algonquin Power & Utilities Corp. PFD SER A (TSX:TSX:AQN.PR.A:CA).

At current interest rates, the preferred shares will yield about 7.24% on par, and that works out to about 9.65% on the current price of $18.75 CAD.

Source: Billionaire Says Observe Carefully When The Tide Goes Out

This is a standard 5-year resetting preferred issue that trades on the TSX and the reset was just announced. Since interest rates dropped into that timeframe, the yield on par was lower.

The dividend rate for the 5-year period from and including December 31, 2023 to but excluding December 31, 2028 will be 6.469%, being equal to the 5-year Government of Canada bond yield determined as of today plus 2.94%

Source: AQN

But those that got in at $18.75 CAD, have locked in 8.63% for the next five years. The shares have moved up to $20.00 CAD currently and we think they are fairly valued. We are removing the buy rating on them and moving to a hold.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AY, ACO.X:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.